Crypto asset funding merchandise skilled web outflows of $240 million over the previous week, in response to the most recent report from CoinShares.

The development displays ongoing investor warning amid international financial headwinds, significantly surrounding latest US commerce tariff bulletins, which have raised issues about future financial progress.

Bitcoin and Ethereum Lead Weekly Outflows

In accordance with the CoinShares report, Bitcoin noticed essentially the most vital capital motion, with $207 million in outflows. This determine brings Bitcoin’s year-to-date web inflows to $1.3 billion, indicating that whereas short-term sentiment could also be cautious, longer-term positioning stays intact.

Ethereum adopted with $37.7 million in outflows, persevering with a development of declining curiosity in main altcoins. Different digital belongings additionally recorded outflows, together with Solana and Sui, which misplaced $1.8 million and $4.7 million respectively.

Nonetheless, some much less distinguished tokens bucked the development. Toncoin (TON), for instance, attracted $1.1 million in new capital, suggesting selective optimism amongst buyers regardless of broader unfavorable flows.

In the meantime, no matter these optimistic inflows from some tokens and smaller unfavorable flows from the bigger cryptocurrencies final week, the aftermath on value efficiency has been fairly comparable the next week.

Notably, on the early hours of Monday, Bitcoin, Ethereum and all different main cryptocurrencies noticed a notable massacre in value efficiency.

Whereas BTC dropped by almost 10% seeing a slide beneath $75,000, ETH and different crypto plunged by almost 20% with ETH particularly dropping beneath $1,500 for the primary time since October 2023.

The promote offs from BTC and ETH and different main crypto belongings out there led to a 9..6% plunge within the international crypto market capitalization.

Combined Regional and Sectoral Exercise

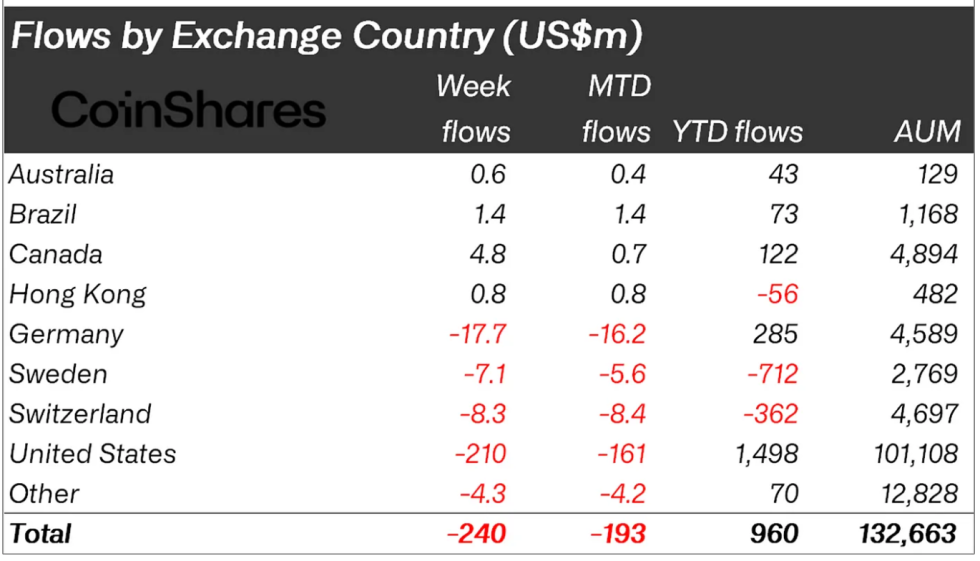

Moreover, the report highlighted that US and German buyers accounted for the majority of capital withdrawal, with $210 million and $17.7 million in outflows respectively. In distinction, Canadian buyers appeared extra optimistic, contributing $4.8 million in inflows throughout the identical interval.

Blockchain-focused equities additionally noticed renewed curiosity, recording $8 million in inflows for the second consecutive week. CoinShares famous that some buyers could also be viewing latest value declines in these belongings as potential entry factors, aligning with a broader technique of diversification inside the digital asset house.

In the meantime, regardless of the unfavorable flows, CoinShares Head of Analysis James Butterfill famous that whole belongings underneath administration (AUM) remained comparatively steady.

As of this week, AUM stood at $132.6 billion, representing a slight enhance of 0.8% week-on-week. Butterfill contrasted this resilience with conventional monetary markets, highlighting that MSCI World equities declined 8.5% over the identical interval. Butterfill wrote:

This resilience is very notable in comparison with different asset lessons, equivalent to MSCI World equities, which noticed an 8.5% decline over the identical interval, underscoring the robustness of digital belongings amid financial uncertainty.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.