- Revenue-taking on Bitcoin has continued to shrink, as sellers out there waned

- Market liquidity flows revealed that Bitcoin buyers may very well be gaining confidence as soon as once more

Because the cryptocurrency market positive factors floor, Bitcoin [BTC] has adopted that sample, with a 3.22% rally throughout this era. This appeared to point that market confidence is rising. Nevertheless, that’s not all as several concurrent developments appeared to trace {that a} rally could also be brewing. Particularly as indicators of vendor fatigue start to floor.

Naturally, when evaluating the prevailing market efficiency to previous episodes of turbulence, the setup feels eerily acquainted.

Vendor exhaustion is nearing

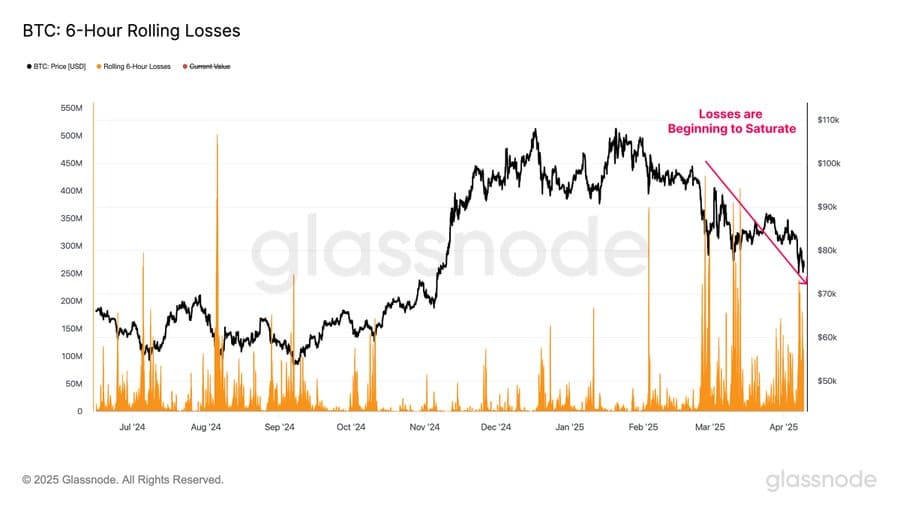

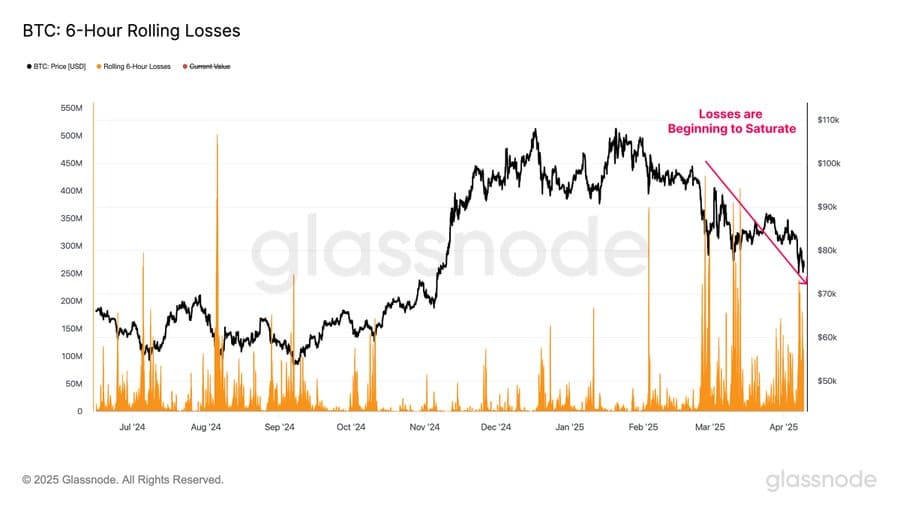

Through the newest market drawdown – one of many largest in crypto market historical past – buyers recorded main losses of upto $240 million. Such episodes sometimes invite aggressive promoting strain. On this explicit case, the realized earnings have continued to shrink.

This contraction may very well be an indication that sellers could also be evidently operating low on ammunition.

In actual fact, it pointed to exhaustion setting in amongst market individuals – A situation that usually precedes a rebound.

