- Cardano’s MVRV ratio flipped unfavorable, signaling that the typical purchaser is now at a loss

- Will HODLers keep agency of their conviction, or will market FUD power them to rethink?

Regardless of a pointy 12.60% month-to-month decline, Cardano [ADA] stays 87% above its election-day opening value, outperforming many high-cap property. It is a signal of robust holder conviction, with traders opting to sit down on unrealized beneficial properties somewhat than exit their positions.

Nonetheless, on-chain fundamentals appeared to color a contrasting image.

In reality, Cardano’s Whole Worth Locked (TVL) dropped under its pre-election ranges, signaling liquidity outflows. Concurrently, Whale Transaction Depend (>100K USD) fell to a cycle low – Indicative of a fall in institutional exercise.

Therefore, to reignite FOMO out there, ADA should affirm its assist on the charts. In any other case, with weakening fundamentals, even HODLers would possibly waver, choosing capitulation over conviction.

Which aspect will prevail?

On the time of writing, the altcoin’s value chart highlighted an actual check of endurance.

Since February, it has posted three consecutive decrease lows, breaking key assist ranges and signaling structural weak point.

Supply: TradingView (ADA/USDT)

The newest breakdown on 06 April noticed ADA lose the $0.58-support – A stage it had held post-election. This sparked considerations of a deeper correction, as revenue margins compressed throughout the board.

This concern was mirrored within the Market Worth to Realized Worth (MVRV) ratio, which flipped unfavorable. It prompt that on common, latest ADA consumers are actually underwater.

Right here, it’s price stating that ADA’s swift restoration did flip market sentiment. Buying and selling at $0.6283 at press time, a 7% rebound could have restored confidence in a restoration.

Nonetheless, is that this rebound a results of a “market-wide” provide squeeze – A reduction rally, maybe? Or is HODLers’ confidence in a bull rally stopping Cardano from erasing all post-election beneficial properties?

Structural weak point threatens HODLers’ conviction

With each failed assist, ADA holders face a essential resolution – Maintain robust or exit earlier than deeper losses unfold. If MVRV stays unfavorable and shopping for stress weakens, capitulation might be subsequent.

Merely put, the nearer Cardano drifts to its election-day value, the extra fragile investor confidence turns into. With out robust fundamentals to bolster sentiment, a sell-off to breakeven ranges may speed up.

Encouragingly, buying and selling quantity on 07 April surged to $1.98 billion – Up from $941 million the day past. Moreover, the whale cohort – holding 100 million to 1 billion ADA – amassed 250 million ADA on 10 April alone.

Consequently, this whale-driven demand blindsided short-sellers, forcing $901k in liquidations. As shorts unwound, a 7% rebound adopted, injecting contemporary momentum.

Bullish reversal, proper? Not so quick.

