|

For crypto followers who got here of age throughout earlier eras — again when Bitcoin was going to financial institution the unbanked and cease all wars, and even throughout the ICO growth when tokenizing carbon credit and disrupting dentistry have been touted as the way forward for finance — the final couple of years have been extremely miserable.

On the one facet, some Bitcoiners who used to need to smash the unfair monetary and banking system now cheer the world’s largest banks and governments for gobbling up an growing share of the availability.

And on the opposite facet, there’s the monetary nihilism of memecoin buying and selling, the place nothing of worth is constructed or created — only a manufacturing line designed to extract as a lot money as doable from retail. The overwhelming majority of Pump.enjoyable customers, 99.6%, haven’t even made $10,000 on the positioning.

Ethereum creator Vitalik Buterin has at all times believed crypto could make the world a greater place however appeared to have a disaster of religion again in February about the place the trade was headed.

“Do I really feel good after I hear folks from crypto twitter and VC corporations telling me that PvP KOL degen on line casino that’s money-losing for >99% of its personal customers is the perfect product market match that crypto goes to get, and it’s ‘condescending and elitist’ to want for one thing higher?” he requested.

So how did crypto lose its method, and does the trade have to rediscover idealism and massive goals to get its mojo again?

Peace, love and crypto’s anarcho-capitalists

Scott Melker, higher generally known as the Wolf of All Streets, says the early days of crypto have been infused with a a lot better sense of function than at this time.

“Early cypherpunks have been true libertarians who deeply believed that cash and the federal government have been damaged and that Bitcoin and blockchain expertise may repair them,” he tells Journal.

Ethereum co-founder Joe Lubin says the fantastic thing about Bitcoin and crypto in these early days was the way it attracted “philosophically numerous” teams to think about totally different doable futures utilizing the tech, together with “cypherpunks, crypto-anarchists, libertarians, hackers, leftists, anti-corporate activists, and even socialists.”

“It’s a testomony to the facility of the expertise that each one of those philosophies noticed parts of what they cared about within the decentralized protocol expertise, as a result of it was versatile sufficient and highly effective sufficient to construct something on prime of it.”

Bitfinex chief expertise officer Paolo Ardoino says there are many true believers nonetheless constructing in crypto, however idealism has been “overshadowed by hypothesis.”

“From the start, blockchain was about monetary inclusion, self-sovereignty, and breaking free from the constraints of the standard monetary system. However because the market grew, hypothesis took middle stage, and for a lot of, crypto grew to become simply one other on line casino somewhat than a device for empowerment.”

The ICO period was 99% memes,

Nonetheless, idealism and mercenary monetary hypothesis have existed facet by facet all through crypto’s historical past.

In some ways, the preliminary coin providing growth in 2018 foreshadowed the memecoin frenzy, given many initiatives have been little greater than a half-baked concept (or meme) spun right into a white paper and presentation deck that earned hundreds of thousands.

It was usually cynical and exploitative, with many ICO founders frittering the cash away earlier than they’d even constructed a minimal viable product. ICO mills sprung as much as scour the web for brand spanking new founders, who they put in with market makers, exchanges and advertising and marketing businesses to generate new ICOs.

“That they had an entire playbook, and they might launch the ICO and simply spit them out the opposite facet and take 10% of the tokens,” remembers Kain Warwick, who ran Australia’s most profitable ICO, which become Synthetix. “Like 98%, 98% of ICOs have been [scams].”

A 2018 research by Satis estimated that 81% of ICOs value over $50 million have been scams, whereas later analysis in 2022 from the College of Vaasa put the determine at 56.8%.

However the period did produce many high quality initiatives that also lead the trade at this time, together with Aave, Chainlink, Bancor, Polkadot, Tezos, Filecoin and even EOS, which is now generally known as Vaulta and run by its neighborhood.

“If you happen to return in time and cease ICOs from ever taking place, the world’s a worse place,” says Warwick. “Did folks lose cash? Sure. Did a number of grift occur and a number of wastage? Sure, however we received a lot great things out of it. Large investments in infrastructure and DevEx (Developer Expertise) and all of that stuff wouldn’t have occurred with out ICOs.”

Crypto idealism turns into ideology

Again in these days, everybody at the least pretended to imagine in crypto’s beliefs of decentralization, banking the unbanked and creating a greater world with blockchain.