Supply: Glassnode

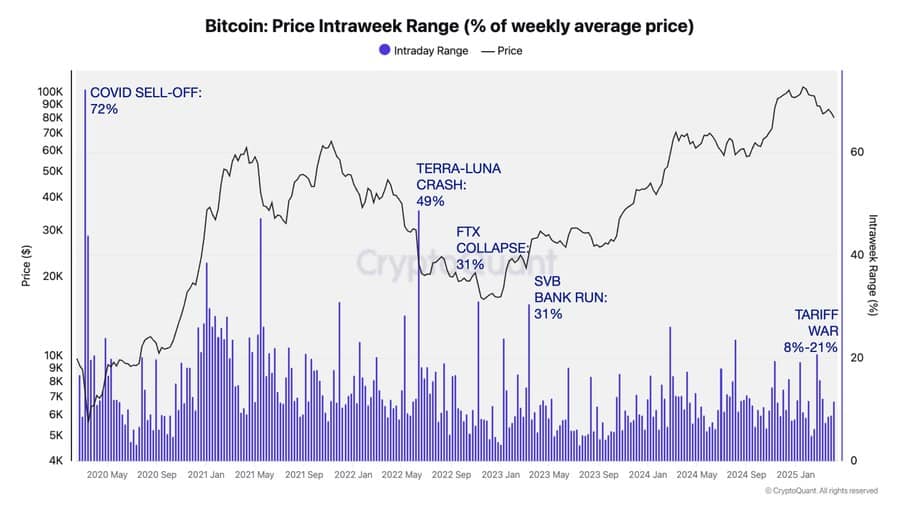

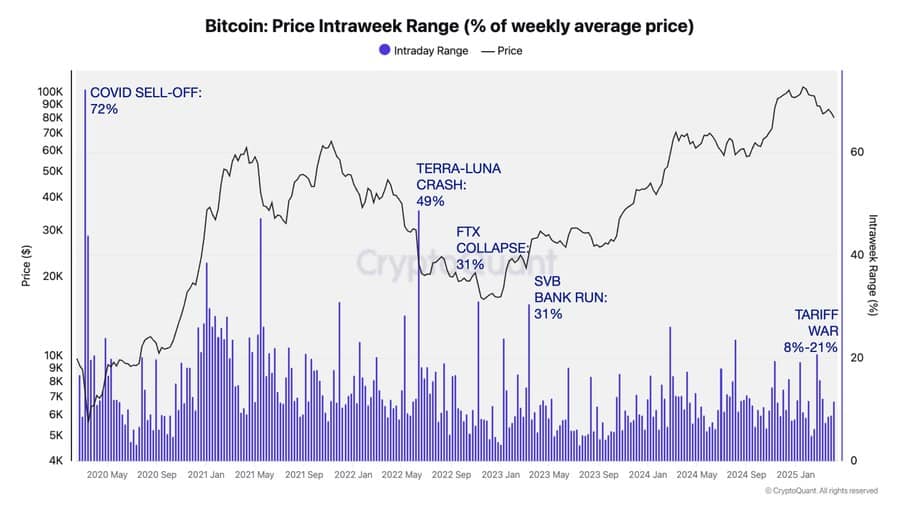

Once we juxtapose the present setup with earlier capitulation phases, just like the U.S. tariff-triggered slide, the Covid-19 crash, the Terra-Luna and FTX meltdowns, and even the SVB banking scare, the resemblance is putting.

All of them have been adopted by intervals of renewed shopping for vitality.

