The Federal Reserve is having a closed-door assembly as we speak to debate probably reducing rates of interest. This might assist crypto in just a few methods, spurring dangerous investments and presumably even weakening the greenback.

Fed Chair Jerome Powell has been hesitant to chop charges, however he’s underneath lots of stress. BlackRock’s CEO Larry Fink is presently pessimistic about price cuts, claiming that they could even enhance this 12 months.

Will the Fed Think about Charge Cuts?

Trump’s tariff threats have the complete market in freefall, as billions have been liquidated from crypto and TradFi alike. The rumor of a 90-day pause on tariffs induced a dramatic rally earlier as we speak.

Quickly after, the White Home denied the rumors, leading to a crash. Nevertheless, the Federal Reserve is having a closed-door assembly as we speak, and it could plan to chop rates of interest:

“A closed assembly of the Board of Governors of the Federal Reserve System at might be held 11:30 am on Monday, April 7, 2025. The next issues of official Board enterprise are tentatively scheduled to be thought of at that assembly: evaluate and dedication by the Board of Governors of the advance and low cost charges to be charged by the Federal Reserve Banks,” the Fed’s web site learn.

There are lots of explanation why the Federal Reserve may reduce rates of interest. Excessive charges make fixed-income investments extra engaging, drawing capital away from riskier belongings like shares and cryptocurrencies, whereas low charges make these belongings extra engaging.

Charge cuts have typically corresponded with market rallies, particularly with ZIRP after the 2008 crash.

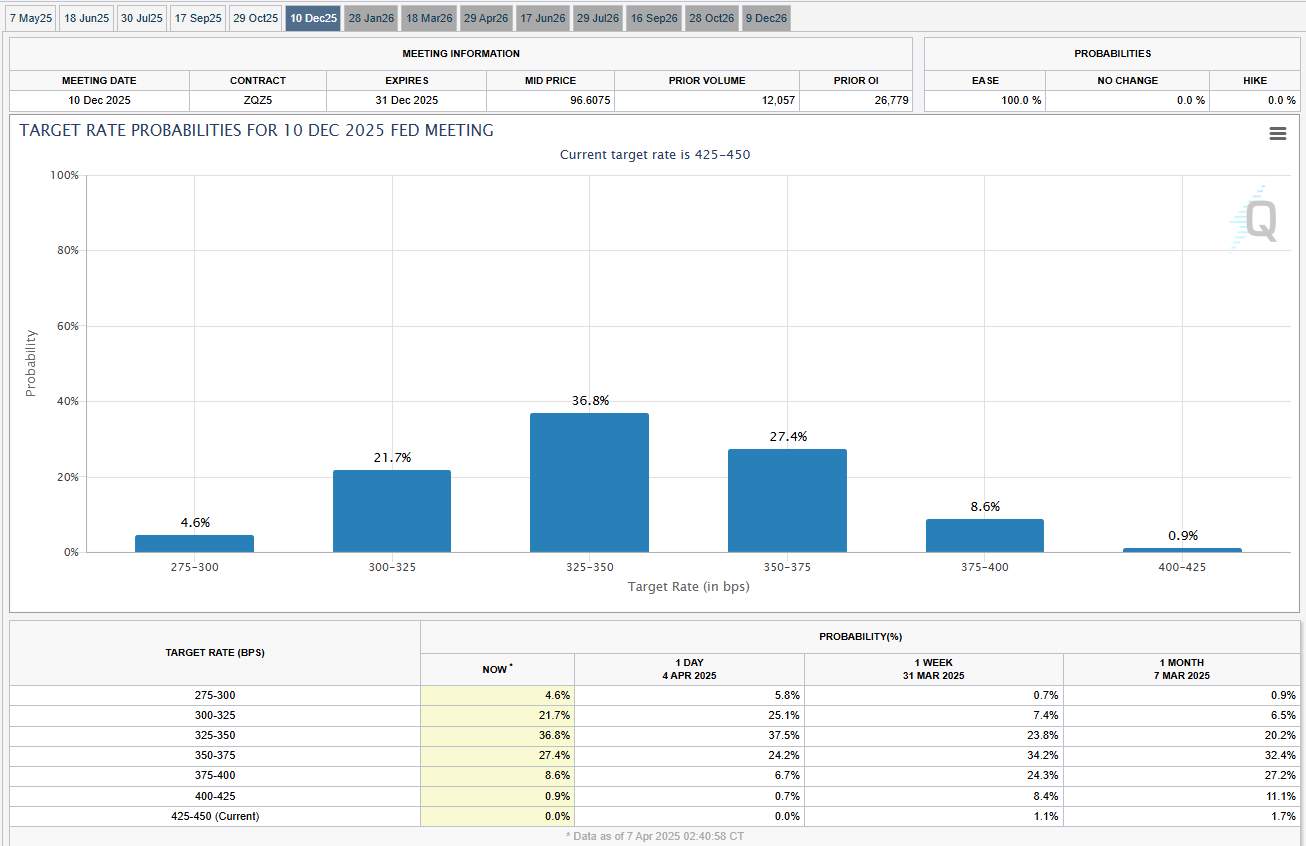

Now that a lot of the market is predicting a recession, the Federal Reserve may trigger a rally with these price cuts. The crypto market not too long ago hoped for price cuts, which the FOMC rapidly rejected.

Fed Chair Jerome Powell initially signaled that he was reluctant to chop charges at this second, however stress has been constructing for him to take action. Sadly, that will not matter but.

Larry Fink, BlackRock’s pro-crypto CEO, has been very pessimistic about potential cuts. In a latest televised interview, he claimed that the majority CEOs consider the US is already in a recession and that the nation is presently not a “international stabilizer” within the markets.

Underneath these circumstances, he acknowledged that there’s a 0% probability of 4 to five price cuts and that charges might even enhance.

Are Curiosity Charge Cuts At all times Bullish for Crypto?

When the Federal Reserve cuts rates of interest, it isn’t a bullish sign throughout the board. In addition they are likely to weaken the US greenback as its yield benefit diminishes relative to different currencies.

This might even be good for crypto, contemplating its use as a retailer of worth, however the Fed isn’t notably eager about that. The trade gained’t be the deciding issue both manner.

Nonetheless, different commentators have been extremely skeptical of Fink’s declare. Powell is underneath lots of stress to chop charges, so elevating them would buck market expectations. Traders are betting on a number of price cuts, and these hypothetical cuts could also be priced to a sure extent.

Wanting again at earlier cycles, intervals of price cuts have typically coincided with market rallies. For example, in the course of the post-2008 restoration, price cuts revived fairness and rising asset courses.

General, decrease charges usually imply simpler entry to credit score, resulting in extra liquidity out there. This further liquidity will help drive up demand for riskier belongings, together with cryptocurrencies.

So, If the FOMC indicators a shift towards decrease rates of interest, this might increase general market confidence. As conventional markets start to stabilize and get well, crypto markets would possibly expertise a rebound.

Investor sentiment, already shaken by the latest sell-offs and heightened volatility, may flip extra optimistic with the prospect of easing financial circumstances.

Most significantly, institutional traders, who’ve been cautious in the course of the present risky interval, might alter their methods in a lower-rate setting.

With decrease fixed-income yields, portfolio managers may enhance their allocation to various belongings, together with cryptocurrencies, to realize larger returns. This inflow of institutional capital may lend credibility to the crypto market and assist drive a restoration.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.