- Ethereum staking ETFs are gaining traction within the U.S. as exchanges like Cboe BZX and NYSE Arca submit proposals to the SEC, probably permitting conventional buyers to earn ETH staking rewards by regulated ETF buildings.

- Key considerations for SEC approval embrace slashing dangers, staking-related liquidity delays, and whether or not staking constitutes an “funding contract” underneath securities legislation — all of which might impression investor protections.

- International strain and evolving sentiment (particularly from Hong Kong’s staking-friendly stance) are pushing U.S. regulators to adapt. Business consultants say the chances of approval by the top of 2025 are rising, although warning stays.

Since early 2025, exchanges like Cboe BZX and NYSE Arca have been pushing for Ethereum ETFs that embrace staking options. If accepted, these might make it simpler for conventional buyers to earn passive revenue from ETH.

Brian Fabian Crain, CEO of Refrain One, is “cautiously optimistic” about these proposals gaining approval earlier than the top of President Trump’s first time period. Nonetheless, he notes that the SEC will seemingly prioritize investor protections earlier than shifting ahead.

The Push for Staked Ethereum ETFs within the US

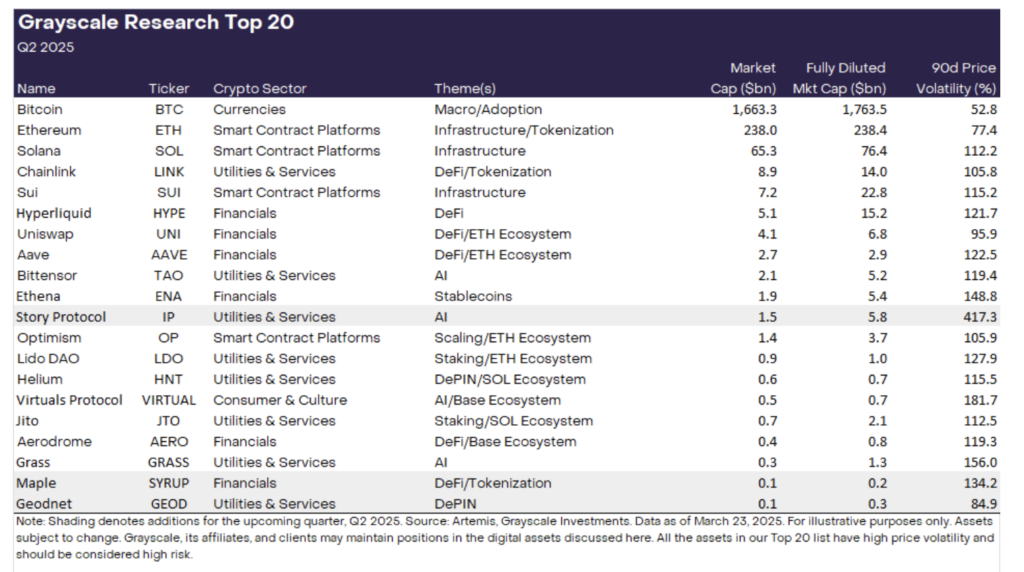

In February, each Cboe BZX and NYSE Arca filed proposals so as to add staking to current Ethereum ETFs. Cboe BZX aimed to amend the 21Shares ETF, whereas NYSE Arca focused Grayscale’s choices.

Staking, a key a part of Proof-of-Stake blockchains, permits members to validate transactions based mostly on the quantity of cryptocurrency they’ve locked up. If these ETFs are accepted, buyers might acquire publicity to ETH and earn staking rewards, all inside a well-known ETF construction.

“The approval of an Ethereum staking ETF would mark a watershed for institutional adoption,” Crain instructed BeInCrypto.”It supplies regulated, easy-to-access publicity to ETH that features its native yield.”

Can Staking Yield Revitalize Ethereum’s Market Place?

All through 2024 and into 2025, Ethereum’s value development lagged behind Bitcoin’s. The ETH/BTC ratio hit a file low in April 2025, indicating Bitcoin’s outperformance.