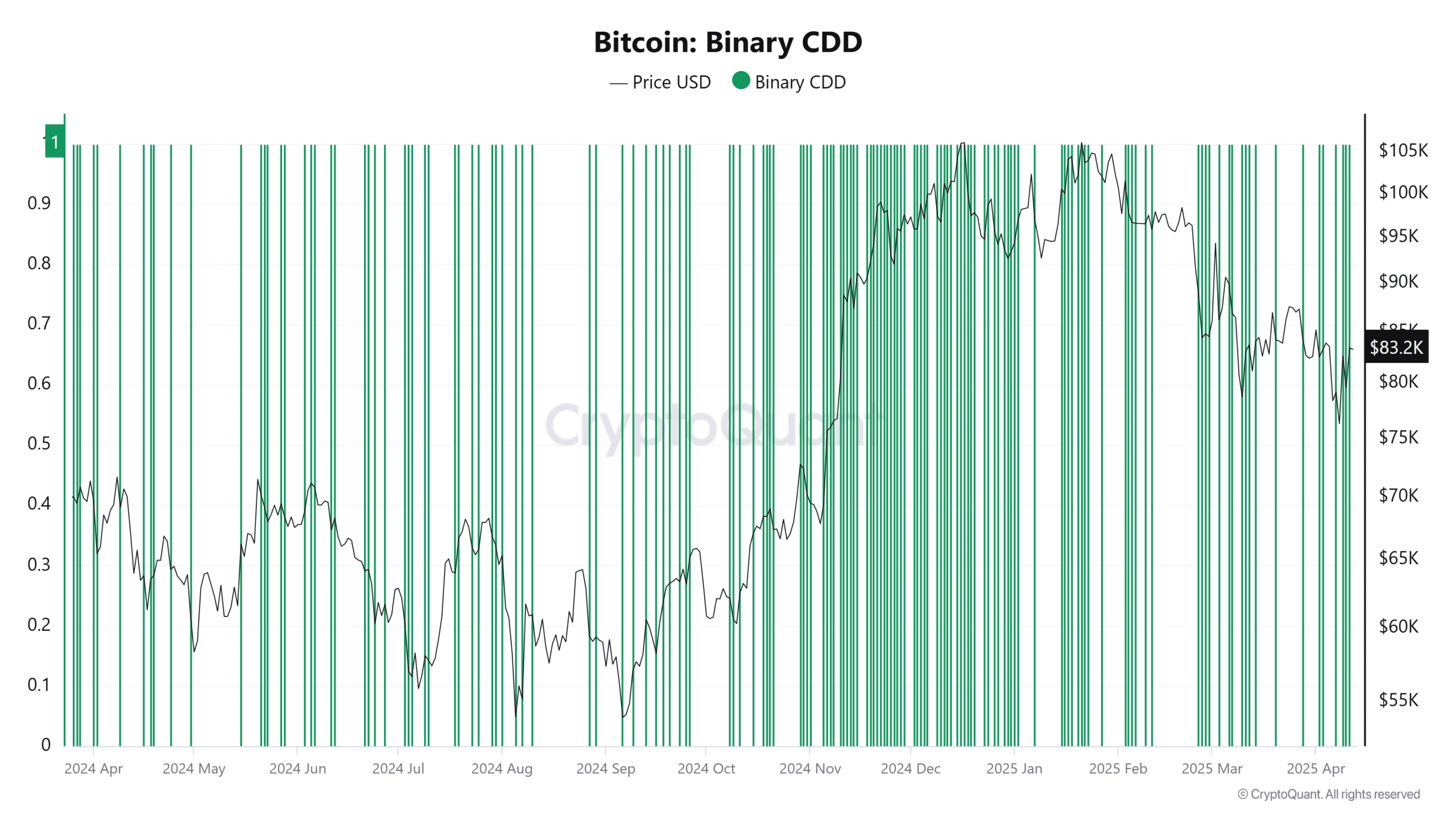

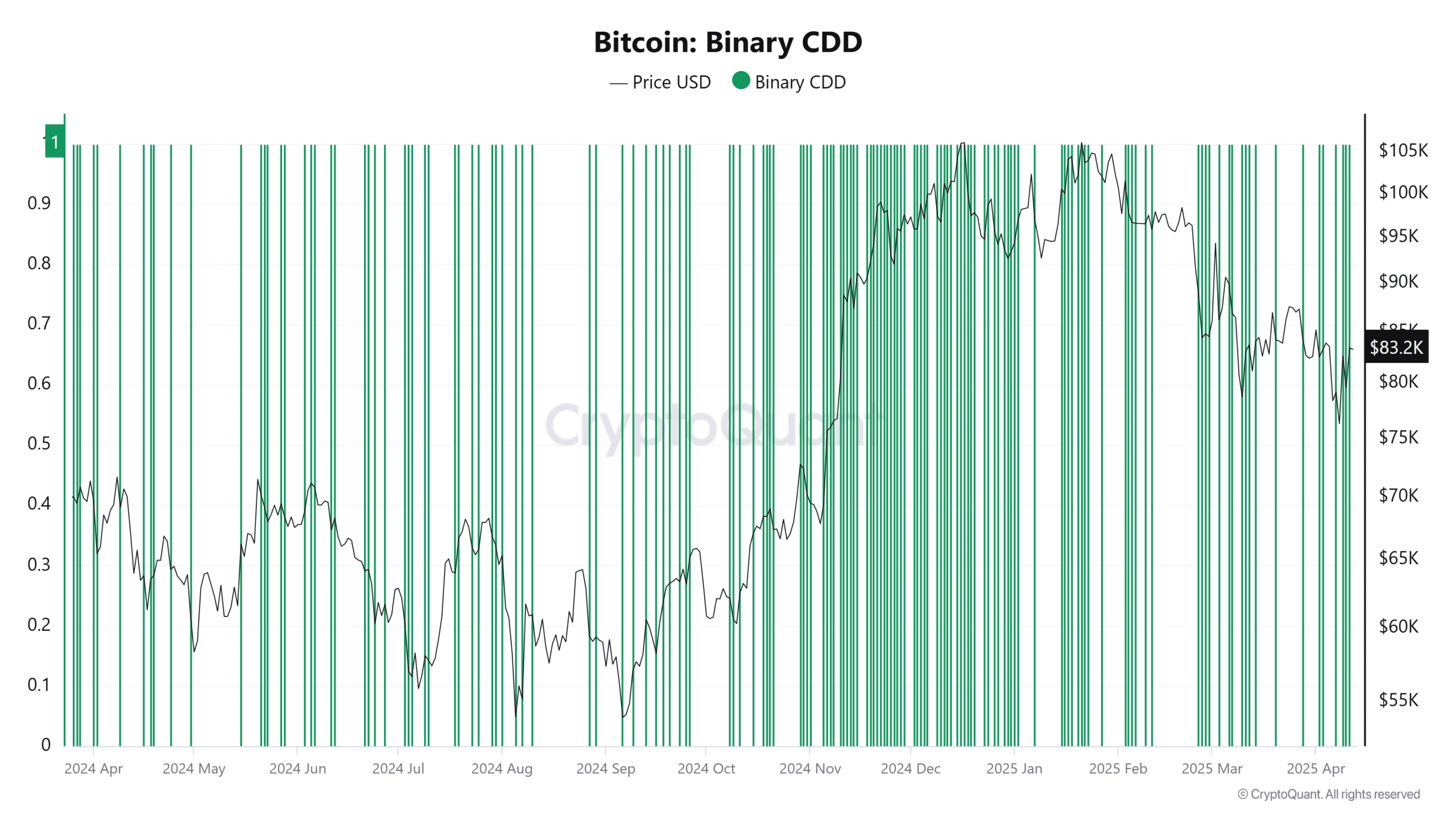

Supply: CryptoQuant

To offer clearer steering on potential market actions, AMBCrypto examined extra metrics to know the actions of main buyers. We found {that a} important rebound might quickly be approaching.

A significant rebound may very well be nearer

On prime of that, the Binary Coin Days Destroyed (CDD) metric tells us a narrative of its personal.

On the time of writing, it was flashing a studying of 1 – Indicative of the truth that long-term holders, typically the stoic believers in Bitcoin, have joined the promoting cohort.

That’s a potent sign. When long-term holders offload post-drop, it’s both to lock in positive factors or minimize losses. These are each indicators of capitulation.

Now, though the market sentiment could also be skewed in the direction of promoting, the tempo has been slowing down.

This mix of metrics—shrinking realized earnings, a Binary CDD studying of 1, and historic parallels—all converge in the direction of a well-known narrative. It’s – Vendor fatigue is right here and a aid rally might very properly be the subsequent chapter.

