- CRV noticed an enormous 24-hour surge following Trump’s new legislative order that grants DeFi belongings independence

- Spot market buyers have continued to extend their publicity to the asset

Within the final 24 hours, Curve DAO [CRV] has seen a big rally following Trump’s newest legislative order, one which protects Decentralized Finance (DeFi) and associated belongings.

Shopping for sentiment has since continued to strengthen, with spot market merchants accumulating a big quantity. Nevertheless, there’s a probable drop incoming earlier than a sustained rally upwards.

How does President Trump’s invoice have an effect on CRV?

On 10 April, the President of the US, Donald Trump, signed the first-ever crypto invoice into regulation, defending DeFi.

This new regulation is ready to stop the Inside Income Service (IRS) Digital Belongings Sale and Exchanges Rule from being handed into regulation. This invoice, often known as the DeFi Dealer Rule, was set to implement each custodial and non-custodial companies to submit reviews to the IRS at intervals.

Consultant Mike Carey of the Home Methods and Means Committee acknowledged,

“The DeFi Dealer Rule needlessly hindered American innovation, infringed on the privateness of on a regular basis Individuals, and was set to overwhelm the IRS with an overflow of latest filings that it doesn’t have the infrastructure to deal with throughout tax season.”

Following the information, DeFi tokens reacted positively. CRV, the native token of Curve, led the cost. It surged by 19% and pushed its month-to-month features to 48%.

Therefore, AMBCrypto analyzed the market to find out how members could be reacting and whether or not the rally may very well be sustained or not.

Merchants accumulate CRV, eyeing a close to $2 rally

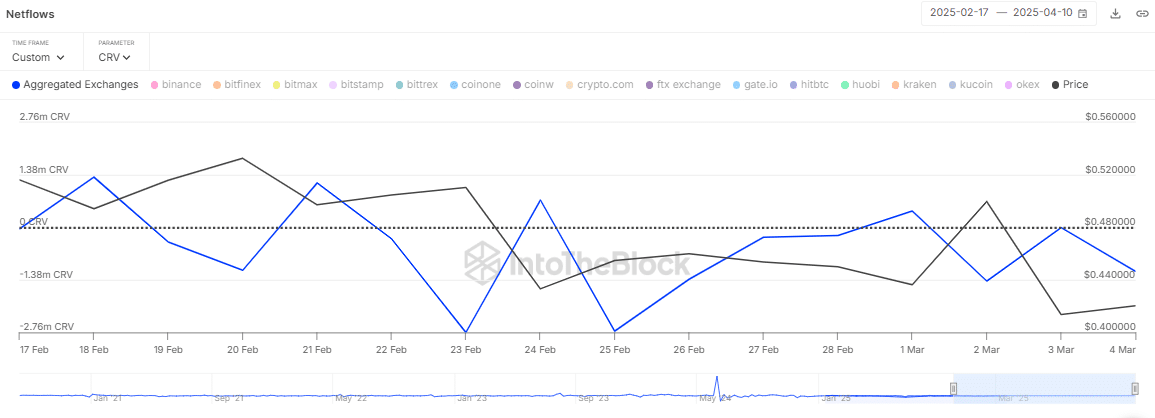

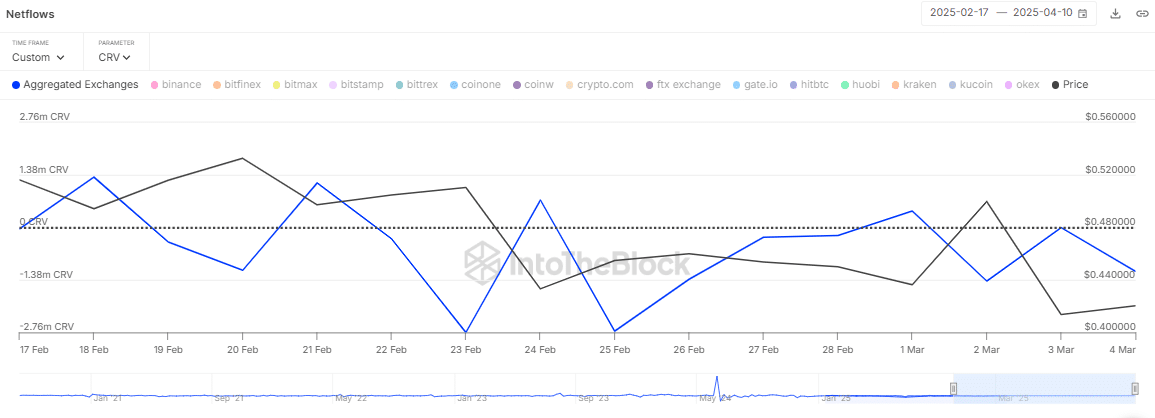

Following the replace, merchants within the spot market accrued 1.15 million CRV, price roughly $667,000, as indicated by the trade netflows.

