The cryptocurrency market is exhibiting potential indicators of an impending altcoin season. Market watchers cite a confluence of technical, sentiment, and macroeconomic components that would result in a major rally in altcoins.

The outlook follows a notable downturn within the altcoin market, which has dropped about 37.6% since its excessive in early December 2024. As of the newest knowledge, the market cap stands at $1.1 trillion.

Is Altcoin Season Coming?

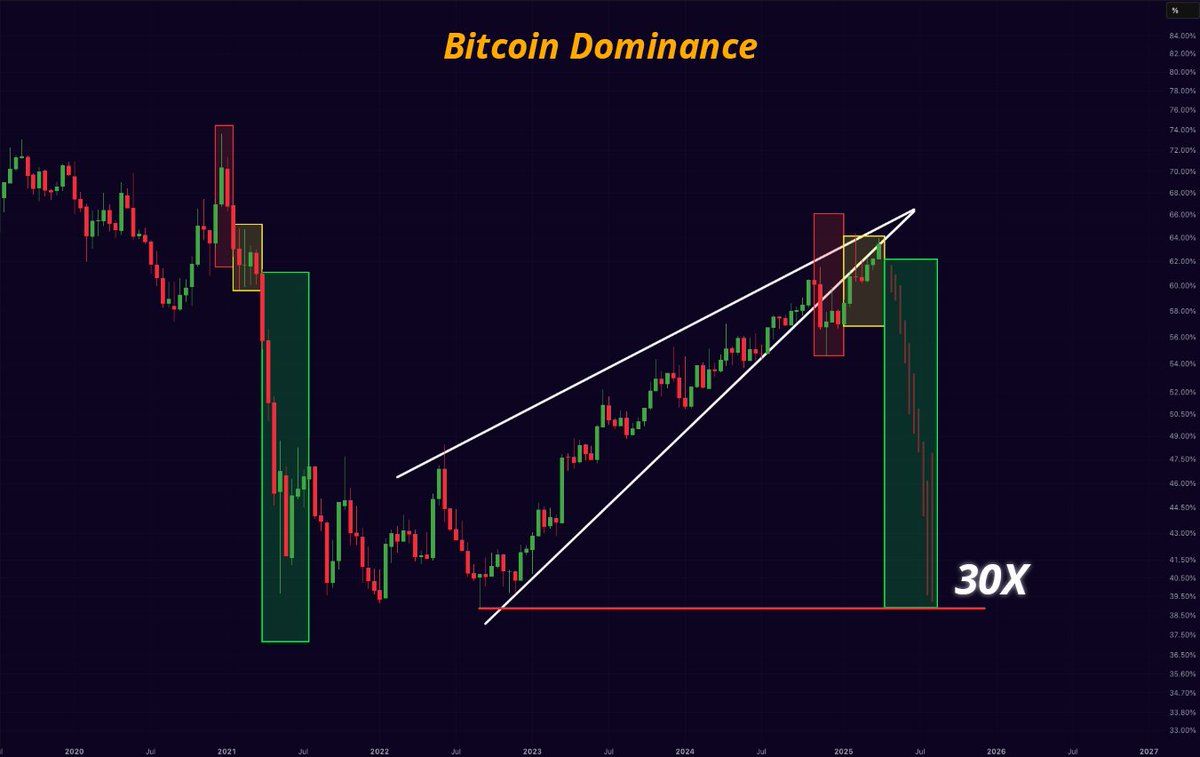

From a technical perspective, Bitcoin (BTC) Dominance, which measures Bitcoin’s market share relative to the full cryptocurrency market, appears to be at a key turning level.

A latest chart shared by crypto analyst Mister Crypto on X highlighted that Bitcoin Dominance has reached a resistance following a rising wedge sample. This sample is usually seen as a bearish sign, usually resulting in sharp pullbacks.

“Bitcoin Dominance will collapse. Altseason will come. We are going to all get wealthy this 12 months!” he wrote.

As well as, one other analyst corroborated these findings, noting that Bitcoin Dominance has reached a peak. Thus, he forecasted a subsequent downturn.

Nonetheless, the Altcoin Season Index has dropped to a low of 16. The index, which analyzes the efficiency of the highest 50 altcoins in opposition to Bitcoin, indicated that altcoins are at present underperforming.

Notably, this stage mirrors the underside for altcoins noticed round August 2024. This era preceded a major altcoin rally, and the index peaked at 88 by December 2024.

Lastly, from a macroeconomic perspective, the 90-day delay in President Donald Trump’s tariff implementation has renewed market confidence. This delay is perceived as a constructive sign, probably encouraging capital inflows into altcoins.

“90 days tariff pause = 90 days of altseason,” an analyst claimed.

Furthermore, analyst Crypto Rover pointed to quantitative easing (QE) as a catalyst for an altseason. In response to him, when the central financial institution begins pumping cash into the economic system (by means of QE), altcoins might expertise a major value surge, benefiting from the elevated liquidity and investor optimism.

“As soon as QE begins. Altcoin season will make a large comeback!” he said.

Nonetheless, within the newest report, Kaiko Analysis careworn {that a} conventional altcoin season could now not be possible. As an alternative, any potential rally might be selective, with only some altcoins experiencing important upside. The main focus will seemingly be on property with real-world use instances, sturdy liquidity, and revenue-generating potential.

“Altseasons could turn out to be a factor of the previous, necessitating a extra nuanced categorization past simply ‘altcoins,’ as correlations in returns, development components, and liquidity amongst crypto property are diverging considerably over time,” the report learn.

Kaiko Analysis famous that the rising focus of liquidity in a couple of altcoins and Bitcoin could disrupt the standard capital move into altcoins throughout market upswings. Moreover, as Bitcoin turns into extra extensively adopted as a reserve asset by establishments and governments, its place available in the market strengthens additional.

In the end, whereas the indicators level to a possible altcoin rally, it’s clear that the way forward for altcoins might contain extra nuanced market dynamics.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.