- ETH traded inside a falling channel as lively addresses and MVRV flashed accumulation indicators.

- Whales and OGs have been unloading, however metrics prompt a possible market backside forming.

Ethereum [ETH] long-term holders have formally entered “capitulation” territory, with the LTH-NUPL metric dipping into the purple for the primary time in months. This shift displays rising losses amongst seasoned holders and infrequently indicators the ultimate part of a bearish cycle.

At press time, Ethereum was buying and selling at $1,591.63, exhibiting a 7.32% enhance within the final 24 hours.

In different phrases, even with extended draw back strain, short-term worth motion now hints at a potential momentum shift.

ETH worth motion, consumer exercise, and MVRV sign market stress

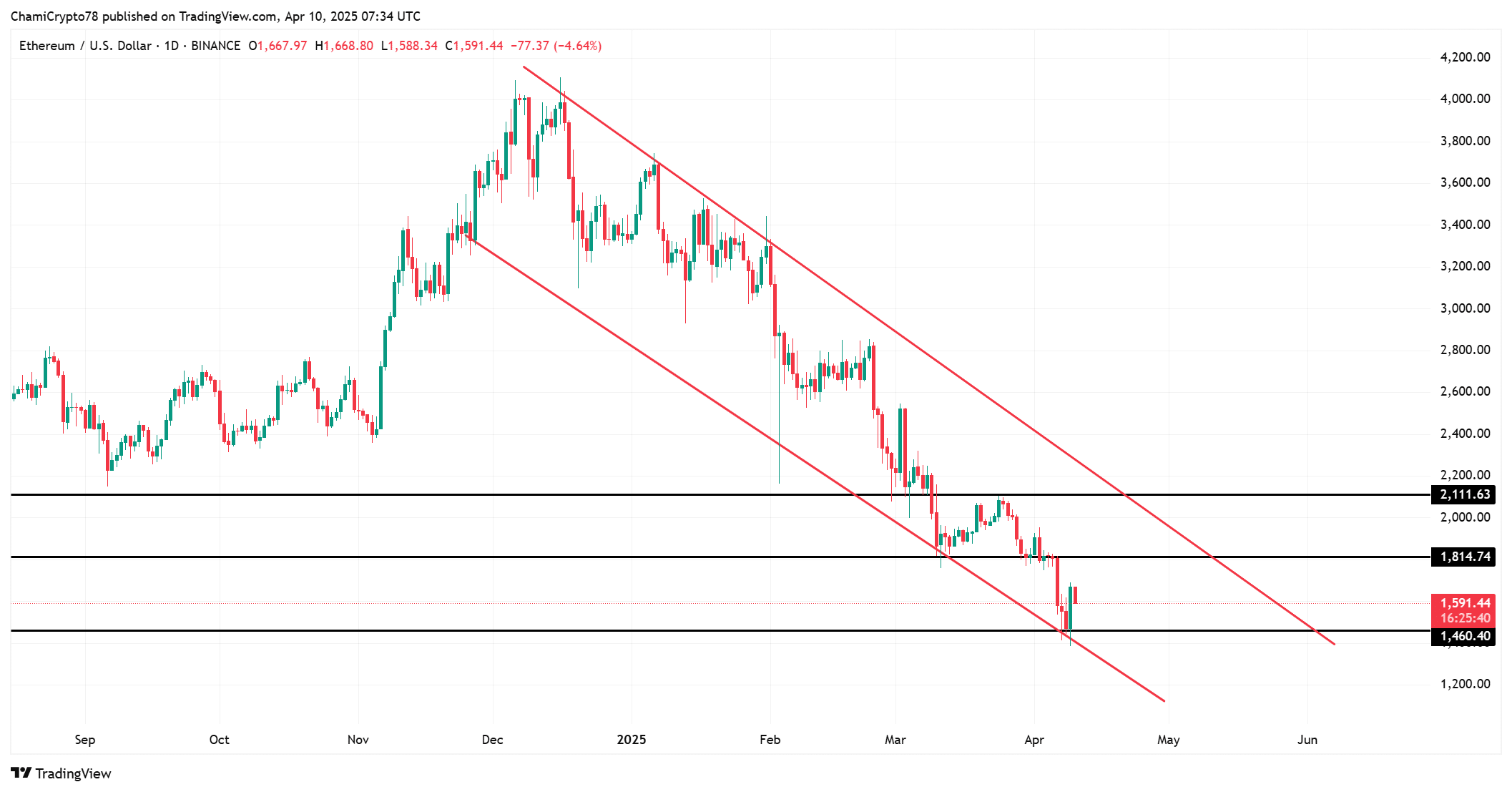

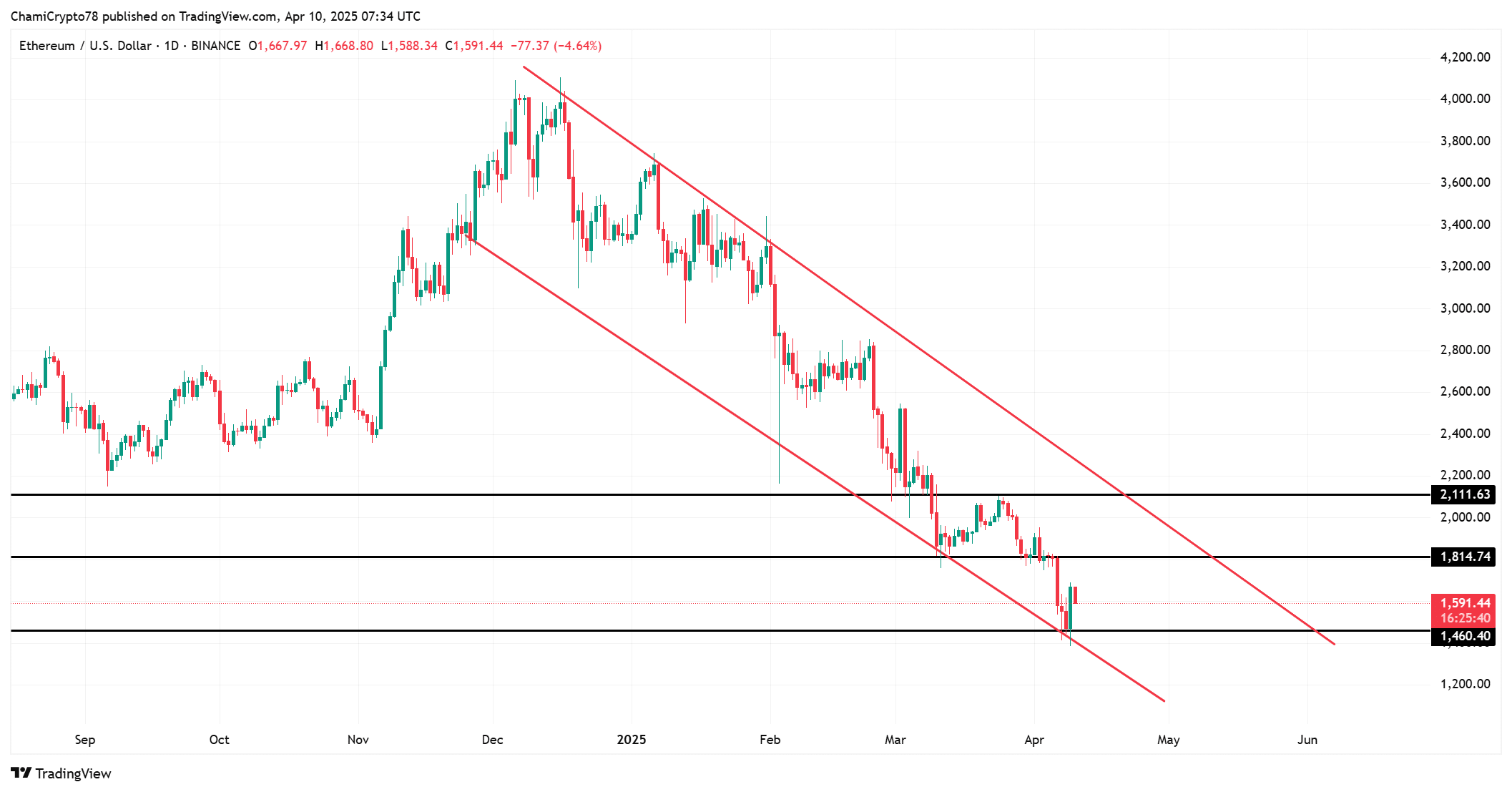

Ethereum’s worth motion stays confined to a steep descending channel, characterised by persistently decrease highs and lows since November 2024.

After rebounding strongly from the $1,460 help zone, the value is now dealing with resistance close to $1,815, a degree the place bears may try to say management.

That mentioned, if the bulls handle to reclaim the $1,815 degree, it may shift the market construction to bullish and set the stage for a problem of the higher channel resistance.

Nevertheless, till this occurs, draw back strain will persist, with potential retests of key help ranges if momentum fades.

