- Largest gainers: Onyxcoin [XCN], Fartoin [FARTCOIN], JasmyCoin [JASMY].

- Largest losers: Tezos [XTZ], Eos [EOS], Motion [MOVE].

The week began tough for the crypto market, with the U.S. economic system feeling the impression of rising commerce tensions. Nevertheless, issues took a flip for the higher by the week’s finish. A key issue was the choice to exclude the know-how sector from the brand new tariffs.

Consequently, it gave the market a much-needed enhance. In actual fact, among the many prime 100, few threat property even noticed triple-digit beneficial properties.

Weekly winners

Onyxcoin [XCN]: Subsequent-gen crypto sees triple-digit surge

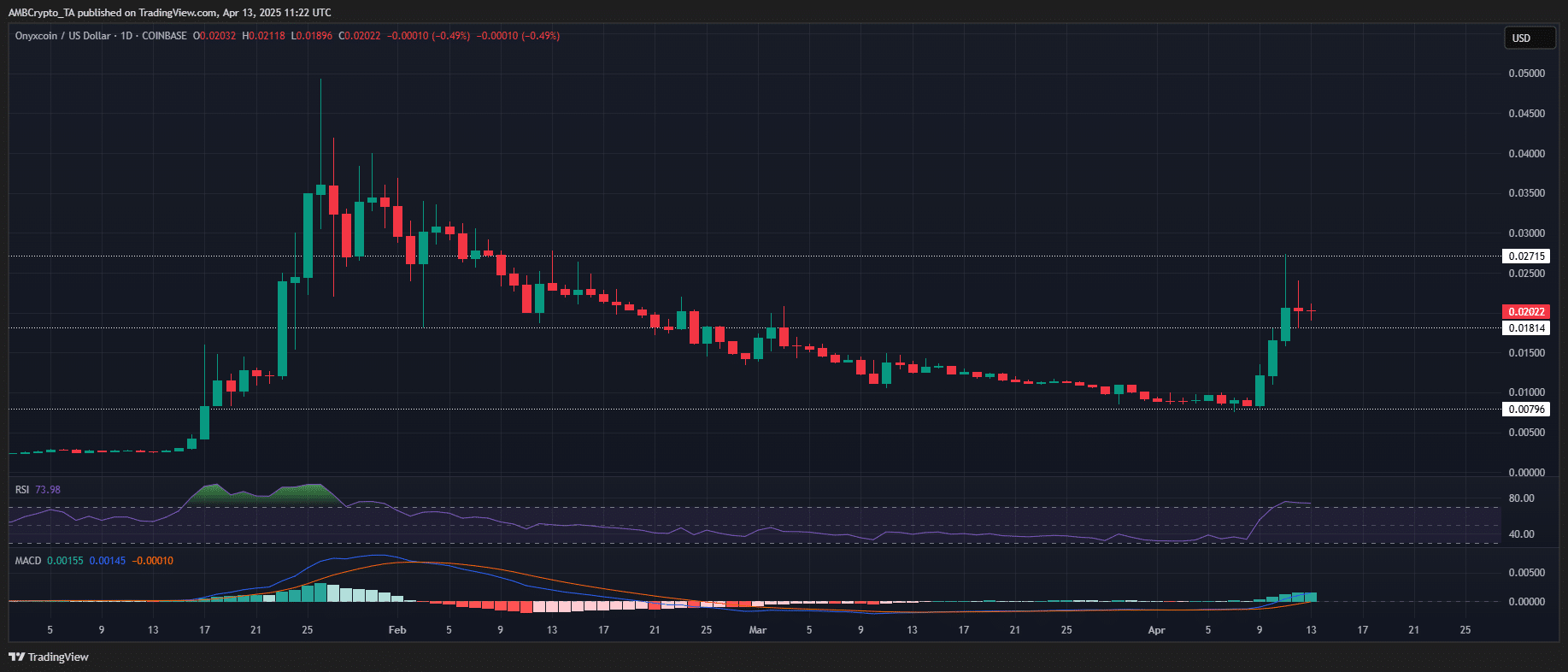

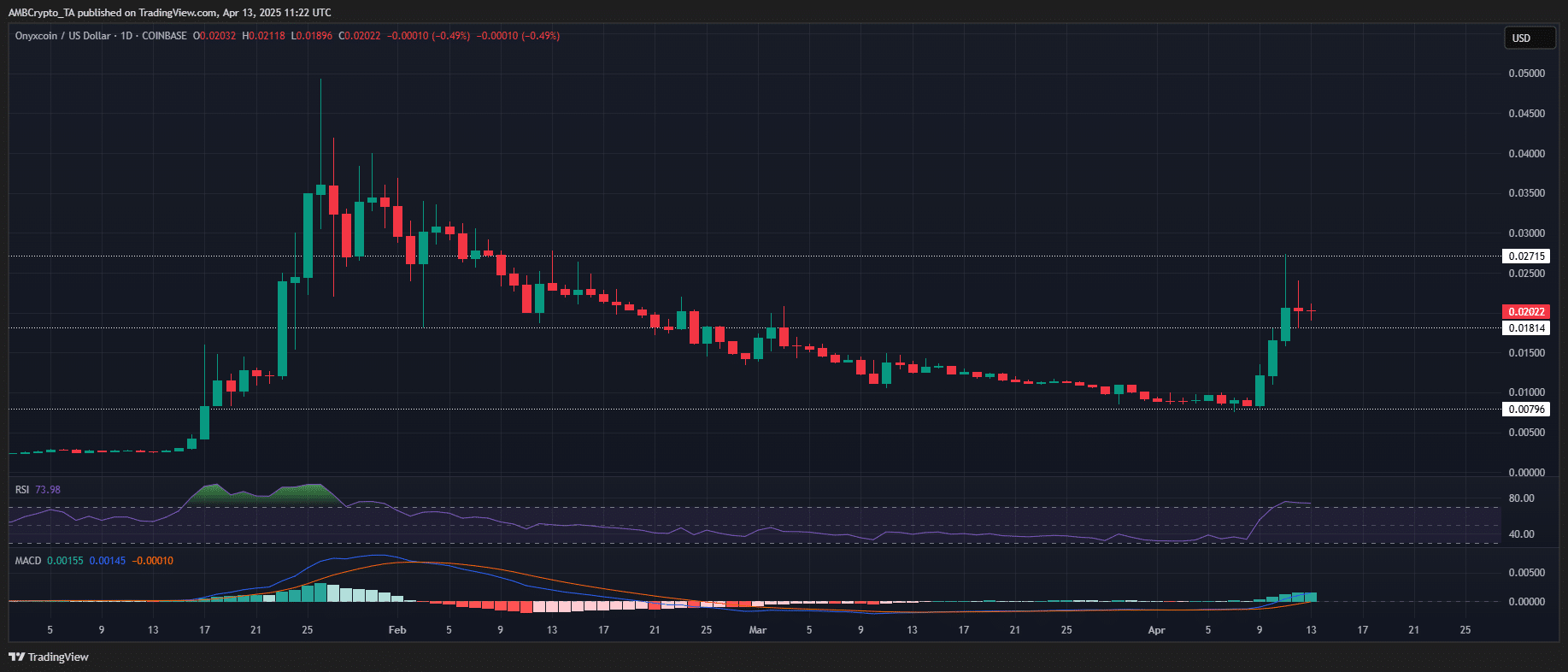

Onyxcoin [XCN] skilled a mid-week rebound, spiking 43.88% in a single day on the ninth of April. This rally was adopted by two consecutive days of heightened shopping for exercise, with value will increase of 36.78% and 24.65%, respectively.

In consequence, the low-cap asset dominated the weekly gainers’ chart, posting a formidable 120% surge. Over the span of simply three days, the value erased two months of losses, breaching $0.027.

Supply: TradingView (XCN/USDT)

As anticipated, profit-taking ensued, and the rally turned overextended, with the RSI hitting a crucial overbought situation at 81.09.

Nevertheless, if the low-cap asset mirrors its January value motion, the place, regardless of the overextension, bulls absorbed the sell-offs and sustained the uptrend, an analogous rebound may unfold.

On the twenty third of January, the asset noticed a dramatic 97.28% single-day rally, lifting the value to $0.025. That mentioned, with XCN closing the week 7.4% beneath its mid-week peak of $0.027, the asset might face headwinds in extending its rally into the upcoming week.

Consequently, it’s very important to trace quantity profiles to evaluate whether or not the uptrend can regain energy or if a consolidation section is imminent.

Fartoin [FARTCOIN]: Privateness-focused token hits a key resistance zone

Fartcoin [FARTCOIN] posted a powerful bullish efficiency this week, rallying over 90% amid a breakout from a multi-week accumulation vary.

The low-cap token decisively cleared the important thing resistance at $0.64, flipping it into intraday help. The breakout, initiated on the ninth of April with a pointy 50% intraday acquire, prolonged to retest the $0.98 degree inside two periods on the day by day timeframe.

At present, $0.87 has established itself as a short-term provide zone on the 4H chart, with value motion displaying indicators of exhaustion.

