Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

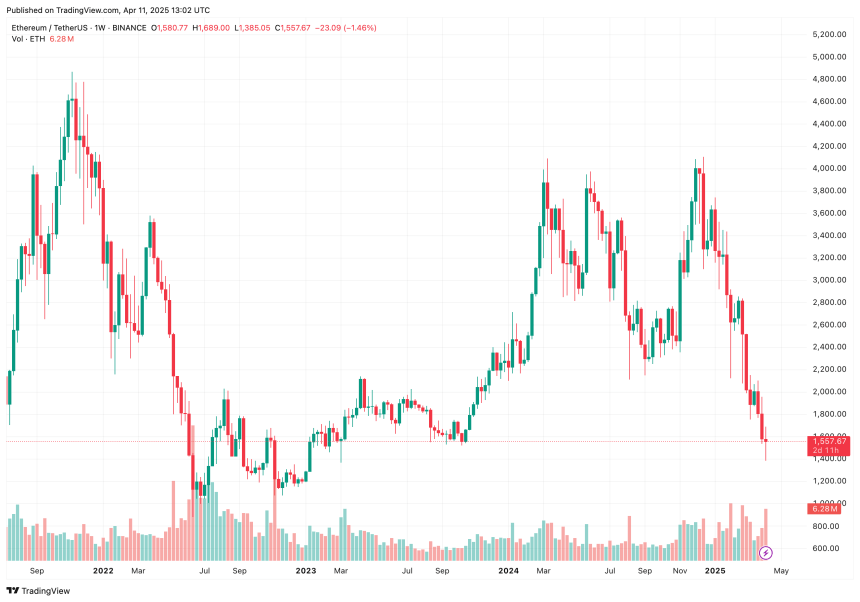

In accordance with a current X put up by seasoned crypto analyst Ali Martinez, Ethereum (ETH) might have already gone by means of its capitulation section for this market cycle. Notably, the second-largest cryptocurrency by market cap is down greater than 55% over the previous yr.

Is Ethereum Capitulation Over?

In contrast to Bitcoin (BTC) and altcoins equivalent to XRP, Solana (SOL), and SUI, Ethereum has endured a difficult two-year stretch. The cryptocurrency was buying and selling at $1,892 precisely two years in the past, on April 11, 2023, and is now priced round $1,560 – over 17% decrease.

Associated Studying

In distinction, BTC has surged from roughly $41,000 two years in the past to $82,127 on the time of writing – a rise of almost 100%. Whereas SOL at present trades beneath its April 2023 value, not like ETH, it did handle to succeed in a brand new all-time excessive (ATH) of $293 earlier this yr in January.

Understandably, sentiment towards ETH – amongst each retail and institutional traders – is hovering close to all-time lows. Nevertheless, Martinez believes that “sensible cash” could also be accumulating at present ranges, anticipating a near-term reversal.