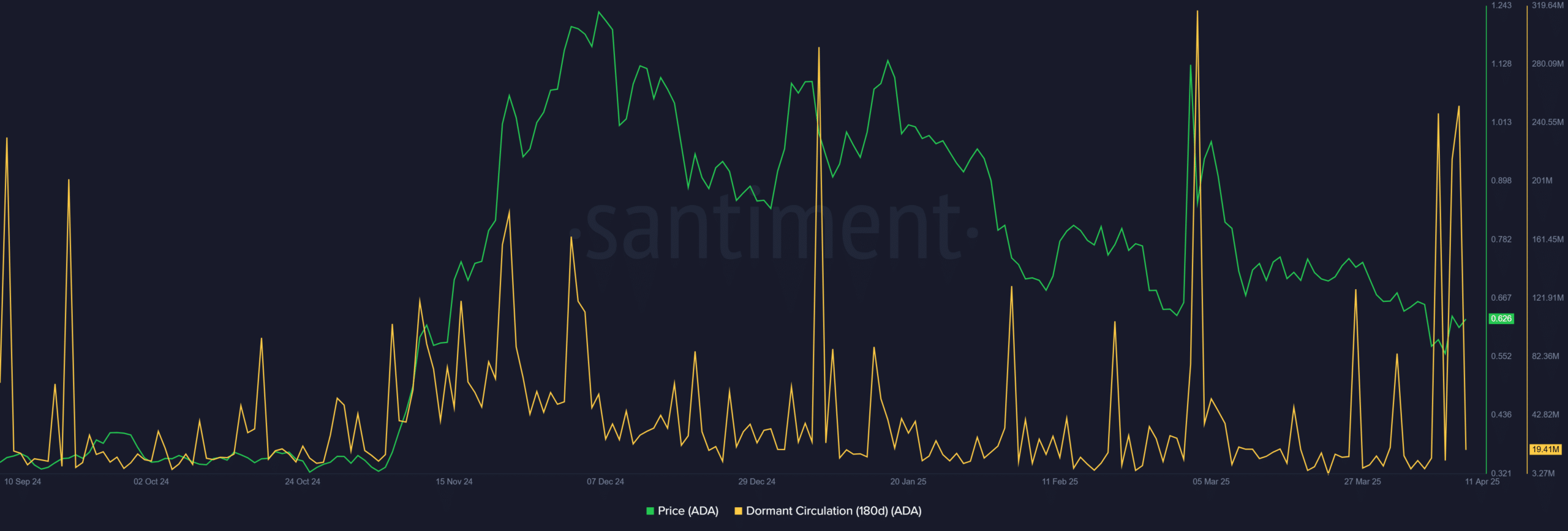

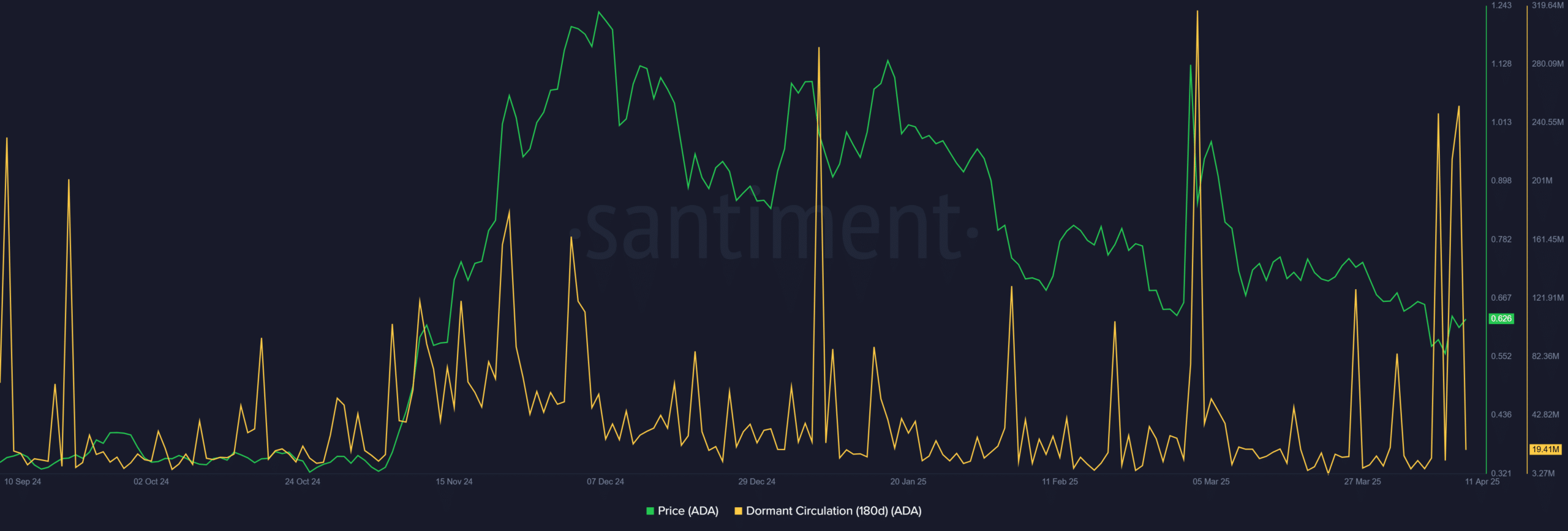

Nicely, the most important whale cohort (12.6B ADA) has been sidelined, signaling warning. Plus, dormant whale circulation (180-day) spiked – A historic warning signal of market tops.

Supply: Santiment

With beforehand idle cash coming into circulation and accumulation remaining weak, promoting stress may intensify.

If ADA fails to carry above $0.58, structural weak point could escalate into full-scale capitulation.