- Bitcoin’s volatility was nearing historic lows — usually a launchpad for main bullish strikes.

- Hash Ribbons purchase sign and low volatility have by no means didn’t precede a BTC rally.

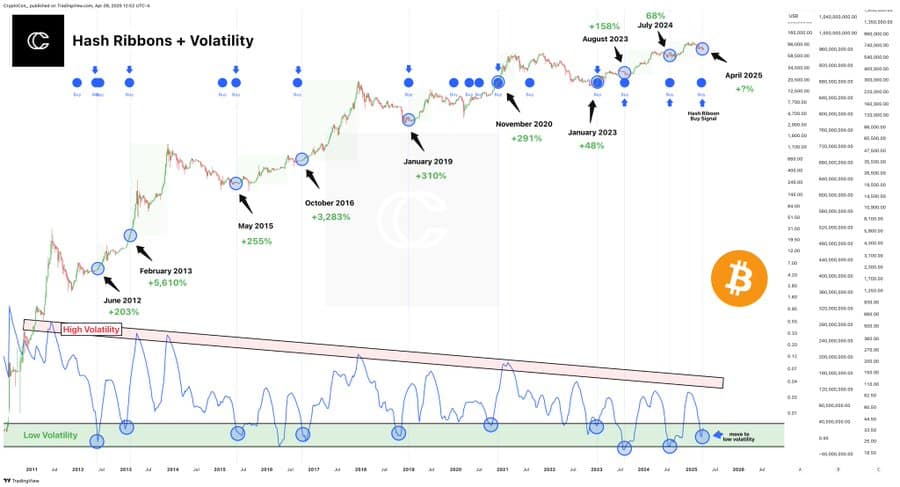

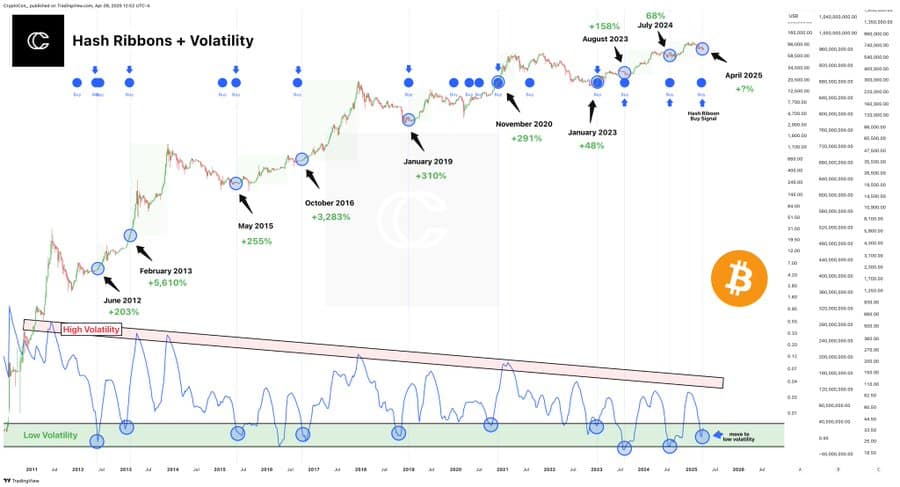

Bitcoin [BTC] has entered an unusually quiet part, with volatility dropping to exceptionally low ranges. Traditionally, such intervals of calm have usually preceded vital worth surges.

Including to this anticipation is the Hash Ribbons purchase sign, which is flashing inexperienced—a dependable indicator suggesting a possible market shift.

May this be the calm earlier than the storm for Bitcoin? It usually is.

Why low volatility isn’t boring – it’s bullish!

When Bitcoin volatility dips into the “low” zone, it often alerts a interval of eerie calm. However don’t mistake it for weak spot!

Traditionally, these intervals of low volatility have usually signaled the buildup of momentum for vital worth surges. Previous cycles in 2012, 2015, 2019, and 2023 display that calm markets regularly precede main upward strikes.

The long-term decline in volatility additionally displays the rising maturity of Bitcoin as an asset class. Nevertheless, every second of calm has persistently been adopted by dramatic worth spikes.

At present, Bitcoin finds itself again on this low-volatility “inexperienced zone,” suggesting a possible coiled spring second if historical past is any indicator.

Notably, Bitcoin has been more and more shifting in tandem with conventional property like shares and gold. This decreased volatility may be seen as an indication of the market’s continued maturation.

The sign with a 100% bullish hit charge

The Hash Ribbons purchase sign — marked by these blue circles within the chart – has by no means been triggered throughout a bear market. Not as soon as.

Supply: X

This sign usually fires up when Bitcoin’s mining problem resets after a interval of miner capitulation, signaling renewed energy within the community.

What’s much more convincing? Each time this Hash Ribbon purchase aligns with low volatility, as it’s doing now, it precedes an enormous rally.

Consider the surges in 2013, 2016, and 2020. The latest purchase in August 2023 already introduced a +158% transfer. And but, in accordance with the chart, we haven’t even touched the high-volatility “cycle high” zone. The primary occasion should be forward.

Skepticism is wholesome — however the knowledge doesn’t lie

May Bitcoin faux us out? It’s all the time a risk.

Nevertheless, the proof suggests in any other case. Volatility is at unusually low ranges, a brand new Hash Ribbon purchase sign has appeared, and there are not any indications of a macro high—Bitcoin has but to enter the high-volatility zone usually seen at bull market peaks.

Traditionally, each occasion of low volatility paired with a Hash Ribbon purchase sign has resulted in substantial returns with out exception.

In fact, previous efficiency just isn’t a assure, however dismissing a 100% historic success charge may be extra wishful pondering than sound technique.

On the time of writing, all indicators pointed upward. This may not mark the height however fairly the start of a major ascent.