- Dogecoin’s whale accumulation and bullish construction pointed to a possible breakout above $0.20

- On-chain metrics and S2F ratio alluded to rising consumer exercise and long-term shortage

Dogecoin [DOGE] has seen a major accumulation part, with whales buying over 80 million DOGE in simply 24 hours.

This aggressive shopping for spree by main holders appeared to coincide with a contemporary wave of bullish sentiment. Particularly because the memecoin rebounded from its native lows.

At press time, DOGE was buying and selling at $0.1638, up 4.07% within the final 24 hours. This, on the again of a major restoration on the charts amid market-wide volatility. This renewed curiosity from deep-pocketed buyers may very well be an indication of early positioning forward of a possible breakout.

DOGE reclaims demand zone – Can bulls maintain momentum?

After bottoming out throughout the vital demand zone between $0.14109 and $0.15200, DOGE has rebounded with power. The chart highlighted a transparent higher-low construction forming, supported by aggressive whale accumulation in the course of the consolidation part.

The fast resistance appeared to lie round $0.20139 – A stage that beforehand acted as a reversal level throughout earlier rallies. If this stage breaks, the following goal would sit at $0.24388, aligning with late 2024’s mid-cycle peak.

Due to this fact, DOGE should keep momentum above $0.18 to maintain bullish strain as any weak spot may set off one other retest of the demand zone.

Supply: TradingView

Funding charges replicate wholesome dealer positioning

Over within the derivatives enviornment, Dogecoin’s Funding Charges throughout main exchanges, particularly Binance, stood at 0.009161% as of press time.

This barely constructive price recommended that lengthy merchants proceed to pay a premium to take care of their positions, reflecting gentle bullish conviction.

Nonetheless, the dearth of elevated charges additionally confirmed that merchants aren’t overleveraging, which reduces the danger of sudden corrections. Due to this fact, DOGE finds itself in a balanced state the place cautious optimism will gasoline gradual upward motion with out creating overheating dangers.

Supply: Santiment

DOGE’s on-chain exercise sees indicators of revival

Community utilization additionally noticed some indicators of life.

On the time of writing, DOGE registered 68,324 day by day lively addresses and 40,514 transactions. Whereas these figures had been beneath the explosive highs of late 2024, they appeared to substantiate a gradual re-engagement by customers.

Extra exercise usually foreshadows speculative curiosity and new capital inflows – Each key substances for sustained value motion.

If this development continues, it may function the gasoline DOGE must punch by means of its resistance stage.

