The authorized standoff between the Nigerian authorities and Binance, the world’s main crypto alternate, continues with new developments. On April 7, 2025, a Nigerian court docket postponed a tax evasion listening to involving Binance to April 30.

The delay offers the Federal Inland Income Service (FIRS) extra time to reply to the alternate’s request. This choice marks a turning level in a tense authorized battle. Nigeria has accused Binance of inflicting critical injury to the nationwide economic system.

Binance Faces Authorized Battle in Nigeria Amid Hovering Inflation

In keeping with Reuters, Binance’s lawyer, Chukwuka Ikwuazom, requested the court docket to annul the order permitting FIRS to serve authorized paperwork by way of e mail. He argued that Binance is an organization registered within the Cayman Islands and has no bodily presence in Nigeria.

Subsequently, serving paperwork exterior Nigeria with out court docket permission violates authorized procedures. His request prompted the court docket to postpone the listening to with a purpose to assessment the validity of the service technique.

“On the entire the order for the substituted service as granted by the court docket on February 11, 2025 on Binance who’s … registered beneath the legal guidelines of Cayman Islands and resident in Cayman Islands is improper and ought to be put aside,” Ikwuazom stated.

FIRS first filed the lawsuit in February 2025. The company claims Binance owes about $2 billion in unpaid taxes from 2022 and 2023. Past taxes, FIRS additionally calls for $79.5 billion in compensation for what it describes as financial injury attributable to Binance’s operations in Nigeria.

FIRS alleges that Binance’s actions have contributed to a pointy devaluation of the naira and monetary instability. They declare Binance has a major financial presence in Nigeria regardless of missing an official workplace and, due to this fact, should pay company earnings taxes, penalties, and curiosity.

Past tax evasion, Nigeria arrested two senior Binance workers—Tigran Gambaryan and Nadeem Anjarwalla—in early 2024. The fees included tax fraud and cash laundering.

Below mounting authorized strain and authorities criticism, Binance stopped supporting naira transactions in March 2024. The transfer was seen as an entire withdrawal from the Nigerian market. It adopted Nigeria’s crackdown on crypto exchanges, which the federal government blamed for worsening international alternate shortages and weakening the nationwide forex.

“From shutting down naira transactions to a stunning $81.5 billion lawsuit, Binance’s conflict with Nigeria has been nothing wanting dramatic. Detained executives, bribery allegations, and claims of financial sabotage—this authorized battle is redefining how crypto operates in Africa’s greatest economic system,” Enterprise Insider Africa reported.

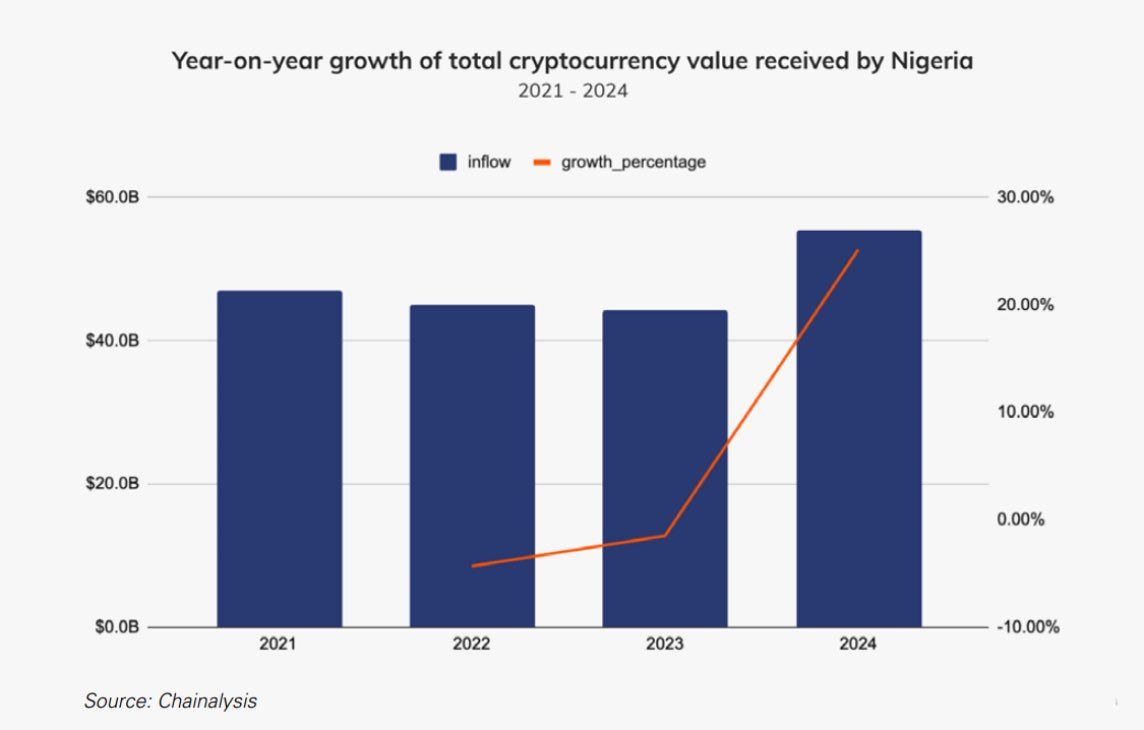

As financial instability grows, many Nigerians have turned to cryptocurrency as a hedge in opposition to inflation and forex devaluation. Blockchain analytics agency Chainalysis revealed that Nigerians traded roughly $59 billion price of crypto belongings in 2024.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.