Blockchain agency Ripple has referred to as on UK policymakers to grab the second and place the nation as a worldwide chief in digital belongings.

Matthew Osborne, Coverage director of Ripple Europe, revealed that panelists at Ripple’s latest London Coverage Summit acknowledged that the nation has the correct mix of monetary experience, infrastructure, and worldwide fame to steer this evolving sector.

UK Has ‘Second-Mover Benefit’

In a weblog publish, Osborne identified that one of many key takeaways from the summit was that the UK holds a “second-mover benefit” within the race for crypto regulation.

In line with the publish, the UK can undertake a extra balanced and innovation-friendly regulatory framework by observing the early efforts of jurisdictions just like the EU, Singapore, and Hong Kong.

They consider that this method may guarantee client safety whereas encouraging accountable development throughout the sector.

“There’s a big alternative for digital belongings within the UK. With rising consensus that blockchain know-how will rework monetary markets, the UK already boasts a globally main, aggressive monetary providers middle. And with specific strengths in FX, capital markets, insurance coverage {and professional} providers, the UK has all of the constructing blocks to be a worldwide chief in digital belongings,” Osborne wrote.

The panelists furthered that these clear guidelines will enhance institutional confidence, increase trade requirements, and decrease systemic dangers. Nonetheless, additionally they warned that the window to behave is shortly closing.

“The window of alternative is narrowing, and one clear theme that emerged from trade contributors is the necessity to present regulatory readability with better tempo and urgency,” the blockchain agency famous.

The necessity for urgency stems from projections that digital belongings may symbolize as much as 10% of world capital markets by 2030, doubtlessly holding a mixed worth of $4 to $5 trillion.

Osborne careworn that the UK should act boldly and collaboratively to take away pointless authorized obstacles and create an innovation-friendly surroundings.

In the meantime, one other urgent concern the panelists highlighted was the shortage of readability round stablecoins.

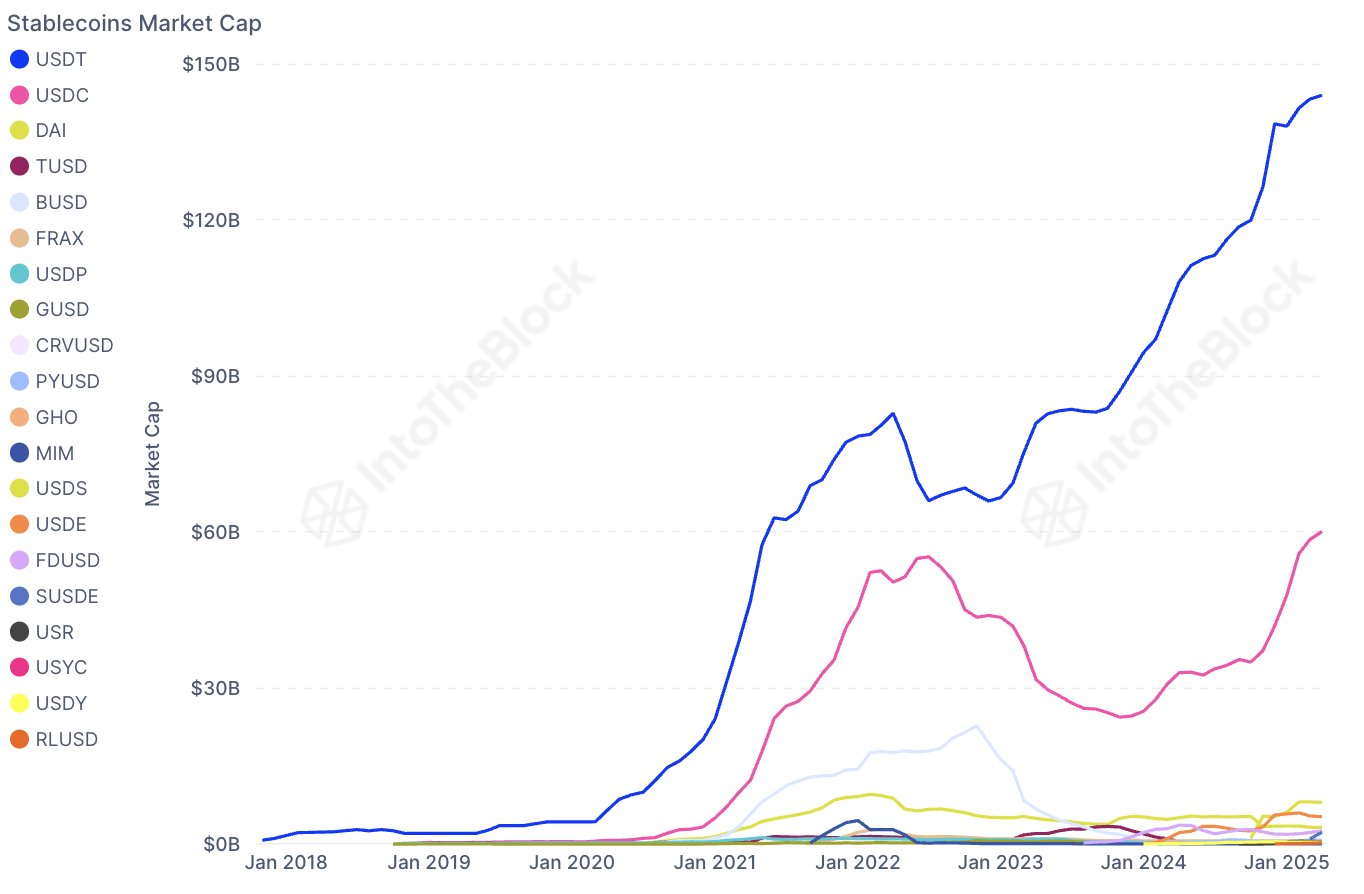

Stablecoins are digital tokens pegged to fiat currencies just like the US greenback and are important to the broader crypto economic system. As they’re more and more used for buying and selling, funds, and settlements, stablecoins have develop into the spine of the digital asset ecosystem.

With a present market valuation exceeding $230 billion, stablecoins are anticipated to develop additional as adoption will increase.

Contemplating this, there are requires the Monetary Conduct Authority (FCA) to fast-track its stablecoin framework. The panelists emphasised the necessity for insurance policies that assist each domestically issued and overseas stablecoins working throughout the UK.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.