Market fluctuations additional sophisticated Ethereum’s place. Earlier this month, ETH reached its lowest value in two years, shaking investor confidence.

Crain believes that incorporating staking into ETFs might make Ethereum extra enticing to buyers. “Ethereum’s ~3% annual staking yield is a serious draw,” he defined. “Even when ETH’s value development trails Bitcoin’s, staked ETH can ship greater complete returns due to the yield.”

How Hong Kong’s Staking Approval Impacts the US SEC

Not too long ago, Hong Kong’s Securities and Futures Fee (SFC) introduced new steerage permitting licensed crypto exchanges and funds to supply staking companies. Platforms should meet strict circumstances earlier than offering these companies.

“Hong Kong’s adoption of regulated staking sends a message: it’s attainable to permit staking in a compliant method,” Crain stated. “US regulators usually watch regimes like Hong Kong as bellwethers for rising finest practices.”

If the US doesn’t ultimately enable staking in ETFs, world buyers would possibly flip to worldwide markets to entry these merchandise.

The “Funding Contract” Conundrum

One main consideration for the SEC is whether or not staking packages represent funding contracts. Beforehand, the SEC focused centralized exchanges like Kraken and Coinbase for working staking companies thought-about unregistered revenue schemes.

Nonetheless, staking inside an ETF differs from exchange-based staking. “An ETF staking its personal belongings isn’t ‘promoting’ a staking service to others; it’s immediately taking part in community consensus,” Crain defined. This nuance is contributing to the SEC’s willingness to rethink its stance.

Slashing Dangers: A Distinctive Problem for Ethereum Staking ETFs

Not like conventional commodity funds, a staking ETF should actively take part in community consensus, exposing it to slashing dangers. Slashing is a penalty the place a portion of the staked ETH could be destroyed if a validator acts improperly.

“The SEC will assess how important this threat is and whether or not it’s been mitigated,” Crain famous. Filings point out that the sponsor won’t cowl slashing losses on behalf of the belief, that means buyers bear that threat.

Custodians sometimes have insurance coverage for asset loss on account of theft or cyberattacks, however slashing is a protocol-enforced penalty, not conventional theft. Due to this fact, the SEC will seemingly inquire about safeguards ought to a slashing occasion happen.

Additional SEC Issues

Staked ETH lacks immediate liquidity. Even after the Shanghai improve enabled withdrawals in 2023, the Ethereum protocol nonetheless incorporates delays that forestall staked ETH from being immediately liquid.

“The SEC will look at how the fund handles redemption requests if a big portion of belongings are locked in staking,” Crain stated. Exiting a validator place can take days to weeks if there’s a backlog.

Throughout heavy outflows, the fund may not instantly entry all its ETH to satisfy redemptions, posing a structural complexity that might hurt buyers if not deliberate for.

The “Level-and-Click on” Mannequin

Securing custody for Ethereum in an ETF is essential, and including staking will increase the SEC’s scrutiny. “The SEC will look at how the ETF’s custodian secures the ETH personal keys, particularly since these keys will probably be used to stake,” Crain defined.

Some exchanges have proposed that the ETH for staking stay throughout the custodian’s management always, known as a “point-and-click” mechanism. This mannequin goals to stake with out altering basic custody or introducing further complexities for buyers.

When Will the SEC Approve Staking in Ethereum ETFs?

Regardless of the complexities, the prevailing political local weather within the US might result in a extra favorable setting for the eventual approval of Ethereum staking ETFs. “On stability, it now appears extra seemingly than not that the SEC will approve a staking function for Ethereum ETFs within the comparatively close to future,” Crain instructed BeInCrypto.

Nonetheless, he cautioned that the SEC won’t approve such an ETF till it’s absolutely glad with the investor protections in place. Even so, the general outlook stays constructive.

“Contemplating all of the components mentioned, the outlook for an Ethereum staking ETF approval seems cautiously optimistic,” Crain concluded. “The chance of eventual approval is rising, although the timing stays a topic of debate.”