|

Ripple has emerged (principally) victorious from its long-running battle with the Securities and Change Fee, however for authorized consultants, the case’s conclusion looks like a missed alternative.

For the reason that case didn’t advance to a better courtroom, Choose Analisa Torres’ authentic district courtroom determination — which famously differentiated between XRP gross sales to institutional traders and people on exchanges — has not established a binding precedent.

For the broader trade, the case’s murky standing leaves corporations combating unanswered questions: How ought to token choices be structured? What authorized weight does Torres’ determination actually carry? And what occurs now that the SEC appears to be pivoting away from enforcement-heavy ways?

Add to this the broader context of evolving frameworks abroad, together with the EU’s MiCA regulation and Hong Kong’s transfer to place itself as a worldwide Web3 hub, and it turns into clear that the Ripple case is only one a part of a quickly shifting authorized panorama.

To know the true affect of the case’s decision, Journal introduced collectively authorized consultants from throughout the globe: Charly Ho of Rikka from the US, Yuriy Brisov from Digital & Analogue Companions in Europe, and co-chair of Hong Kong Web3 Affiliation Joshua Chu. Collectively, they unpack what Ripple’s “win” actually means for crypto legislation, and whether or not the trade is any nearer to readability than it was 4 years in the past. This dialogue has been edited for readability and size.

Journal: What implications does the tip of the long-running case have for different crypto companies?

