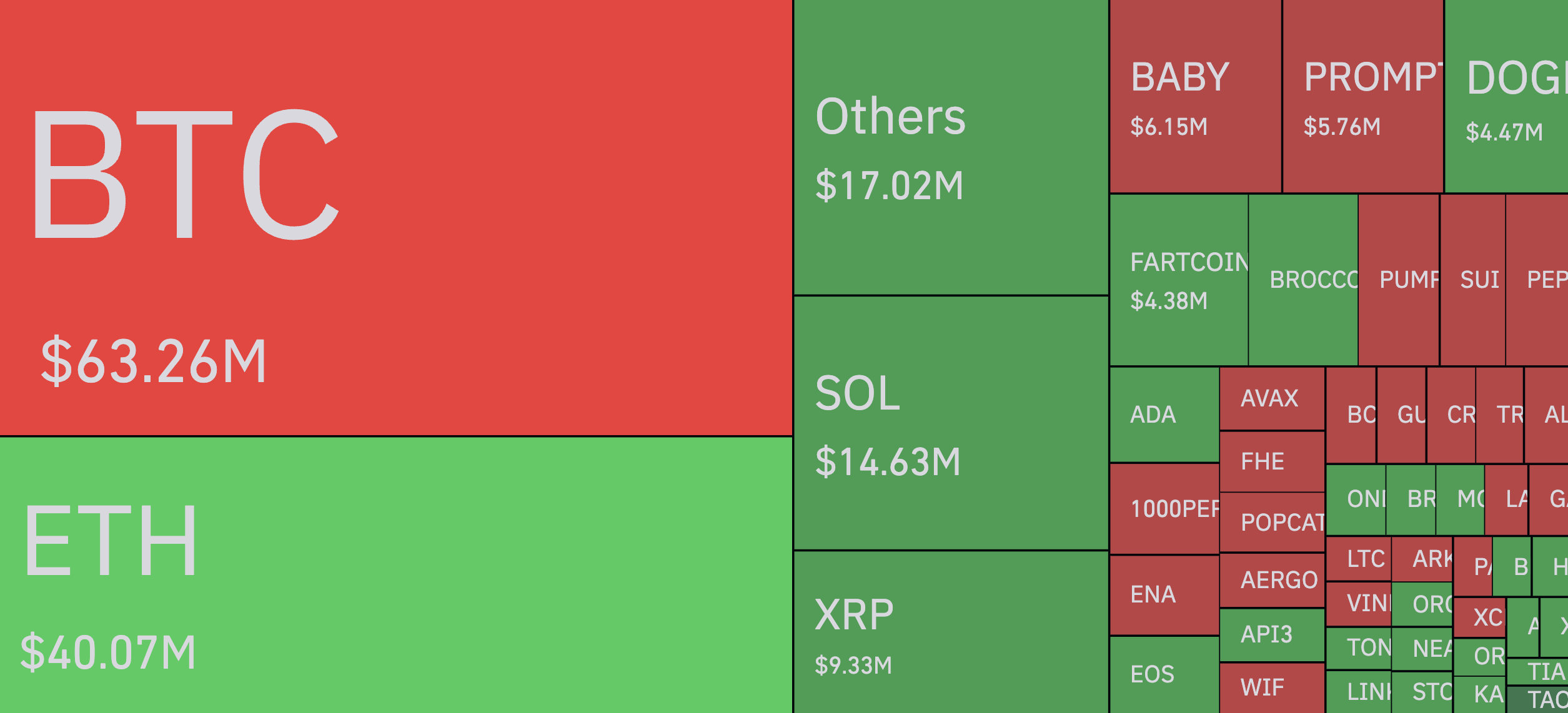

A 346% liquidation imbalance is strictly what occurred right this moment as Bitcoin (BTC) flushed out $52 million in longs towards simply $15 million in shorts, flipping sentiment and value course with none macro set off or breaking information — only a correction born purely from market construction going too far in a single course.

The preliminary consequence wasn’t dramatic on the floor, however the impact was clear: value dropped, leverage reset with Bitcoin slipping above $86,000 earlier than fading again under $84,000, suggesting not a lot a collapse as a mechanical reset after bearish merchants have been caught leaning too onerous right into a narrative that had already run out of momentum.

This wasn’t a second of FOMO or euphoria, only a actuality test — one the place an over-leveraged market quietly tipped over and compelled liquidations to scrub up the surplus. Whereas $67 million in complete liquidations over a brief interval isn’t a large quantity in isolation, the ratio or the imbalance is what issues right here, as a result of it reveals simply how concentrated sentiment had turn into and the way little draw back buffer existed as soon as the tide turned.

No CPI knowledge, no Fed minutes, no sudden transfer in charges — simply the pure consequence of leverage-heavy setups overstaying. You may see the outcomes on the chart, which present how rapidly costs bounce again as soon as weak positions are cleared.