- Ethereum’s Worth Decline: Ethereum (ETH) has skilled a big drop, shedding 46.06% over the previous yr, with the present worth round $1,788.

- Technical Indicators Level to Bearish Tendencies: The formation of a symmetrical triangle sample and a breakdown with retest recommend robust downward momentum, indicating potential for additional losses.

- On-Chain Knowledge Displays Bearish Sentiment: Declines in futures purchase quantity to $4.75 billion and enormous holders’ netflow turning detrimental at -1.65k point out lowered investor confidence and elevated promoting stress.

Ethereum (ETH) has confronted a big downturn lately, with its worth declining by roughly 46.06% over the previous yr. This decline is extra pronounced in comparison with different cryptocurrencies like Bitcoin, which have proven upward traits throughout the identical interval.

Technical Evaluation: Symmetrical Triangle Breakdown

The altcoin has damaged down from a symmetrical triangle sample, a technical indicator that always suggests potential bearish actions. This breakdown, coupled with a retest of the sample’s decrease boundary, signifies that ETH could be poised for additional losses.

Market Place and Dominance

Ethereum’s market dominance can be below stress. The cryptocurrency’s dominance has decreased from 17.32% to 7.39%, highlighting its underperformance relative to rivals.

On-Chain Knowledge Insights

- Futures Purchase Quantity: Ethereum’s futures purchase quantity has declined to a two-week low of $6.17 billion, down from $16.25 billion. This implies lowered shopping for curiosity amongst traders.

- Whale Exercise: Giant holders, also known as “whales,” are exhibiting promoting habits. Knowledge signifies that the online circulate of ETH amongst these massive holders has turned detrimental, with an outflow of roughly 1.65k ETH.

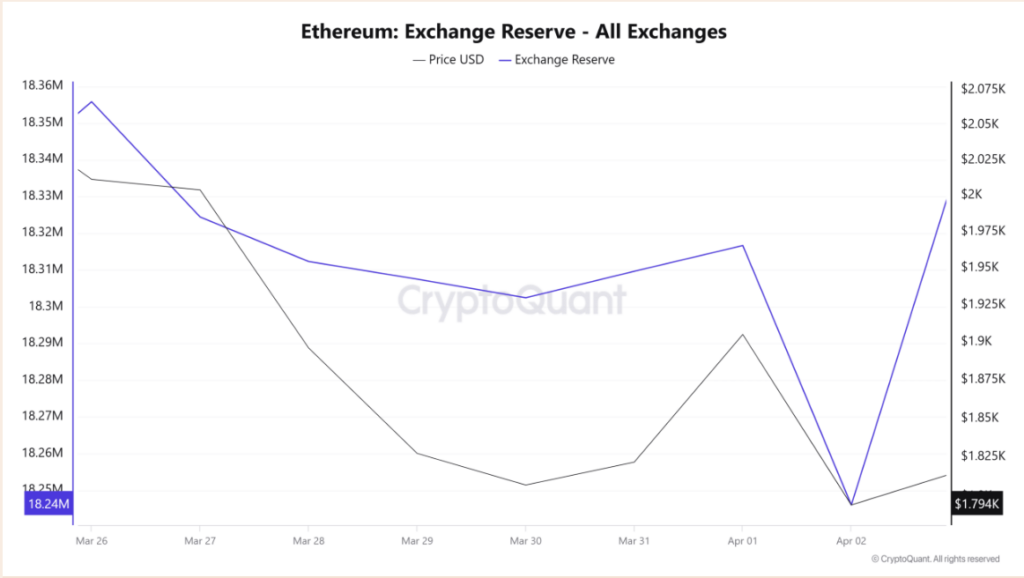

- Change Reserves: The quantity of Ethereum held on exchanges has elevated, reaching 18.4 million ETH—an increase of 200 million tokens prior to now day. This uptick implies that extra traders are transferring their holdings to exchanges, probably to promote, reflecting a bearish sentiment.

Potential Worth Actions

Given the present market circumstances and technical indicators:

- Assist Ranges: If ETH breaches the $1,757 help degree, it might decline additional to round $1,657, ranges final seen in October 2023.

- Resistance Ranges: For a bullish reversal, Ethereum would wish to attain a every day shut above $1,800.

Conclusion

Ethereum is presently going through important bearish pressures, influenced by technical patterns, decreased shopping for curiosity, elevated promoting by massive holders, and rising trade reserves. Traders ought to train warning and carefully monitor these indicators to tell their choices.