Extensively adopted on-chain analyst PlanB says that Bitcoin’s (BTC) present correction is a component and parcel of normal bull market situations.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the symptoms he watches are nonetheless signaling bullishness for the flagship crypto asset.

Says PlanB,

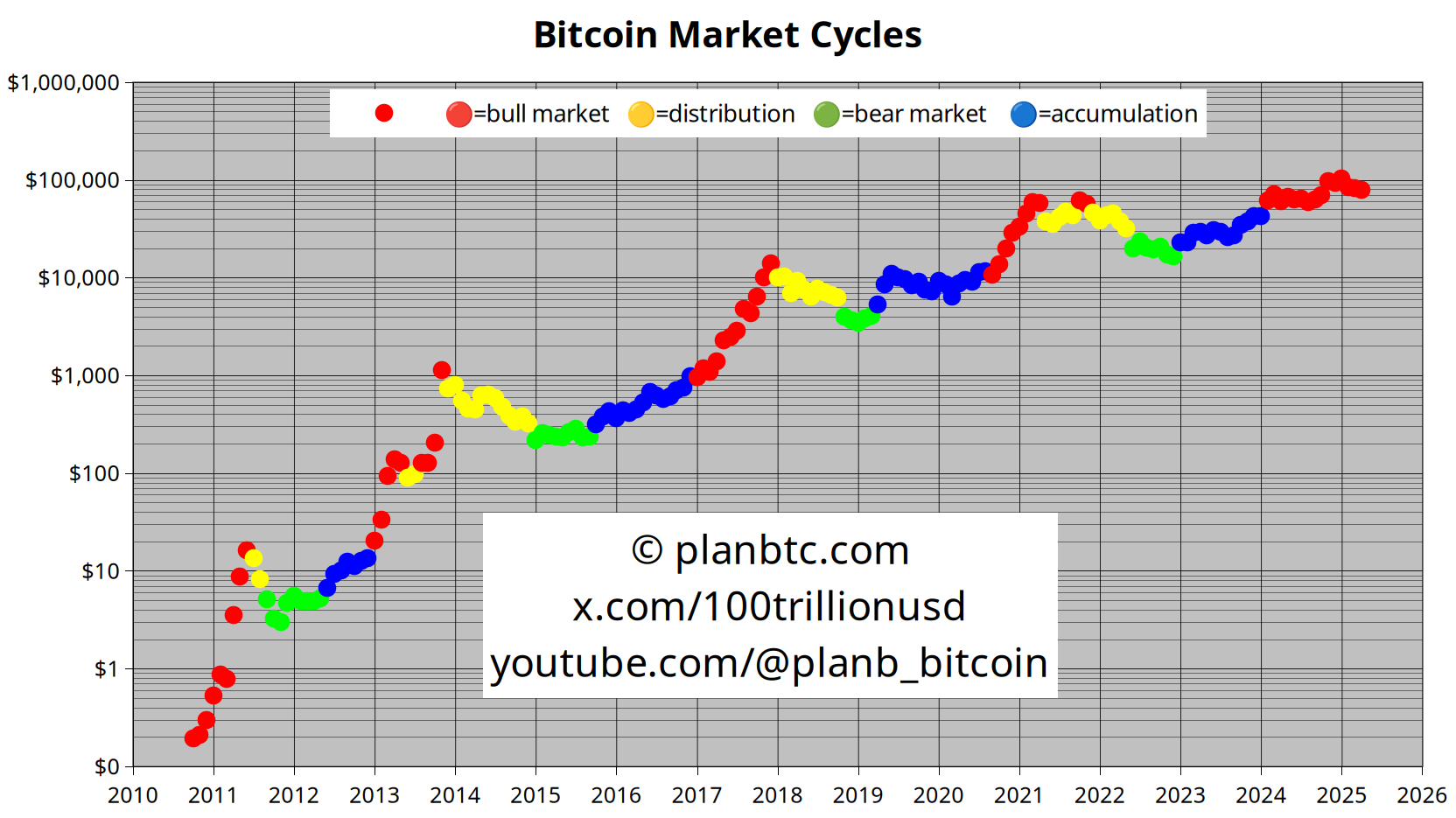

“Even with at present’s low bitcoin costs my on-chain indicators nonetheless sign bull market. So for my part this can be a regular bull market dip and never a transition from bull part to distribution part (after which bear part).”

PlanB’s color-coded dot chart signifies the variety of months till every halving – when BTC miners’ rewards are lower in half – with the crimson dots representing the start of the halving cycles.

In a current video replace, the analyst advised his 209,000 YouTube subscribers {that a} mixture of 200-week means suggests Bitcoin could quickly enter an explosive uptrend primarily based on historic precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are presently operating shut collectively on the chart, signaling a potential Bitcoin breakout.

“It could be that the bull market continues to be forming and that the [arithmetic mean] will separate once more, will diverge once more, from the geometric imply.

Yet one more factor on these two traces. Discover which you could’t have a bear market or a giant crash when the 200-week [arithmetic mean] and the geometric imply are collectively. The large crashes right here [in 2021 and 2022] are occurring when there’s a diversion between the 2 traces. Additionally, right here in 2018, there was a giant hole between the 2 [means]. Similar right here in 2014 and 2015.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney