- Bitcoin’s STH provide is dealing with growing strain as macro uncertainty fuels market volatility

- If BTC breaks under $72k, capitulation dangers may escalate

On 09 April, U.S. President Donald Trump introduced a 90-day pause on tariffs, triggering an 8.27% single-day surge in Bitcoin [BTC] – Its longest inexperienced candlestick in practically a month. Then, on 10 April, U.S. core CPI inflation fell under 3.0% for the primary time since March 2021. In response, Bitcoin surged by 3.36% to $82,532 at press time.

With these back-to-back macro boosts, the market appeared to be gaining momentum. Nevertheless, an actual take a look at would possibly lie forward.

Quick-Time period Holders (STHs) have been feeling the strain, as their realized value stood at $93k at press time – Far above BTC’s stage.

So, if the Federal Reserve delays price cuts, will STHs maintain agency? Or will mounting resistance drive them to capitulate?

Bitcoin’s STH provide alerts capitulation danger

Bitcoin’s short-term holder (STH) provide is approaching a vital inflection level.

On 10 February, STH-held BTC peaked at a four-year excessive of 400k. Nevertheless, it has since declined to 360k, signaling web distribution.

This coincided with the world’s largest cryptocurrency breaching three key help ranges – An indication of the sustained sell-side strain from this cohort.

Supply: Glassnode

On-chain information from Glassnode revealed that the majority of those holdings have been amassed round $93k. With BTC buying and selling under this realized value, roughly 360k BTC stays in an unrealized loss state, heightening the chance of capitulation.

Extra critically, the STH realized value sat at $131k and $72k, defining the important liquidity zones.

If Bitcoin retraces to the decrease band at $72k, revenue margins for these holders would erode by 22%, putting extra stress on short-term conviction. Traditionally, a breach of the decrease band has catalyzed pressured liquidations.

Ought to Bitcoin maintain a transfer under $72k, cascading promote strain may materialize, amplifying drawdowns.

Conversely, reclaiming $93k would flip STH’s positioning again into revenue, probably mitigating supply-side danger and reviving bullish momentum.

Macro volatility shaking short-term confidence

From a macro-structural standpoint, Bitcoin’s value motion continues to consolidate under the pivotal $85k resistance stage. Repeated rejections at this threshold point out a liquidity zone that, if breached, may set off a cascade of quick liquidations.