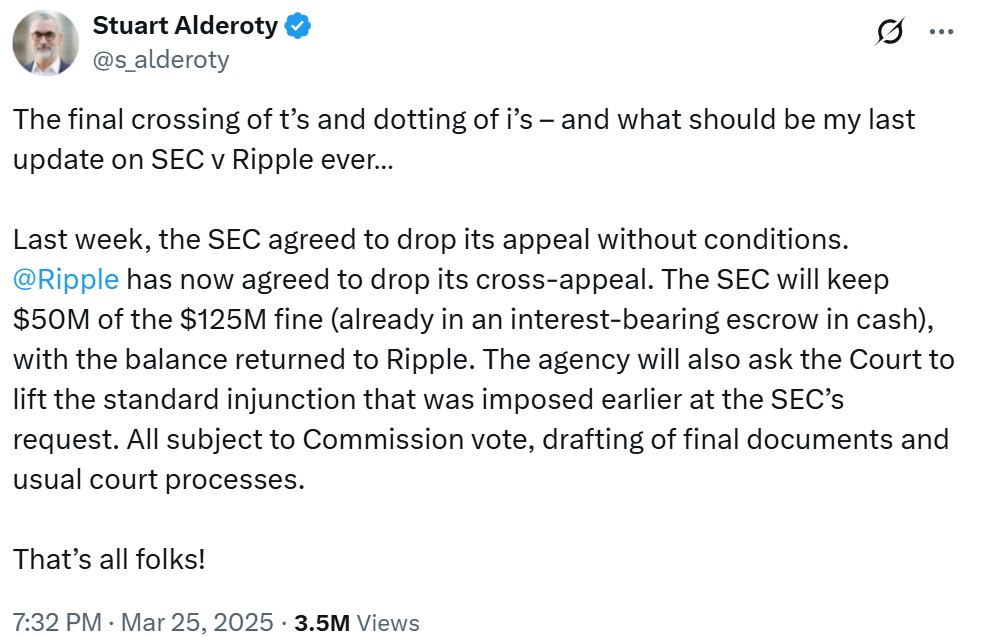

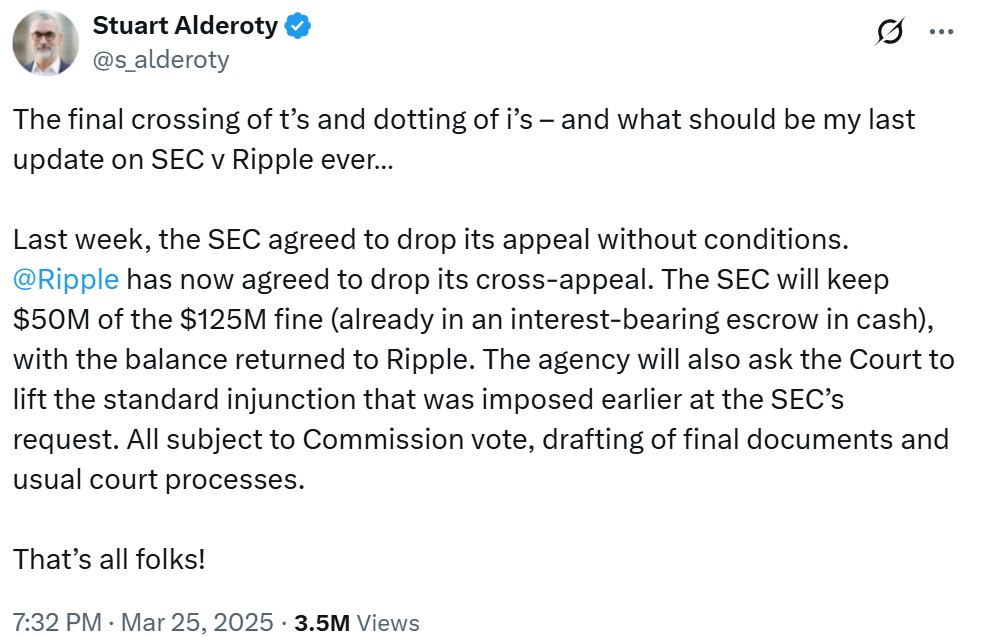

Ho: There have been a lot of hopes about elevated clarification. It was a partial win for the SEC, a partial win for Ripple; after which the SEC was going to attraction the choice that was not favorable for it, after which Ripple was going to attraction the choice for the portion of the choice that was not favorable for Ripple.

However as a result of the SEC has now dropped the grievance and the claims in opposition to Ripple, a part of the settlement discussions was Ripple agreeing to drop its attraction as nicely.

The problem is that settlements are sometimes confidential. So we could not get that readability the trade seeks.

