- Whale inflows spiked as traders shifted focus from shortage

- On-chain metrics supported bullish sentiment with sturdy holder profitability and key value assist zones

Over 22,000 BTC have flowed into Binance inside a span of lower than two weeks. Its newest uptick elevated the alternate’s Bitcoin [BTC] reserves from 568,768 BTC on 28 March to 590,874 BTC by 9 April.

Such a pointy rise in reserves displays rising investor exercise, probably triggered by fears surrounding macroeconomic uncertainty and the looming U.S. Shopper Value Index (CPI) announcement.

Whereas some could interpret these inflows as an indication of potential promote strain, others consider that it may very well be strategic accumulation in preparation for market volatility.

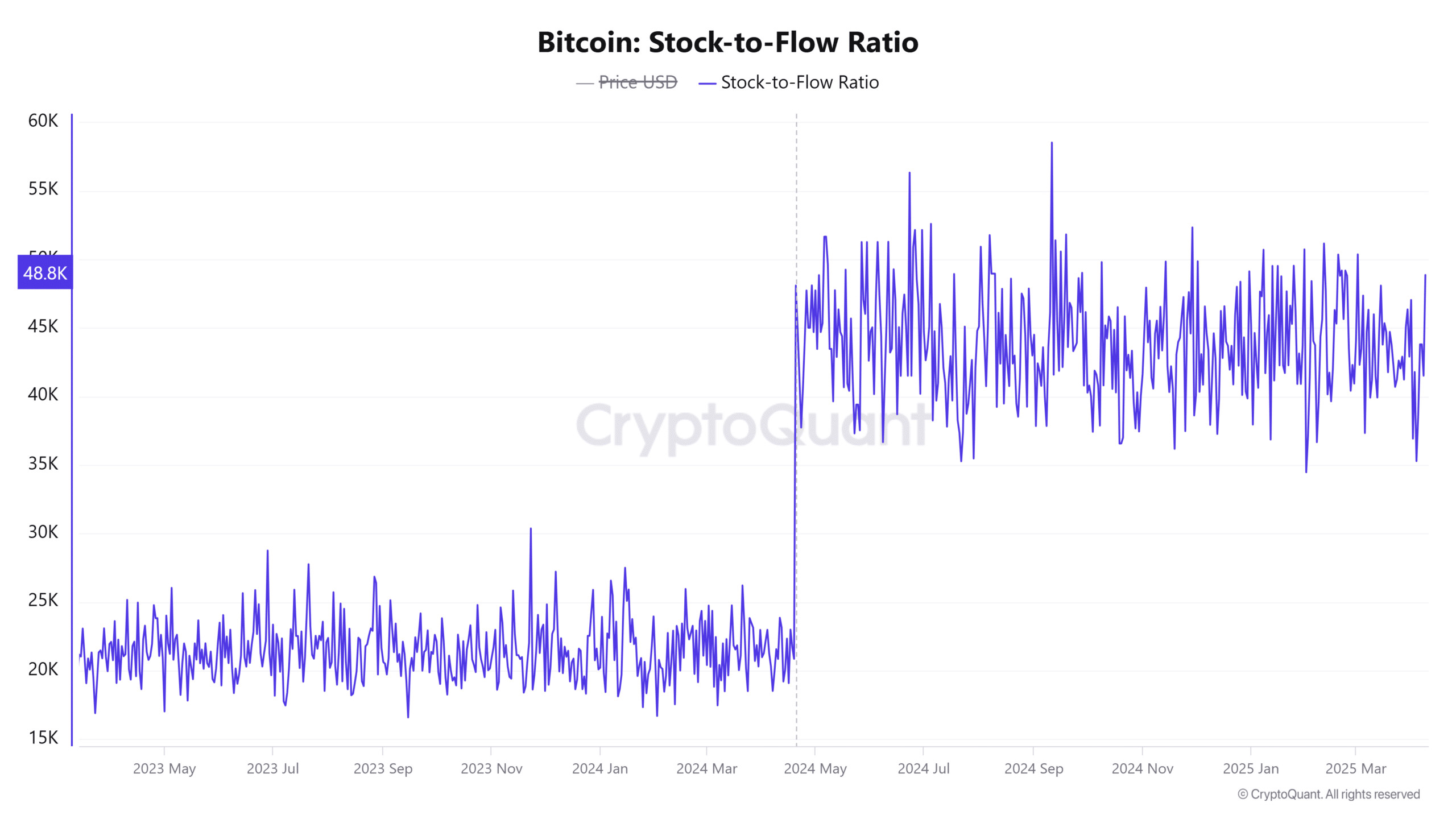

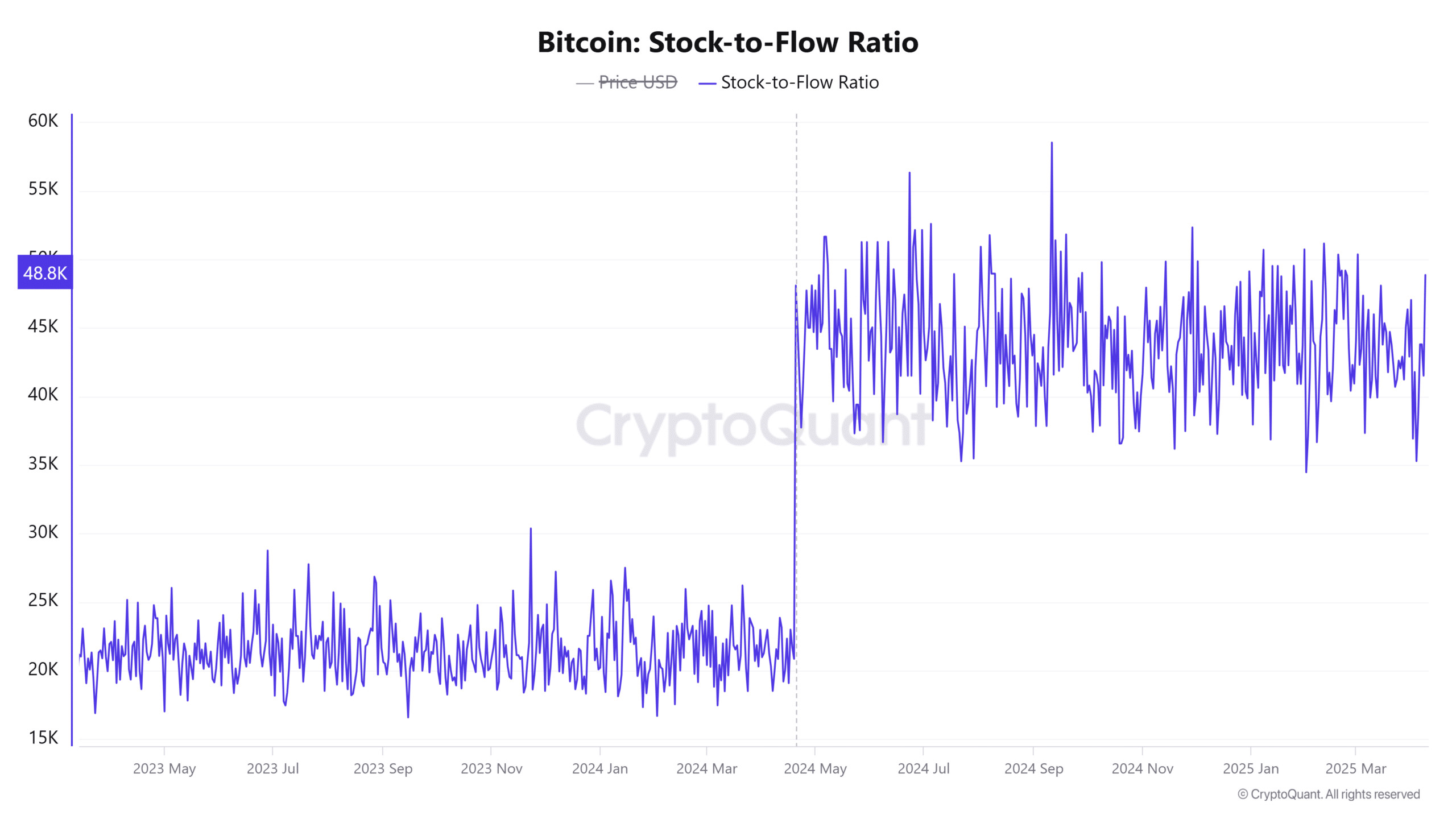

Inventory-to-flow ratio drops sharply – Has shortage misplaced its affect?

