- Ripple has seen a decline in key metrics, together with the variety of transactions accomplished on its platform.

- Within the derivatives market, curiosity in XRP remained excessive, with the potential for extra shopping for exercise.

Ripple [XRP] has maintained a comparatively low decline following the current market turbulence, with a number of property recording main losses.

Prior to now 24 hours, sentiment has turned bullish, with XRP recording a 2.35% acquire—its first constructive rally in comparison with its previous week and month of decline.

Nevertheless, the market stays unsure concerning the asset’s subsequent transfer, as key metrics point out combined alerts. Nonetheless, derivatives merchants are betting on a rally.

AMBCrypto analyzed how this might play out.

Key metrics present a pointy drop

On-chain insights counsel fading curiosity amongst market individuals over the previous few days, as notable metrics monitoring exercise and engagement have declined.

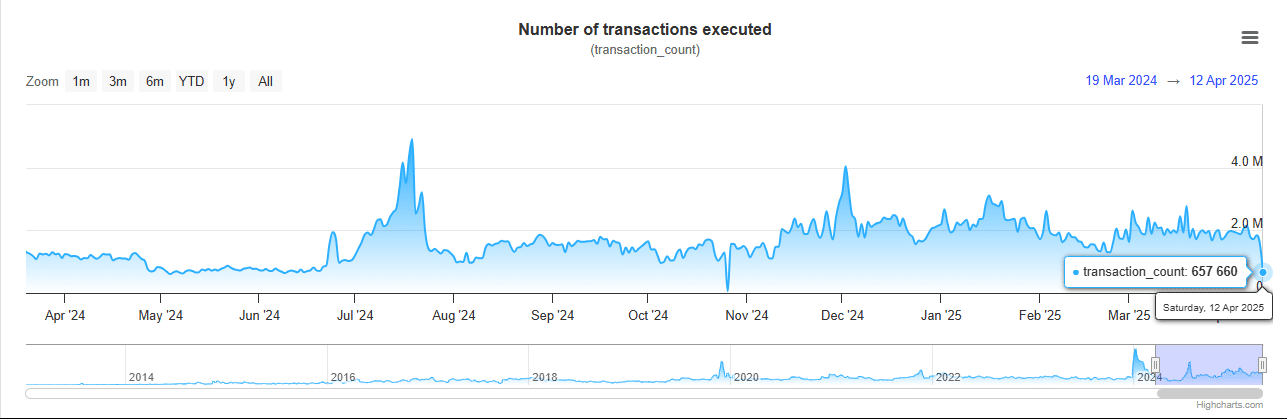

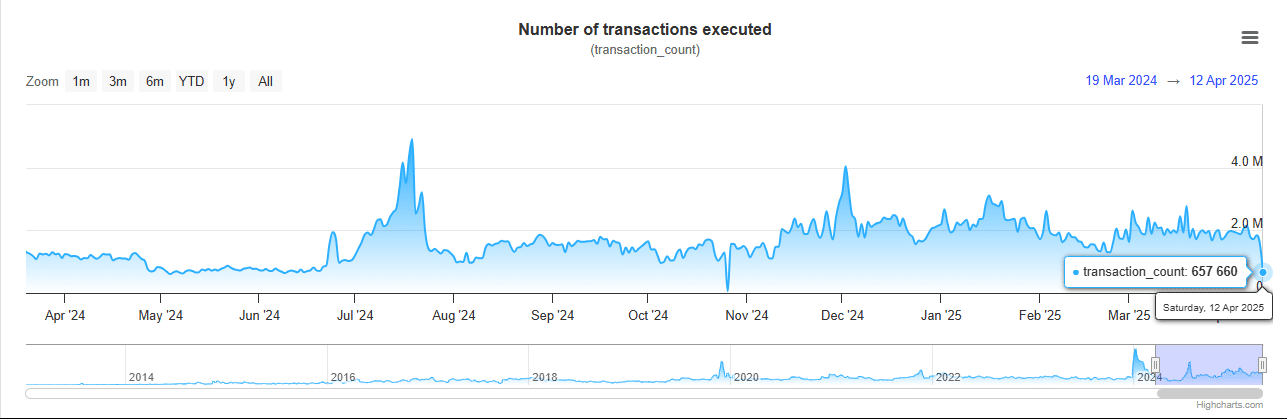

Prior to now 24 hours alone, the variety of transactions executed has dropped considerably—from roughly 1.4 million to 657,000 accomplished transactions.

Supply: XRPscan

This decline signifies diminished community exercise and suggests waning curiosity.

