- Shares soared after Trump introduced a 90-day pause on most tariffs, with the S&P 500 leaping 8.5%.

- China was hit tougher, as Trump raised tariffs on its items to 125% regardless of easing strain on different nations.

- Buyers rallied on hopes of negotiations, however analysts warned the commerce struggle is much from over.

Wall Avenue lastly caught its breath Wednesday after President Trump hit the brakes—no less than a bit of—on his sweeping reciprocal tariff plan. And the markets? They completely took off.

The S&P 500 shot up a wild 8.5%, marking what might find yourself its greatest one-day pop in 5 years. Over on the Dow, it surged 2,711 factors (that’s 7.2%, by the way in which), whereas the Nasdaq completely ripped increased by almost 11%.

So, what occurred? Trump posted on Reality Social—yeah, that’s nonetheless the principle information supply now—saying, “I’ve approved a 90 day PAUSE, and a considerably lowered Reciprocal Tariff throughout this era, of 10%, additionally efficient instantly.”

However not so quick—China nonetheless acquired the hammer. Trump added the tariff on Chinese language items was getting hiked once more, this time all the way in which as much as 125%. Yikes.

Aid Rally or Only a Breather?

Treasury Secretary Scott Bessent cleared issues up later, confirming that each one nations besides China could be dialed again to that 10% fee whereas negotiations have been ongoing. Nevertheless, this pause doesn’t contact sector-specific tariffs—that stuff’s nonetheless rolling ahead.

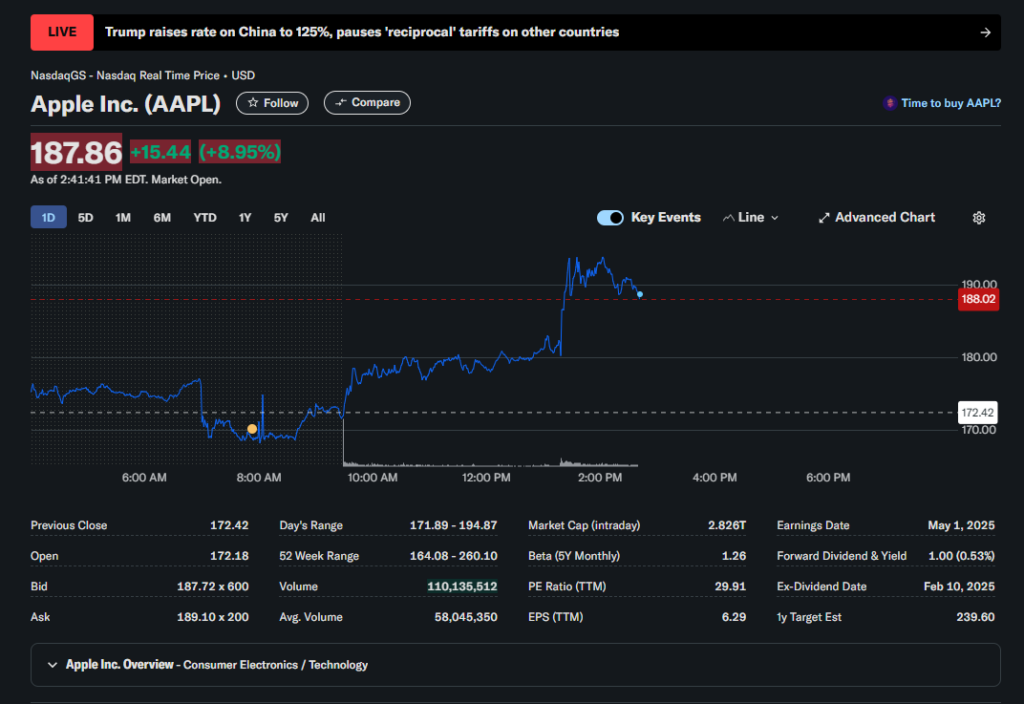

Shares that’ve been completely battered by commerce struggle fears have been all of the sudden the darlings of the day. Apple surged over 11%. Nvidia? Up 13%. Walmart rallied 9.7%, and Tesla blasted up 19%—doubtless due to each the tariff information and its typical drama.

“This transfer seems like a strain valve launch,” mentioned analyst Adam Crisafulli, including, “however let’s not fake that is over. China’s tariff fee is now within the triple digits, and who is aware of what sort of curveball hits in 90 days.”

Not So Quick, Say the Skeptics

Sam Stovall from CFRA Analysis sounded a bit extra cautious. “It’s a aid rally, positive,” he mentioned. “However let’s be trustworthy—this might all flip once more. Idiot me as soon as, disgrace on you. Idiot me 5 instances… nicely, disgrace on me.”

Markets have been already bouncing even earlier than Trump’s submit. Merchants have been clinging to any glimmer of hope after 4 brutal days. Bessent, for what it’s value, mentioned he’s taking the lead on the tariff talks—possibly signal?

Trump, in the meantime, did what he does greatest: tried to rally the troops. “Now’s a GREAT time to purchase!” he posted not lengthy after the open.

The Harm So Far

Nonetheless, this aid comes after a bruising selloff. In simply 4 days, the Dow misplaced 4,500 factors. The S&P 500 dropped 12%. Nasdaq? Down 13%—ranges not seen for the reason that pandemic-era chaos.

And with China, the EU, and who is aware of who else prepared to fireside again with their very own tariffs, issues are nonetheless, nicely… shaky.

Keep tuned. It’s not over—not even shut.