- BTC bounced +10% after Trump’s 90-day tariff pause.

- Per analysts, a China tariff deal might rally BTC or cap it.

Bitcoin [BTC] jumped 10% on the ninth of April to $83.5K after President Donald Trump introduced a 90-day pause on tariffs in opposition to different international locations, besides China.

The aid rally was seen throughout U.S. equities, too. However the U.S.-China tariff woes might have an effect on BTC. Trump hiked tariffs on Chinese language imports to 125% after Beijing performed hardball with an 84% retaliatory tariff improve in opposition to the U.S.

Now, the tariff showdown might decide the subsequent BTC motion, per analysts, however some views have been combined.

Navigating BTC’s tariff woes

It’s value noting that China was prepared for a deal, in keeping with the most recent replace by President Trump. Per analyst Joe McCann, a possible ‘deal’ would ship BTC larger, noting that such an final result wasn’t priced in.

“If a China deal comes, market explodes. If it doesn’t, it’s already priced. Trump has signaled max ache for China and is prepared to barter. Market can solely re-price larger.”

McCann added that an indicator of such a constructive settlement with China can be the Yuan (CNY) forex rallying larger in opposition to the US greenback (USD).

Sadly, China was pushing for the other final result — a weak CNY. Bitwise’s head of alpha, Jeff Park, was anxious that this could be ‘unfavorable to danger property,’ together with BTC.

“With what irreversibly occurred with weakened yuan now exporting deflation + 10% tariff creating development drag, the web final result remains to be unfavorable for danger property particularly if 10yr stays above 4%.”

For his half, BitMEX founder Arthur Hayes echoed comparable rivalry however added that it might find yourself in cash printing by the Fed and increase BTC.

“No deal, PBOC continues a really gradual Yuan weakening. Shit ‘bout to get spicy. Fortunately, $BTC loves cash printing and related CNY weak spot.”

That mentioned, the tariff fallout has reportedly made the case for BTC, particularly in worldwide commerce settlements between Russia and China, famous VanEck.

BTC breakout prospects

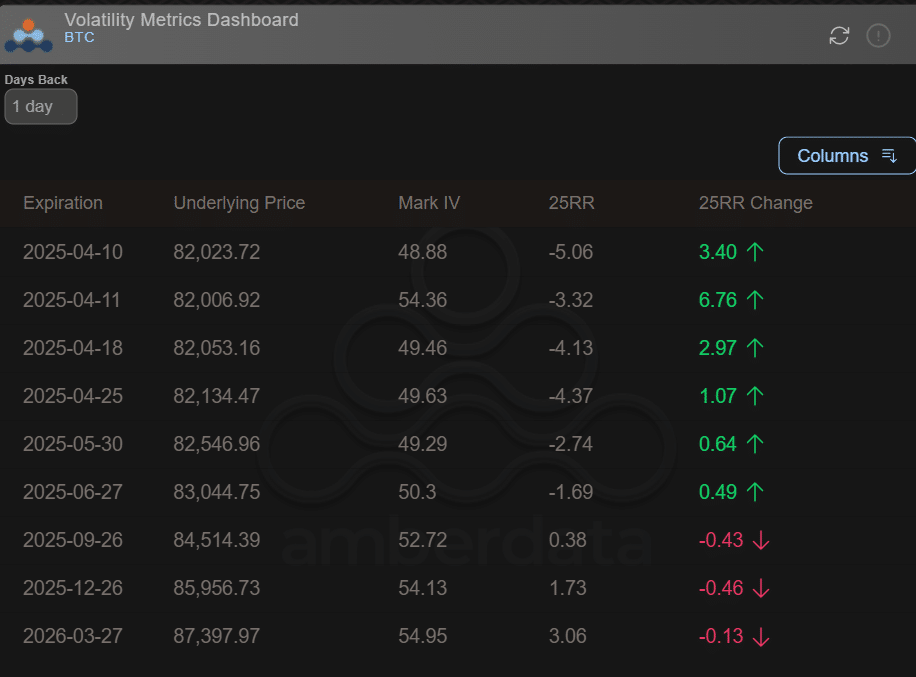

Supply: Amberdata

In the meantime, heavy hedging was nonetheless in play for the second half of April, as illustrated by the unfavorable readings on the 25RR (25 delta danger reversal) indicator. This instructed an elevated demand for put choices (bearish bets) for additional draw back safety.

