- Bitcoin’s long-term realized cap impulse neared historic assist, signaling a possible main market pivot.

- Sentiment remained impartial as long-term holders face a key determination that would outline Q2’s route.

Bitcoin [BTC] is at a pivotal juncture. As one in every of its most telling long-term metrics approaches a traditionally important degree, the market finds itself holding its breath.

The times forward might set the tone for what’s to come back — whether or not as the bottom of a contemporary rally or the sting of a deeper slide.

What does the info say?

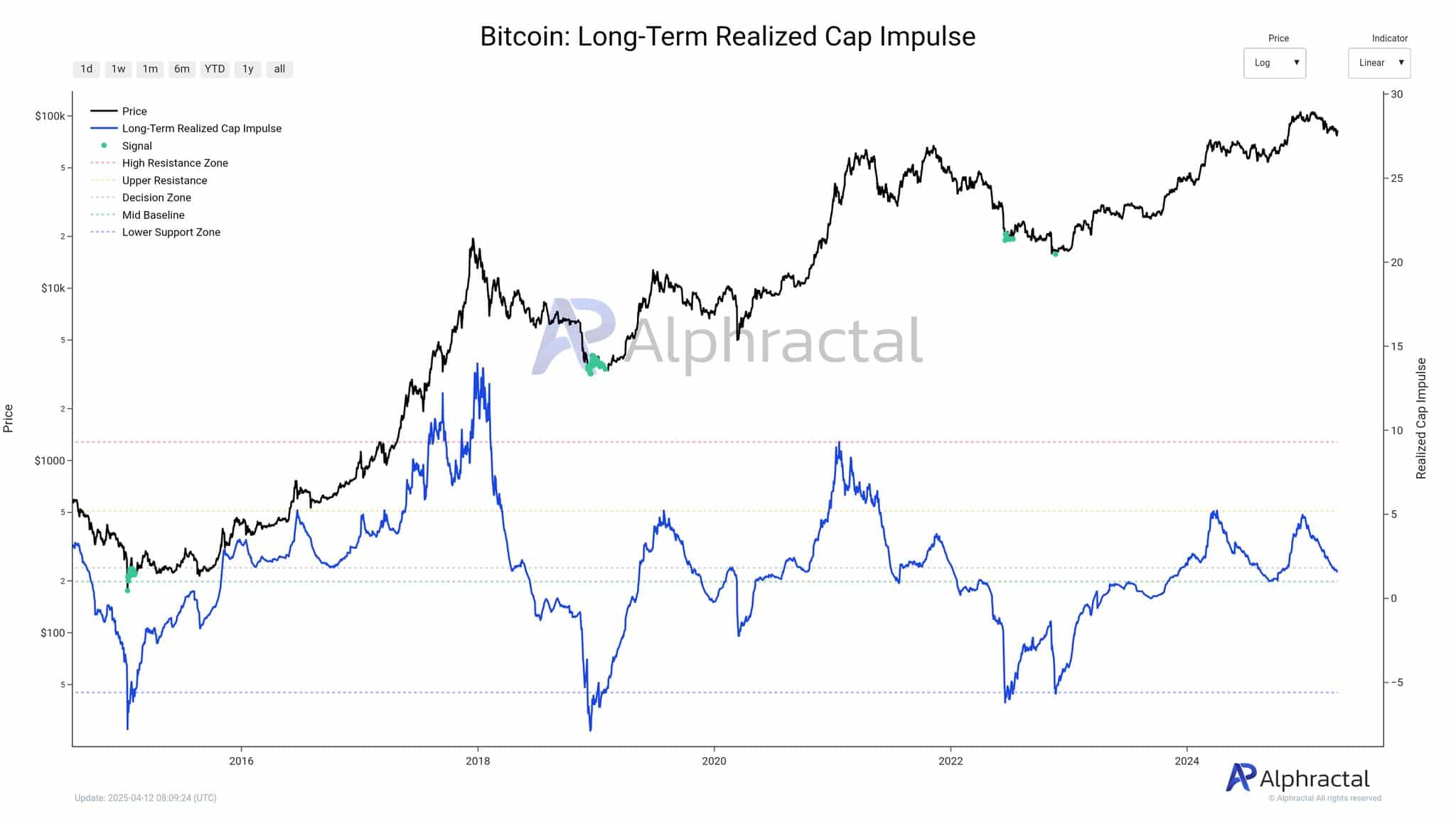

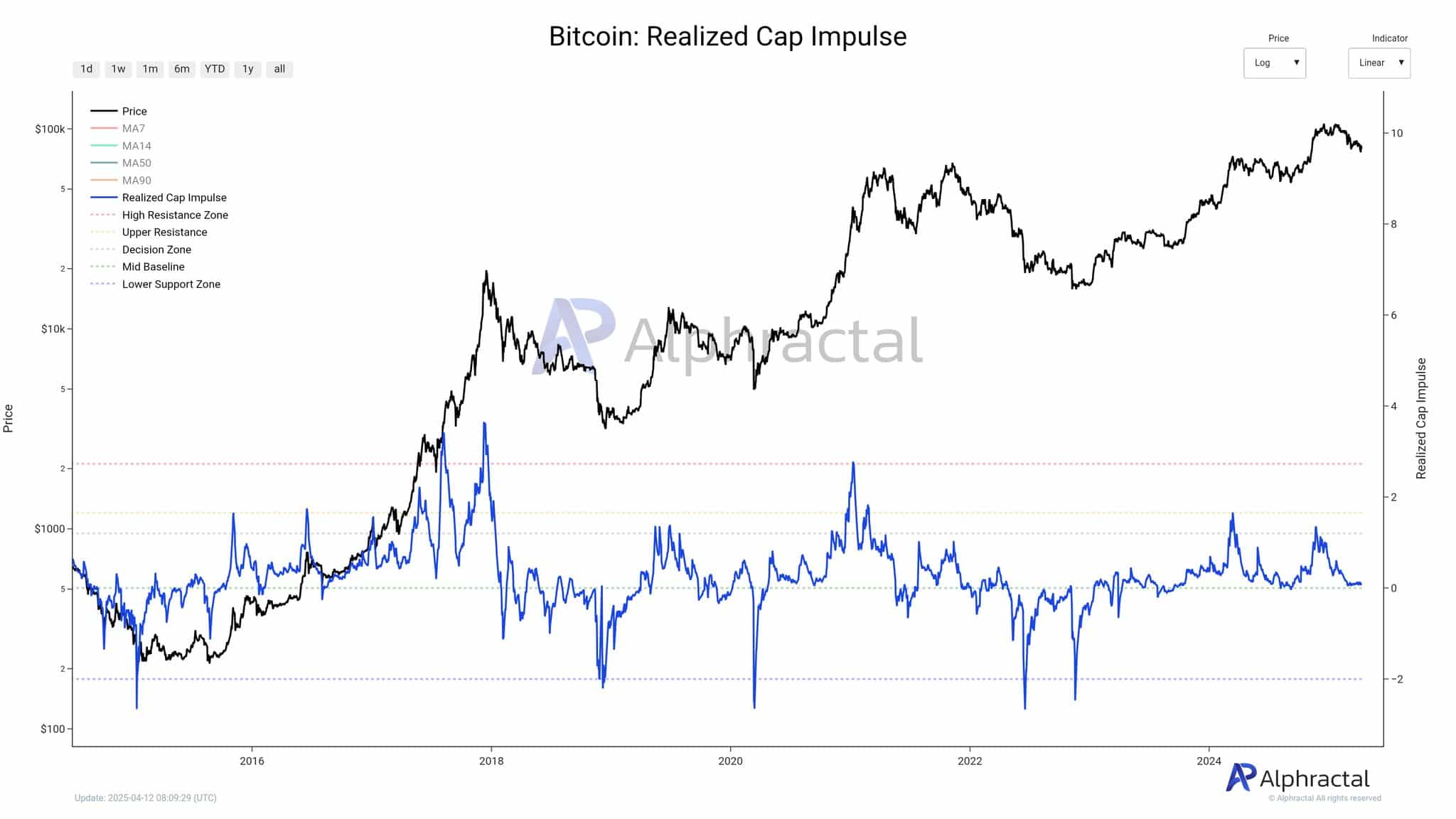

The long-term realized cap impulse is a key metric for gauging the conviction of long-term Bitcoin holders.

This metric evaluates the momentum of realized capitalization, which displays the motion of cash primarily based on their most up-to-date transaction worth and is adjusted for long-term tendencies.

Traditionally, when this impulse reaches its decrease assist zone, it has aligned with important turning factors in Bitcoin’s worth.

Supply: Alphractal

At press time, the impulse sits at a degree that beforehand preceded important market recoveries in 2019 and late 2022. This sample means that long-term holders are getting into a important determination window.

Both they continue to be agency, or the broader market narrative might start to shift.

