Solana (SOL), EOS, and Jupiter (JUP) are three Made in USA cash making headlines this week with sharply completely different trajectories. Solana has dropped beneath $100 amid market volatility and tariff-driven uncertainty.

EOS is up practically 15% over the previous seven days, standing out as one of many few large-cap gainers. Jupiter stays the highest crypto aggregator by quantity, whilst its value hovers close to all-time lows.

Solana (SOL)

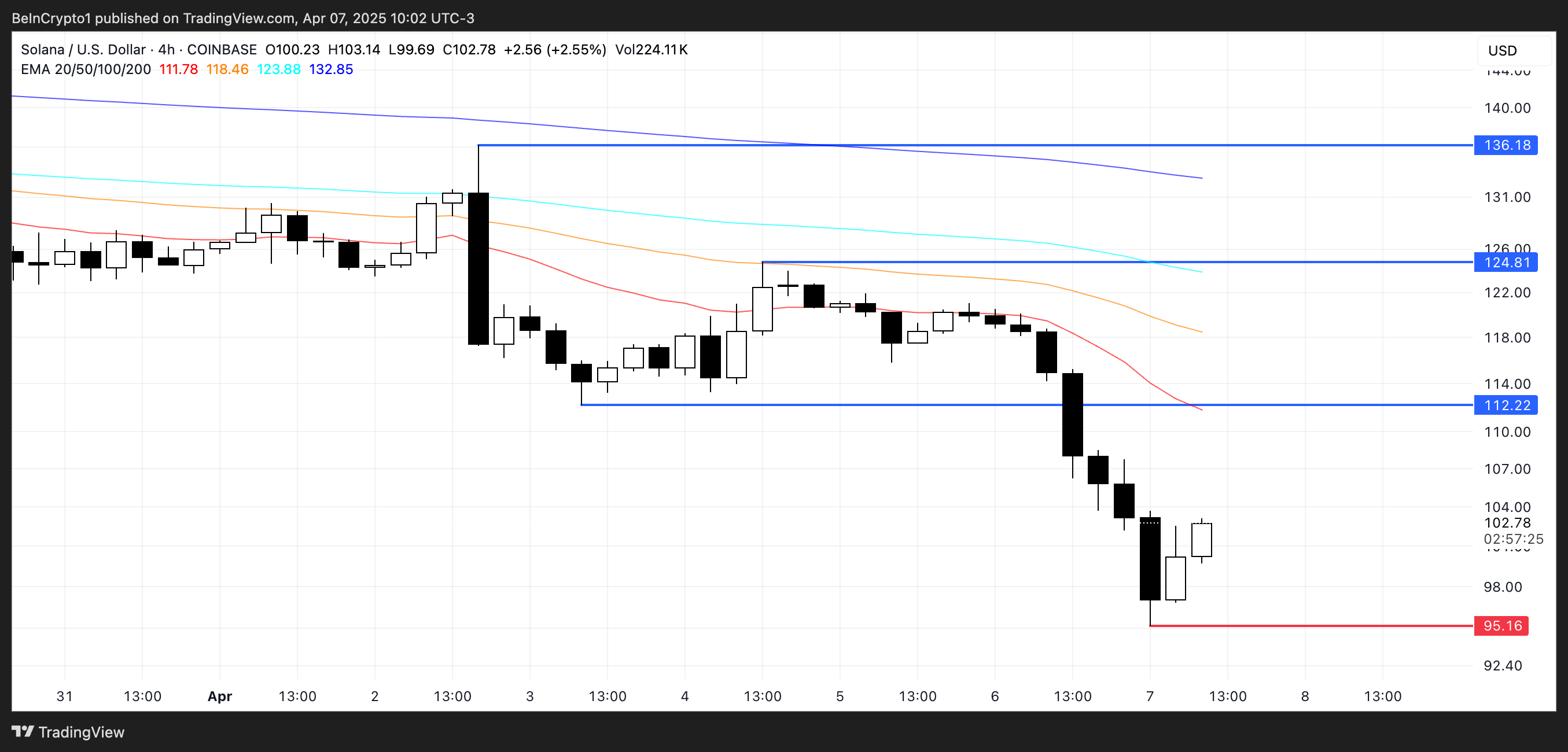

Solana has dropped over 10% prior to now 24 hours, briefly dipping beneath the $100 mark earlier right now.

The sharp decline displays broader weak spot throughout the crypto market, with SOL struggling to keep up key psychological assist ranges amid volatility brought on by Trump’s tariffs.

Over the previous week, SOL has misplaced greater than 18% of its worth and was not too long ago overtaken by Ethereum in decentralized change (DEX) quantity—an area the place it had led for months.

If bearish momentum continues, SOL might retest the $95 assist stage, with a break beneath opening the door to additional draw back towards $90.

Nevertheless, if the pattern reverses, the token might push towards resistance at $112, and a decisive breakout there may see it rally to $124 and even $136 on sturdy bullish momentum, making Solana get well its place as one of the vital necessary made in USA cash.

