Outstanding crypto analytics agency Swissblock says Bitcoin (BTC) could have but to discover a market backside regardless of the US enacting a 90-day tariff pause.

Swissblock says on the social media platform X that Bitcoin’s momentum to the upside shouldn’t be but an indication of a convincing breakout.

“Don’t let your guard down but! The 90-day commerce warfare extension eases tensions, however we’re not out of the woods. Bitcoin breaks $78,000-$79,000, now holding above $80,000. Are we within the clear?”

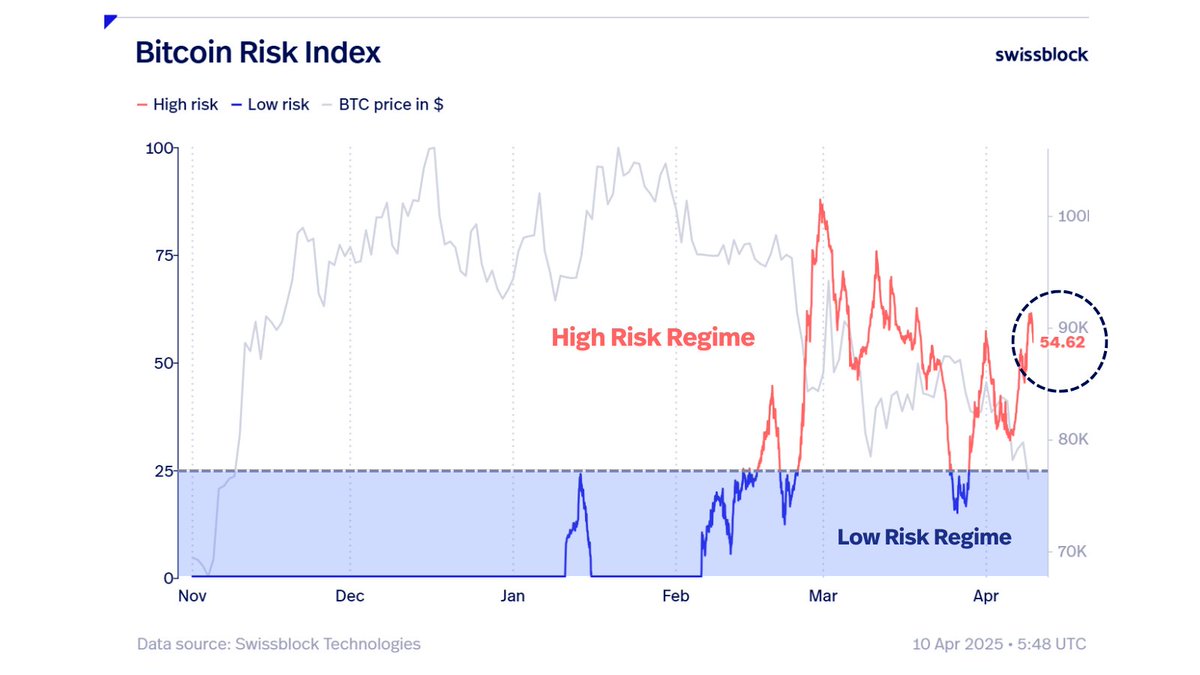

Swissblock says the Bitcoin Danger Sign – which makes use of a number of indicators, together with value information, on-chain information and a number of different buying and selling metrics to gauge whether or not BTC is susceptible to a significant drawdown – shouldn’t be but indicating a market backside has been reached.

“Market danger should ease for a real backside. It’s underneath management however nonetheless elevated, not in a low-risk regime but. We have to see a transparent decline in danger.”

In accordance with Swissblock, Bitcoin stays in a downtrend.

“For the underside to progress, market development should sign formation.

We’re in a downtrend section, regular in bottoming cycles: bottom-downtrend-uncharted.

The underside is shut, however not confirmed.”

Swissblock says that for Bitcoin to verify a bullish reversal, the flagship crypto asset wants to carry $80,000 as assist.

“Bitcoin should maintain $80,000 and consolidate to interrupt the downward compression. Energy and quantity are key for a bullish shift.”

Bitcoin is buying and selling for $83,221 at time of writing, up 4.7% within the final 24 hours.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you might incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney