The analytics agency Glassnode has revealed how the development within the Bitcoin Realized Loss might indicate sellers could also be beginning to attain exhaustion.

Bitcoin Realized Loss Is Exhibiting Indicators Of Saturation

In a brand new put up on X, Glassnode has talked about how the Bitcoin capitulation has regarded in the course of the newest value drawdown. The on-chain indicator of relevance right here is the “Realized Loss,” which measures, as its identify suggests, the entire quantity of loss that the buyers on the Bitcoin community as an entire are ‘realizing.’

The metric works by going via the transaction historical past of every coin being moved or offered on the blockchain to see what value it was transacted at previous to this. If the earlier promoting value is greater than the present spot value for any coin, then its sale is alleged to be contributing to loss realization.

The quantity of loss being realized within the sale is, in fact, equal to the distinction between the 2 costs. The Realized Loss calculates this worth for all transactions occurring on the community and sums them as much as discover the entire state of affairs.

Just like the Realized Loss, there’s additionally an indicator often called the Realized Revenue. This metric naturally retains monitor of the gross sales of the alternative sort (that’s, the place final switch worth is decrease than the most recent spot value).

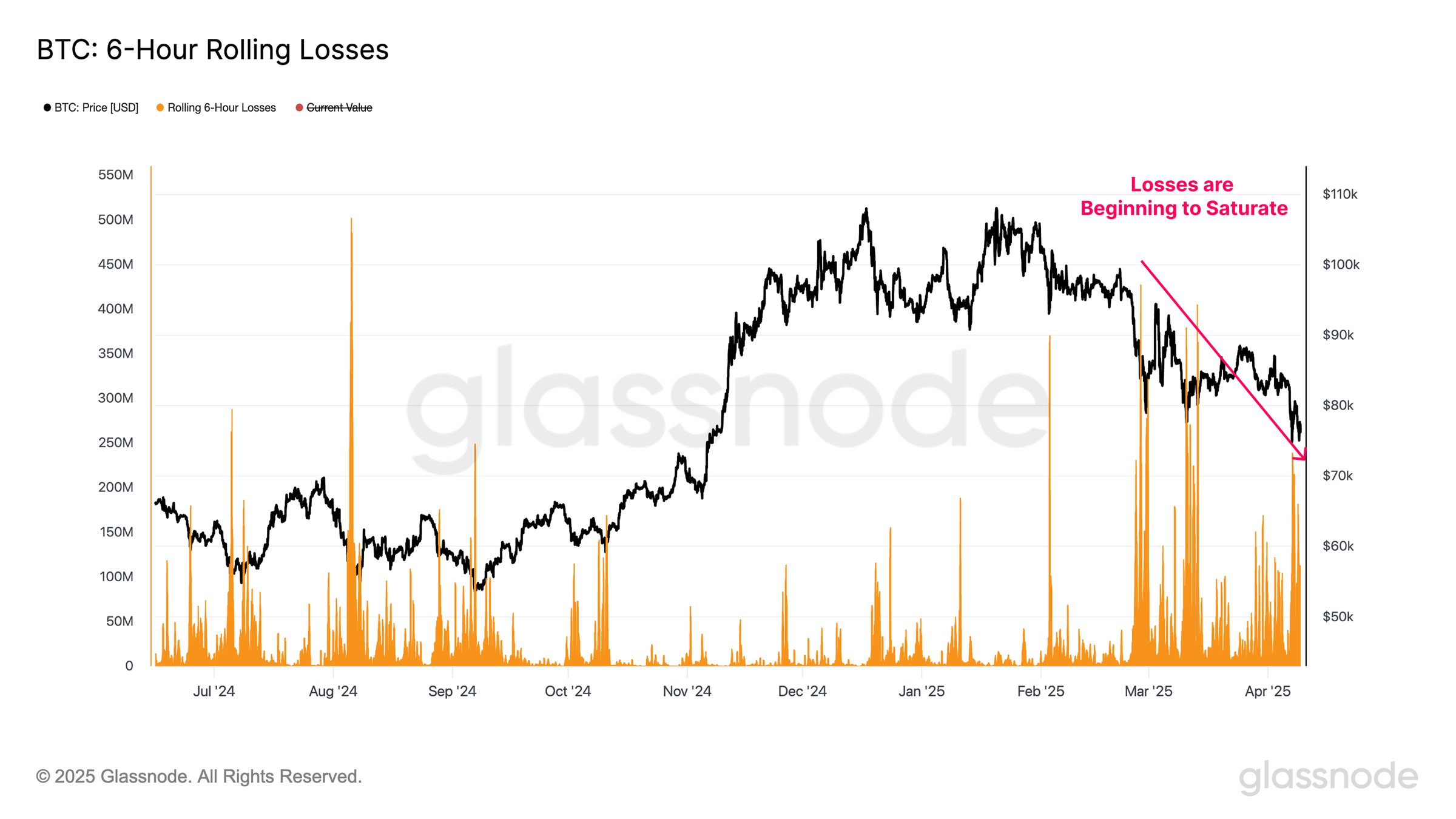

Now, right here is the chart for the Bitcoin Realized Loss shared by the analytics agency that reveals the development in its 6-hour rolling worth over the previous yr:

Seems like the worth of the metric has noticed massive spikes in current days | Supply: Glassnode on X

As is seen within the above graph, the Bitcoin Realized Loss noticed a number of massive spikes in the course of the bearish value motion in February and March, suggesting the buyers panic offered their underwater cash.

