5 key US financial indicators might affect Bitcoin (BTC) sentiment this week amid heightened bearish sentiment within the crypto market.

The affect of US financial occasions and insurance policies on Bitcoin and crypto normally continues to develop. This makes the anticipated knowledge factors significantly essential for merchants and buyers.

US Financial Information To Watch This Week

Amid the crypto black Monday woes, this week’s US financial knowledge might be essential for Bitcoin and altcoin markets.

March FOMC Minutes

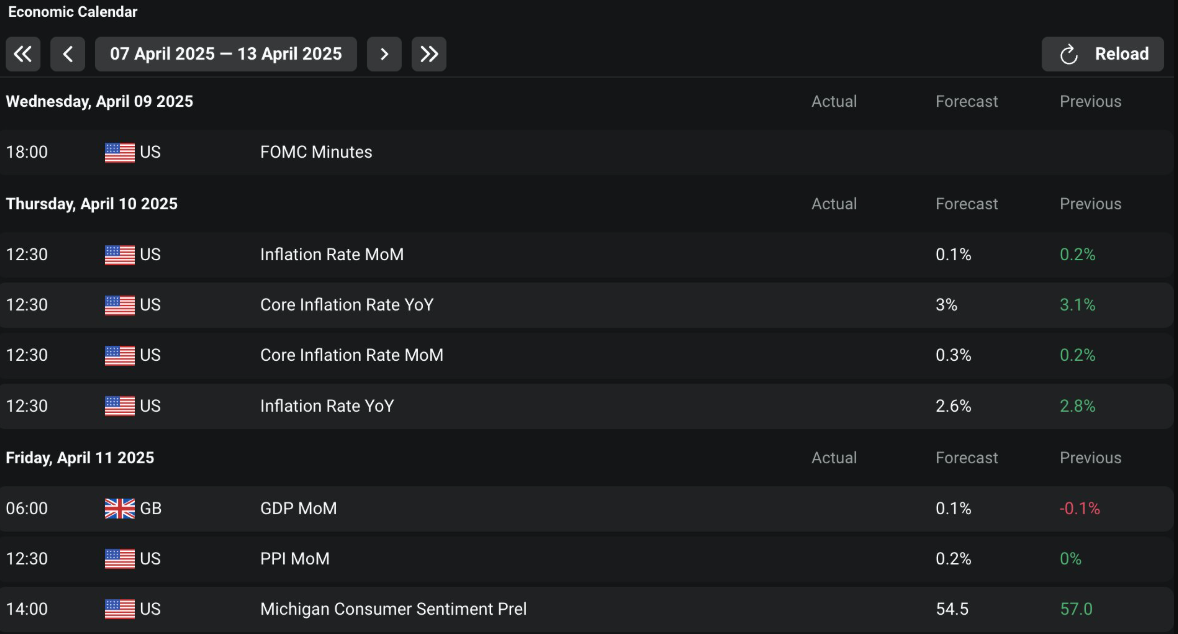

The Federal Open Market Committee (FOMC) minutes from the March assembly are due on Wednesday. This US financial indicator will provide merchants and buyers a window into the Federal Reserve’s (Fed) financial coverage path.

These minutes element discussions on rates of interest, inflation, and financial development, influencing market sentiment. If the tone is hawkish, suggesting tighter coverage or fewer price cuts, Bitcoin might face downward strain as buyers favor safer property like bonds, bolstered by a stronger US greenback.

Conversely, a dovish outlook hinting at price cuts might enhance danger urge for food, driving capital into crypto. This could come as cheaper borrowing encourages funding in high-growth property.

Based mostly on these, crypto merchants will look ahead to clues in regards to the Fed’s stance on inflation. That is extra so contemplating latest knowledge confirmed no vital re-acceleration.

Fed Chair Jerome Powell might reaffirm earlier feedback about resisting untimely price cuts, or new indicators would possibly emerge. Given Bitcoin’s sensitivity to liquidity, any sudden pivot might spark volatility.

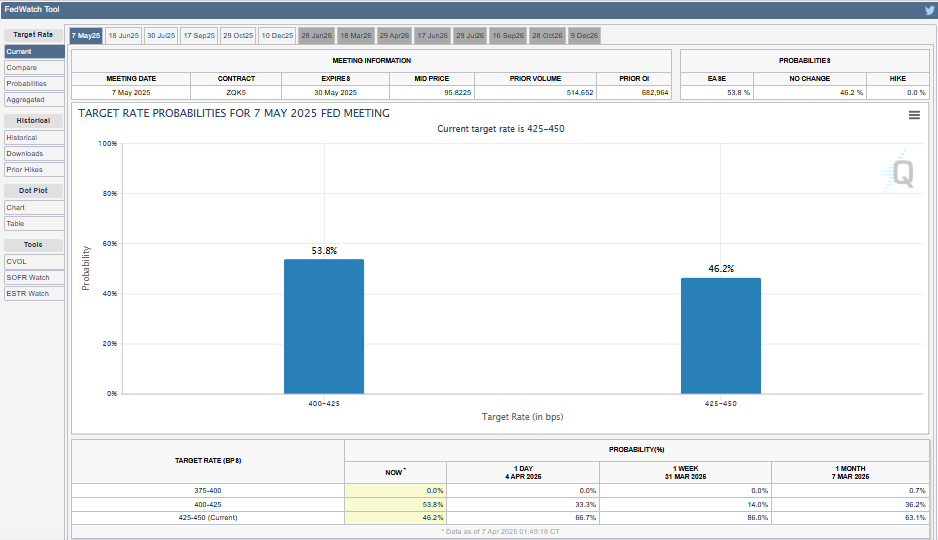

Merchants and buyers ought to brace for short-term worth swings, significantly if the minutes deviate from market expectations priced in by the CME FedWatch.

