Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

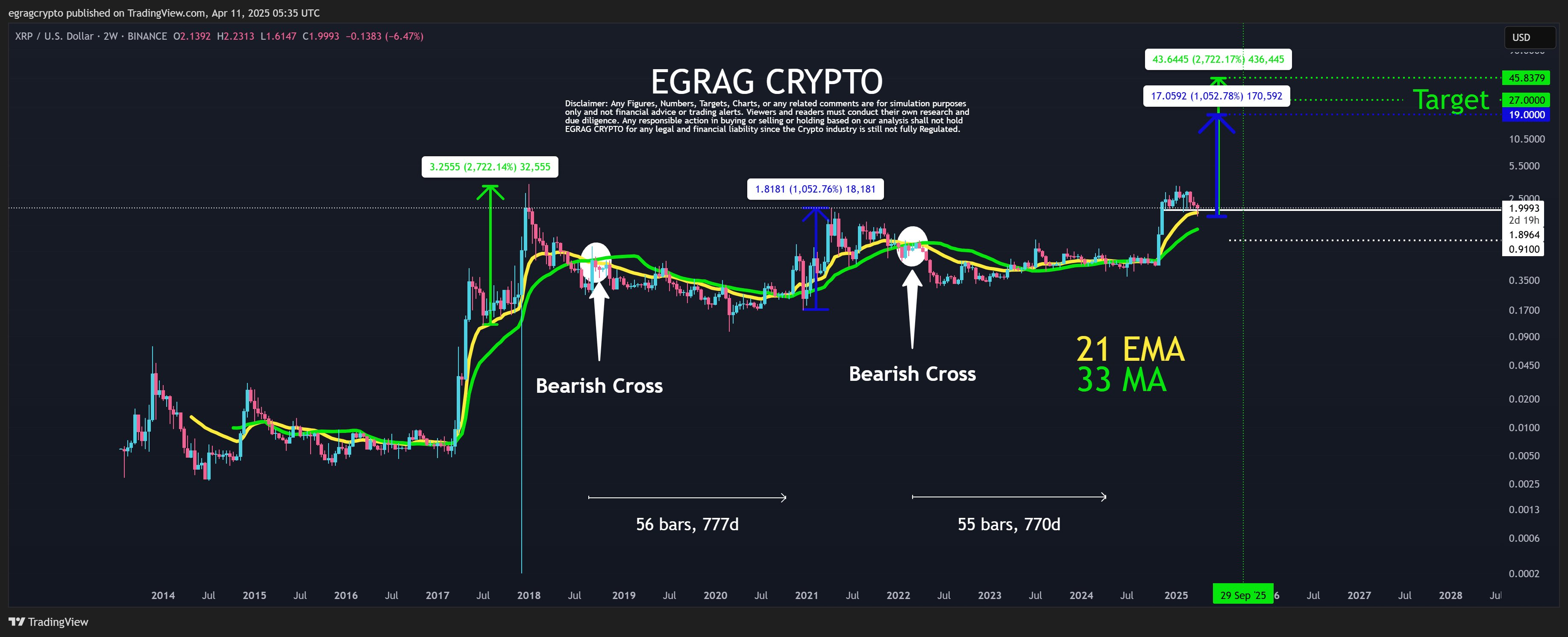

In a newly revealed chart evaluation, crypto analyst Egrag (@egragcrypto) posits that XRP could also be on the cusp of a major worth breakout paying homage to its earlier cycle peaks. The info, which spans from late 2013 by 2025, highlights a number of cases wherein XRP went by a protracted bear market earlier than staging an explosive rally. Two specific examples stand out in Egrag’s evaluation: the 2017 surge wherein XRP rose over 2,700% from its pre-rally worth ranges, and the 2021 run-up that noticed the asset climb by greater than 1,000%.

Egrag Predicts XRP Surge To $19–$45

The chart reveals a constant framework that depends on the interaction between the 21-week Exponential Shifting Common (EMA) and the 33-week Easy Shifting Common (MA). These shifting averages are proven crossing throughout bearish cycles after which finally curving upward, implying the formation of a backside.

Associated Studying

Traditionally, XRP’s remaining bullish legs—typically culminating in “blow-off tops”—started as soon as the worth retook the 21 EMA and the 33 MA, with the 777-day (and in a single occasion, 770-day) window earlier than these bullish crosses recurring as a noteworthy time cycle. “Males lie, girls lie, however charts don’t,” says Egrag. “I’m not improvising right here; I’m counting on historic information to current future predictions. Will it rhyme precisely? No, as a result of if it had been that straightforward, everybody can be a multimillionaire!”

In accordance with the chart, XRP has already mirrored a few of the patterns seen in 2017 and 2021, a parallel that leads Egrag to posit two potential worth targets if the token completes one other blow-off high situation. Whereas he acknowledges numerous complicating elements, the analyst believes XRP might rally as a lot as 2,700%—taking the asset to roughly $45—or, in a extra average iteration, 1,050% to simply under $20. “Now, right here’s my measured transfer: if #XRP mimics both of those cycles, we might see worth actions of two,700% or 1,050%, placing XRP round $45 or $19!” he notes, referencing the earlier explosive expansions.