The current FUD round tariffs has triggered a continuation of the drawdown for the asset and predictably, the holders have proven sizeable capitulation now as properly.

However curiously, the size of the 6-hour Realized Loss has been notably decrease than the spikes from earlier than. This might indicate capitulation is reaching a degree of saturation, which, in accordance with Glassnode, could also be an early signal that the sellers have gotten exhausted. If that’s the case, then it’s potential that BTC could also be near some form of backside.

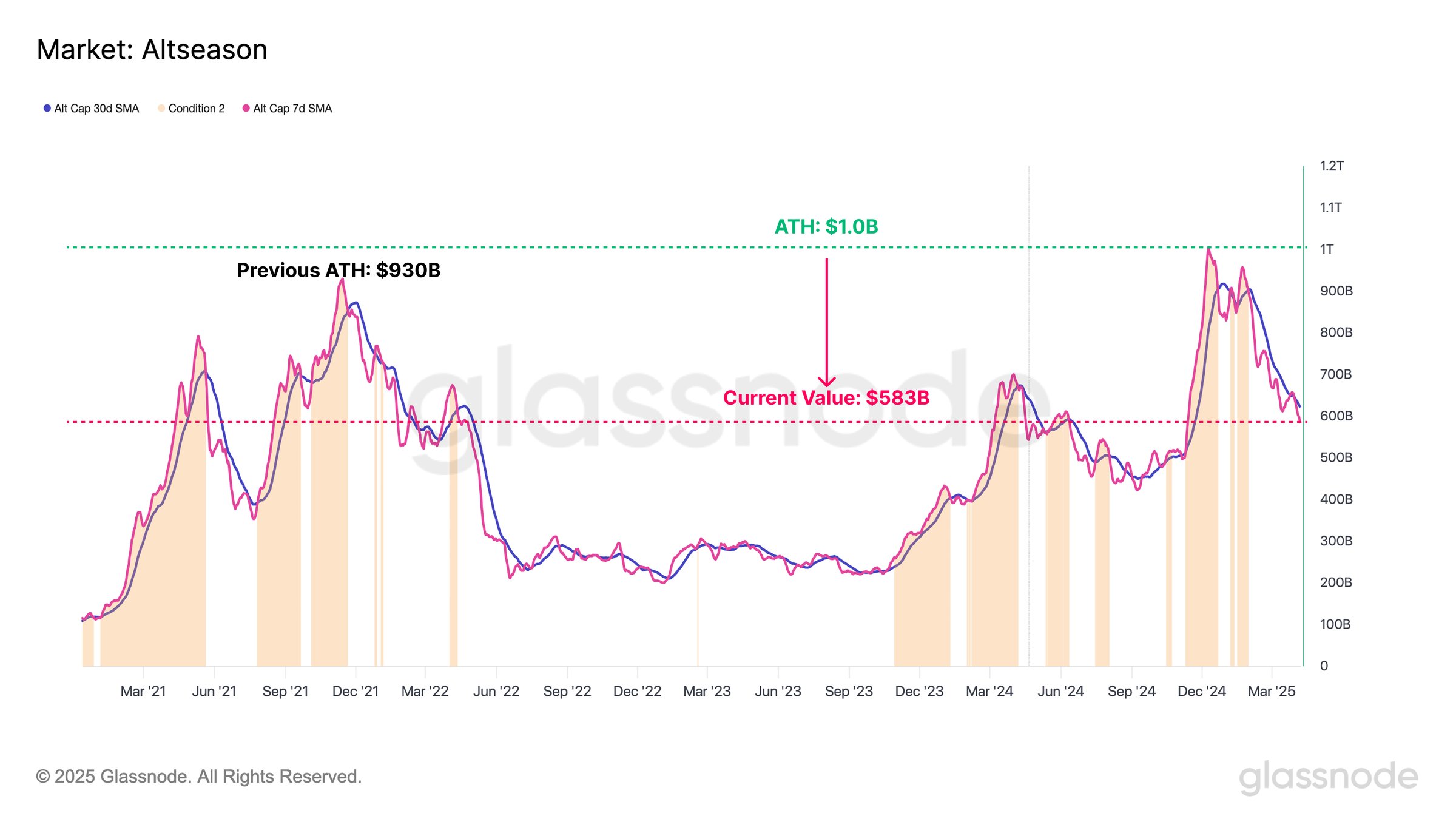

In the identical thread, the on-chain analytics agency has additionally mentioned concerning the current trajectory out there cap of the altcoins (that’s, the cryptocurrencies excluding Bitcoin, Ethereum, and the stablecoins).

The development within the mixed market cap of the altcoins over the previous couple of years | Supply: Glassnode on X

From the chart, it’s obvious that the altcoin market cap was sitting at an all-time excessive of $1 trillion in December 2024, however right now the metric has shrunken to $583 billion. “Property additional out on the danger curve have proven heightened sensitivity to liquidity shocks, resulting in extreme sector-wide devaluation,” notes Glassnode.

BTC Worth

Bitcoin has been attempting at restoration over the past couple of days as its value has returned to $81,900.

The value of the coin appears to have been rising not too long ago | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.