This buy is probably going long-term, particularly as this cohort of merchants moved the CRV into non-public wallets for holding.

Supply: IntoTheBlock

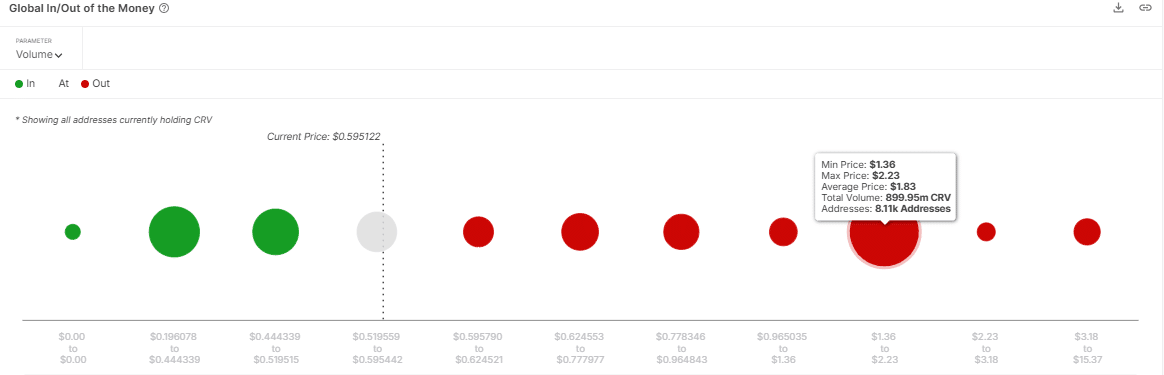

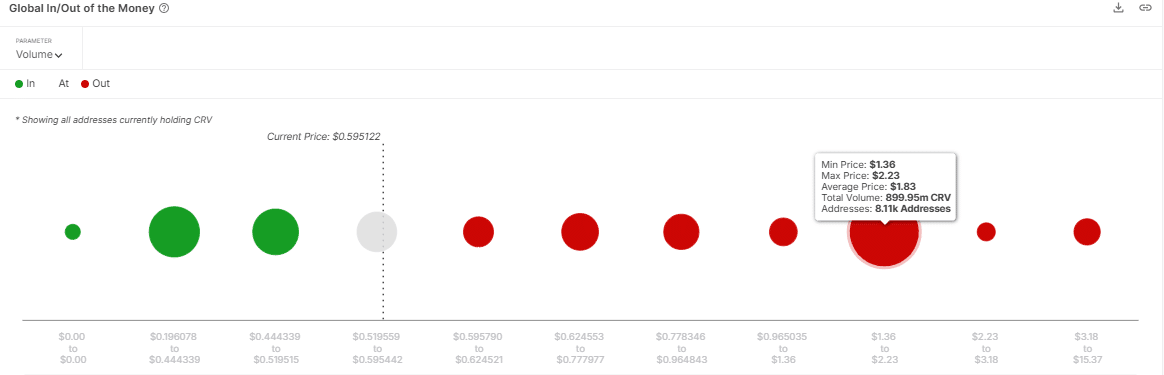

The In/Out of the Cash Round Worth (IOMAP) indicator revealed minimal resistance forward, hinting at extra room for progress.

On the time of writing, the IOMAP highlighted no robust resistance till $1.83. At that stage, roughly 899.95 million CRV promote orders might exist.

If shopping for strain persists, CRV may climb in the direction of this resistance zone.

Because of this if shopping for sentiment available in the market continues to climb, CRV may document a worth run-up to the $1.83-level.

