- The SOL/ETH chart has seen a big surge, implying that Solana is gaining extra traction than ETH.

- This large surge could be attributed to the current development in transactions and community utilization.

Solana [SOL] and Ethereum [ETH] have had various performances up to now month, with the property taking completely different paths.

On the one hand, SOL has had a bullish run, with a optimistic final result of three.45% over the previous month. For ETH, it’s a distinct state of affairs—it has dropped 14.37%, including to the previous’s dominance.

Nevertheless, evaluation reveals there’s extra to the current acquire in market dominance that Solana has had over Ethereum up to now day, and its affect on the property’ value shifting ahead.

New document, excessive curiosity

Within the final 24 hours, the SOL/ETH each day chart closed above $0.08043—marking its highest degree since inception. Naturally, this milestone indicators a recent wave of capital rotation into Solana.

Supply: TradingView

The implications are clear: Traders are allocating extra funds into SOL relative to ETH.

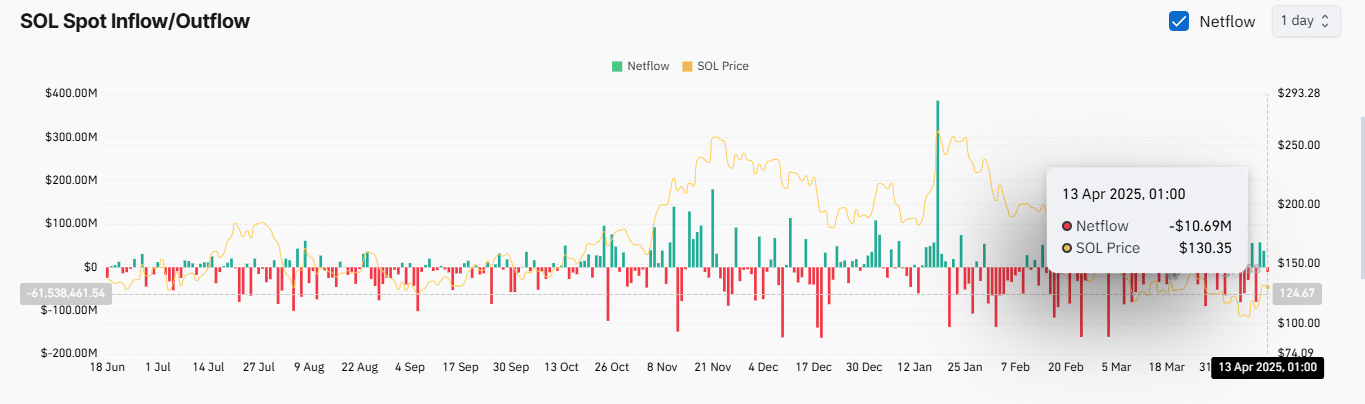

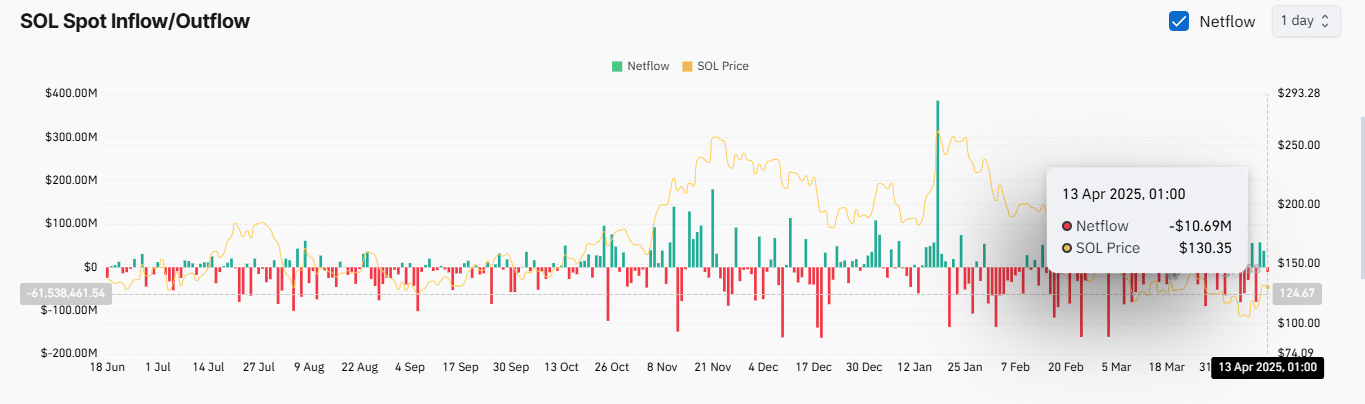

This type of transfer sometimes displays expectations of stronger efficiency from Solana within the quick to mid-term. Additionally, Artemis’ liquidity stream knowledge aligns with this shift.