Merely put, the market was nonetheless cautious amid the continued tariff showdown between the US and China.

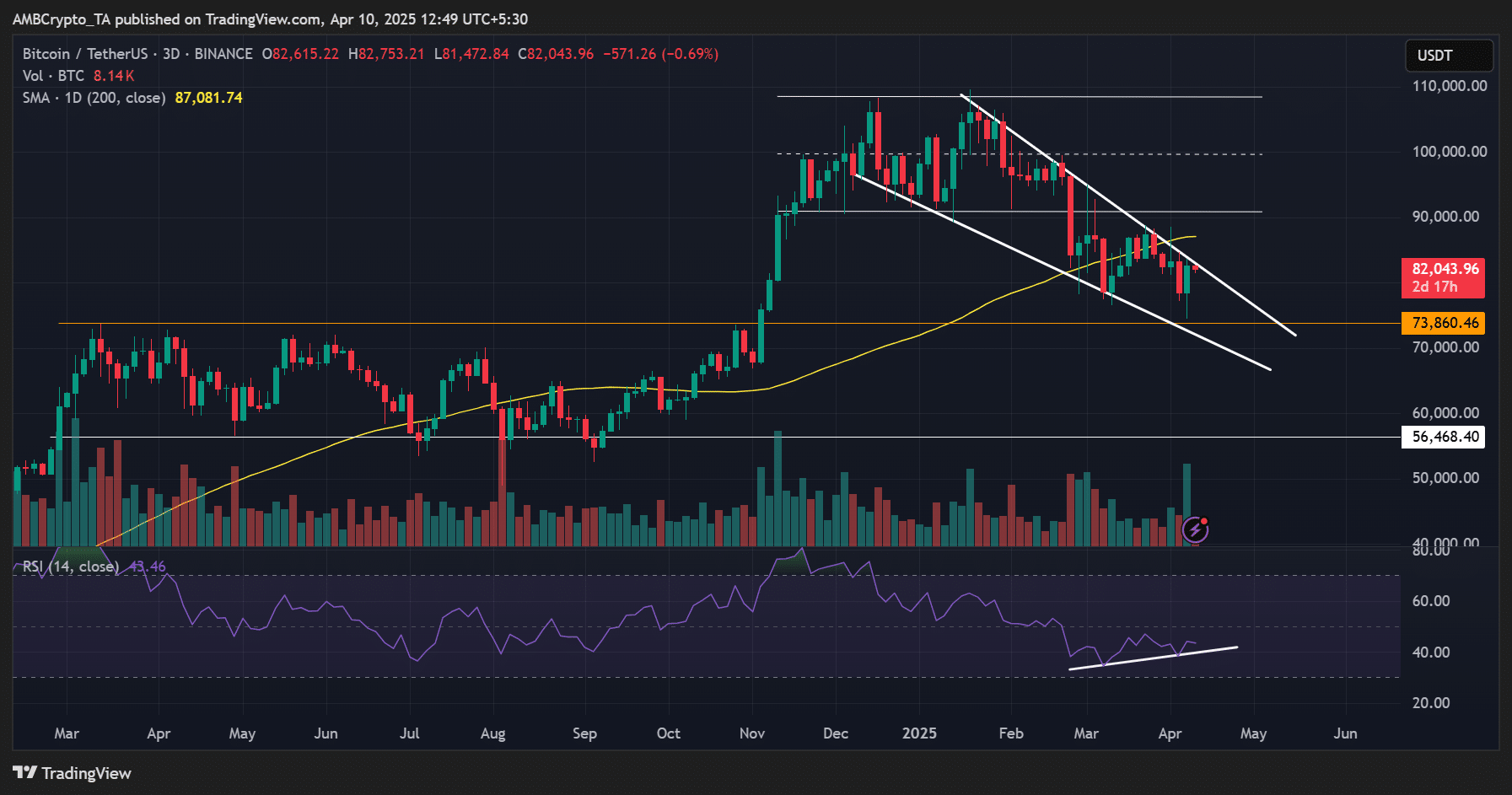

From a value chart perspective, although, BTC chalked a bullish falling wedge sample, a sign that the downtrend momentum might lose steam quickly and permit for a restoration.

Supply: BTC/USDT, TradingView

The bullish RSI divergence additionally supported the breakout prospects. As such, final 12 months’s range-high above $70K was a pivotal stage to observe if macro circumstances enhance.