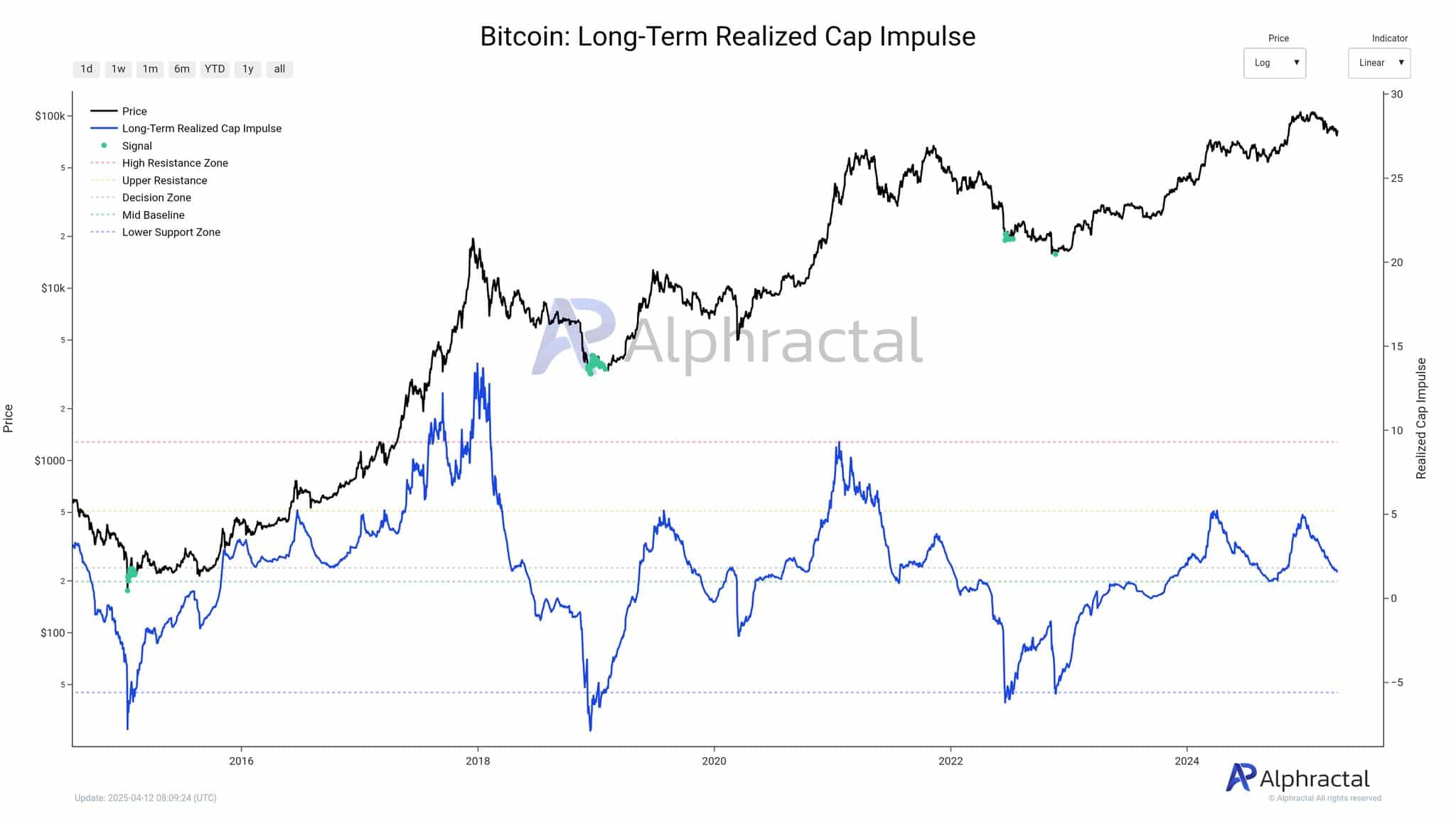

Help bounce or structural breakdown?

The present setup presents a binary consequence. If Bitcoin manages a optimistic bounce from this assist zone, it may sign that long-term holders are sustaining their positions, laying the groundwork for renewed accumulation and upward momentum.

Supply: Alphractal

Nonetheless, a breakdown at this degree may signify a lack of confidence among the many market’s most resilient contributors—those that often take in promoting stress somewhat than add to it. Such a shift would possibly set off a extra pronounced correction.

Contemplating the long-term impulse’s observe document of anticipating macro reversals, its subsequent motion may outline the trajectory for the upcoming quarter.