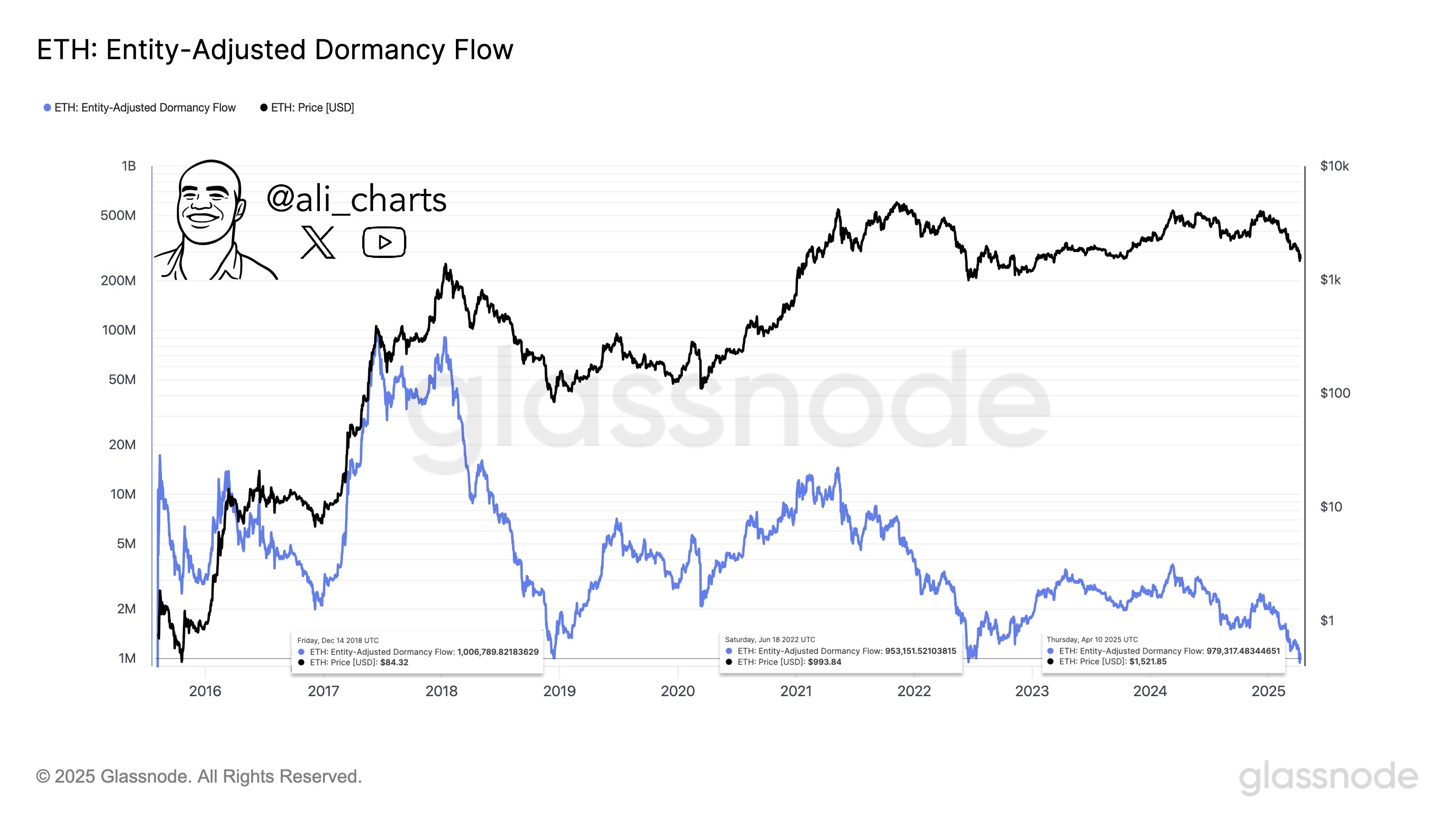

The analyst identified that Ethereum’s Entity-Adjusted Dormancy Circulation has just lately dropped beneath a million. Martinez added:

This traditionally signifies a macro backside zone, that means $ETH is likely to be undervalued and long-term holders are much less inclined to promote. It additionally suggests: sentiment is low, capitulation might have occurred, sensible cash is likely to be accumulating.

For the uninitiated, Ethereum’s Entity-Adjusted Dormancy Circulation is an on-chain metric that compares the market cap to the dormancy – the typical age of ETH being moved – adjusted for distinctive entities as a substitute of uncooked addresses. The metric helps determine whether or not the market is overheated or undervalued by monitoring the conduct of long-term holders.

