|

High Tales of The Week

Shaquille O’Neal will get decide’s greenlight for $11M Astrals NFT settlement

Former NBA star Shaquille O’Neal has been granted remaining court docket approval to settle a class-action lawsuit for $11 million with Astrals non-fungible token (NFT) consumers.

Florida federal court docket decide Federico Moreno granted approval of the settlement between O’Neal and the category group led by Daniel Harper in an April 1 order made out there on April 8.

The deal created a fund of as much as $11 million for eligible class members and awarded $2.9 million in lawyer charges and prices. All those that bought Astrals NFTs from Could 2022 to Jan. 15 and people who bought the mission’s native GLXY tokens up till mid-January are eligible.

“The price sought by lead class counsel has been reviewed and authorized as honest and affordable by plaintiffs,” Moreno’s order learn.

New York invoice proposes legalizing Bitcoin, crypto for state funds

A New York lawmaker has launched laws that will enable state companies to just accept cryptocurrency funds, signaling rising political momentum for digital asset integration in public providers.

Meeting Invoice A7788, launched by Assemblyman Clyde Vanel, seeks to amend state monetary legislation to permit New York state companies to just accept cryptocurrencies as a type of fee.

It might allow state companies to just accept funds in Bitcoin, Ether, Litecoin, and Bitcoin Money, in line with the invoice’s textual content.

Synthetix USD stablecoin loses greenback peg, drops to 5-year low of $0.83

The Synthetix protocol’s native stablecoin, Synthetix USD (sUSD), fell to its lowest worth in 5 years, extending a months-long wrestle to keep up its $1 peg.

The asset has confronted persistent instability because the begin of 2025. On Jan. 1, sUSD dropped to $0.96 and solely rebounded to $0.99 in early February. Costs continued to fluctuate by February earlier than stabilizing in March.

On April 10, sUSD fell to a five-year low of $0.83, in line with knowledge from CoinGecko.

SUSD is a crypto-collateralized stablecoin. Customers lock up SNX tokens to mint sUSD, making its stability extremely dependent available on the market worth of SNX.

SEC, Ripple file joint movement to pause appeals in XRP case

The US Securities and Trade Fee and blockchain funds agency Ripple agreed to pause their appeals within the ongoing XRP authorized battle, signaling a possible transfer towards a remaining settlement.

The SEC and Ripple agreed to place their appeals in “abeyance,” that means the proceedings at the moment are paused pending an anticipated settlement of the XRP case.

“An abeyance would preserve judicial and social gathering sources whereas the events proceed to pursue a negotiated decision of this matter,” the events collectively said in an April 10 court docket submitting.

Ripple CEO Brad Garlinghouse beforehand introduced the top of the XRP case on March 19, and the brand new submitting hints that the SEC is able to settle as soon as nominated and confirmed Chair Paul Atkins takes workplace, in line with some group hypothesis.

Crypto shares see huge features alongside US inventory market rebound

Crypto shares have surged as a part of a broader restoration within the US inventory market on April 9 following President Donald Trump’s 90-day pause on sweeping world tariffs.

The Wednesday, April 9, buying and selling day closed with Michael Saylor’s Technique up 24.76% to $296.86, whereas crypto alternate Coinbase (COIN) closed up 17% to $177.09, in line with Google Finance knowledge.

Crypto mining firms additionally noticed features, with MARA Holdings (MARA) up 17%, Cipher Mining (CIFR) up 16.59%, and Riot Platforms (RIOT) rising 12.77%.

