- ONDO broke out of a two-month-long descending channel after posting 20% beneficial properties on Wednesday

- Metrics signaled a shopping for alternative for market bulls, however buyers ought to be cautious of the dangers too

Ondo [ONDO] registered beneficial properties of 19.8% on Wednesday, and the buying and selling quantity for the day was additionally above common. This was encouraging for the market’s bulls. In actual fact, ONDO had fashioned a descending channel sample (white) over the previous two months, however noticed a breakout past the highs throughout its most up-to-date rally.

And but, the market construction on the 1-day chart was nonetheless bearish.

Supply: ONDO/USDT on TradingView

Technical evaluation revealed that the 78.6% Fibonacci retracement degree at $0.915 was nonetheless a key resistance degree. It marked the decrease excessive that ONDO wanted to beat to shift the construction bullishly. The OBV didn’t make a brand new increased excessive, in comparison with March’s ultimate week. This confirmed the patrons weren’t very robust. The RSI was at impartial 50, indicating a possible momentum shift.

Ought to merchants belief the channel breakout and go lengthy? Effectively, metrics confirmed there could also be a shopping for alternative at hand.

Shopping for alternative for ONDO bulls as accumulation traits stay robust

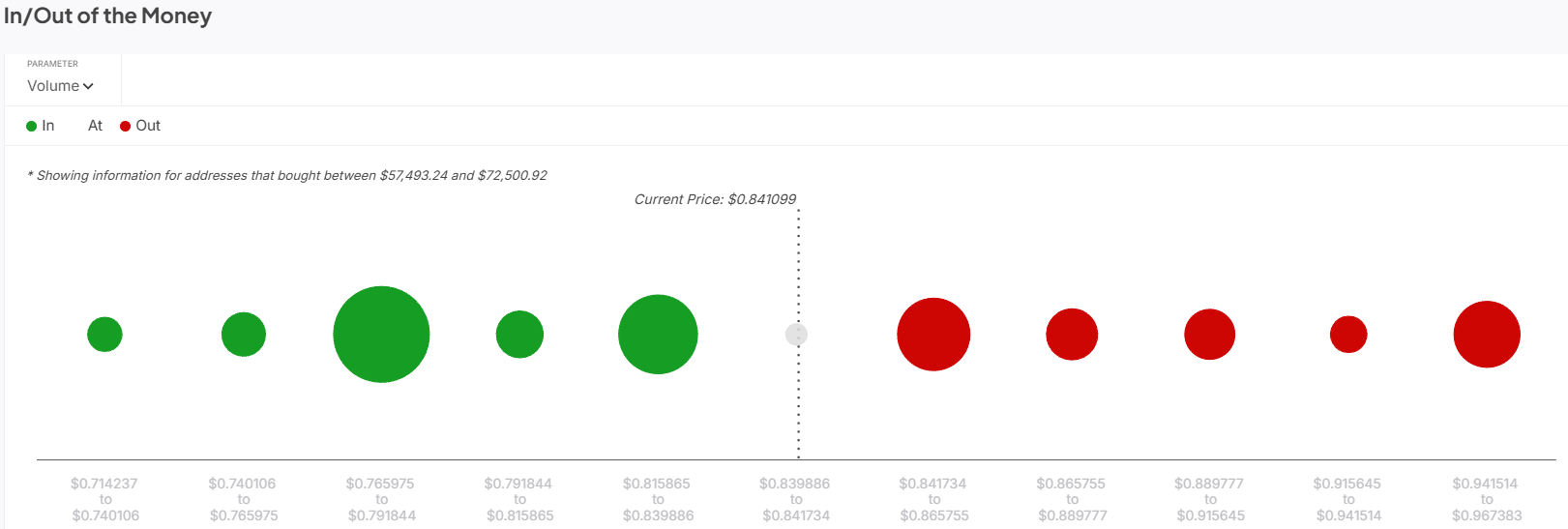

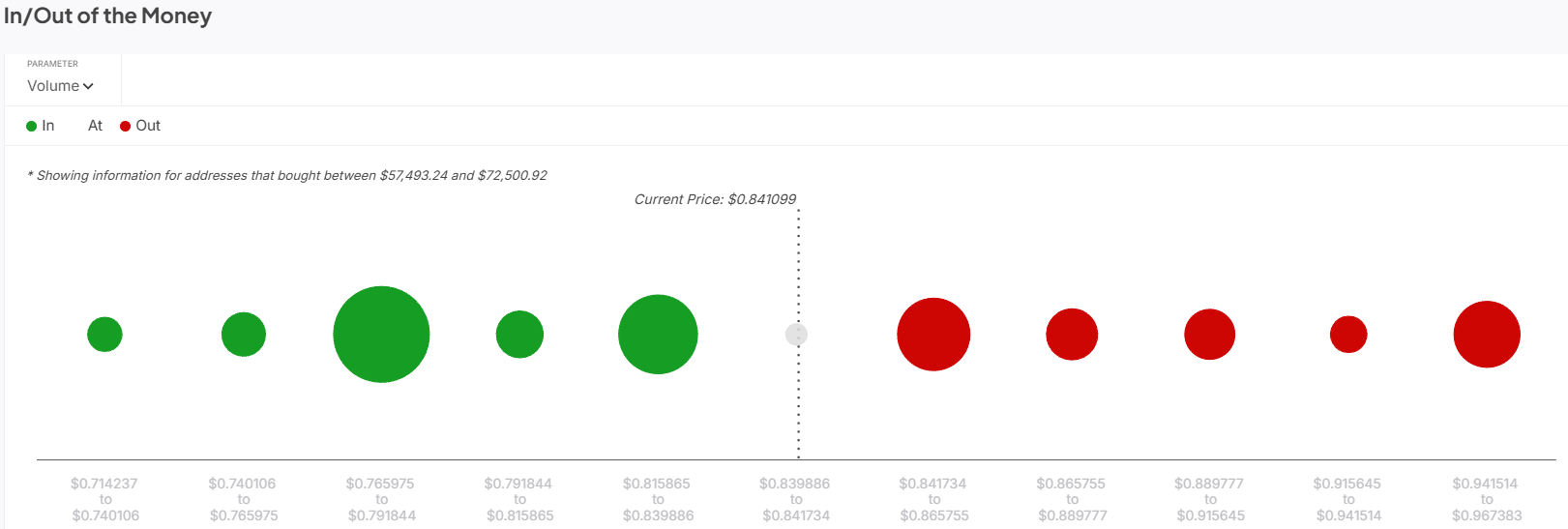

Supply: IntoTheBlock

The in/out of the cash round worth metric marked two close by help zones for ONDO at $0.815 and $0.791. These had been above the falling channel highs.

Due to this fact, a retest of those ranges or the channel as help would provide a shopping for alternative within the coming days.