Supply: Santiment

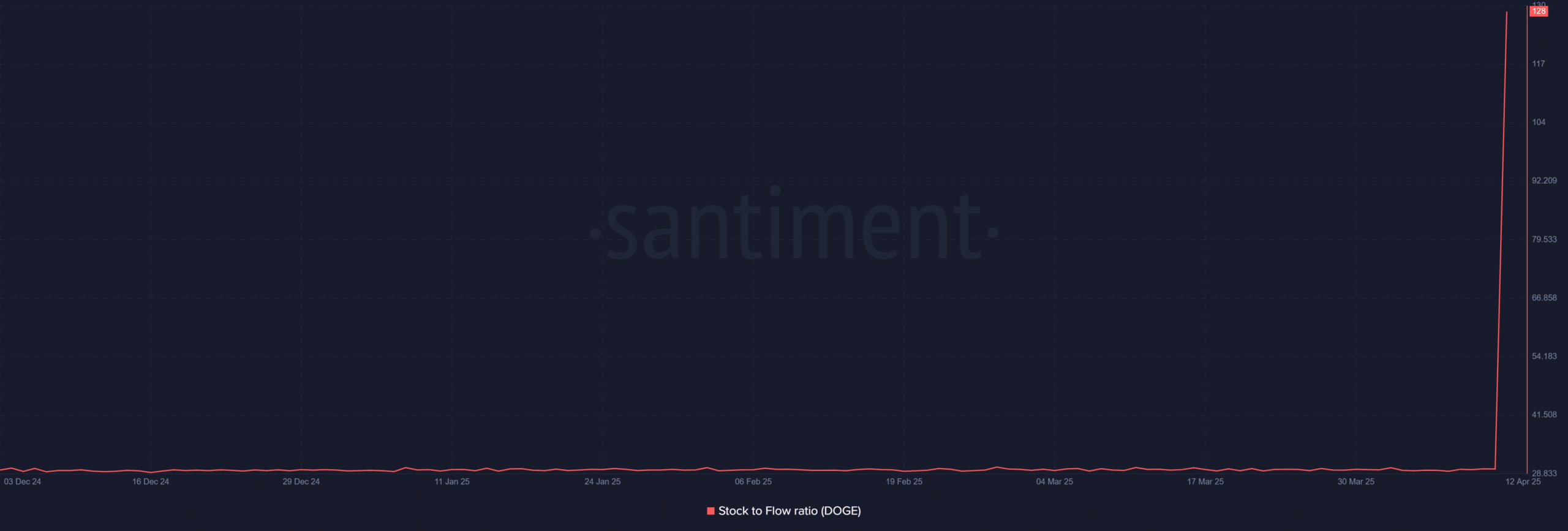

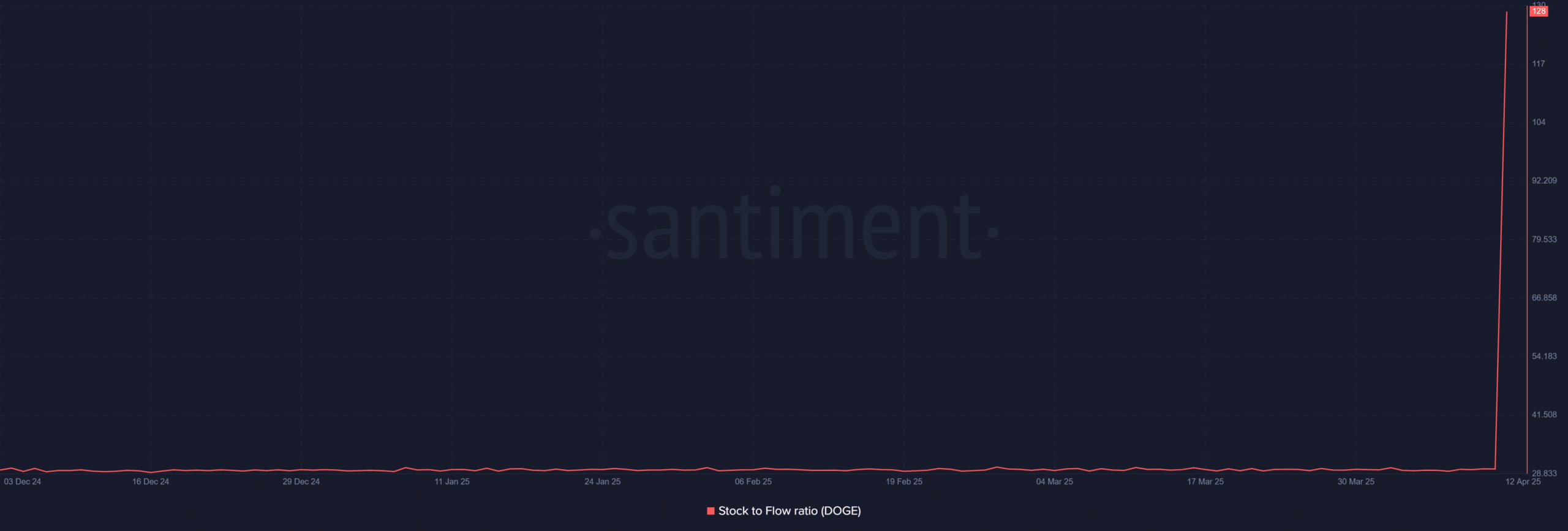

Inventory-to-flow ratio spikes as perceived shortage will increase

On prime of that, the altcoin’s Inventory-to-Circulation ratio jumped sharply to 128.94, reaching its highest studying in months.

Such a steep spike would imply that market members are more and more viewing DOGE as scarce, doubtlessly including upward strain to long-term valuations. Nonetheless, decoding this sign in isolation may mislead buyers.

Supply: Santiment

Conclusively, whale accumulation, a rebound from key technical ranges, favorable funding situations, and rising on-chain exercise, all aligned to help a possible breakout.

Whereas short-term volatility stays an element, these metrics created a robust basis for a push in direction of the $0.20–$0.24 vary.

Due to this fact, if bulls keep strain and retail curiosity picks up, DOGE may very well be able to reclaim a stronger bullish development.