The rally towards the psychological $1.00 degree has stalled, coinciding with profit-taking. Moreover, the RSI is trending decrease from overbought circumstances, and the MACD has flipped bearish, indicating waning upside strain.

Given these indicators, FARTCOIN might require a liquidity sweep or corrective flush-out earlier than bulls can stage one other try and reclaim the $1.00 resistance degree.

JasmyCoin [JASMY]: Information-driven coin holds strong development reversal

JasmyCoin [JASMY] kicked off the week with a modest 4.85% bounce from a contemporary 52-week low of $0.00897. What adopted was a pointy and regular restoration.

By the week’s finish, JASMY was buying and selling at $0.01656, up 68.91%, making it the third-best performing asset of the week.

The rally adopted a clear breakout from its multi-month downtrend. Additionally, supported by rising shopping for quantity and a bullish crossover in indicators just like the RSI, which moved firmly into constructive territory.

The worth motion additionally suggests accumulation at decrease ranges, with regular inexperienced candles and restricted volatility—not like extra speculative spikes seen elsewhere. This means stronger arms stepping in, presumably leaving room for additional upside.

For now, the important thing resistance sits at $0.018–$0.0194. A decisive breakout above that might open the door for a transfer towards the subsequent goal at $0.022.

Different notable gainers

Past the highest performers, the broader market exhibited notable value motion.

Edge [EDGE] spearheaded the rally with a meteoric 825% surge, outperforming the highest 1,000 tokens by way of value momentum. Aergo [AERGO] and Retard Finder Coin [RFC] adopted with substantial value beneficial properties of 332.8% and 270%, respectively.

Weekly losers

Tezos [XTZ]: On-chain token erases its post-election beneficial properties

Tezos [XTZ] completed the week as the biggest underperformer, with a 17.20% decline, extending its consecutive week-on-week losses.

On the 1D timeframe, value motion stays beneath vital bearish strain, with no discernible bid-side absorption to halt the promoting momentum.

In consequence, XTZ has shaped a brand new decrease low, breaking beneath its post-election peak of $1.90 and establishing a contemporary help at $0.53.

Supply: TradingView (XTZ/USDT)

Regardless of the retracement, demand stays weak, with no indicators of robust dip-buying.

The absence of accumulation at these ranges means that XTZ’s draw back momentum may persist until a powerful help base materializes to soak up sell-offs.

And not using a shift in market construction or a bounce off key help, the asset is more likely to proceed its downtrend within the quick time period.

Eos [EOS]: Scalable blockchain shifts from winner to loser

EOS [EOS] skilled a major pivot this week, transferring from final week’s greatest winner to second on the loser chart, posting a 12.34% weekly drawdown.

The altcoin initiated the week with a 7.28% rally, displaying early indicators of a breakout try after forming three consecutive decrease lows.

Nevertheless, momentum shortly reversed as bears took management, resulting in a pointy 12.83% bearish engulfing candle, erasing the week’s early beneficial properties and pushing value again to $0.65.

On the 4H timeframe, the value construction stays firmly bearish, with consecutive crimson quantity bars indicating robust distribution.

The absence of bid-side absorption suggests a scarcity of liquidity help, and with out substantial buy-side curiosity, EOS may face a deeper pullback to check the subsequent help at $0.53.

Motion [MOVE]: Health platform posts decrease lows

Motion [MOVE] posted a 12.78% weekly drawdown, retracing from final week’s shut at $0.37, inserting it third among the many prime decliners.

Worth motion continues to mirror a distribution section, as bulls fail to generate adequate momentum for a structural breakout. In actual fact, throughout the week, MOVE traded inside a consolidation channel between $0.24–$0.40.

Nevertheless, the absence of demand-side absorption close to native lows confirms weak market participation, with no indicators of accumulation or base formation.

Regardless of a 21% improve in quantity (as much as $76.88M), the uptick seems to mirror opportunistic liquidity sweeps fairly than a real shift so as circulate dynamics.

The RSI stays in a downward trajectory, reinforcing bearish bias, whereas the dearth of a confirmed greater low suggests MOVE may very well be organising for an additional liquidity purge beneath the $0.24 vary low.

Different notable losers

Within the broader market, a number of tokens underwent vital value retracements.

MetFi [METFI] led the declines, dealing with a steep 51% drawdown, whereas MMX [MMX] and Comic [BAN] adopted with 41.7% and 40% pullbacks, respectively.

Conclusion

Right here’s the weekly recap of the highest gainers and losers. It’s vital to recollect the extremely unstable nature of the market, the place value fluctuations can happen quickly.

As such, conducting thorough due diligence (DYOR) earlier than making any funding choices is strongly really useful.