For years, crypto in Africa was synonymous with Bitcoin (BTC). In the present day, that narrative has flipped, with firms like Yellow Card, a crypto alternate working in Africa, clearly reflecting this shift.

In an unique with BeInCrypto, Yellow Card co-founder and CEO Chris Maurice reveals how it’s constructing a pan-African stablecoin community to leapfrog conventional finance (TradFi). That is amid rising regulatory readability, collapsing fiat methods, and a remittance revolution.

Stablecoins Are Reworking Africa’s Monetary Scene

The pan-African alternate operates in over 20 markets, and Maurice says stablecoins now account for over 99% of its transactions. This makes Yellow Card a bellwether for what is perhaps probably the most transformative pattern in rising markets finance.

“After we first launched Yellow Card in 2019, individuals have been completely shopping for Bitcoin. Now, the preferred asset is Tether (USDT),” Maurice advised BeInCrypto.

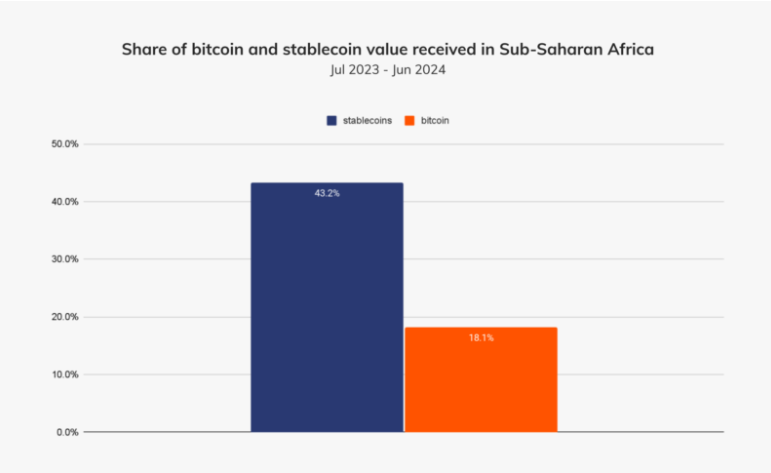

Because it occurred, necessity, not hypothesis, has pushed this evolution. Africa leads the world in peer-to-peer (P2P) crypto buying and selling quantity. Nevertheless, not like world crypto hubs chasing unstable returns, Africans are selecting stablecoins out of monetary survival.

Native currencies are eroding below inflationary stress in international locations like Nigeria, which ranks second globally in crypto adoption (per Chainalysis). Stablecoins provide a dependable retailer of worth and seamless technique of cross-border funds.

That is particularly important in a continent with $48 billion annual remittances and protracted banking limitations.

“Stablecoins are fixing sensible monetary companies challenges in Africa. Folks aren’t in love with the tech. They want quicker, cheaper methods to maneuver cash to outlive and thrive,” Maurice added.

Infrastructure Constructed for the Unbanked

Yellow Card has gone past buying and selling companies. Its infrastructure integrates cellular cash methods (like M-Pesa in Kenya) and native fiat currencies such because the Nigerian naira and Ghanaian cedi. In keeping with the agency’s CEO, this helps onboard customers with out financial institution accounts.

By managing compliance, foreign money alternate, and funds internally, the agency allows companies to function with out battling unreliable native rails.

“Our mission is to let firms make investments, rent, and develop in rising markets while not having to emphasize over infrastructure. We’ve constructed the again workplace [meaning] cybersecurity, AML, [and] information safety, to allow them to deal with progress,” he articulated.

The Regulatory Dam Has Damaged

Maurice additionally noticed that African regulators saved crypto in limbo for years. In Yellow Card’s view, 2024 marked a tipping level.

“There may be regulatory momentum in Africa that’s solely accelerating. The dam has damaged,” he mentioned.

South Africa now classifies crypto as a monetary product. It has licensed main exchanges like Luno and VALR. International locations within the Central African Financial and Financial Neighborhood (CEMAC), Mauritius, Botswana, and Namibia have adopted go well with with licensing regimes.

In the meantime, regulatory incubators are rising in Kenya, Nigeria, Rwanda, and Tanzania. In opposition to this backdrop, Maurice says Yellow Card has actively helped draft laws in Kenya and helps crypto frameworks in Morocco.

Preventing the Casual Market

Nonetheless, challenges stay. In international locations like Ethiopia, Cameroon, and Morocco, outright bans have pushed customers underground into high-risk P2P networks. Yellow Card pushes for frameworks that stage the enjoying subject for compliant gamers.

“We face a variety of competitors from firms that don’t keep excessive AML requirements…A stage enjoying subject is all we search,” he mentioned.

With $85 million in enterprise funding, Yellow Card is deploying capital into compliance and partnerships. With this, the corporate positions itself because the go-to infrastructure supplier for world companies seeking to faucet African markets.

From Africa to Rising Markets All over the place

Cross-border funds are maybe Yellow Card’s strongest use case. The corporate’s co-founder says its stablecoin-powered rails are serving to companies scale back working capital wants, increase to new areas, and rent quicker.

“We’ve had shoppers inform us we’ve enabled them to scale into new international locations and scale back their prices dramatically. That’s actual financial influence,” mentioned Maurice.

The corporate just isn’t stopping at Africa. Its infrastructure extends into different frontier markets, with a wave of strategic partnerships anticipated in 2025.

“Yellow Card has constructed a collection of simple buttons for developed world firms to increase into sophisticated, high-growth markets,” he famous.

The Finish of SWIFT?

Maybe the boldest declare from Yellow Card is what it sees on the five-year horizon: the decline of SWIFT and conventional worldwide transfers altogether.

“As we glance out 5 years, SWIFT is in hassle. In ten, nobody will likely be making worldwide wires once more,” Maurice chimed.

Backed by enterprise-grade safety and regulatory rigor, Yellow Card attracts curiosity from blue-chip companies like PayPal and Coinbase alternate, that are searching for stablecoin companions in rising markets.

“Stablecoins are already a normal a part of the monetary infrastructure in Africa. CFOs and treasurers in conventional industries are actually routinely utilizing them to retailer and switch worth,” he added.

Africa’s crypto market continues to be small in comparison with world giants. However, because the world shifts from hypothesis to utility, the continent’s fragmented monetary methods might provide a glimpse into crypto’s most impactful use case: financial empowerment. For Yellow Card, the mission is obvious and more and more pressing.

“We’ve constructed an organization for longevity and scale. Crypto adoption in Africa is stablecoin adoption,” Maurice concluded.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.