With alternate reserves rising, one other metric took a noticeable hit.

The Inventory-to-Stream (S2F) ratio plunged by 16.66% within the final 24 hours. Right here, it’s price noting that this metric tracks Bitcoin’s shortage by evaluating provide to mined cash.

Its decline introduced the press time worth right down to roughly 1.0586 million – Indicative of a decreased market emphasis on Bitcoin’s shortage mannequin.

Whereas the S2F usually aligns with long-term bullish developments, current conduct underlined the main focus shifting to inflation and rate of interest elements.

Supply: CryptoQuant

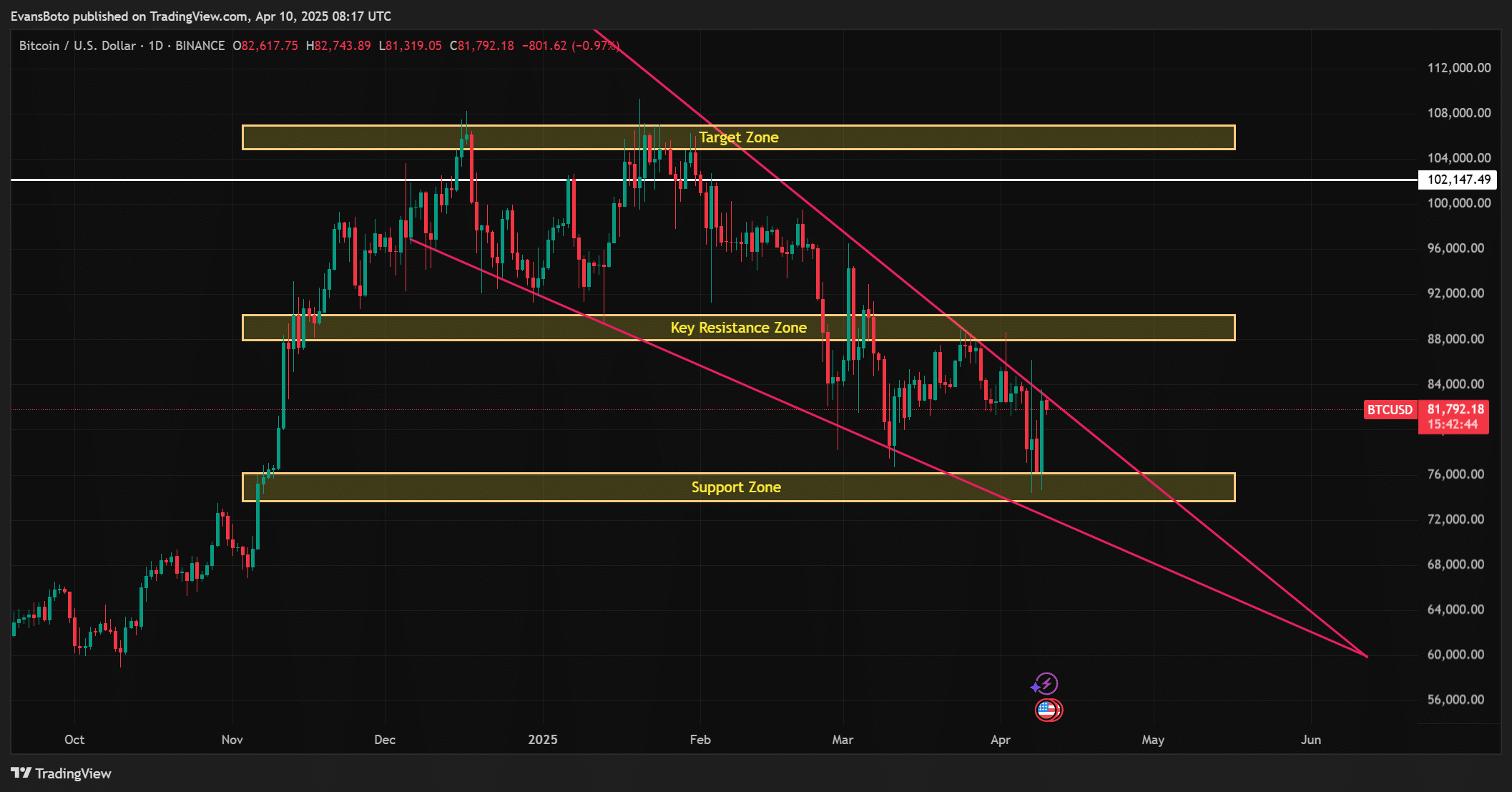

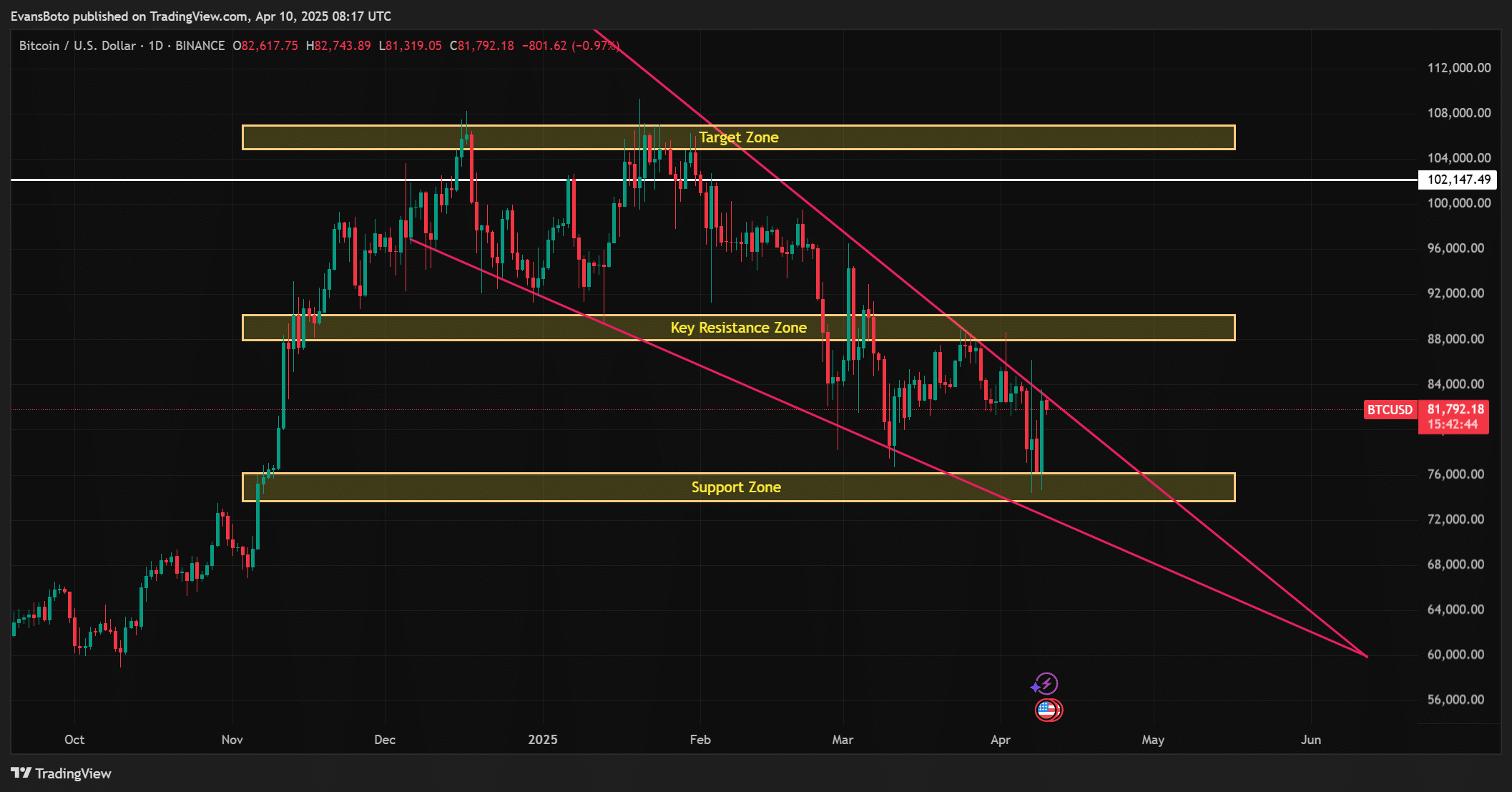

Bitcoin value compresses below key resistance

On the time of writing, Bitcoin was buying and selling at $81,715.99, following positive aspects of 5.57% over the previous 24 hours.

