In current developments, XRP, the cryptocurrency related to Ripple, has seen a number of pivotal occasions unfold, together with the launch of the first-ever XRP ETF in the USA. This marks a major milestone for the cryptocurrency, providing a brand new method for traders to achieve publicity to XRP.

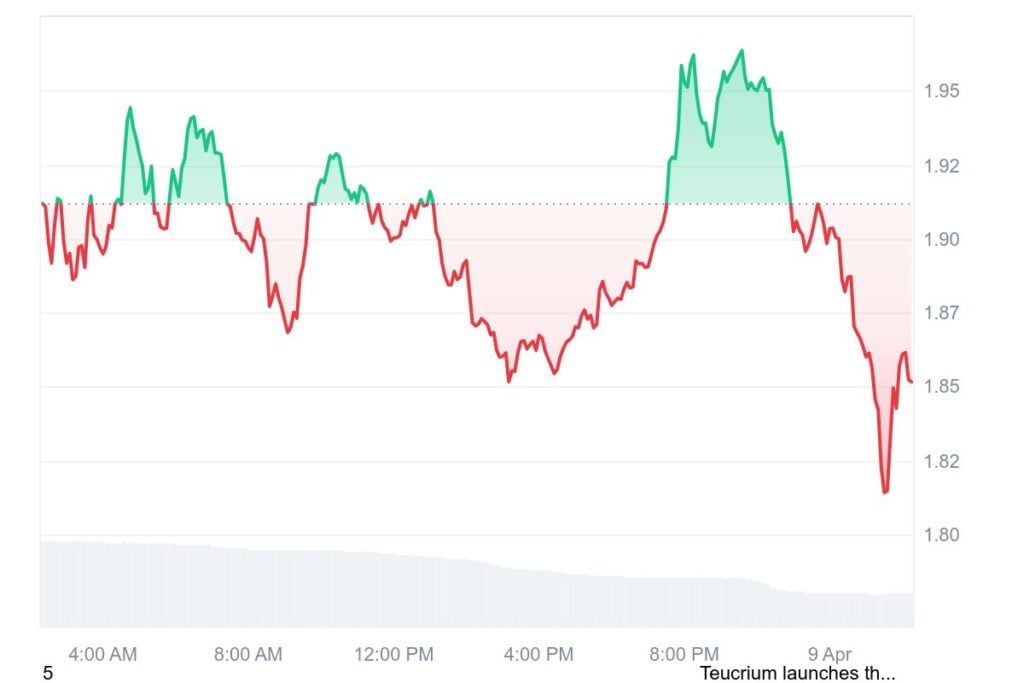

Regardless of the thrill surrounding the ETF launch, the market response has been extra subdued than anticipated, with $XRP exhibiting some volatility. After hitting a excessive of $1.97, it pulled again to round $1.85, highlighting the continuing challenges available in the market.

Whereas the worth fluctuation could seem regarding to some, it’s largely considered as a brief response, probably influenced by profit-taking and market manipulation fairly than any elementary weaknesses in XRP itself.

Hidden Highway Acquisition Might Be a Bullish Catalyst for XRP, Regardless of Present Worth Motion

One other main announcement is Ripple’s current acquisition of Hidden Highway for $1.25 billion, a transfer that has flown beneath the radar however might be rather more bullish for XRP than present value motion suggests.

Hidden Highway, a major dealer, gives institutional providers to high monetary establishments, and a part of its capital and exercise will now faucet into the XRP ledger.

Supply – Austin Hilton on YouTube

This might have important implications for XRP’s development, as it might appeal to extra liquidity, decentralized functions, and builders to the community. The acquisition is structured as a mixture of money, XRP, and inventory, exhibiting Ripple’s dedication to increasing its operations.

Moreover, using ROUSD as collateral within the prime brokerage providers may elevate XRP’s function within the rising stablecoin narrative Nonetheless, it stays to be seen how a lot of this capital and exercise will instantly impression XRP’s ledger.

XRP Worth Prediction

Within the quick time period, $XRP’s value remains to be largely influenced by Bitcoin’s efficiency, and its correlation to Bitcoin stays excessive. If Bitcoin sees a restoration, XRP could reclaim $2 and transfer again into its established vary. Nonetheless, if Bitcoin experiences a pullback, $XRP is more likely to comply with.

Regardless of this, the acquisition indicators long-term development potential for XRP, and it may make the token extra enticing to traders, particularly at value bottoms. This information highlights the continuing developments at Ripple, and the longer term for XRP might be rather more promising than it initially appeared.

XRP’s Resilience Amid Financial Uncertainty: Ripple’s Put up-SEC Technique Is Paying Off

Regardless of these optimistic developments, the broader monetary market is dealing with turbulence, with geopolitical tensions and financial uncertainty contributing to market fluctuations.

These macroeconomic elements, significantly the continuing tariff points between the USA and China, have created a risky surroundings for all property, together with cryptocurrencies.

Whereas XRP’s value could not have surged in response to those current occasions, the long-term implications of Ripple’s strategic strikes are seen as extremely optimistic, with many anticipating that the corporate’s increasing affect and partnerships will repay sooner or later.

Ripple’s method to navigating the post-SEC period has additionally been noteworthy. With the SEC lawsuit out of the image, the corporate is shifting ahead with extra confidence, forging important offers and partnerships that place XRP for future development.

This displays Ripple’s ongoing efforts to combine XRP into varied sectors, together with worldwide cash transfers, clearing providers, and monetary transactions between organizations, governments, and companies.

These strategic strikes are setting the stage for the way forward for Ripple and XRP within the international monetary panorama, although the rapid market response could not totally replicate the potential long-term advantages.

In conclusion, whereas the marketplace for XRP could also be dealing with short-term volatility, the underlying developments level to a promising future for the crypto. Ripple’s acquisition of Hidden Highway and the launch of the XRP ETF sign the corporate’s continued growth and its skill to faucet into main monetary markets.

Because the broader financial scenario evolves, XRP’s strategic positioning may result in important development, making it an asset to look at carefully within the coming months.