Supply: TradingView

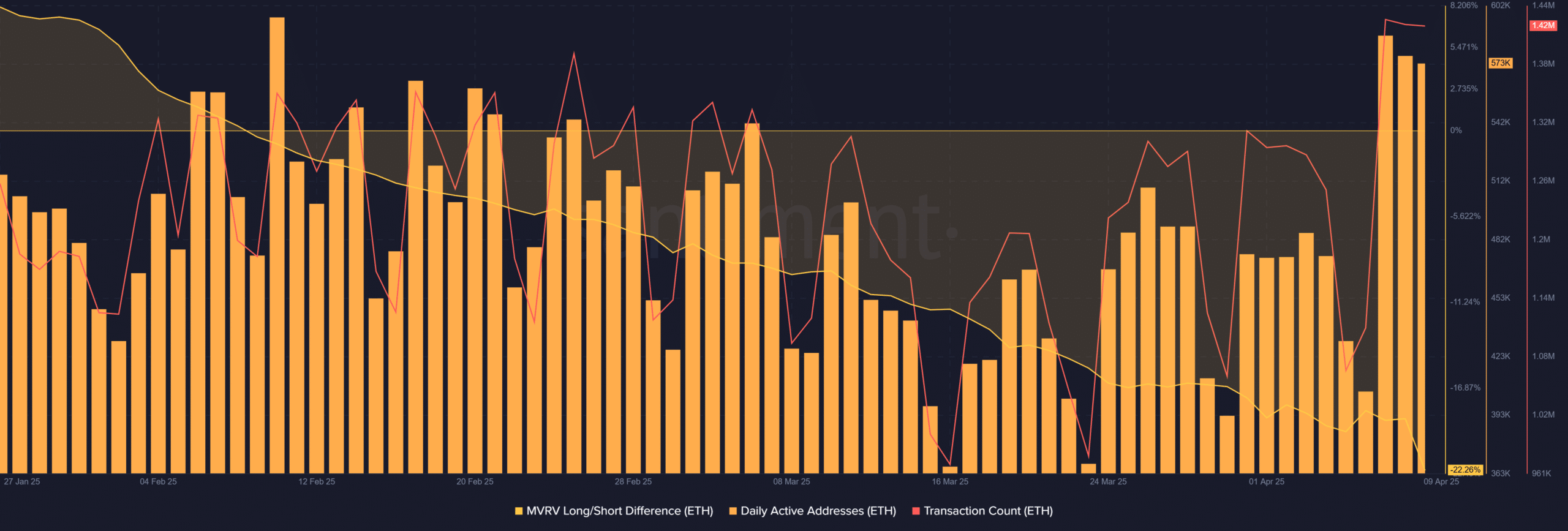

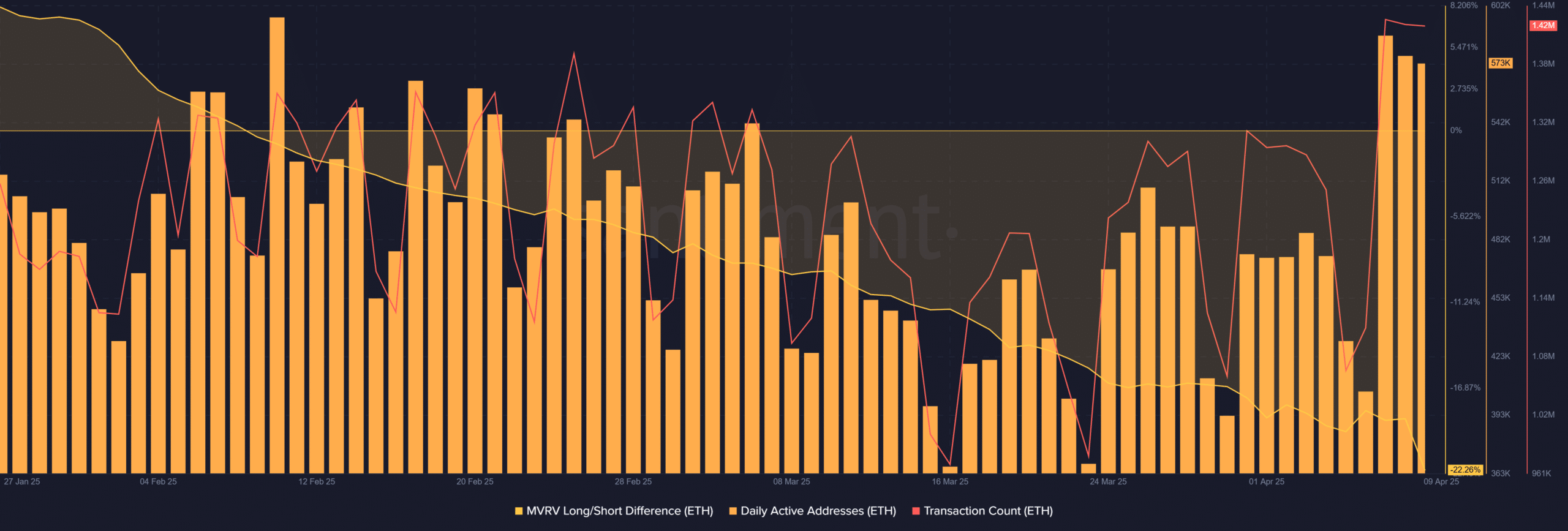

In the meantime, on-chain exercise tells a special story.

Every day lively addresses surged to 573,000 and transaction rely hit 1.42 million on the ninth of April, marking a major spike in consumer engagement.

This elevated participation—regardless of worth weak point—suggests rising curiosity in Ethereum’s ecosystem at discounted costs.

Moreover, the MVRV Lengthy/Quick Distinction has plummeted to -22.26 %, a degree typically related to most ache and perfect accumulation throughout historic bottoms.

Supply: Santiment

Whale strikes and OG promoting affirm capitulation risk-off temper

Curiously sufficient, whale habits has intensified.

Over 530,000 ETH was moved throughout main wallets in simply the previous week, usually pointing to strategic accumulation or rebalancing.

Much more telling is a dormant Ethereum OG that acquired ETH again in 2016 and offloaded 10,702 ETH price $16.86 million at simply $1,576.

Curiously, this whale has persistently offered solely during times of great market corrections, even avoiding gross sales when ETH surpassed $4,000.

Such actions could point out strategic exits or makes an attempt at psychological manipulation designed to impress retail panic, setting the stage for eventual market restoration.

Is now the very best time to purchase Ethereum?

Ethereum’s long-term holder capitulation, excessive MVRV readings, and elevated whale exercise all level to a traditional accumulation setup. Rising community utilization provides additional affirmation that curiosity stays robust underneath the floor.

Due to this fact, regardless of short-term volatility, all indicators point out that Ethereum is buying and selling in a high-probability reversal zone.

Good buyers could view this as among the best risk-reward entry factors earlier than the subsequent bullish leg unfolds.