Bitcoin has been struggling to recuperate, with its worth not too long ago dipping under $80,000, marking a big loss. The downtrend intensified because of the broader market’s weak point, significantly the impression of US President Trump’s commerce wars.

The decline in US inventory markets for the reason that starting of the month has affected Bitcoin as the worldwide financial local weather worsens.

Bitcoin Traders Lose Massive

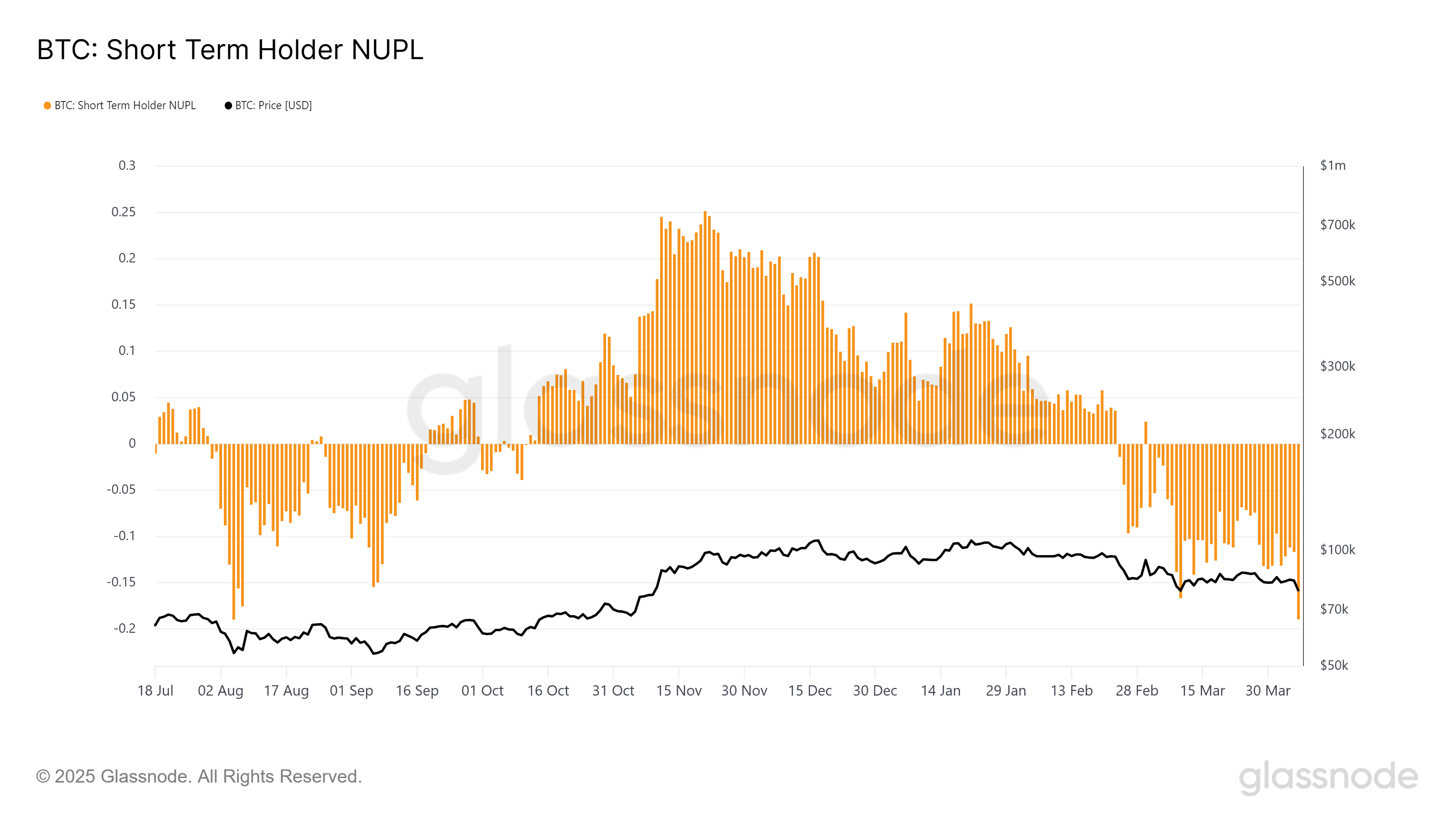

The STH (short-term holders) NUPL (Web Unrealized Revenue and Loss) has reached an 8-month excessive, signaling a possible shift in investor habits. Rising losses within the brief time period point out that Bitcoin could have gone by a interval of capitulation, that means that panic-driven promoting has probably peaked.