Supply: IntoTheBlock

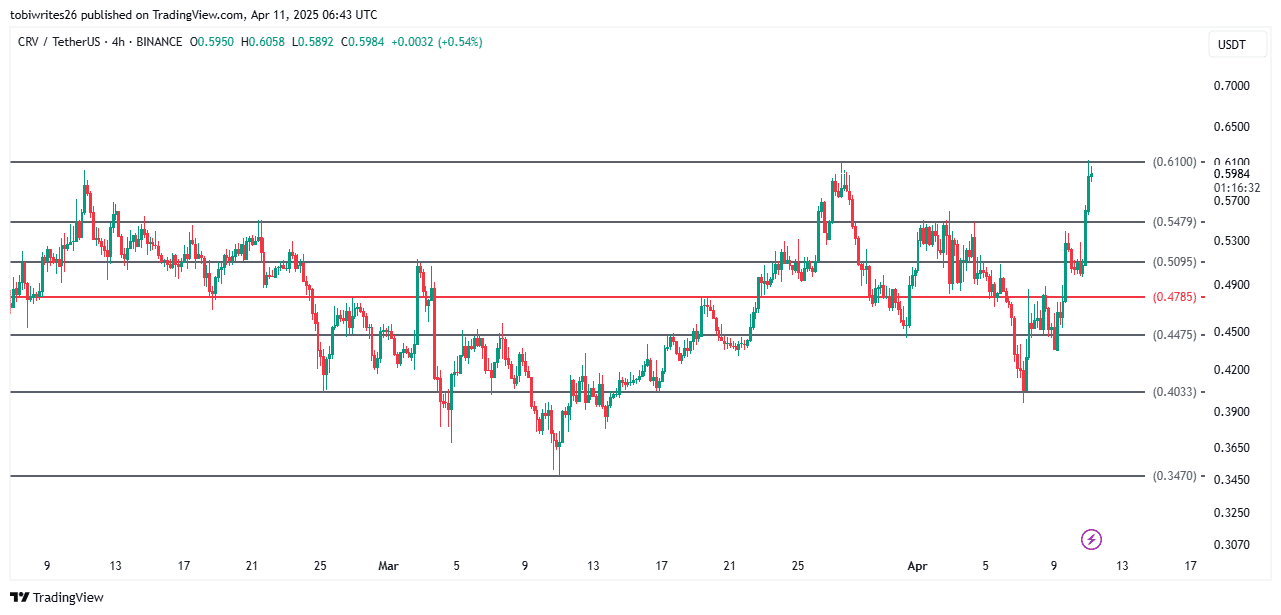

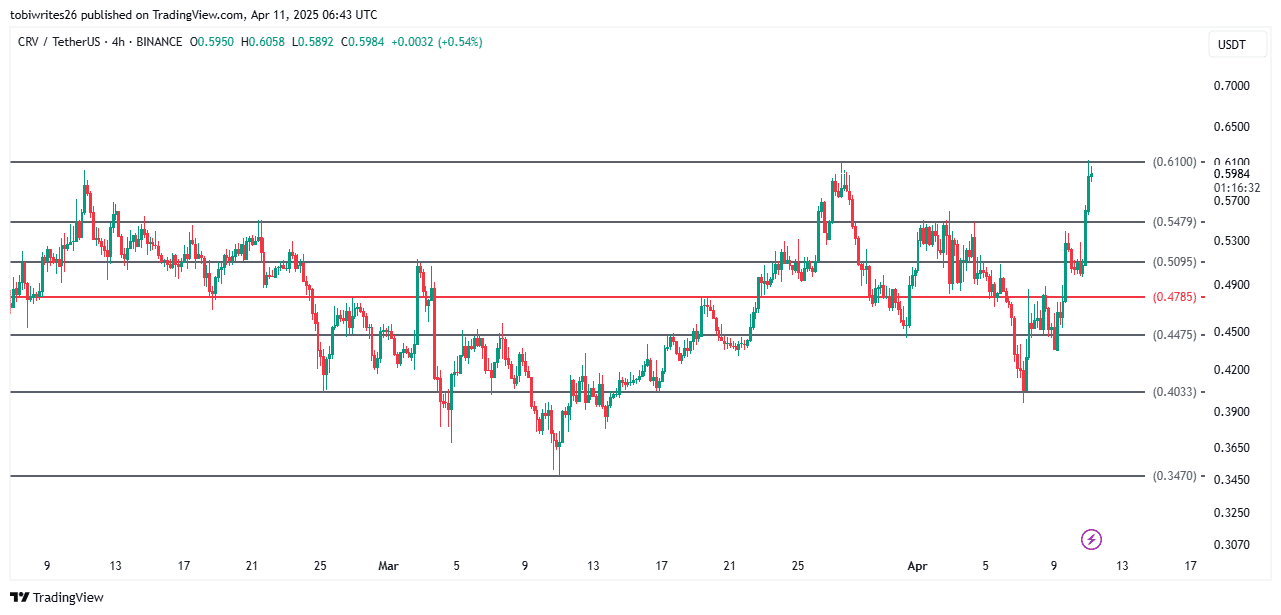

A drop earlier than an additional push

CRV may witness a worth cooldown earlier than a sustained market rally. On the time of writing, it was buying and selling right into a key resistance stage at $0.61 – A stage which beforehand pressured the value decrease the final time the asset hit this stage.

This drop is unlikely to be important, particularly given the prevailing bullish sentiment. Three ranges are anticipated to behave as help to push the asset additional – $0.549, $0.509, or $0.478, relying on market momentum.

Supply: TradingView

Within the derivatives market, promoting strain appeared to be constructing too. The OI-weighted funding price flipped adverse too – An indication of a hike in brief exercise.

CRV’s newest rally mirrored renewed confidence, particularly on the again of regulatory readability from the White Home.

Whereas a short dip might occur quickly, robust accumulation and minimal resistance recommended bulls should have some room to run.