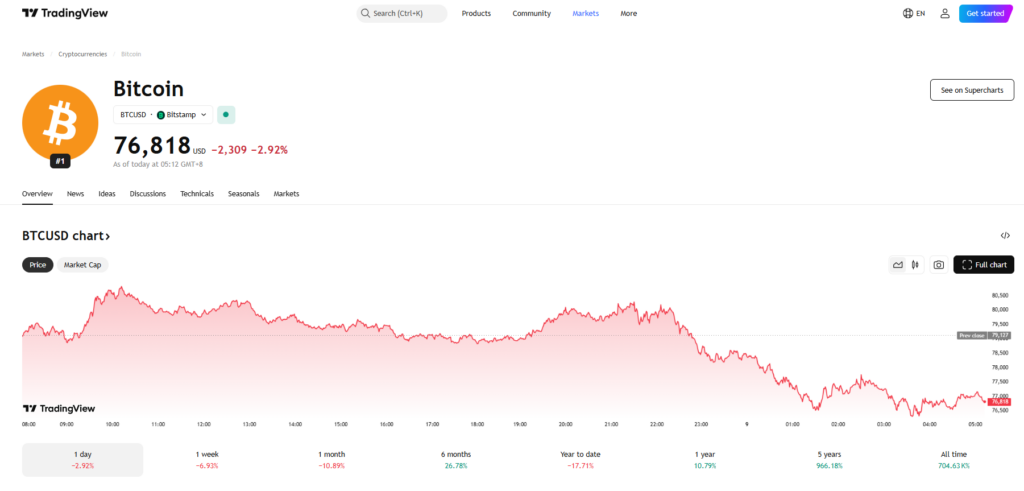

- Bitcoin rebounded to $80K after panic-selling attributable to Trump’s tariff plans rattled world markets.

- Regardless of latest volatility, BTC dominance rose to 60% as traders sought security within the high crypto asset.

- Futures liquidations remained low, suggesting a managed selloff with establishments quietly rising holdings.

After a tough experience triggered by tariff jitters from President Trump’s newest coverage transfer, Bitcoin has bounced again—kind of. The main crypto clawed its method again to $80,000, recovering from a pointy drop that had spooked markets throughout the board. It wasn’t simply crypto that bought rattled—this was worry bleeding in from each path.

Market Cap Holds Regular as Bitcoin Takes the Lead

Even with all of the back-and-forth in value, Bitcoin’s market cap continues to be hanging robust round $1.5 trillion. That’s no small feat contemplating how uneven issues have been. And get this: Bitcoin dominance simply hit 60%. What that principally means? Individuals are pulling their cash outta altcoins and flocking to BTC for shelter. It’s an indication—clear as day—that traders need security, or a minimum of some model of it, in the course of the storm.

Analysts say this isn’t about crypto drama—it’s macro stuff. World rigidity, financial nerves, all of it. Bitcoin’s simply caught within the crosswinds.

Futures Market Reveals… Bizarre Resilience

Now right here’s one thing fascinating—futures knowledge is exhibiting somewhat spine. Based on Glassnode, open curiosity in BTC futures dropped to $34.5 billion. That’s really up from the April 3 low of $33.8B, however nonetheless sliding general. So what’s happening?

Properly, seems merchants are dialing issues again. Since March 25, cash-margined open curiosity has dropped from $30B to $27B. And for crypto-margined positions? Down from $7.5B to $6.9B… however creeping again up once more now. So yeah, danger urge for food continues to be alive—simply hiding within the shadows a bit.

Apparently, the share of crypto-backed futures contracts climbed from 19% to 21% since April 5. That may imply the market’s gearing up for extra value swings—fasten your seatbelts.

Not a Liquidation Massacre—But

Regardless of all of the wild value motion, liquidations have been… surprisingly tame. Solely $58 million price of BTC futures bought liquidated within the final day. And outta that, $42M have been longs. The remainder—simply $16.6M—have been shorts. That’s not a lot, contemplating Bitcoin dropped 10%.

Examine that to previous shakeouts—February and March noticed every day liquidations round $140M. This time? It’s been far more chill. Feels just like the sell-off was extra managed, much less panic-leveraged-frenzy, and extra like regular spot promoting. Which, relying in your angle, won’t be the worst factor.

Massive Gamers Nonetheless Lurking

Right here’s the kicker—regardless of all of the drama, institutional whales haven’t flinched. Actually, extra of them are swimming in. Stories present 76 new establishments holding 1,000+ BTC have popped up within the final two months. That’s a 4.5% uptick within the big-money crowd.

So yeah, whilst headlines scream chaos, some of us are clearly seeing alternative. Possibly it’s the calm earlier than one other storm. Or possibly—simply possibly—it’s the groundwork for what’s coming subsequent.