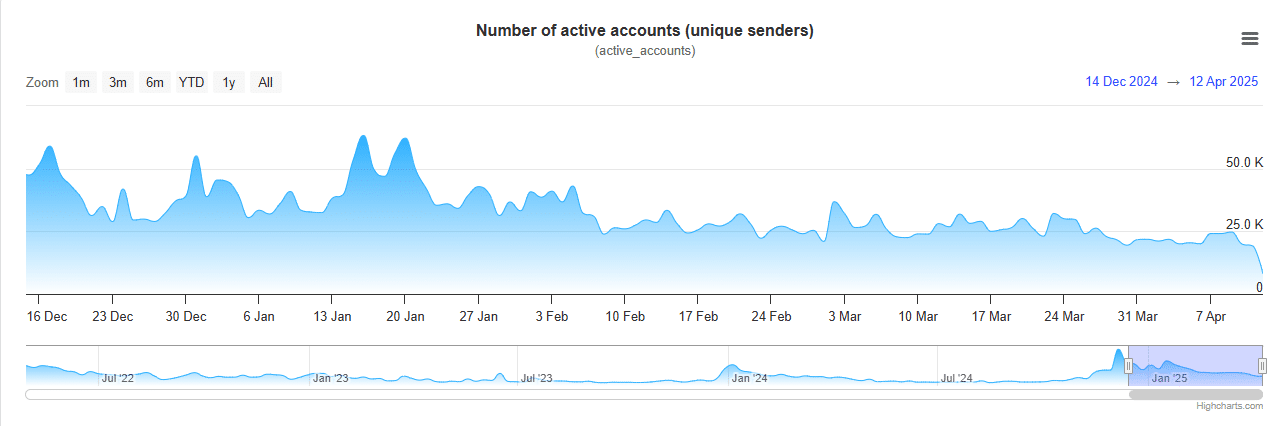

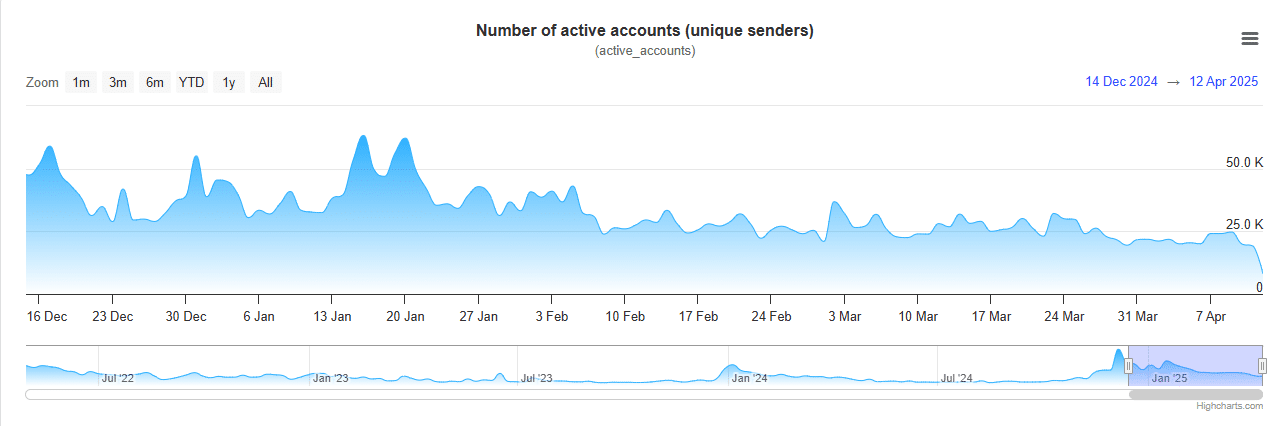

The drop in transactions may be traced to a pointy fall within the variety of distinctive accounts interacting with XRP, which declined by greater than half—from 19,018 to eight,039.

Decrease market exercise may affect XRP’s trajectory, limiting its potential for a near-term rally.

Supply: XRPscan

Bullish narrative builds within the derivatives market

Merchants within the derivatives market are presenting a contrasting narrative, with lengthy (purchase) contracts taking the lead.

Open Curiosity (OI) has been steadily growing in each futures and choices markets. Within the futures market, OI has risen by 2.15%, reaching $3.18 billion, whereas the choices market has seen a outstanding progress of 108.93%, climbing to $242,000.

Furthermore, the Funding Charge of 0.0091% over the previous 24 hours signifies that lengthy merchants maintain a considerable portion of those futures and choices contracts.

Supply: Coinglass

The Open Curiosity Weighted Funding Charge, which affords a clearer image of the market’s sentiment, stays constructive and is rising shortly. On the time of writing, it stood at 0.0078, indicating a bullish bias.

If sentiment stays sturdy, it may drive XRP’s value larger.

The place is XRP heading?

A significant impediment lies forward for XRP on the resistance degree of $2.1004.

If bullish momentum shouldn’t be sturdy sufficient to push the asset past this degree, a value drop might observe.

Supply: TradingView

Potential help ranges for a pullback embody $1.923, $1.850, or $1.759, the place the asset might stabilize earlier than making an attempt a rebound.

On the upside, a decisive break above the $2.233 resistance degree may ship Ripple even larger on the chart.