Solana (SOL) has recovered over 12% right now after Trump introduced a 90-day pause on tariffs. Regardless of the numerous restoration, technical indicators proceed flashing bearish warnings. Key indicators just like the RSI, BBTrend, and EMA strains all level to weakening momentum and a scarcity of purchaser conviction. Whereas oversold circumstances have began to stabilize, the broader construction nonetheless leans barely in favor of sellers.

Solana RSI Reveals The Lack Of Conviction Amongst Patrons

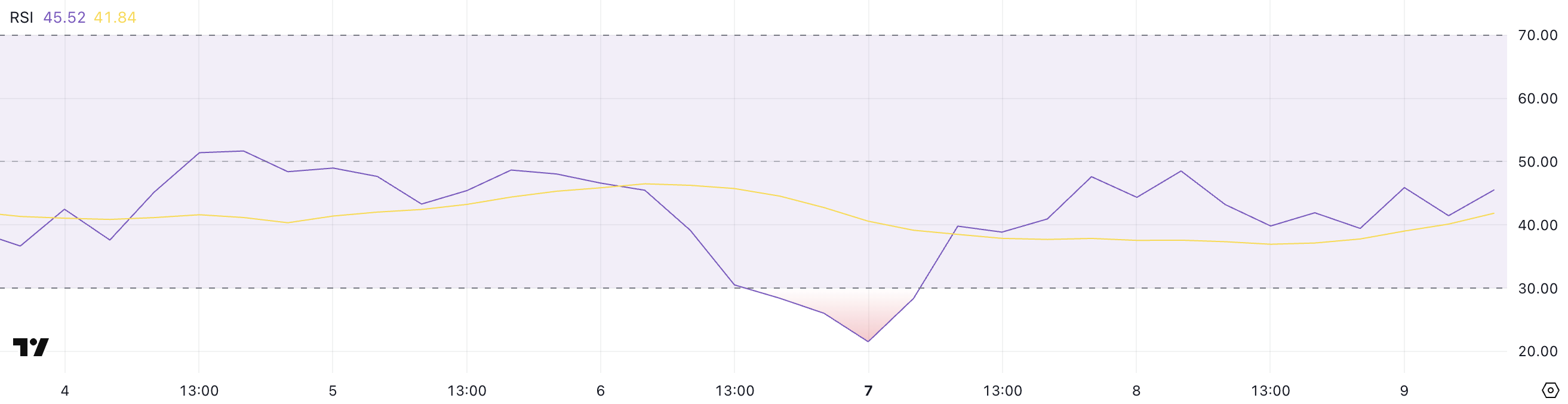

Solana’s Relative Energy Index (RSI) is at the moment sitting at 45.52, hovering in impartial territory however remaining under the midline of fifty for practically two days.

This comes after the RSI briefly dipped to an oversold degree of 21.53 two days in the past, indicating that sellers had briefly dominated earlier than demand started to stabilize.

The RSI’s gradual climb again towards impartial means that whereas excessive promoting strain has eased, bullish momentum has not but taken management.

The RSI is a momentum oscillator that measures the pace and magnitude of latest value actions. It sometimes ranges from 0 to 100.

Readings above 70 are usually interpreted as overbought, signaling the potential for a pullback, whereas readings under 30 recommend oversold circumstances and potential for a rebound.

Solana’s RSI at 45.52 signifies that the asset is in a restoration part however lacks conviction. If the RSI fails to cross above 50 quickly, it may suggest continued hesitation amongst patrons and the potential for sideways value motion and even one other leg decrease.

SOL BBTrend Has Reached Its Lowest Ranges In Nearly A Month

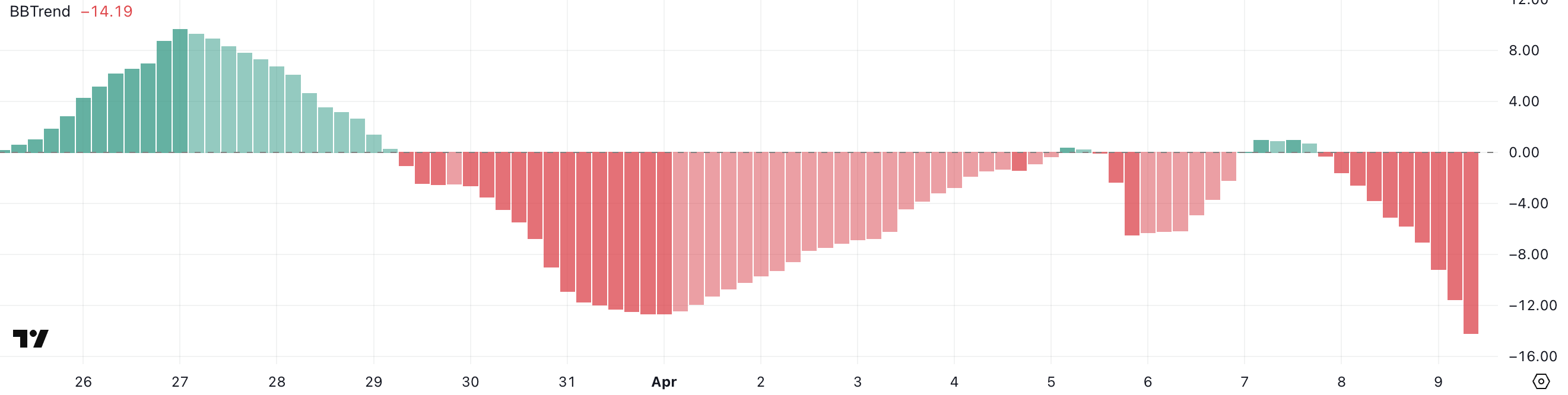

Solana’s BBTrend indicator is at the moment at -14.19, having turned damaging since yesterday, and is at its lowest degree since March 13—practically a month in the past.