Winners and Losers

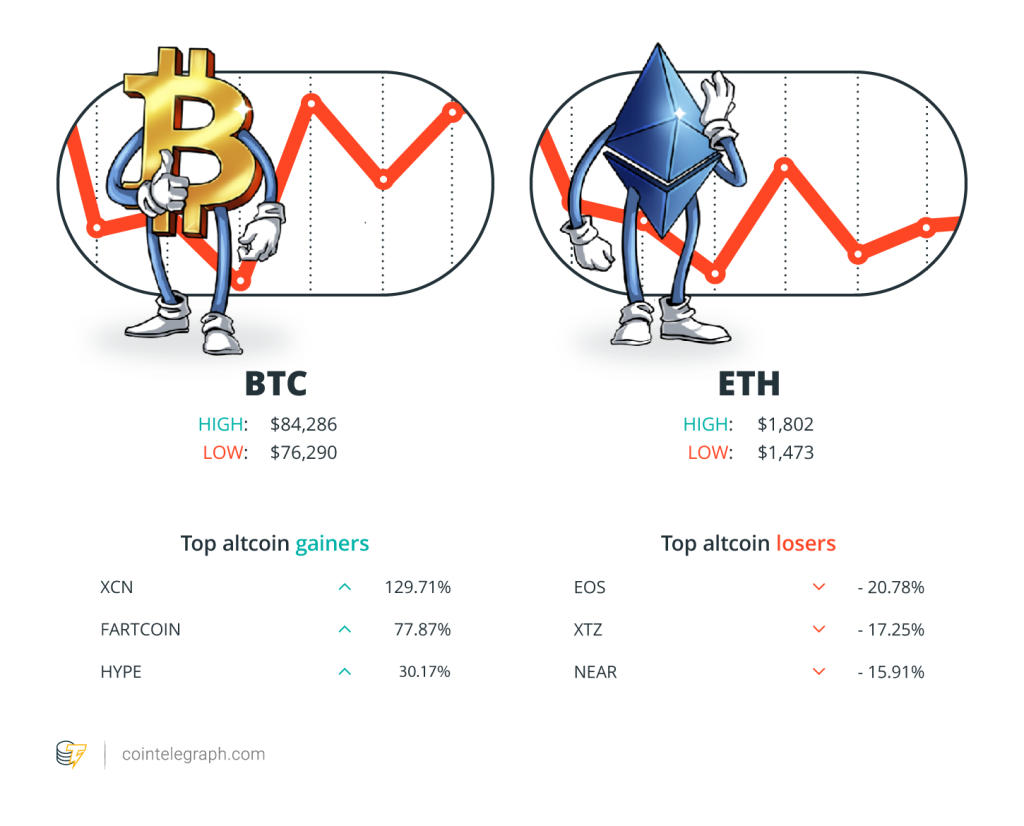

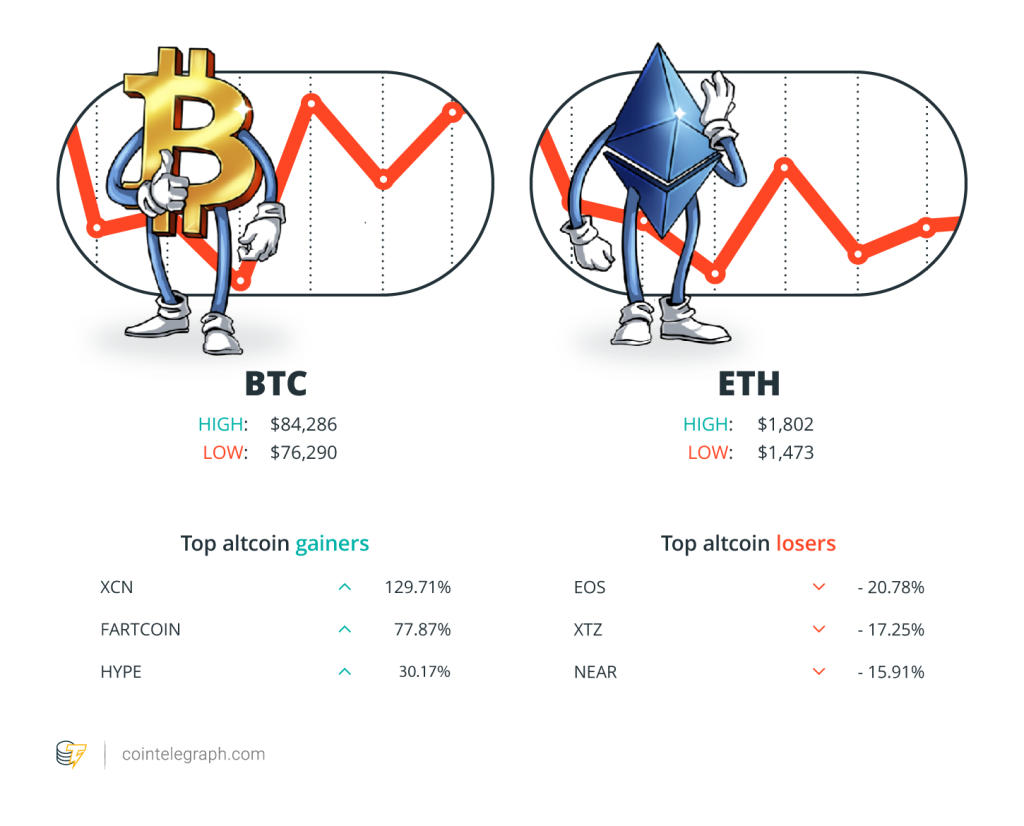

On the finish of the week, Bitcoin (BTC) is at $83,430, Ether (ETH) at $1,566 and XRP at $2.02. The entire market cap is at $2.63 trillion, in line with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Onyxcoin (XCN) at 129.71%, Fartcoin (FARTCOIN) at 77.87% and Hyperliquid (HYPE) at 30.17%.

The highest three altcoin losers of the week are EOS (EOS) at 20.78%, Tezos (XTZ) at 17.25% and NEAR Protocol (NEAR) at 15.91%. For more information on crypto costs, ensure that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“If we don’t make Bitcoin extra helpful, we threat making it irrelevant.”

