The crypto market has entered a turbulent section, with Bitcoin, Ethereum, and a number of other main cryptocurrencies struggling some of the important downturns in current reminiscence.

This sharp decline isn’t remoted to digital belongings alone—international commodities and the S&P 500 have additionally been hit onerous, triggering widespread concern throughout monetary markets.

The uncertainty has been compounded by geopolitical components, most notably a brand new tariff occasion that has spooked buyers and wiped trillions off the market.

As concern dominates sentiment, notably in high-risk and unstable sectors like crypto, buyers who entered the market late throughout bullish runs are dealing with important losses.

Supply – Jacob Crypto Bury on YouTube

Crypto Sentiment at Rock Backside – Is a Main Rebound Coming?

Regardless of the chaos, there’s a silver lining for some contrarian buyers. Market indicators, notably Ethereum’s Relative Power Index (RSI), have dropped to ranges not seen since December 2018, signaling potential undervaluation.

Ethereum just lately dropped to round $1,500, and whereas that represents a steep decline from its earlier highs, it additionally presents what some take into account a shopping for alternative.

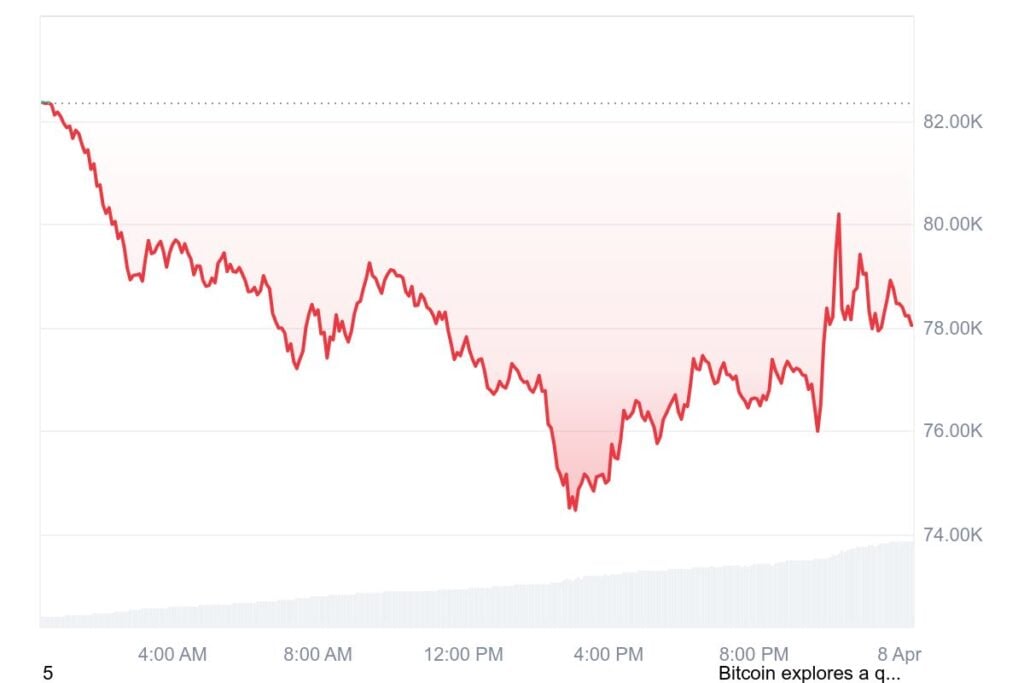

Equally, Bitcoin has fallen into a vital help vary between $72,000 and $80,000, a variety that would function a launchpad for future restoration—if bullish momentum returns.

Although no person can say with certainty whether or not a rebound is imminent, the present technical patterns mirror historic ones which have preceded sturdy rallies, fueling cautious optimism. The whole crypto market cap has shrunk dramatically, falling from $3.7 trillion to $2.44 trillion.

In the meantime, the concern and greed index exhibits excessive concern at simply 17, reflecting overwhelming pessimism amongst merchants. But traditionally, such ranges of concern have generally marked the underside of market cycles, creating alternatives for these keen to go towards the grain.

That is the kind of atmosphere that may reward affected person accumulation and cautious dollar-cost averaging—assuming, after all, the market ultimately rebounds.

Crypto Faces Vital Crossroads – Specialists Weigh In on What’s Subsequent

Different main belongings like Solana have additionally seen steep value corrections, with speak of doable accumulation if costs revisit earlier lows round $60 and even $20. Nonetheless, the general sentiment stays extraordinarily cautious.

Analysts and commentators counsel {that a} deeper bear market might nonetheless play out, with projections of Bitcoin doubtlessly falling to $35,000 or $45,000 if help fails to carry.

This degree of unpredictability makes portfolio danger administration extra necessary than ever, notably in unsure instances when markets can rapidly flip in both path. Within the broader monetary world, market watchers are warning of continued instability.

Predictions of one other 20% drop within the inventory market are including to the overall unease, making the present atmosphere certainly one of excessive stakes and heightened volatility.

Whether or not this second represents a short lived correction or the start of a protracted downturn is unclear—however what is for certain is that these are defining instances for crypto buyers and conventional markets alike.