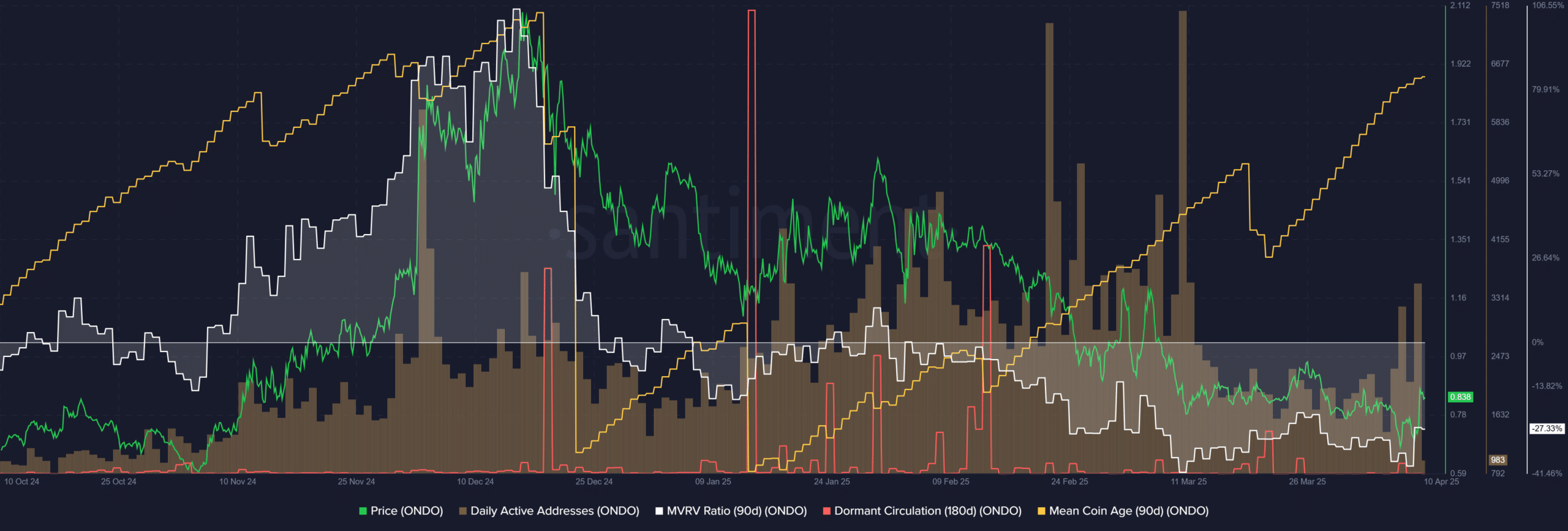

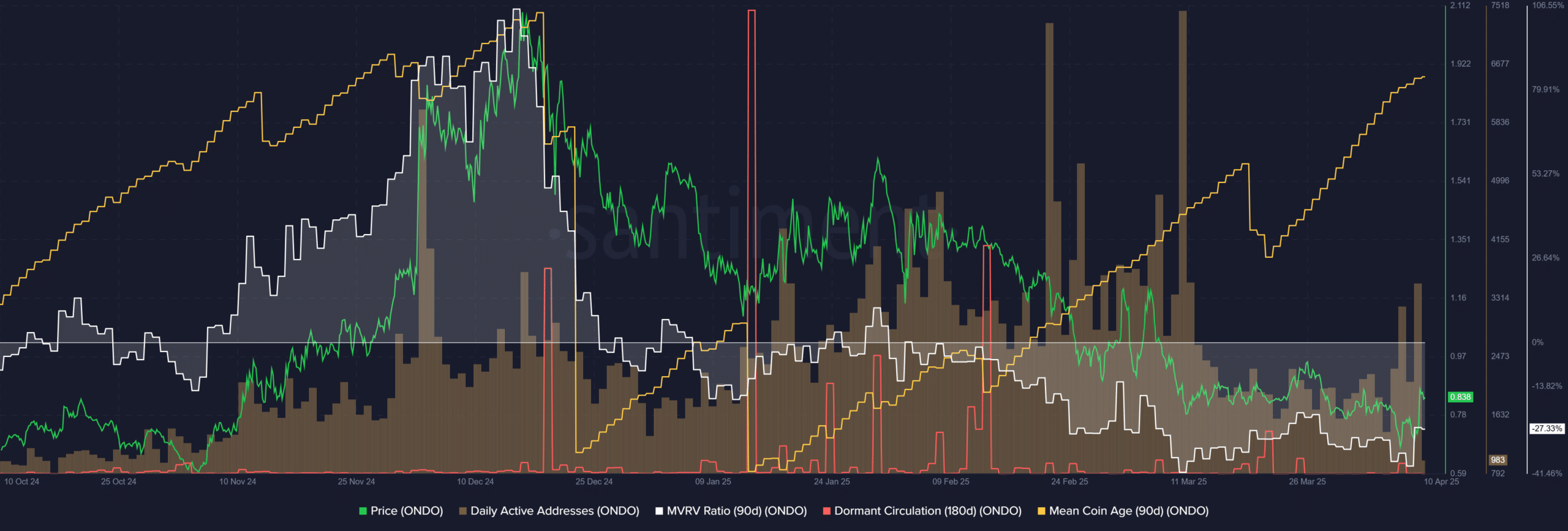

Supply: Santiment

The each day energetic addresses metric noticed a extreme decline from the second week of March. Over the previous week, it has begun to climb increased as soon as once more. Rising on-chain exercise can level in direction of a hike in utilization and demand.

The 90-day imply coin age has been in a gradual uptrend since January, with a minor drop in mid-March. The rising MCA might be an indication that cash had been transacted much less. On the similar time, the ONDO dormant circulation metric noticed few notable spikes in latest weeks.

Collectively, it pointeds towards accumulation. The 90-day MVRV ratio was additionally unfavorable, exhibiting that brief to medium-term holders had been going through losses.

The buildup traits, alongside the breakout from the two-month channel, had been an early signal that ONDO could also be a good shopping for alternative. Nonetheless, buyers should stay cautious given the market-wide bearish sentiment.