JPMorgan is the primary Wall Avenue financial institution to forecast a US recession following Trump’s tariffs. In keeping with the financial institution, the FED is likely to be compelled to chop charges earlier than the following assembly. Notably, the following FOMC assembly after the April 9 minutes might be Might 6-7, 2025.

Regardless of JPMorgan’s fears and urges, the continuing crypto market massacre however, no emergency conferences are introduced for April as per the Fed’s official calendar. Accordingly, the following seemingly date for any coverage adjustments, like the speed reduce JPMorgan talked about, is Might 6-7.

“The following FOMC assembly is on the primary week of Might, can buyers wait? Can US folks wait? How excessive is present inflation? Can we now have an pressing price reduce assembly? Till China enters crypto, BTC nonetheless is determined by US liquidity,” one consumer famous.

Preliminary Jobless Claims

Past the March FOMC minutes, the following US financial indicator for crypto merchants to look at is the Preliminary Jobless Claims. Due each Thursday, this report offers crypto market contributors with a real-time snapshot of US labor market well being. This makes it a key driver of financial stability.

Measuring new unemployment filings, decrease claims would sign a powerful financial system, whereas larger claims point out weak point.

For crypto, a powerful labor market (fewer claims) would possibly dampen Bitcoin’s attraction as buyers lean towards conventional equities. Nonetheless, rising claims might gasoline recession fears, prompting the Fed to think about price cuts. Traditionally, this has been a boon for crypto, as decrease charges make borrowing cheaper and enhance liquidity.

Merchants will, due to this fact, monitor whether or not claims exceed the earlier week’s 219,000. Such an final result would enhance Bitcoin as a hedge in opposition to financial uncertainty.

In the meantime, latest developments present claims have been declining. Nonetheless, rising persevering with claims counsel that job-finding challenges persist.

Crypto volatility might spike if the info surprises, particularly alongside Thursday’s interaction, with the CPI launch coming shortly afterward.

“US Core Inflation Price and CPI (Thu10) and Preliminary Jobless Claims (Thu10) are top-tier market movers, seemingly impacting USD, bond yields, and Fed price expectations amid tariff uncertainties,” one consumer famous.

US CPI

The Shopper Worth Index (CPI), which might be launched on Thursday, is one other essential US financial indicator for crypto market contributors to look at. The info measures inflation by way of adjustments in shopper items and providers costs.

A better-than-expected CPI might sign persistent inflation, probably main the Fed to take care of or increase charges. This could strengthen the greenback and strain crypto costs downward as danger property lose attraction.

The earlier CPI knowledge confirmed inflation cooled to 2.8% in February. If March’s CPI exceeds the anticipated 2.6% annual rise, Bitcoin would possibly dip as buyers pivot to inflation-resistant property.

Conversely, a decrease CPI might reinforce expectations of price cuts, boosting crypto as a retailer of worth amid easing financial coverage.

Crypto merchants will even give attention to core CPI (excluding meals and power) for a clearer inflation development, because it closely influences Fed selections.

Given Bitcoin’s April efficiency dropping under $75,000, this knowledge might dictate its subsequent transfer. Volatility is nearly sure, so contributors should be prepared for market reactions, particularly as FOMC minutes will nonetheless be contemporary in thoughts.

US PPI

Friday’s Producer Worth Index (PPI) tracks inflation on the wholesale stage. This US financial indicator affords crypto market contributors perception into manufacturing prices that might trickle all the way down to customers.

Rising PPI suggests larger enter prices, like power or {hardware}, that are essential for crypto mining. This might squeeze miner profitability and scale back Bitcoin provide development.

If March’s PPI climbs considerably above 3.3% year-over-year, it’d sign brewing inflationary strain. This might immediate a Fed tightening bias that might weigh crypto costs as liquidity tightens.

Conversely, a softer PPI would possibly ease inflation fears, supporting a bullish crypto outlook if paired with dovish Fed indicators on Wednesday.

Crypto buyers ought to notice PPI’s lead indicator standing for CPI. A stark divergence from Thursday’s CPI might confuse markets and heighten volatility.

“Huge macro week forward FOMC minutes, CPI, and PPI. A battleground for price reduce bets,” Deribit famous.

With Bitcoin delicate to greenback power, contributors ought to watch how PPI shapes Fed expectations. A balanced studying would possibly stabilize sentiment, however surprises might set off sharp strikes.

Shopper Sentiment

The College of Michigan’s Shopper Sentiment Index, launched Friday, will mirror US customers’ financial confidence. It is a important sign for crypto market contributors.

A excessive studying signifies optimism, probably spurring spending and risk-taking, which might carry Bitcoin as buyers search development property. Robust sentiment may also scale back recession fears, not directly supporting crypto by sustaining market liquidity.

Nonetheless, a drop under expectations of 54.5 might trace at inflation or job worries, denting danger urge for food. This might push funds towards safer havens, pressuring crypto costs. This index typically embeds inflation expectations, such that Bitcoin’s hedge narrative might strengthen if customers anticipate rising costs.

These occasions collectively form the crypto market sentiment this week, intertwining financial coverage, financial well being, and investor psychology.

Individuals should keep agile and mix knowledge insights with market reactions to develop knowledgeable methods. They need to additionally conduct their very own analysis.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.