Regardless of this restoration, nevertheless, the value stays trapped inside a descending wedge sample. In reality, it gave the impression to be testing a serious resistance zone close to $84,000. Whereas the assist stage round $76,000 has been holding, the narrowing sample prompt {that a} breakout could also be imminent.

If the bulls handle to push via the higher boundary, the $102,000 goal may come into play. Nevertheless, failure to keep up assist may set off a fall in the direction of $60,000. Therefore, this a make-or-break zone for BTC.

Supply: TradingView

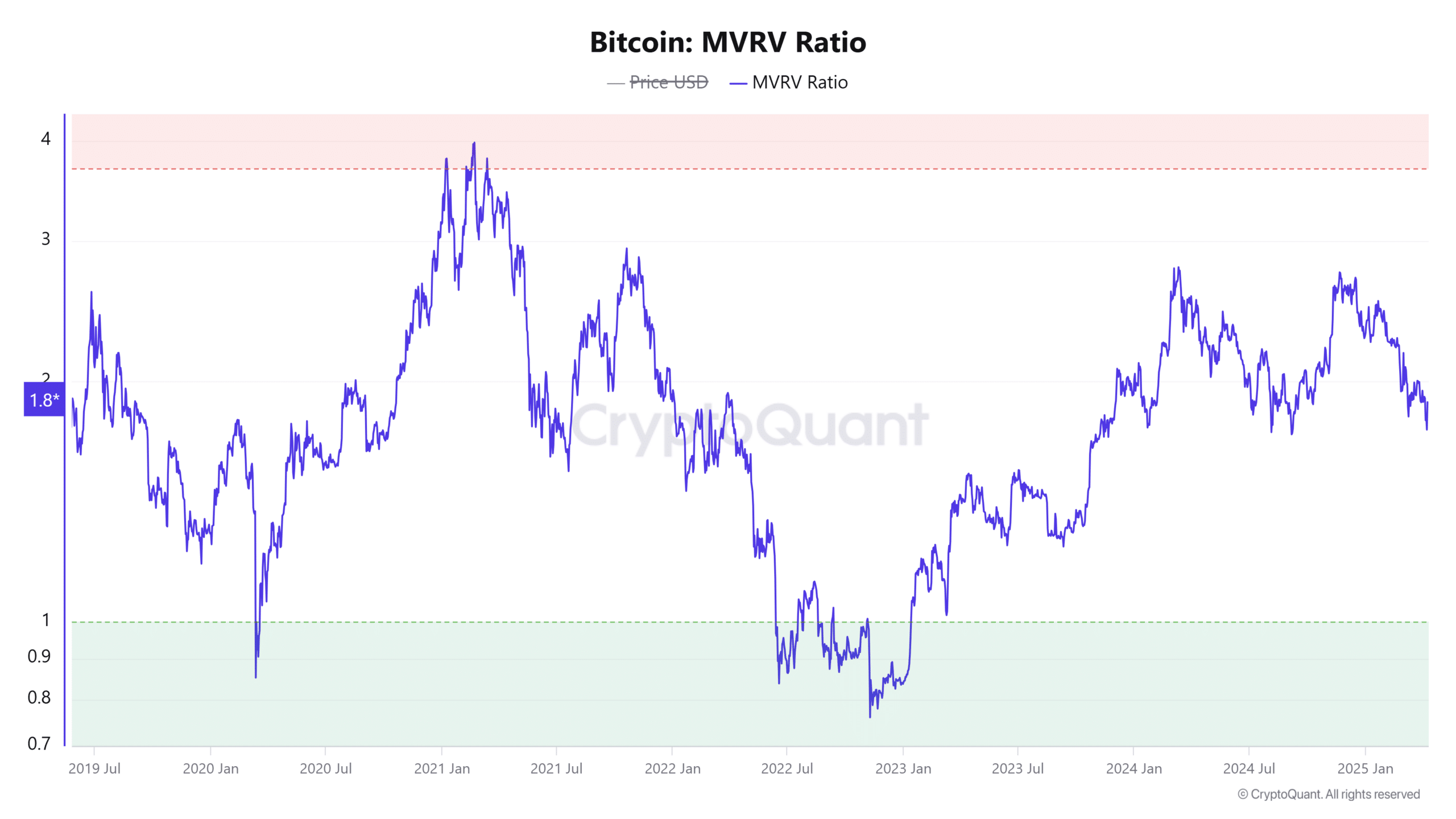

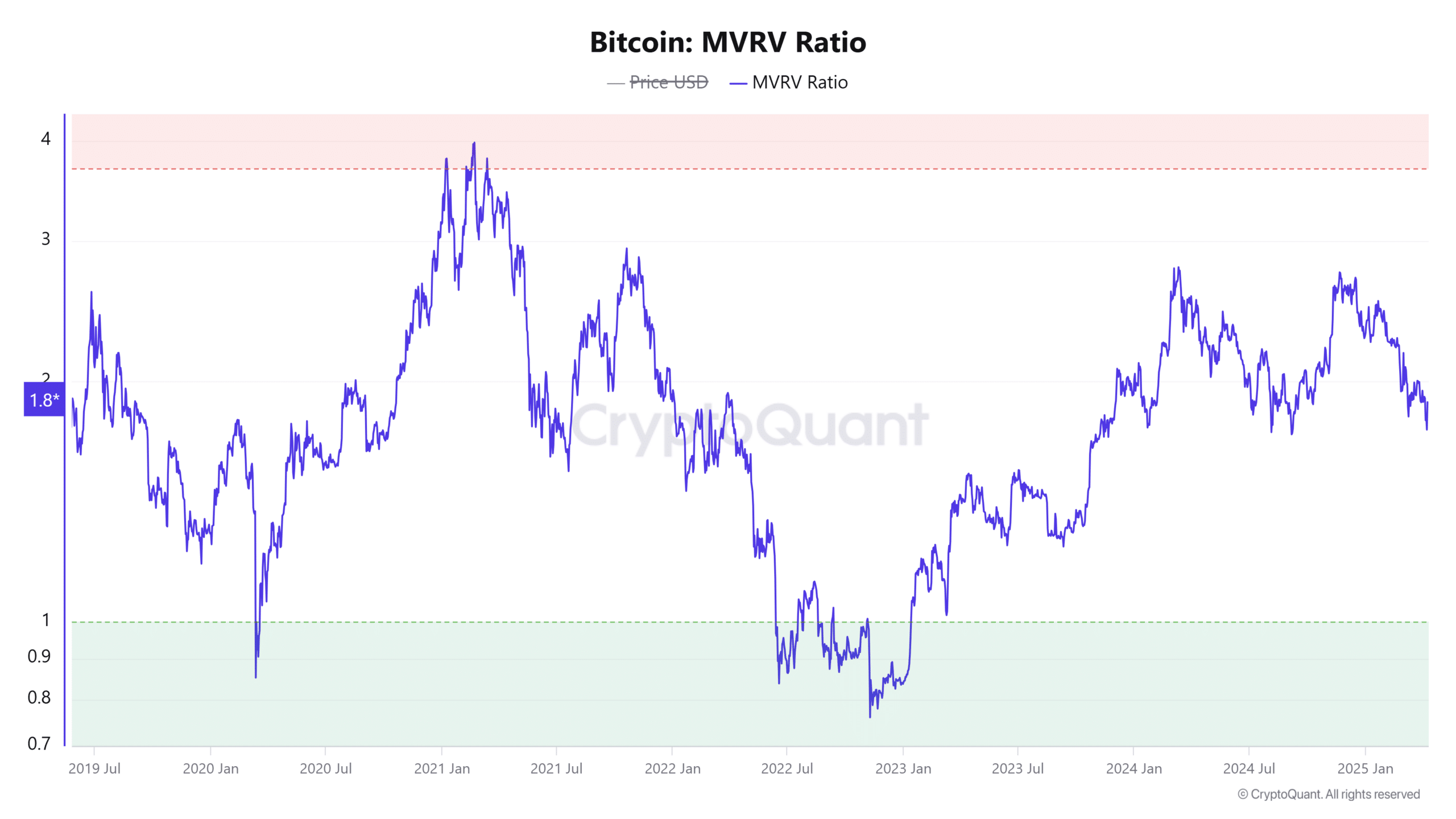

Bitcoin MVRV ratio climbs – Are traders nonetheless assured of their positions?