Idealism is just not with out its personal issues, nonetheless, and may shortly flip into ideology, characterised by slim, prescriptive and exclusionary pondering.

Learn additionally

Asia Specific

Asia Specific: China’s NFT market, Moutai metaverse common however buggy…

Options

Faux workers and social assaults: Crypto recruiting is a minefield

“After I received into the Ethereum area and began constructing, I undoubtedly drank the Kool-Help,” says Warwick, including that DeFi Summer time in 2020 was geared towards a distinct segment viewers that was “ideologically aligned with low limitations to entry, permissionlessness, censorship resistance, and so forth, and so for those who have been constructing a product, it needed to adhere to these ideological constraints.”

Warwick reveals he was such an ideologue again then that he refused to permit Maker’s decentralized DAI stablecoin for use in Synthetix as a result of Maker had accepted the centralized stablecoin USDC as a part of its collateral pool.

“We have been insanely ideological, decentralization maxis,” he says. “And that held us again. It precipitated the venture to actually wrestle.

“Finish-users don’t care about any of that. They need to use merchandise that make their lives higher.”

The rise of VC cash

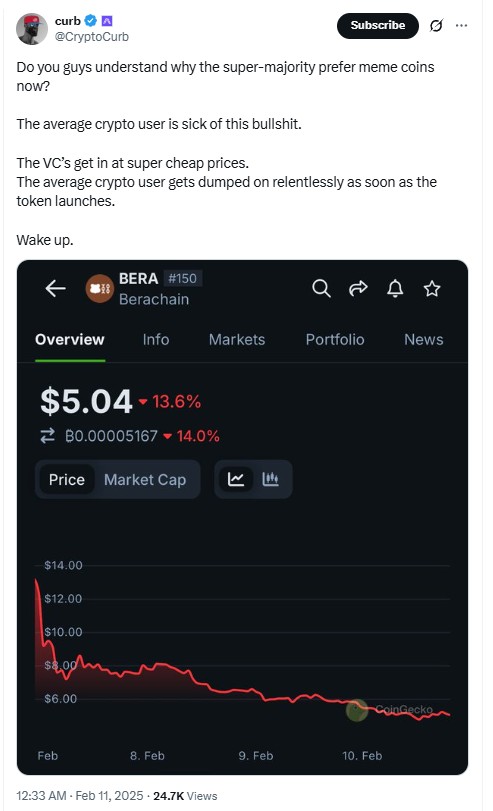

An enormous issue that turned the area towards monetary nihilism was as a result of retail buyers getting screwed by VCs on token launches.

“VCs have a number of energy they usually restructured the sport to make it maximally worth extracted for themselves,” says Warwick

“Low float, excessive absolutely diluted worth” grew to become a standard technique from about 2020 onward. “Low float” refers to releasing only a small share of the whole provide onto the market, which forces retail customers to compete to purchase the identical handful of cash, pushing up costs.

“Excessive FDV” refers back to the whole provide of the coin, a lot of it owned by VCs who’d drip-feed it again onto the market, killing token costs because the circulating provide grew ever bigger.

A CoinGecko research discovered 21.3% of the highest 300 cryptocurrencies are low float, excessive FDV, together with initiatives like Celestia, Sui, Aptos, Injective and dYdX.

Ultimately, retail speculators wised as much as the actual fact the sport was rigged towards them and that they couldn’t win even by investing in high quality initiatives.

“The response that they’d was, ‘nicely, if I can’t play that recreation, this early-stage ICO-style recreation of purchase a token actually low cost and hope that it goes up, possibly I’ll play a special recreation.’ And the sport that emerged out of that was memecoins.”

Memecoins have been honest launches and provided the prospect of turning a couple of bucks into a number of million. No person cared that the venture and token didn’t truly do something — so long as the worth went up. It was the start of monetary nihilism.

“Persons are naturally inclined towards playing,” says Melker. “Most individuals come to crypto to get wealthy in a single day, to not take a very long time choice funding technique into superior cash.”

Monetary nihilism: Hypothesis is all the things

Lubin believes that folks flip to memecoins as a result of the system is damaged. They watch as others amass large wealth whereas they barely scrape by regardless of having a full-time job and faculty training.

“They really feel as if playing cards are stacked towards them and the sport is rigged,” he says.