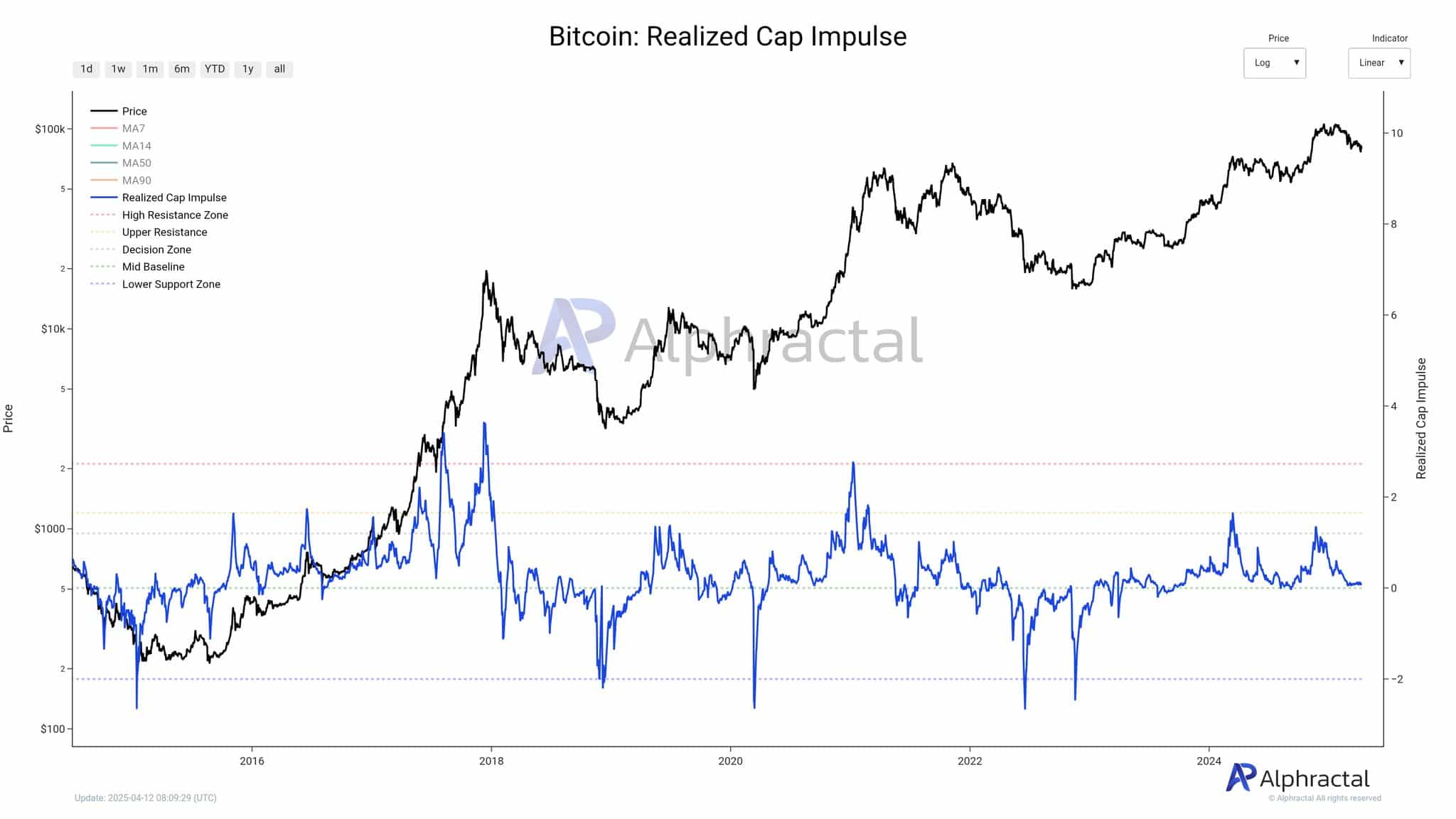

Bitcoin: Sentiment on the sting

At press time, the worry and greed index stood at 45, indicating a cautiously impartial sentiment—leaning towards worry however stopping in need of capitulation. This displays a market characterised by uncertainty whereas remaining aware of potential catalysts.

The sentiment studying mirrors the indecision seen on the long-term impulse chart, underscoring that Bitcoin is nearing a important determination level.

Traditionally, sentiment typically trails structural metrics, suggesting the present calm may precede a big directional shift. Whether or not this shift turns bullish or bearish will largely depend upon the conduct of long-term holders throughout this pivotal second.