Bitcoin sharply fell beneath $75,000 as Asian and Pacific inventory markets opened on Wednesday morning, shedding 6% in a single day. International monetary markets are sinking beneath strain from the US imposing a 104% tariff on Chinese language imports.

The sell-off coincided with mounting fears that escalating commerce tensions between the world’s two largest economies may derail international financial restoration.

Inventory Markets Bleed Worldwide and Bitcoin Follows

In Asia, Japan’s Nikkei 225 plummeted almost 4% on the open, whereas markets in South Korea, Australia, and New Zealand additionally posted important declines.

Australian shares opened 2% decrease, wiping out positive factors from the earlier session amid waning hopes for a US-China commerce decision.

The S&P 500 plunged 1.6%, reversing an earlier 4.1% achieve and pushing the index almost 19% beneath its February peak. The Dow Jones Industrial Common slipped 0.8%, whereas the tech-heavy Nasdaq dropped 2.1%.

The sharp crypto correction triggered almost $400 million in every day liquidations, led by leveraged lengthy positions.

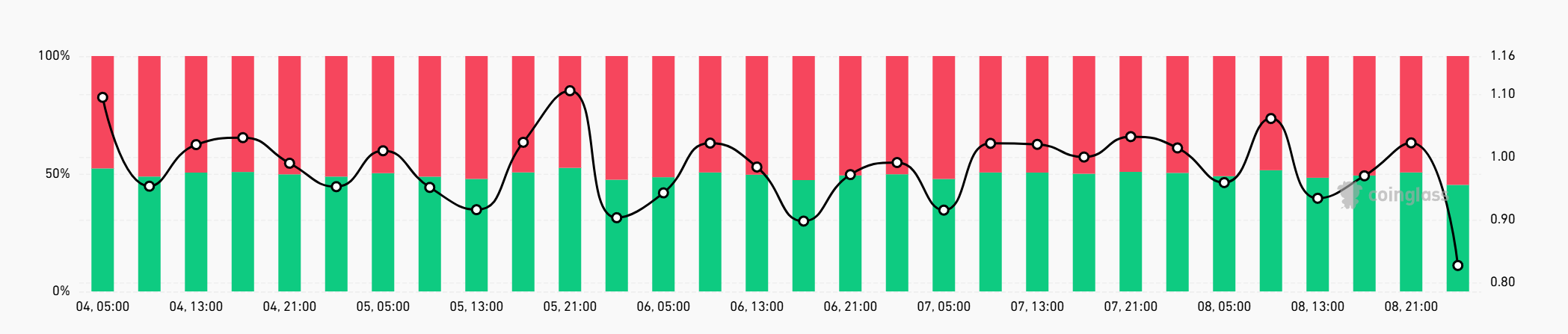

Notably, Bitcoin’s long-short ratio flipped for the primary time in weeks, with quick positions now accounting for 55% of open curiosity—a transparent signal of bearish sentiment overtaking the market.

Buyers are shortly de-risking throughout asset courses, bracing for additional volatility because the commerce dispute escalates.

Trump’s further 104% tariffs on China and the dearth of diplomatic progress have intensified uncertainty, prompting merchants to hunt liquidity and shift to defensive methods.

With Bitcoin usually seen as a barometer of macro threat urge for food, its decline underscores the market’s rising unease.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.