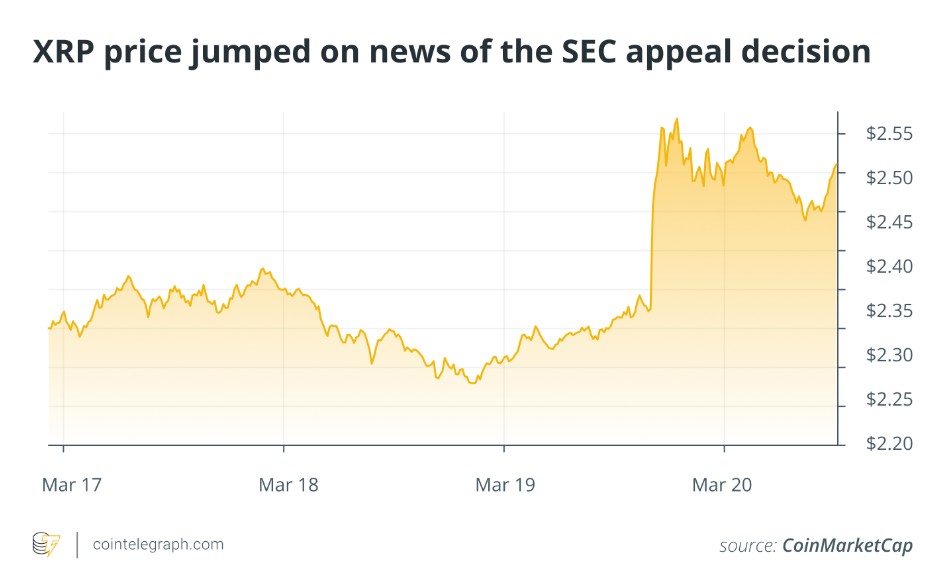

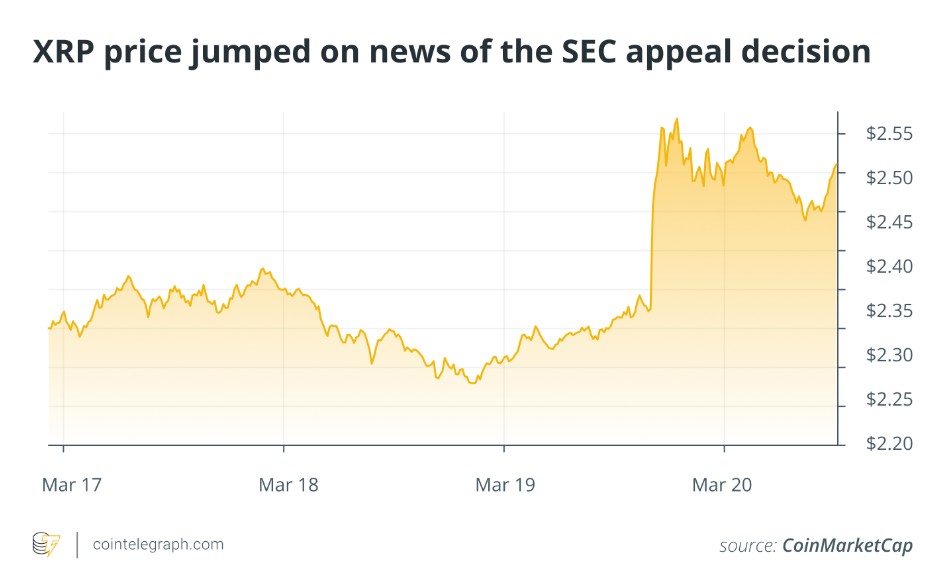

Brisov: That is in all probability good for Ripple as we noticed with XRP worth reacting. They nonetheless must pay a positive however they received’t must combat any longer. For the entire trade, it simply signifies that the precedent that everybody was actually anticipating for over 4 years additionally wouldn’t occur. If you need your case to turn out to be a precedent in a circuit, it should attain the circuit degree. This case didn’t.

However in SEC versus Coinbase and all the opposite crypto litigations for the time being, they’re already citing this determination. Nonetheless, it’s only a persuasive authority. It’s just like the courtroom determination from one other jurisdiction, or the opinion of an skilled or a scholar. It didn’t create a binding authorized precedent, however I believe that future handbooks and college packages will certainly cite this case to show the brand new technology of digital attorneys.

Journal: Does that imply this case can’t be used as a precedent?

Ho: The district courtroom determination remains to be authorized precedent. The choose nonetheless gave a ruling. I believe it’s not honest to say it’s not authorized precedent in any sense of the that means of the phrase, however it isn’t as clear as we might have favored, as a result of Choose Torres is one choose. There have been different judges really in the identical courtroom that dominated otherwise, like in circumstances just like the Terraform Labs case.

Chu: It’s really a missed alternative insofar as authorized growth is worried.

Journal: Ripple was hit with a “unhealthy actor disqualification” underneath Rule 506 of Regulation D. What does that imply and is that this restriction nonetheless in place?

Brisov: Crypto initiatives often use Reg D, which implies providing securities to different institutional traders within the US. It’s not a public providing however relatively a non-public providing.

If you’re thought-about a nasty actor, it signifies that you violated the principles of Reg D in violation of the securities legal guidelines. Which means that you’re banned from utilizing this regulation for 5 years.

This determination stays. So Ripple received’t have the ability to provide any extra institutional offers with VCs for his or her tokens.

Learn additionally

Columns

We tracked down the unique Bitcoin Lambo man

Asia Specific

ETH whale’s wild $6.8M ‘thoughts management’ claims, Bitcoin energy thefts: Asia Specific

Journal: However they have already got carried out that and that’s why this case was caused.

Brisov: That’s proper. In the actual world economic system, I believe that it’s a full victory for Ripple. The unhealthy actor determination doesn’t have an effect on Ripple’s market technique.

Journal: Throughout Gensler’s period, crypto companies within the US complained about banking service entry. Are there related circumstances of crypto debanking on the planet and have we seen any international locations transfer to stamp it out?

Chu: With out wishing to reveal the names of our purchasers, I do recall having to take care of a variety of banks. Again in 2017, crypto didn’t actually have the popularity it has at this time. More often than not folks had been prejudiced in opposition to crypto and it was for a very long time seen as one thing that solely folks throughout the fringe elements of society, drug sellers and whatnot, will use.

