XRP is at the moment experiencing a steep selloff, a part of a broader downturn affecting your entire cryptocurrency market.

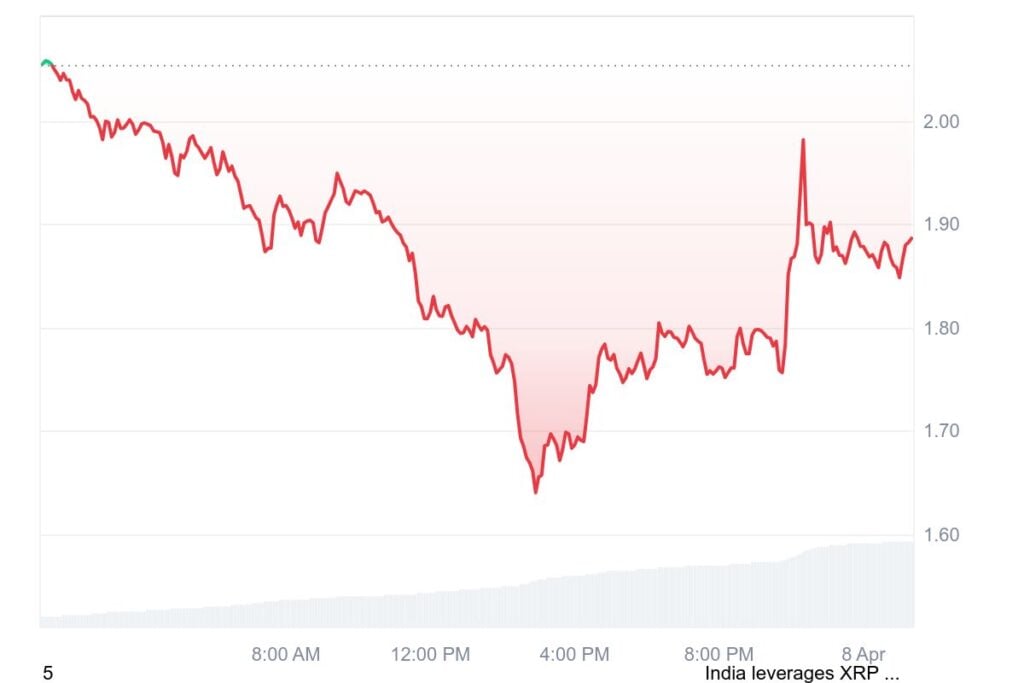

With the entire crypto market capitalization shedding lots of of billions of {dollars} and main property like Bitcoin and Ethereum additionally plummeting, XRP has not been spared—dropping round 8% inside 24 hours and touching a low of $1.64.

This decline is just not remoted to XRP’s fundamentals however is basically pushed by wider macroeconomic and geopolitical tensions. The general monetary market is rattled by a continuation of final week’s bearish momentum, intensified by the fallout from the continued tariff disputes and uncertainty surrounding Federal Reserve coverage.

Dow and Nasdaq futures are deeply within the purple, whereas headlines warn of recession dangers and financial coverage standoffs. Regardless of the unfavorable sentiment, this downturn is being interpreted by some long-term holders as a possibility.

With the assumption that the crypto market will recuperate and develop within the coming years, some buyers are selecting to double down—shopping for extra $XRP at decrease costs to cut back their common price per unit by way of dollar-cost averaging (DCA).

The present fear-driven selloff, although unsettling, is just not being attributed to any basic flaw in XRP itself however to the broader stress seen throughout all markets.

Supply – Austin Hilton on YouTube

XRP Value Prediction

On the time of writing, $XRP is valued at $1.87, with a market cap of $109 billion and a 24-hour buying and selling quantity of $15.7 billion. At present, XRP has managed to reclaim the essential $1.75 assist degree, which is taken into account essential for any potential upward motion.

If this degree holds, XRP might probably check the $2 mark within the close to future. Nonetheless, if it fails to keep up this assist, a drop again to the weekly low at $1.66 is anticipated, with an extra decline being a chance.

There’s hypothesis that $XRP might probably fall under the $1 mark, a transfer that might undoubtedly stir feelings within the XRP neighborhood. But for dedicated buyers, such a drop is seen as a shopping for alternative somewhat than a trigger for panic.

$XRP’s short-term outlook is carefully linked to Bitcoin’s efficiency, with worth swings probably in both course. Nonetheless, accumulating throughout bearish phases might result in robust positive aspects as soon as the market recovers.

Conclusion

Though the timing of a market reversal stays unsure—nobody can say for positive when the turbulence will ease—historic market cycles recommend that the crypto sector has persistently recovered from downturns prior to now.

Whereas short-term merchants might comply with promote alerts and technical indicators to guard capital, long-term holders keep a distinct technique, specializing in the larger image.

The current worth motion, although alarming, is a part of a a lot bigger narrative of market rebalancing, geopolitical posturing, and world financial realignment. Ultimately, conviction and endurance are what separate speculators from strategic buyers.