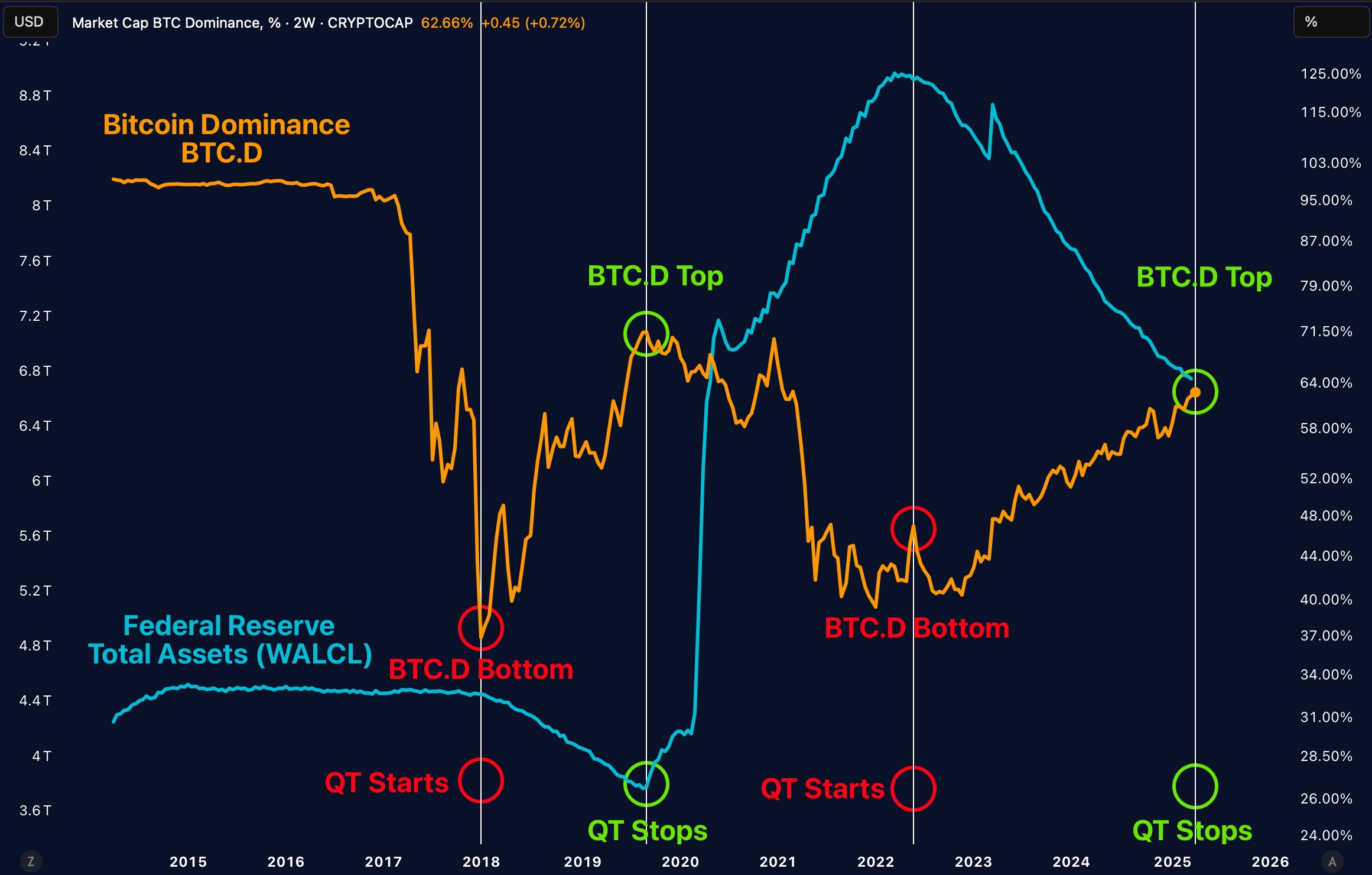

If ETH follows historic developments, it might be approaching a momentum reversal. In a separate X put up, crypto dealer Merlijn The Dealer recommended that Bitcoin Dominance (BTC.D) is nearing a peak, which may shift capital into altcoins and set off a short-term rally.

On the time of writing, BTC.D stands round 63.5%. A possible pivot by the US Federal Reserve towards quantitative easing (QE) may inject contemporary liquidity into the market, probably sparking a mini altcoin rally.

ETH Calls for Cautious Optimism

Whereas there are a number of indicators that ETH could also be near bottoming out, some indicators counsel that there may very well be continued weak point for the digital asset earlier than any significant momentum shift.

Associated Studying

In a current evaluation, Martinez warned that ETH may fall as little as $1,200 if the present sell-off continues. Additional, ongoing capital outflows from US-based spot Ethereum exchange-traded funds (ETF) stay a priority for the asset’s short-term outlook.

That mentioned, crypto analyst NotWojak just lately famous that ETH could also be on the verge of a breakout, with a possible upside goal of $1,835. At press time, ETH is buying and selling at $1,557, down 2.3% prior to now 24 hours.

Featured picture created with Unsplash, charts from X and TradingView.com