Consequently, a number of banks did undertake the coverage. I wouldn’t say it’s regulatory induced, however banks even have their very own threat appetites in the case of Anti-Cash Laundering considerations. And these is perhaps the reason why a number of instances crypto faces hurdles in the case of opening accounts, in addition to accounts all of a sudden being closed. And it’s important to perceive this as nicely: conventional cash laundering pink flags will probably be triggered by the very nature of how crypto buying and selling operates. One of many pink flags in AML is whenever you all of a sudden have an enormous amount of cash coming in that’s off the charts from what you might be usually getting. That can lead to a freeze or enhanced due diligence.

Now that having been mentioned, regulators in Hong Kong, particularly when the federal government determined to turn out to be a Web3 hub, proactively encourage banks to turn out to be extra open-minded. They’ll solely encourage. In case your account operator finally ends up doing one thing that’s cash laundering associated, the chance nonetheless falls on the banks.

Journal: Over within the European Union, is MiCA simplifying banking entry for European companies?

Brisov:MiCA may be very complicated, and it’ll take a number of years for European corporations to regulate to it. It’s vital to know that MiCA just isn’t full. There are nonetheless legislative committees which are engaged on MiCA half two and it ought to, ultimately, cowl all the opposite tokens, not solely cost tokens.

What’s occurring now within the EU market is, each firm that offers with crypto initiatives remains to be requested by banks, monetary establishments and different events they take care of each day to supply their MiCA compliance or whether or not they have a license or one thing like that. The market is 100% confused for the time being with MiCA.

Learn additionally

Options

Promote or hodl? put together for the tip of the bull run, Half 2

Options

Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’

Journal: So is MiCA forcing crypto corporations out of Europe?

Brisov: For international gamers like Circle, it’s a possibility. Today, when you have cash and make use of sufficient attorneys and tech specialists to turn out to be MiCA compliant, you nearly turn out to be a monopoly on this market. They received’t be restricted for fairly a while throughout this MiCA adjustment interval; the anti-monopoly authorities received’t prosecute these gamers.

In the meantime, many smaller corporations are dissatisfied with MiCA, together with those who aren’t even utilizing any EMT or ART. Some corporations simply transfer to totally different jurisdictions, clearly to the UAE and Hong Kong. They’re additionally shifting to the islands like BVI and Cayman.

Journal: Hong Kong is changing into more and more enticing to crypto companies due to its regulatory readability. Are you able to clarify the newly handed Safety of Essential Infrastructures Invoice and what it means for the trade?

It’s what’s colloquially generally known as the Cybersecurity Regulation. It creates this new commissioner throughout the authorities who is basically the cybersecurity czar. There are a sure variety of insurance policies and legal guidelines in place that will probably be very strict upon corporations which are thought-about as essential infrastructure. That features banking, finance, and telecommunication.

Contemplating the truth that we’re aiming to be the crypto hub, it’s affordable to foresee that the federal government may decide in saying sure digital belongings will fall underneath essential infrastructure as nicely.

We’ve not too long ago had the largest crypto heist at Bybit in February. Think about if the corporate didn’t must go at it alone however had your complete heavy weight of the federal government taking proactive steps to mainly reign within the scenario as a substitute of counting on the mercy of different ecosystem companions — which is definitely nice and heartwarming, however is it all the time enough?

So if the crypto buying and selling platform in query seems to be thought-about a essential infrastructure or not it actually brings it to the subsequent degree of cybersecurity. This record just isn’t publicly accessible so as to keep away from portray them as a goal. It provides much more confidence for market contributors as nicely saying, we’re mainly working with a platform that’s not going to be knocked out simply due to a crypto heist by North Korea.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Learn additionally

Hodler’s Digest

Bitcoin breaks $60K, US gov’t strikes seized BTC, and extra: Hodler’s Digest, Feb. 25 – March 2

Editorial Workers

7 min

March 2, 2024

Bitcoin’s worth reaches two-year excessive, Sam Bankman-Fried seeks close to seven-year sentence, and U.S. authorities strikes tens of millions in BTC after worth crosses $60K.

Learn extra

Columns

‘Elon Musk at Bitcoin 2024’ rip-off, Lazarus Group hacks, MOG phishing: Crypto-Sec

Christopher Roark

6 min

July 31, 2024

Deepfake Elon Musk Bitcoin 2024 livestream, MOG holder phished for $148K, silly ransomware backdoor in ESXi server software program. Crypto-Sec.

Learn extra