Bitcoin’s value could also be hovering near a five-month low, however U.S. President Donald Trump’s tariffs have hit the nation’s largest tech firms tougher.

Since Nov. 5, the most important cryptocurrency by market worth has strengthened towards the “Magnificent Seven,” a bunch of Nasdaq corporations together with prime tech names like Apple, Nvidia, and Tesla.

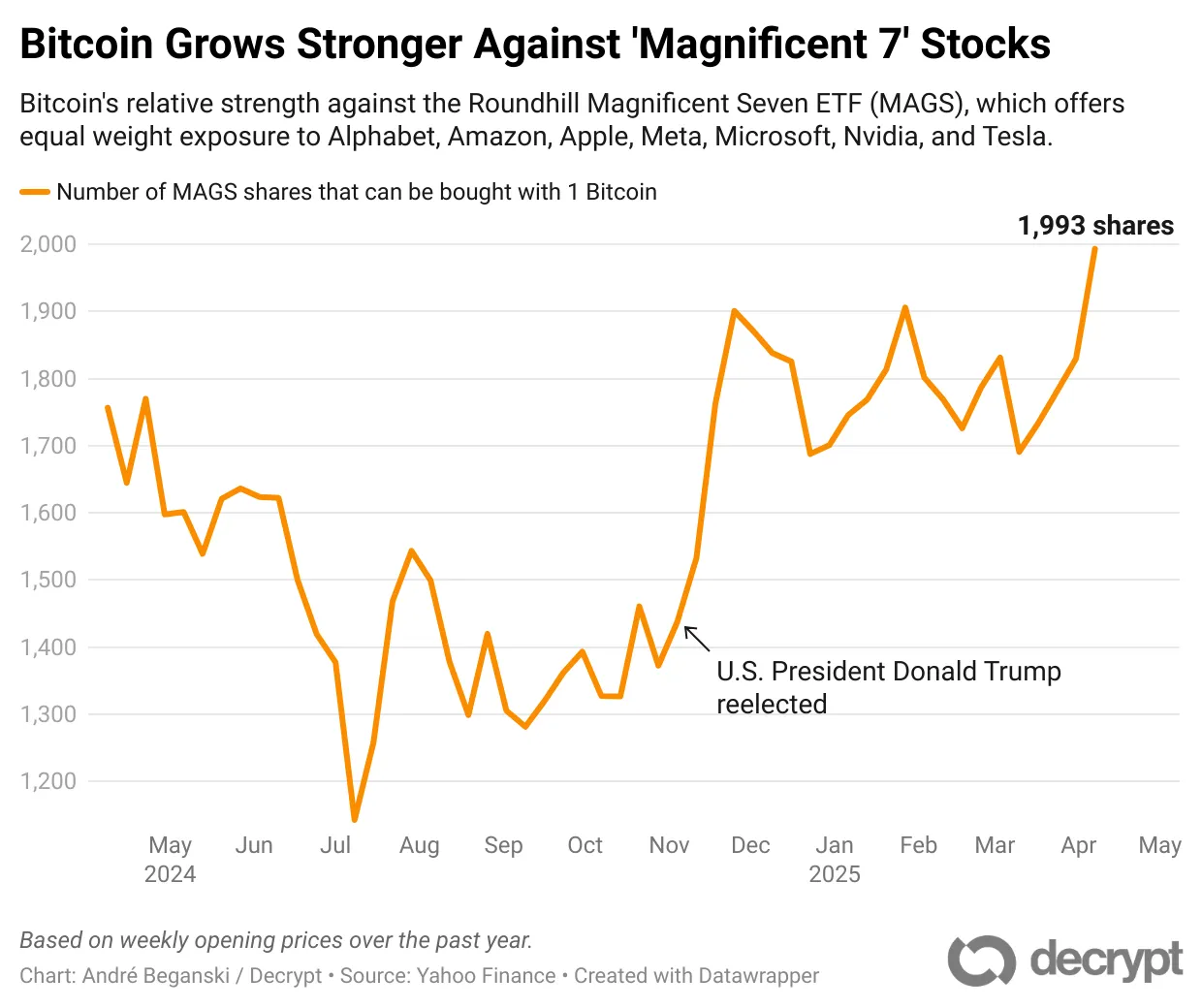

On Monday, one Bitcoin was price round 1,993 shares of the Roundhill Magnificent Seven ETF (MAGS), which affords equal weight publicity to the group of tech corporations. A yr in the past, one Bitcoin might’ve purchased 1,756 of the exchange-traded fund’s shares, when it was price $69,000.

On Friday, Matthew Sigel, head of digital belongings analysis at asset supervisor VanEck, mentioned the ratio had reached an all-time excessive on X, previously often called Twitter.

“[I’ve] been telling shoppers for years to make use of Bitcoin to hedge FAANG publicity,” he added, referring to a preferred acronym for mega-cap tech shares Meta (previously Fb), Amazon, Apple, Netflix and Google.

Bitcoin’s relative power towards Magnificent Seven shares was at its highest stage throughout the previous yr on Monday, rising 13.5% over the course of that interval. Regardless of Bitcoin not too long ago buying and selling like a tech inventory, some market contributors seen it as an indication of divergence.

“In previous market turmoil, Bitcoin has had a combined observe document of offering short-term safety,” Bitwise Senior Funding Strategist Juan Leon informed Decrypt. “Is that this the turning level when it begins to shine as a resilient brief and long-term retailer of worth?”

Because the president has pushed ahead along with his commerce conflict, U.S. shares have weathered their worst stretch because the onset of the coronavirus pandemic. On Monday, the S&P 500 fell for a 3rd straight day and has dropped 10% over the previous week, per Yahoo Finance.

Bitcoin’s value fell as little as $74,600 on Monday, setting a brand new low for Trump’s second time period, in accordance with crypto knowledge supplier CoinGecko. Whereas the S&P 500 has given up its post-election good points, Bitcoin continues to be altering arms above its Election Day value of $69,000 on Nov. 5.

“In contrast with historic macroeconomic shocks or crypto market cycles, these should not record-setting drawdowns,” Thomas Perfumo, Kraken’s international economist, informed Decrypt. “The asset class has weathered worse and, traditionally, emerged stronger every time.”

Edited by James Rubin

Every day Debrief E-newsletter

Begin on daily basis with the highest information tales proper now, plus authentic options, a podcast, movies and extra.