“Given this backdrop, it’s not exhausting to see why folks flip to extremely speculative property that supply them an opportunity, nonetheless small, of constructing important good points, and possibly even altering their fortunes.”

Learn additionally

Options

Earlier than NFTs: Surging curiosity in pre-CryptoPunk collectibles

Options

Easy methods to make a Metaverse: Secrets and techniques of the founders

However for crypto believers and builders, the shift to memecoins left them feeling despondent. They thought they have been constructing a generational change to the finance system, so it was a shock to seek out out customers have been as completely satisfied shopping for Fartcoin as Bitcoin.

“Unexpectedly, everybody realized that the emperor had no garments, that the speculators who have been our customers, who had been right here for the final 5 years making an attempt to get wealthy, didn’t care about any of the stuff that we cared about,” says Warwick.

“Now they have been overplaying this memecoin recreation that has no utility, that isn’t creating something, that’s not making the world higher, that’s not ideologically aligned, it’s only a on line casino. And we’re like, Properly, what the fuck is happening now? That is loopy.”

Memecoins leap the shark with Trump and Milei

Sarcastically, memecoins look as if they could have been killed by the identical individuals who’d helped create them: mercenary grifters making an attempt to extract as a lot cash from retail as doable.

January noticed the launch of the Donald Trump-themed memecoin TRUMP, adopted two days later by the much more swiftly thrown collectively cash-in MELANIA.

Chainalysis reported that round 810,000 wallets misplaced a collective $2 billion buying and selling TRUMP, whereas $100 million in buying and selling charges went to Trump’s firms, which management 80% of the availability.

The launch of the LIBRA memecoin a short while later — pumped by Argentine President Javier Milei — appeared like the ultimate nail within the coffin. Insiders made a small fortune from the coin because it peaked at $4.5 billion in worth earlier than crashing 98%.

It’s too early to say memecoins are useless, however exercise on Solana and Pump.enjoyable has plunged within the aftermath. As with low float, excessive FDV cash, memecoins followers are realising the sport is rigged towards them.

“The issue is that the home at all times wins, and the sport is far more mounted even than in an actual on line casino,” says Melker.

Crypto idealism by no means died

For the reason that fall of FTX, memecoins have been the dominant narrative, if solely as a result of the SEC made it nearly unattainable to launch a venture with actual utility within the US.

Now that memecoin exercise is dying down, crypto feels somewhat empty.

“You’re at a degree now the place it’s mainly Bitcoin and monetary nihilism on the two ends of the barbell and all the things within the center has suffered or languished,” says Melker.

“The idealism of earlier eras actually nonetheless exists within the Bitcoin neighborhood, and within the ethos of many altcoins as nicely. With the embrace of Wall Avenue and governments, it’s extra vital than ever that we educate folks on the asset class, somewhat than permitting it to easily change into one other funding.”

Lubin factors out that many builders and neighborhood members in Ethereum additionally stay true to the early spirit of crypto.

“The core tenets of that period and the people who have been interested in cryptocurrency in the beginning are nonetheless very a lot there. Possibly they’re exhausting to detect if you’re exterior as a result of layers of hypothesis, nonetheless, probably the most elementary layers of the expertise are nonetheless being constructed by people who genuinely care about decentralization.”

And whereas Trump’s tariff battle could also be weighing closely on costs, the brand new pro-crypto SEC and probably the most pro-crypto authorities in Bitcoin’s historical past lay the groundwork for an explosion of latest crypto initiatives with utility that ship actual worth to the world, with out having to fret concerning the authorized dangers of regulators stepping in.

Ardoino says the speculative memecoin period is drawing to a detailed.

“That part is fading. The world is waking as much as the truth that the standard monetary system isn’t simply inefficient — it’s basically unfair. Billions of individuals stay unbanked and even these contained in the system are watching their buying energy erode as a result of inflation, excessive charges and arbitrary restrictions. Crypto has at all times been about fixing these issues, and now the main focus is shifting again to real-world utility.”

He says the way forward for crypto is about delivering on the promise that crypto has at all times held.

“The subsequent part might be about constructing resilient monetary infrastructure — one which operates exterior the constraints of conventional programs and offers folks true possession over their property.”

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Based mostly in Melbourne, Andrew Fenton is a journalist and editor protecting cryptocurrency and blockchain. He has labored as a nationwide leisure author for Information Corp Australia, on SA Weekend as a movie journalist, and at The Melbourne Weekly.