- Chainlink is struggling on the $12.5 resistance degree, which used to behave as assist—failure to carry this degree could set off additional draw back.

- On-chain knowledge reveals elevated trade deposits, hinting at promoting stress, whereas no larger highs have fashioned since LINK peaked close to $16.

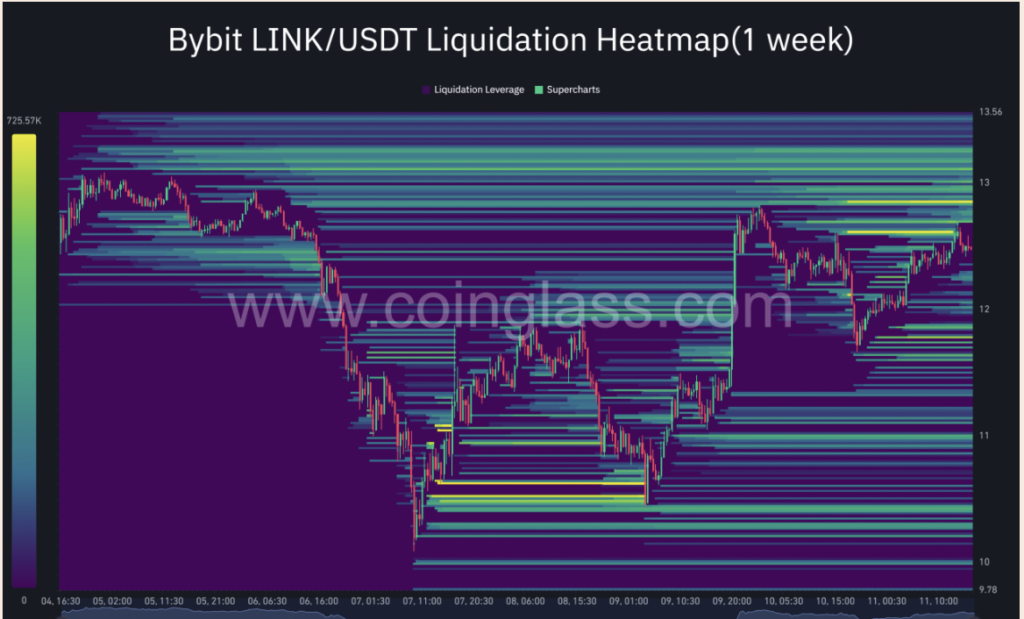

- Liquidation heatmaps reveal clusters close to $10, suggesting that if LINK dips decrease, it might cascade towards $7.5 attributable to lengthy positions being worn out.

Chainlink (LINK) hasn’t had the simplest week—after a string of day by day purple candles, the token is now hanging round a key resistance degree close to $12.5. Not too way back, this similar degree was performing as strong assist… however now? Not a lot. The best way issues are shaping up, it’s wanting extra like a retest which may flop into resistance as a substitute of a clear bounce.

So, what offers? Let’s break it down a bit.

Construction Trying a Little Shaky

For starters, LINK hasn’t been in a position to put in the next excessive because it topped out close to $16, and that’s by no means a fantastic signal for the bulls. Worth motion hovering close to the descending trendline—with out a lot response or bounce—is displaying weak point. It’s just like the consumers confirmed as much as the celebration late and didn’t deliver sufficient power to maintain issues going.

On-Chain Knowledge? Eh, Not Tremendous Bullish

If you happen to had been hoping that some behind-the-scenes knowledge may inform a extra optimistic story… not likely. Based on CryptoQuant, web deposits to centralized exchanges are ticking up simply barely above the 7-day common. That may not look like a giant deal, but it surely normally means extra persons are shifting LINK onto exchanges with plans to promote.

And when that pattern traces up with a weak technical chart? It tends to validate the bearish vibes.

Eyes on the $10 Lure Door

Yet another factor that would fire up hassle: liquidation heatmaps. There’s a pleasant fats cluster of lengthy liquidation ranges increase round $10. And if the value drops into that zone, you may see a wave of promoting kick in, particularly from leveraged merchants getting worn out.

Ought to that occur, the subsequent doubtless cease could possibly be round $7.50—that’s the extent from This fall final 12 months the place LINK discovered assist earlier than working larger.

The Backside Line

- $12.5 is the make-or-break zone. If bulls can’t maintain it, the subsequent steps may not be fairly.

- Bearish on-chain alerts + liquidation stress = hassle.

- A break beneath $10 might set off a waterfall to $7.5, particularly if the broader market stays unsure.

For now, all eyes are on that $12.5 degree. If LINK can flip it and begin constructing some momentum—nice. But when not… buckle up.