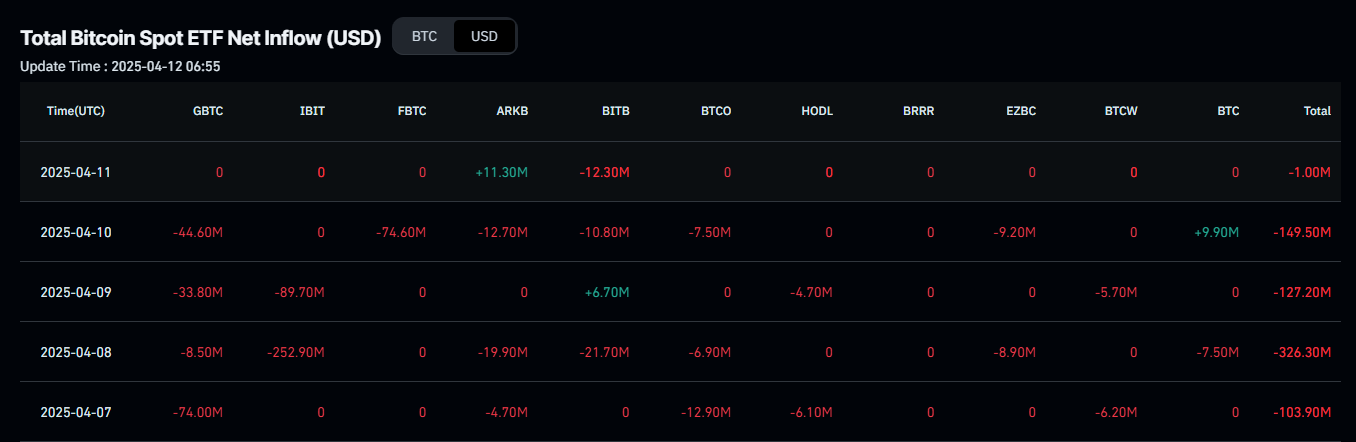

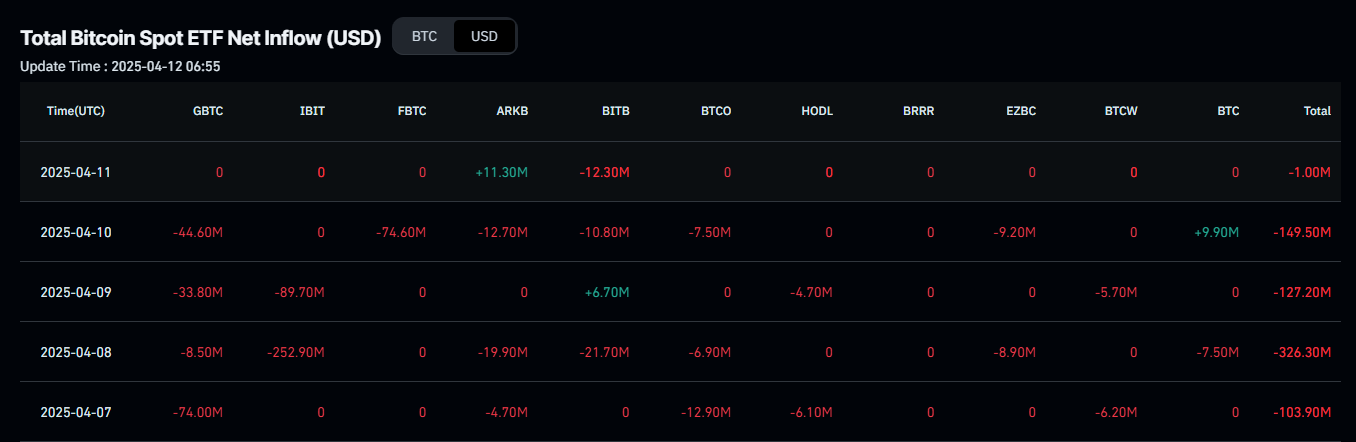

Supply: CryptoQuant

In actual fact, constructing on indicators of vendor exhaustion, long-term holders might now be nearing their closing part of promoting.

They may quickly maintain onto the remaining. That’s very true for establishments, who’re shifting gears too.

For instance – Institutional netflows have dried up. Solely $1 million in Bitcoin was offered not too long ago, down from a $176.72 million four-day common.

Supply: CoinGlass

That’s an enormous drop. Naturally, this implies confidence is creeping again into the palms of big-money gamers. These establishments don’t commerce flippantly. Their actions typically form Bitcoin’s subsequent main transfer.

Within the spot market, CryptoQuant’s information highlighted a brand new pattern. Netflows flipped detrimental – All the time a bullish sign. That instructed that accumulation is on and that Bitcoin is being moved into personal wallets and away from exchanges.

On this part, 1,959 BTC have been scooped up – Value round $162 million. Common purchase value? $83,000. If this tempo holds, Bitcoin might proceed absorbing the remaining promote strain. A breakout could also be nearer than anticipated.