- Solana jumped 12% following Trump’s 90-day tariff pause, however technical indicators like RSI and BBTrend nonetheless counsel bearish momentum hasn’t gone away.

- RSI stays below 50, displaying weak purchaser conviction, and BBTrend is at its lowest stage since March—each hinting at attainable additional draw back except bulls present up robust.

- If SOL fails to carry above $100, it might revisit $95 and even dip under $90, except there’s a robust shift in sentiment or shopping for quantity quickly.

Solana (SOL) noticed a pointy 12% rebound as we speak, using excessive off the information of a 90-day tariff pause introduced by former President Trump. On the floor, it appeared like a robust restoration. However dig just a bit deeper, and issues aren’t fairly as rosy. Technical alerts are nonetheless flashing pink, and there’s this nagging query hanging within the air: Is the rally already operating out of fuel?

RSI Says: Consumers Nonetheless Appear… Not sure

Let’s speak RSI—Solana’s Relative Energy Index is at the moment hovering round 45.52. Not horrible, but in addition not nice. It’s caught on this limbo zone, under the impartial 50 mark, and it’s been caught there for the previous two days.

Simply two days in the past, it was scraping the underside at 21.53—an oversold studying that mainly screamed, “Sellers took over!” However now? It’s making an attempt to claw again up, slowly. The truth that it hasn’t bounced more durable may imply consumers aren’t actually stepping in with confidence simply but.

If it doesn’t break previous 50 quickly, we would simply be taking a look at a stall—or worse, one other slide again down.

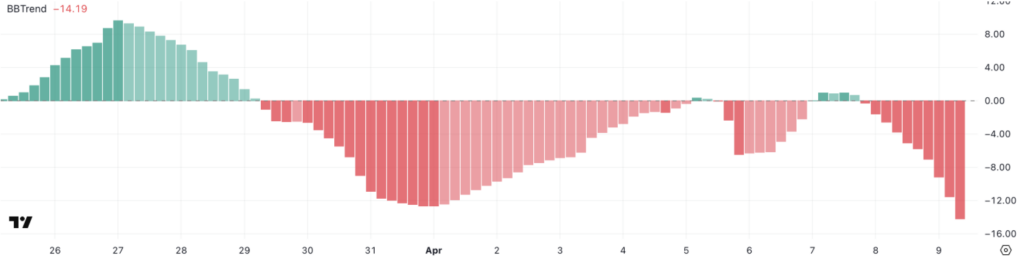

BBTrend Dips to Its Lowest Since March—Bear Stress Mounts

Now right here’s the extra worrying bit: the BBTrend (that’s Bollinger Band Pattern, for the much less chart-savvy) has dropped to -14.19. That’s the bottom it’s been since mid-March, and yeah—it’s type of an enormous deal.

BBTrend turning this adverse means bearish momentum is selecting up once more. It’s not just a bit dip—it’s a sign that sellers are urgent more durable, and the ground won’t maintain if bulls don’t present up quickly.

When this indicator dips that far, traditionally it doesn’t simply snap again up. It normally will get worse earlier than it will get higher—except quantity pours in and sentiment flips quick.

Under $100 Once more? It’s Not Off the Desk

From a worth construction perspective, Solana’s nonetheless in tough waters. The EMA setup isn’t precisely inspiring confidence. Quick-term transferring averages are sitting effectively beneath the longer ones—a textbook bearish structure. That tells us the development remains to be down, no matter as we speak’s bounce.

If SOL can maintain above $108 and push towards $120, we would see it problem the $134 zone once more. However that’s an enormous if.

If issues tilt bearish once more, we’re probably looking at a revisit to $95. And if that breaks? A drop under $90 isn’t out of the query. That stage hasn’t been seen since January, and it’d be a reasonably large psychological hit.

Last Ideas

Positive, Solana popped off the again of some political headlines—however the chart remains to be displaying cracks. Momentum indicators are shaky, bearish developments are sticking, and confidence amongst consumers is… effectively, let’s simply say “cautious” at finest.

It’s a type of occasions the place short-term merchants may benefit from the bounce, however long-term holders ought to hold their seatbelts fixed. April’s not executed with us but.