Including extra context to the market temper, the MVRV ratio—which gauges whether or not BTC is over- or undervalued—was at 1.86, reflecting a 4.84% hike within the final 24 hours.

A ratio above 1 implies that holders are more likely to stay assured and maintain, reasonably than promote at a loss.

Nevertheless, because the ratio climbs, so does the temptation to lock in positive aspects. This highlights the significance of monitoring sentiment shifts in actual time.

Supply: CryptoQuant

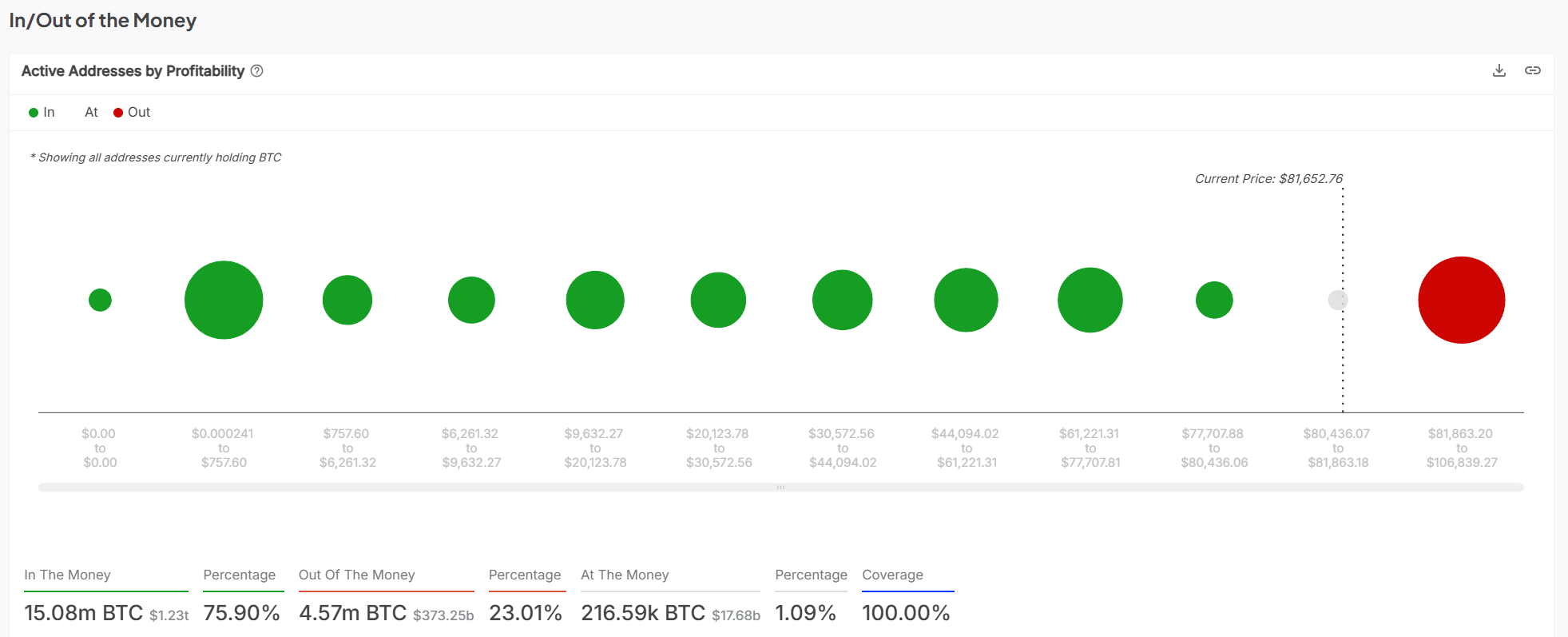

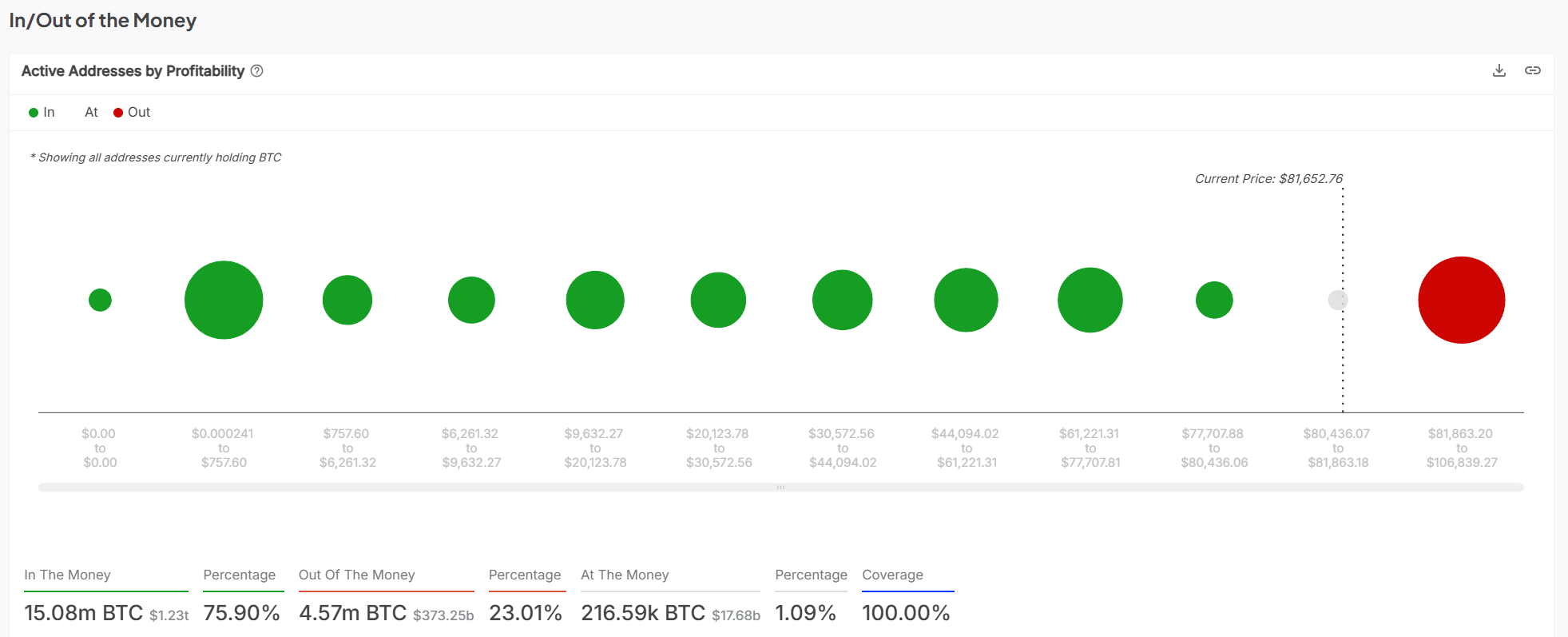

Most wallets nonetheless “Within the Cash,” however for the way lengthy?

In line with the most recent in/out of the cash knowledge, 75.90% of addresses are holding BTC at a revenue, whereas simply 23.01% are out of the cash. This can be a signal {that a} majority of market members stay well-positioned. This will function a psychological cushion throughout pullbacks.

Moreover, the focus of holders slightly below the press time value appeared to create a robust assist zone, probably limiting the draw back.

Nevertheless, with a big cluster of addresses additionally nearing breakeven, any important drop may set off panic amongst weak palms.

Supply: IntoTheBlock

Placing all of the items collectively, the info appears to favor strategic positioning over fear-driven exits.

A majority of holders stay in revenue, the MVRV ratio has been supporting a bullish outlook, and the value continues to be respecting key assist ranges.

In brief, whales aren’t bailing, they’re betting. Their accumulation conduct hinted that good cash has been quietly organising for the following transfer, not fleeing from it.