Egrag cites previous cycles to assist these targets, pointing to how XRP discovered assist on the 21 EMA in 2017 simply earlier than launching into its final blow-off part. In 2021, the coin rallied as soon as it decisively broke above each the 21 EMA and 33 MA.

Associated Studying

To underscore the tactic behind utilizing each indicators, Egrag provides that “market makers use the identical shifting averages to see the place assist and resistance are and act towards us. So I’m utilizing totally different shifting averages—one is quick (exponential) and one is easy—to grasp worth motion higher.” He emphasizes these alerts are lagging indicators however can nonetheless verify whether or not market sentiment is shifting from bearish to bullish.

Notably, Egrag’s private long-standing goal for XRP has been $27. He underlines that nothing is assured, particularly in a market characterised by what he calls “human reactions and behaviors.” Quoting a line from the movie Margin Name, he explains, “You can’t management it, cease it, or gradual it, and even barely alter it…it’s important to simply react. Make some huge cash when you get it proper, otherwise you’ll be left by the aspect of the highway when you get it improper.” But he notes that it’s sensible to strategize promoting—or “DCA (Greenback-Promote-Common)—if circumstances name for it, to mitigate danger.

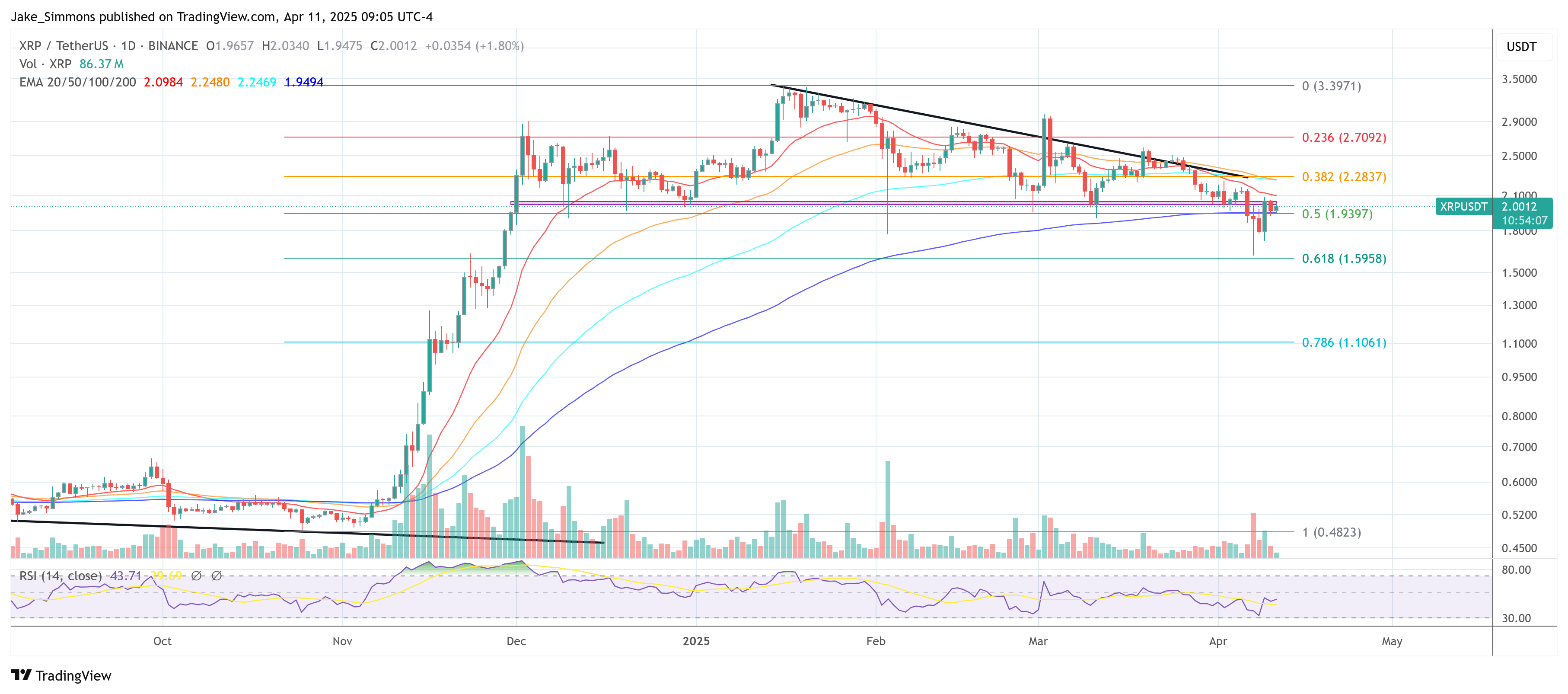

At press time, XRP traded at $2.00.

Featured picture created with DALL.E, chart from TradingView.com