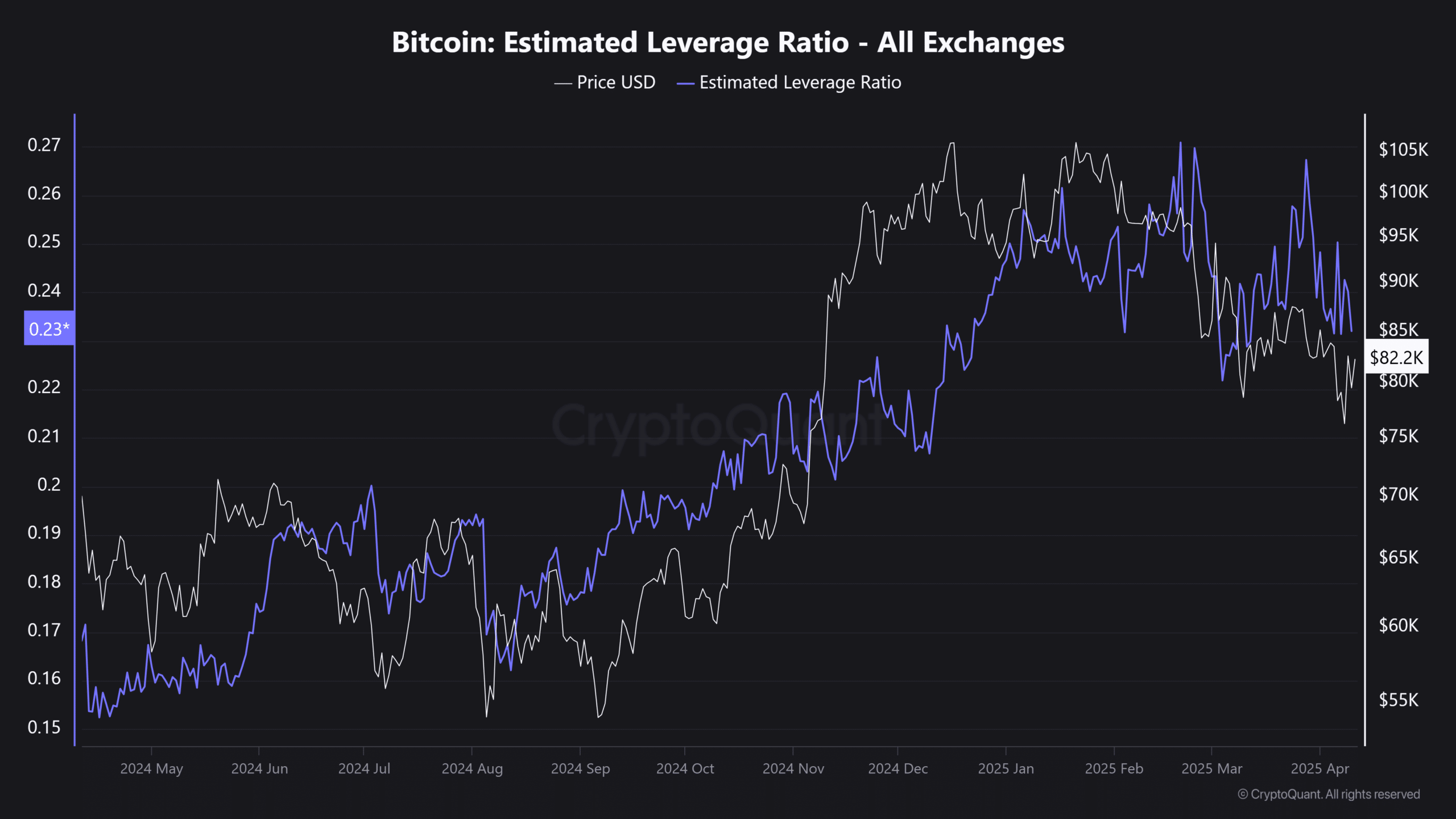

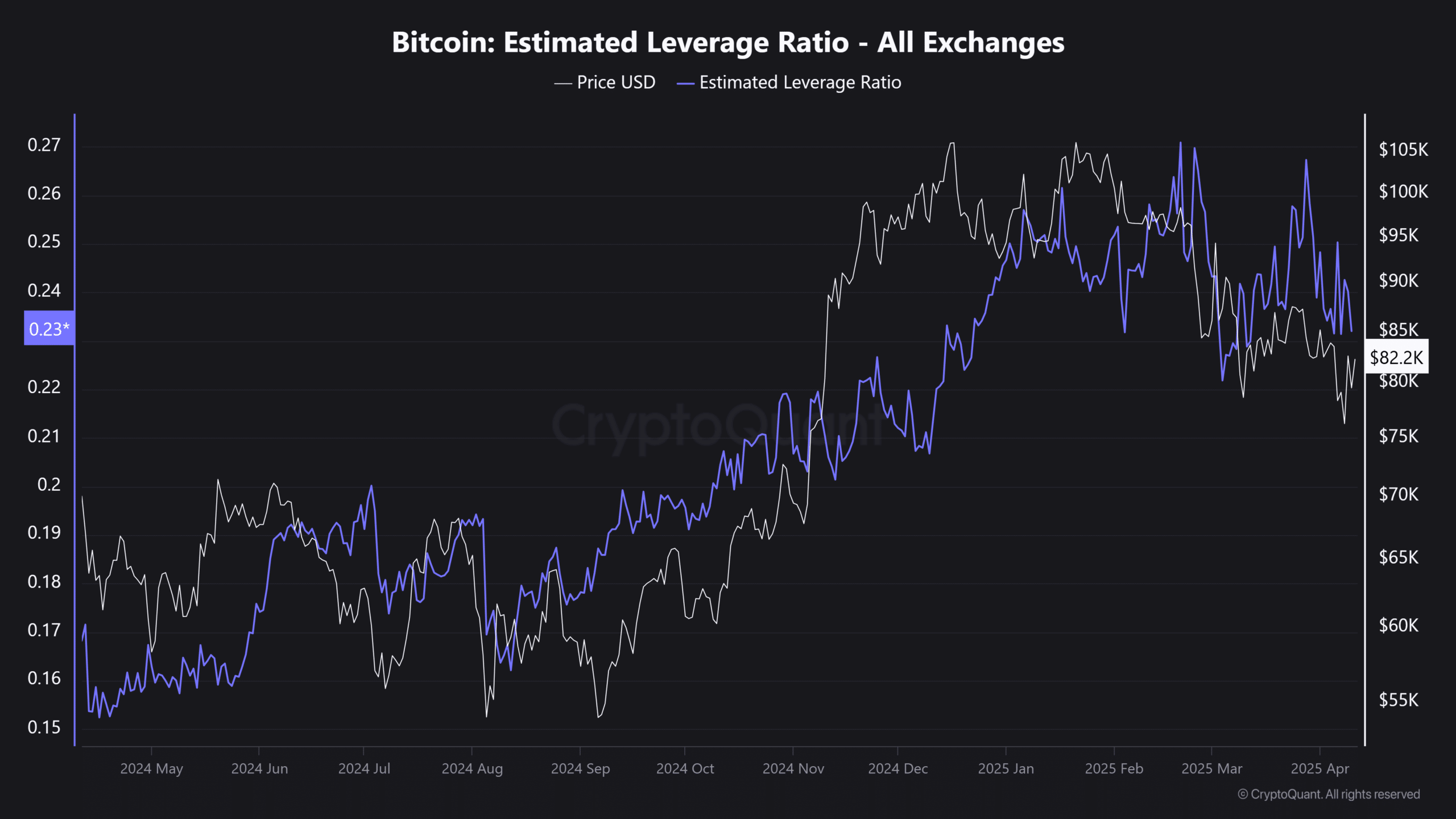

Concurrently, Bitcoin’s Estimated Leverage Ratio (ELR) slipped under its early March baseline – Signaling a sustained deleveraging part. Futures merchants stay risk-averse, with a noticeable discount in high-leverage positioning.

Supply: CryptoQuant

Regardless of these challenges, nevertheless, Bitcoin has demonstrated some resilience.

Following the tariff-related market turbulence, BTC’s market cap noticed solely a $90 billion drawdown – A comparatively modest flush-out in comparison with different danger belongings.

Nevertheless, with the Federal Reserve much less more likely to minimize rates of interest quickly, macro uncertainty may push short-term holders to exit. A lot of them purchased round $93k. And, if the worth doesn’t get well quickly, they could promote to keep away from deeper losses.

With concern nonetheless excessive, speculative demand low, and key resistance ranges overhead, a dip to $72k stays an actual chance earlier than Bitcoin can try a sustained breakout.