EOS

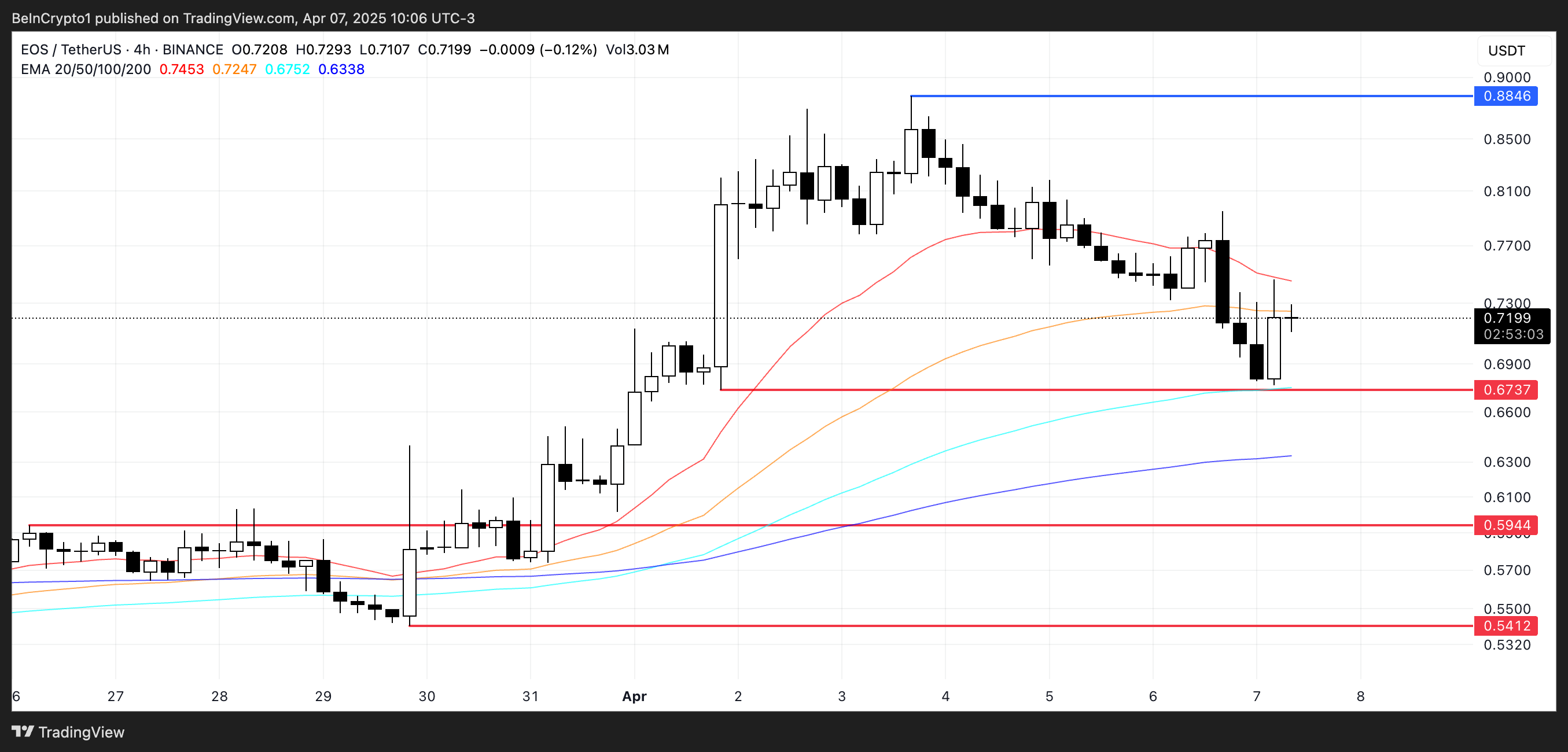

Whereas most main cryptocurrencies have struggled, EOS stands out as one of many few Made in USA cash posting good points this week, climbing practically 15% over the previous seven days.

Its market cap has now approached $1.1 billion, placing it in shut vary of notable gamers like Maker, Story, Optimism, and Arbitrum.

If this upward momentum holds regardless of the broader market correction, EOS might push greater to check resistance round $0.88, with potential to interrupt above $0.90 and even problem the $1 mark.

Nevertheless, if sentiment shifts and EOS follows the market downturn, it might fall again to assist at $0.67. If that stage fails, additional declines towards $0.59 and even $0.54 could also be in play.

Jupiter (JUP)

Jupiter, Solana’s high aggregator, has seen its market cap drop beneath $1 billion after falling greater than 10% prior to now 24 hours, now buying and selling dangerously near its all-time lows.

Regardless of the value drop, Jupiter stays the dominant aggregator in crypto, posting a formidable $8.98 billion in buying and selling quantity over the previous week—greater than the subsequent 9 aggregators mixed.

It additionally ranked because the fourth-largest protocol by charges within the final seven days, producing $14 million, trailing solely Tether, Circle, and Pump.

If the downtrend continues, Jupiter might slip beneath the $0.30 mark, setting new lows; but when it regains bullish momentum, the token could climb to $0.35, $0.41, and doubtlessly retest the $0.50 stage.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.