- Large Stablecoin Inflows: SUI noticed the best stablecoin inflows throughout all chains in 24 hours — $6.1M — signaling a spike in investor curiosity and potential shopping for energy ready on the sidelines.

- Open Curiosity Jumps 30%: Derivatives market is heating up for SUI, with open curiosity hitting $785M. The combo of inflows + rising OI factors to bullish merchants betting on a breakout.

- Cup & Deal with Sample Varieties: A bullish chart sample is creating, with $2.23 performing because the breakout stage. If that flips, worth might goal $2.80 — however affirmation is vital earlier than calling it a transfer.

Sui (SUI) simply made a daring transfer on the blockchain stage — pulling within the largest stablecoin inflows of any community over the past 24 hours. With a web enhance of $6.1 million, it stood out whereas different chains like Ethereum, Solana, and BNB Chain watched capital pour out. That sort of shift? It normally doesn’t go unnoticed.

This type of contemporary liquidity (aka “dry powder”) touchdown on SUI may very well be signaling one thing greater. When stablecoins flood right into a community, it usually means consumers are on the point of make a transfer — and normally, meaning upside stress on worth.

Open Curiosity Spikes — What Are Merchants Betting On?

Open curiosity on SUI shot up over 30%, touchdown at a hefty $785.35 million. That’s an enormous leap. And it didn’t occur in isolation. The bump in open curiosity alongside stablecoin inflows? That’s normally a bullish combo.

Open curiosity exhibits how a lot cash is locked in futures — and when it climbs like this, it’s sometimes an indication that merchants are putting severe bets. Whether or not they’re hedging or speculating, the momentum’s constructing. If the celebrities align, this may very well be SUI gearing up for a decisive transfer.

Cup and Deal with Sample Varieties — However Resistance Nonetheless Stands

Trying on the day by day chart, SUI’s worth motion has been forming what’s generally known as a cup and deal with sample — a traditional bullish setup. As of now, SUI’s buying and selling round $2.16, after rallying almost 13% in a day.

The “deal with” half is shaping up inside a descending wedge, and the breakout line is sitting close to $2.23. If bulls can lastly shut a powerful candle above that stage, the following massive goal floats round $2.80. For now, although, it’s all about that breakout affirmation.

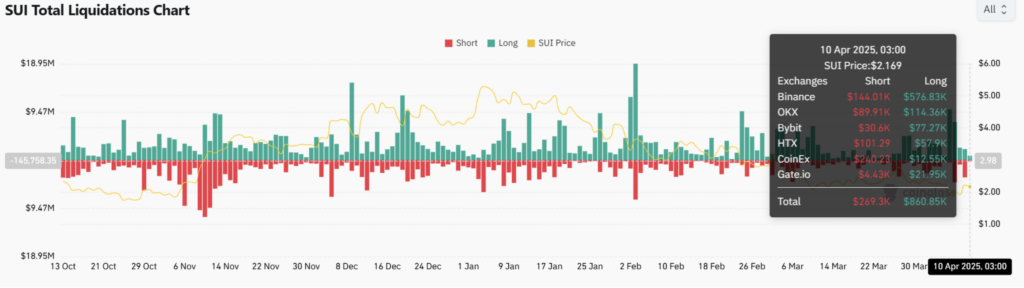

Liquidations + Funding: Bulls Nonetheless within the Recreation?

Over the previous 24 hours, lengthy liquidations hit $860k, in comparison with solely $269k in shorts. That exhibits some overconfident bulls acquired wiped — however hey, generally that sort of shakeout clears the trail for a cleaner rally. It’s like hitting reset on leverage.

Additionally price noting — funding charges flipped barely constructive, clocking in at 0.0087%. When merchants are paying to remain lengthy, that’s normally an indication they nonetheless consider upside is coming. If each funding and inflows maintain robust, we may very well be in for one more leg larger.

Remaining Take: Setup Seems to be Sturdy, However Persistence Issues

All indicators are pointing towards a possible breakout — robust inflows, rising open curiosity, a bullish sample, and bettering funding knowledge. Nonetheless, let’s not get forward of ourselves.

$2.23 stays the important thing stage to observe. A strong breakout and shut above that, and this factor might begin working. Till then? It’s all about watching and ready. However yeah, SUI’s trying like one of many extra fascinating performs on the desk proper now.