Hedera (HBAR) worth rebounded over 10% within the final 24 hours, as some technical indicators are starting to flash early indicators of a possible restoration. The BBTrend has flipped constructive after a full week within the purple, hinting at a attainable momentum shift. Nonetheless, the Ichimoku Cloud nonetheless exhibits a firmly bearish setup, and EMA strains proceed to favor draw back threat. Whether or not HBAR can reclaim misplaced floor or proceed sliding towards multi-month lows will rely upon how these conflicting alerts resolve within the coming days.

Hedera BBTrend Is Optimistic After Seven Days

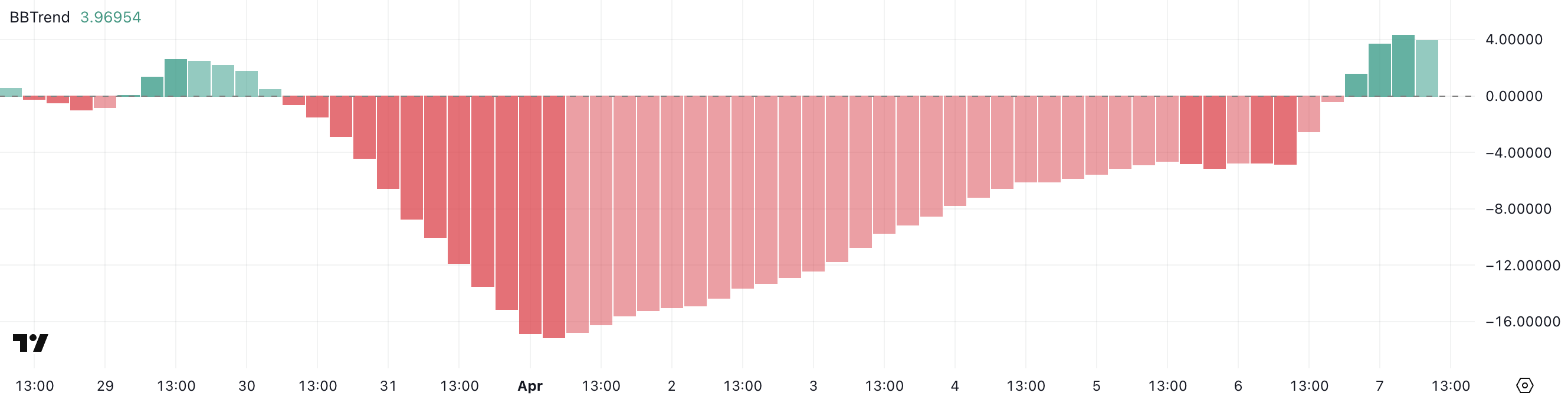

Hedera’s BBTrend indicator has turned constructive, presently sitting at 3.96 after spending the previous seven days in unfavourable territory and hitting a low of -17.12 on April 1.

The BBTrend (Bollinger Band Pattern) is a momentum-based indicator used to evaluate the energy and path of a development relative to its place inside the Bollinger Bands.

Readings above 0 recommend bullish momentum and potential upside motion, whereas readings beneath 0 point out bearish stress and downward momentum.

The present BBTrend worth of three.96 means that Hedera is displaying early indicators of a possible bullish reversal following a protracted downtrend. The shift into constructive territory may imply that purchasing stress is returning and, if sustained, could help a worth restoration.

Nonetheless, given the current volatility and total weak spot within the broader market, HBAR will want constant follow-through above its mid-range ranges to substantiate this upward shift.

A failure to keep up a constructive BBTrend may end result within the continuation of sideways or downward motion.

HBAR Ichimoku Cloud Paints A Bearish Image

The Ichimoku Cloud chart for Hedera presently shows a bearish construction. The worth is positioned nicely beneath the Kumo (cloud), indicating that downward momentum stays dominant.

The Tenkan-sen (blue line) and Kijun-sen (purple line) are each sloping downward and performing as rapid resistance ranges, suggesting that sellers nonetheless have management over the development.

The cloud forward is thick and purple, reinforcing a bearish outlook and signaling that sturdy resistance lies above the present worth motion. Nonetheless, a current bullish candle pushing towards the Tenkan-sen suggests early indicators of a attainable aid rally.

For any significant development reversal to happen, HBAR would wish to interrupt above each the Tenkan-sen and Kijun-sen, and finally transfer into the cloud itself—a difficult job given the present setup.

Total, the Ichimoku configuration confirms that whereas some short-term upside is feasible, the broader development stays firmly bearish for now.

Will Hedera Fall To five-Month Lows?

Hedera’s EMA (Exponential Transferring Common) strains proceed to sign a bearish development, with short-term averages positioned beneath the long-term ones—a basic indication of downward momentum.

So long as this alignment holds, HBAR stays weak to additional declines.

If promoting stress resumes, the token may fall to check help at $0.124. A breakdown beneath that degree would mark the primary transfer below $0.12 since November 2024.

Nonetheless, if Hedera worth manages to reverse its present correction, a restoration may achieve traction and push the value towards resistance at $0.155.

A breakout there may pave the way in which for additional good points to $0.168, and if bullish momentum accelerates, HBAR may even try a transfer towards the $0.18 and $0.20 zones.

A crossover of the short-term EMAs above the long-term strains can be a key sign confirming a possible development reversal.

Disclaimer

In step with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.