Capitulation sometimes marks the underside of a market downturn, suggesting that promoting strain may ease. Nevertheless, the continued bearish sentiment within the broader market, pushed by commerce tensions and world financial uncertainty, nonetheless poses a danger for Bitcoin.

Regardless of the potential for a market backside, short-term holders should still face continued strain because of the broader monetary context.

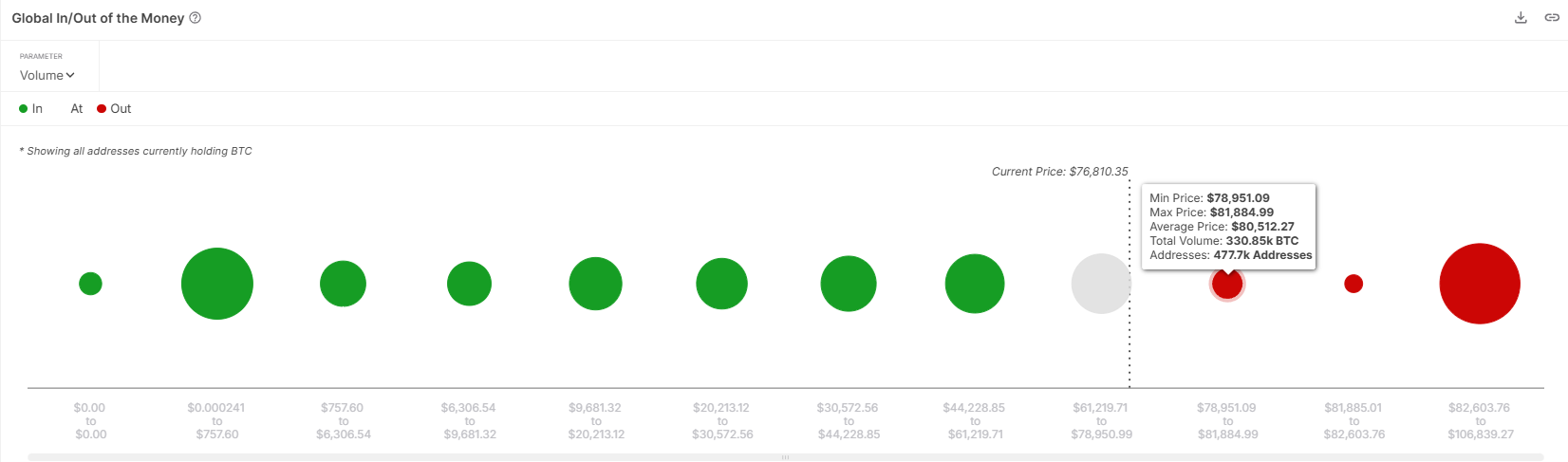

Bitcoin’s macro momentum has been largely influenced by latest monetary market actions. Based on the IOMAP (In/Out of the Cash Round Value) indicator, over $25 billion in losses have been recorded within the final 48 hours.

About 330,850 BTC have been purchased between the $78,951 and $81,884 worth vary, however Bitcoin is now buying and selling at $77,234, placing these buyers within the purple. This important lack of profitability has led many potential new buyers to hesitate, as the present market situations don’t appear favorable for short-term features.

Bitcoin’s wrestle to achieve traction within the face of those losses is compounded by market situations that deter contemporary capital. The IOMAP information means that Bitcoin could face issue in bouncing again, as extra buyers might be reluctant to purchase within the present setting, awaiting extra steady situations.

BTC Value Wants Help

Bitcoin’s worth crashed by 8% over the previous 24 hours, buying and selling at $76,775. The drop from $82,500 to its present stage has brought on important losses for buyers. Bitcoin is at present holding above its key help stage of $76,741, however it stays weak to additional declines.

Transferring ahead, Bitcoin may proceed to face blended alerts, probably consolidating above the help stage of $76,741. Nevertheless, ought to macroeconomic situations worsen, a drop to $74,000 or decrease is feasible. If Bitcoin fails to carry this help stage, additional declines could comply with, extending losses for buyers.

The one option to invalidate the bearish outlook can be for Bitcoin to interrupt above $80,000 and reclaim $82,503 as help. If Bitcoin can maintain this upward motion, it may begin recovering the latest losses and regain investor confidence.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.