Over the previous week, Solana posted a optimistic internet influx of $25.4 million—calculated by subtracting outflows from whole inflows.

Ethereum, in contrast, noticed a unfavorable internet stream of $8.8 million, indicating a pullback in investor confidence as liquidity exited the community.

Supply: Artemis

Extra components surrounding SOL’s dominance

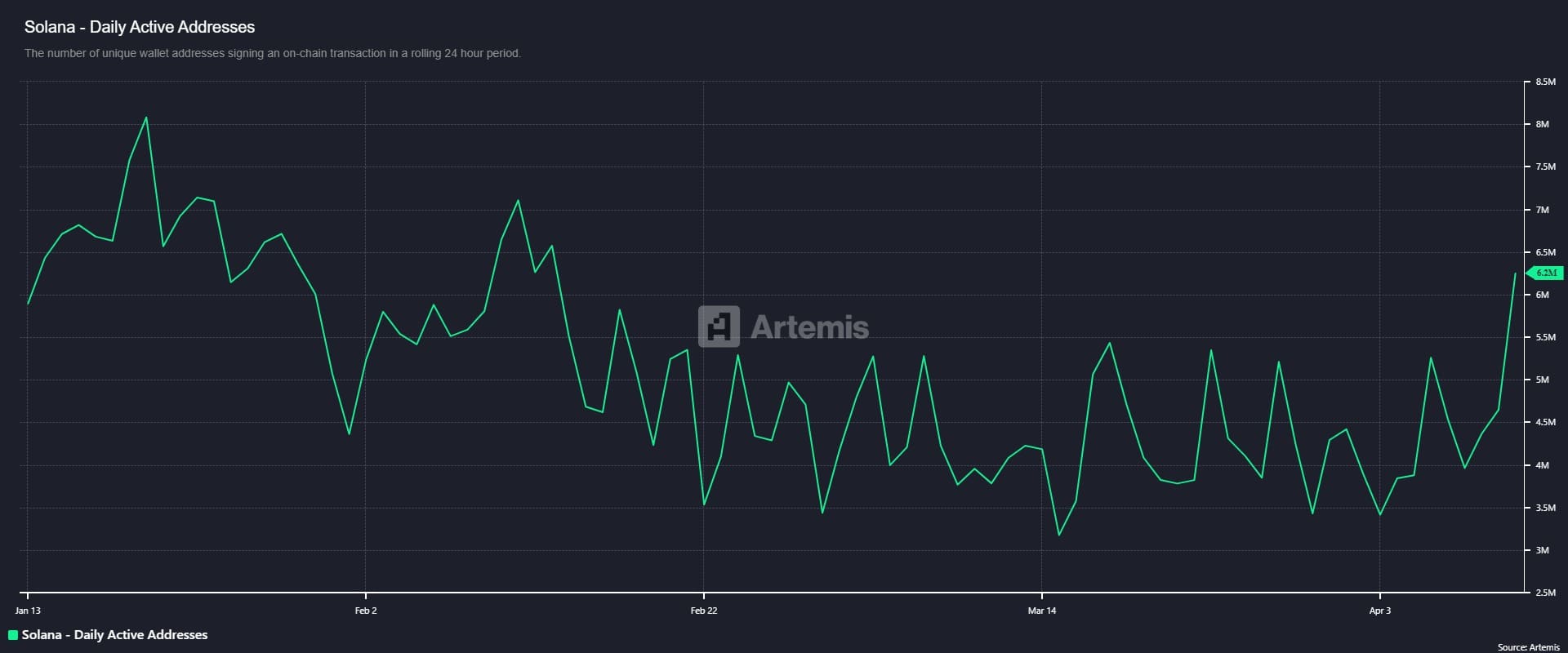

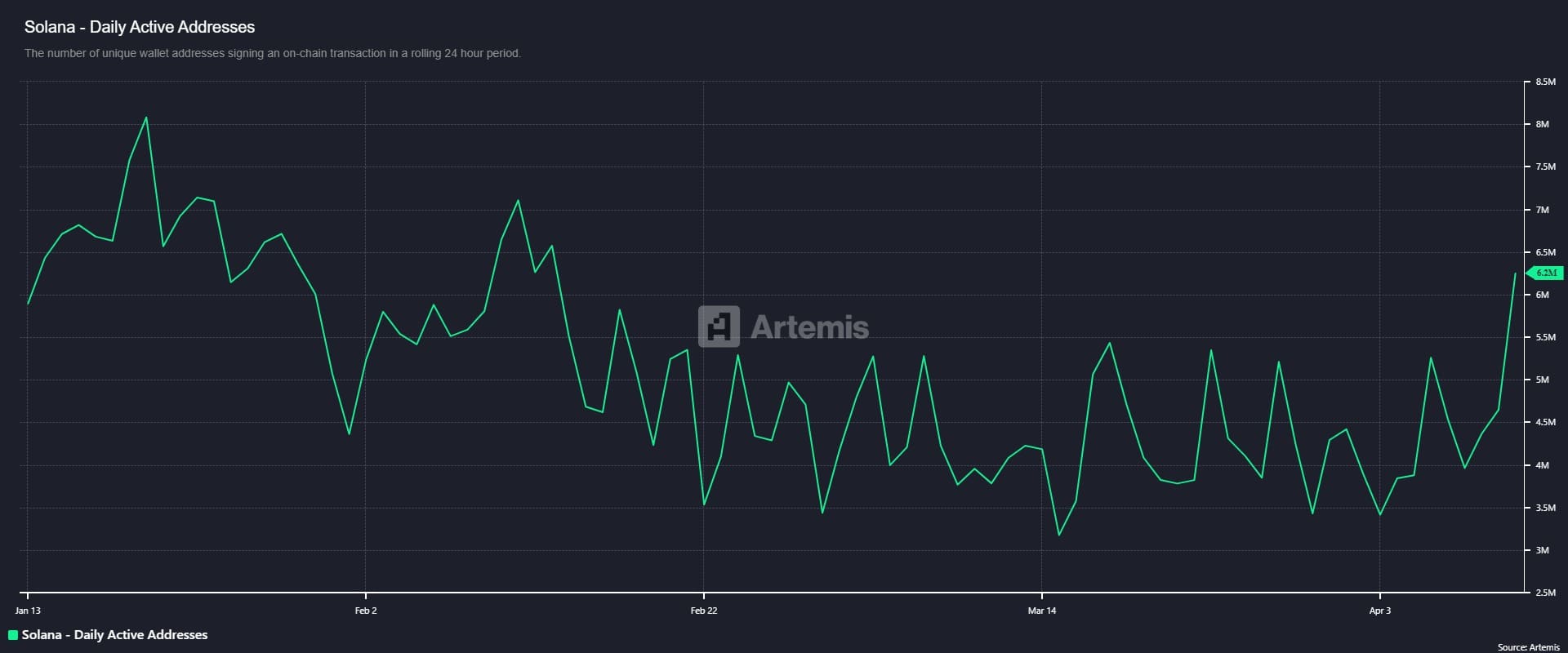

Solana’s current market share development has been fueled by elevated on-chain exercise. Day by day Energetic Addresses just lately reached 6.2 million, marking the best degree since February.

This surge highlights a rising curiosity out there. With sentiment bettering, extra customers are actively partaking with the community.

Naturally, this elevated exercise drives demand for SOL.

Supply: Artemis

This has led to each day transactions performed on Solana rising to a excessive of 96.1 million, up from a low of 69.5 million on the first of March, highlighting the energy the market is gaining and the rising degree of utilization.

In truth, the supply of stablecoins on Solana has reached $12.6 billion—once more hitting a degree it final noticed in February.

When the provision of stablecoins grows, it implies there’s rising demand to be used on the community, including to the potential development for SOL and its worth over time.

Supply: Artemis

Market responds positively

The market response to Solana’s current exercise has been encouraging.

After two days of promoting, throughout which $95.54 million exited the market, spot merchants have resumed shopping for—a transparent indicator of renewed curiosity.

Over the previous 24 hours, spot merchants bought $9.28 million value of property, additional boosting sentiment.

Supply: CoinGlass

If on-chain exercise continues to favor bulls out there, together with continued spot dealer accumulation, then SOL is primed for an extra rally.