This shift into deeper damaging territory means that bearish momentum is constructing as soon as once more after a interval of relative stability.

The return to those ranges might point out rising draw back strain, particularly if follow-through promoting continues within the brief time period.

The BBTrend (Bollinger Band Pattern) is a volatility-based indicator that measures the power and path of a value pattern utilizing the gap between value and Bollinger Bands.

Constructive BBTrend values usually mirror bullish momentum, whereas damaging values sign bearish momentum. The deeper the studying into damaging territory, the stronger the downward strain is taken into account to be.

Solana’s BBTrend is now at -14.19, implying an intensifying bearish part, which may imply additional value declines until sentiment or quantity shifts shortly in favor of patrons.

Will Solana Dip Under $100 Once more In April?

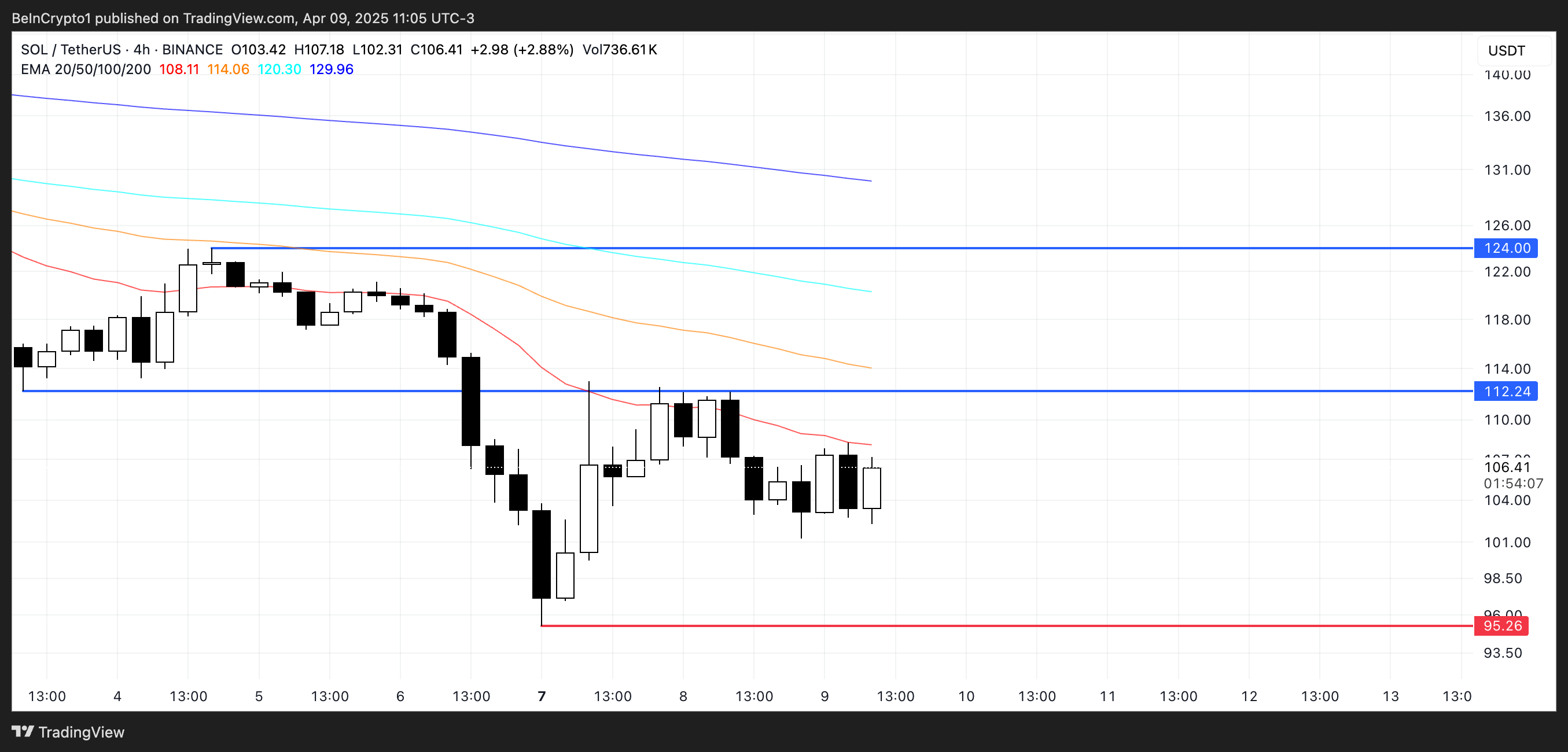

Solana’s EMA setup continues to mirror a powerful bearish construction, with short-term transferring averages remaining properly under long-term ones.

This alignment confirms that downward momentum continues to be in management, protecting sellers in a dominant place.

Nonetheless, if Solana value manages to maintain the present power and shopping for curiosity, it may take a look at resistance at $120. A break above that degree might open the trail towards the following goal at $134.

On the draw back, if the present bearish pattern persists, Solana may revisit help close to $95, a degree that has beforehand acted as a short-term ground.

Shedding this degree can be technically vital, doubtlessly pushing SOL under $90—territory not seen since January 2024.

Disclaimer

In step with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.