Eli Ben-Sasson, co-founder and CEO of StarkWare

“Perpetual swaps play a key position in worth discovery for newly launched altcoins and are a powerful signal of market sentiment as they’re usually the primary derivatives product to be launched.”

Stephan Lutz, CEO of BitMEX

“Nobody from the MELANIA staff has addressed this. Not the actions. Not the promoting.”

Bubblemaps, blockchain analytics agency

“So there’s an actual prospect of Bitcoin competing with gold after which beginning to take a few of the gold use circumstances, like as a geopolitical hedge, take a few of that cash into Bitcoin.”

Adam Again, CEO of Blockstream

“In the long run, nearly all the opposite tariff negotiations and rhetoric are all about getting China to agree a deal.”

Raoul Pal, founding father of International Macro Investor

“I really assume the true query is, when does the bull market come? When you ask me, that’s going to be Q3, This autumn of this yr.”

Eric Turner, CEO of Messari

High Prediction of The Week

Bitcoin $100K goal ‘again on desk’ after Trump tariff pause supercharges market sentiment

Bitcoin staged a pointy rebound after US President Donald Trump introduced a pause on tariffs for non-retaliating international locations, reigniting bullish momentum and elevating hopes for a possible surge towards the $100,000 mark.

On April 9, BTC/USD surged by roughly 9%, reversing a lot of the losses it incurred earlier within the week, to retest $83,000. In doing so, the pair got here nearer to validating a falling wedge sample that has been forming on its day by day chart since December 2024.

As of April 9, Bitcoin’s worth was confined throughout the falling wedge vary whereas eyeing a breakout above its higher trendline at round $83,000. Whether it is confirmed, BTC’s major upside goal by June may very well be round $100,000.

High FUD of The Week

Feds, SEC cost app maker with fraud, saying ‘AI’ service was Philippine staff

US authorities have charged a tech app founder with fraud, alleging that his marketed synthetic intelligence-powered e-commerce app really relied on human staff within the Philippines.

Albert Saniger of Barcelona, Spain, founder and former CEO of the corporate Nate, was charged with one rely of securities fraud and wire fraud, the Justice Division mentioned in an April 9 assertion, whereas the Securities and Trade Fee filed a parallel civil motion.

Learn additionally

Options

Anti-aging tycoon Bryan Johnson nearly devoted his life to crypto

Options

Unique: 2 years after John McAfee’s dying, widow Janice is broke and desires solutions

Courtroom paperwork mentioned Saniger based Nate round 2018 and launched an app of the identical title in July 2020, advertising and marketing it as an AI-powered common buying cart that provided customers the flexibility to finish on-line retail transactions, together with filling in transport particulars and sizing, with out human enter.

Democrats slam DOJ’s ‘grave mistake’ in disbanding crypto crime unit

Crypto-critical US Senator Elizabeth Warren has led six Senate Democrats in urging the Division of Justice to reverse its resolution to terminate its crypto investigations and prosecutions division.

In an April 10 letter to Deputy Lawyer Normal Todd Blanche, the senators mentioned the choice to disband the division’s Nationwide Cryptocurrency Enforcement Staff was a “grave mistake” that will assist “sanctions evasion, drug trafficking, scams, and youngster sexual exploitation.”

Senators Richard Durbin, Mazie Hirono, Sheldon Whitehouse, Christopher Coons and Richard Blumenthal signed the letter along with Warren.

Jack Dorsey’s Block fined $40M for alleged crypto compliance, AML failures

Digital funds firm Block, Inc. has reached a $40 million settlement with New York regulators over alleged compliance misconducts tied to its Money App platform, Bloomberg reported on April 10.

Learn additionally

Options

Lazarus Group’s favourite exploit revealed — Crypto hacks evaluation

Options

Crypto Pepes: What does the frog meme?

Block was fined by the New York Division of Monetary Providers following an investigation into Money App’s Anti-Cash Laundering and cryptocurrency compliance operations, Bloomberg mentioned after reviewing the federal government company’s consent order.

NYDFS decided that Block allegedly violated shopper safety legal guidelines and didn’t conduct correct due diligence on its clients. The corporate was allegedly too sluggish in reporting suspicious transactions to regulators and did not adequately display screen so-called “high-risk” Bitcoin transactions.

High Journal Tales of The Week

Memecoin degeneracy is funding groundbreaking anti-aging analysis

Crypto initiatives like Pump.science and VitaDAO are utilizing crypto hypothesis to analysis longevity and anti-aging therapies.

Unlawful arcade disguised as … a pretend Bitcoin mine? Soldier scams in China: Asia Categorical

Faux Chinese language soldier’s door-to-door crypto rip-off, a Bitcoin mining agency serves as a authentic entrance for illicit operations, and extra!

UK’s Orwellian AI homicide prediction system, will AI take your job? AI Eye

Tariffs on China to kickstart USA-based robotic factories, creepy robotic canines given cute dragon makeovers, is your job in danger to AI?

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.