- AAVE’s new yield choices enable it to compete with common fintech options like Sensible and Revolut

- Market has reacted positively because the improvement, with shopping for exercise rising over the past 24 hours

Aave [AAVE] is likely to be interesting to buyers available in the market proper now after a month of main sell-offs introduced the altcoin’s value down by 19.42%. In response to this optimistic sentiment, the crypto climbed by 3.57% quickly after? That’s not all although as at press time, there have been extra indications that the rally may proceed.

Throughout this part of the market, merchants have bought a major quantity of AAVE. All whereas the ecosystem worth accrued throughout this era has continued to climb.

Aave protocol outperforms fintech options

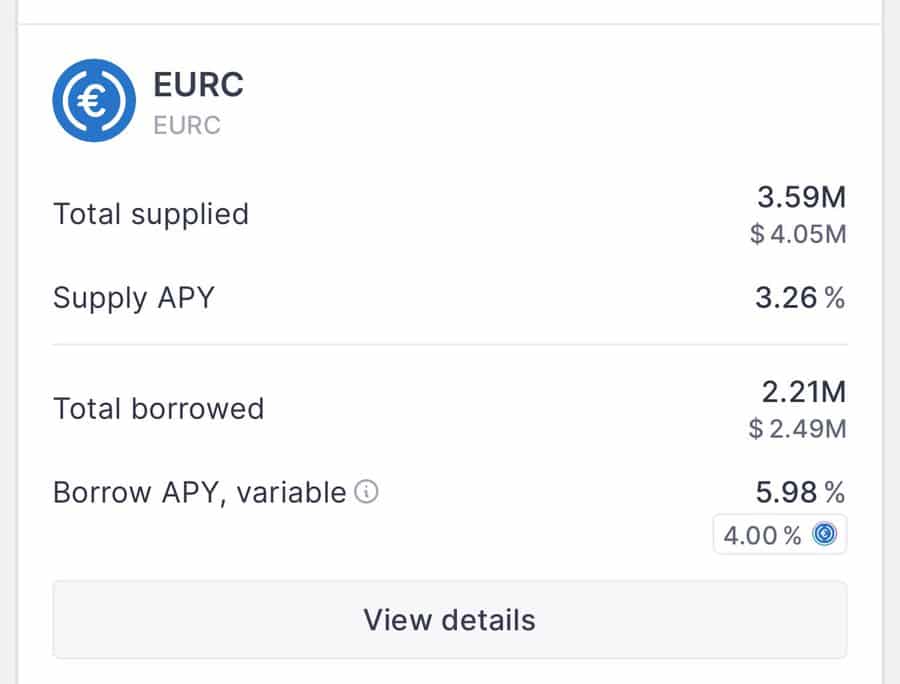

In keeping with a current submit by Founder Stani Kulechov, Aave now supplies extra yield on its EUR Coin than common fintech options Sensible and Revolut, which supply decrease rates of interest.

Supply: Aave

Lenders on Aave now earn as much as 3.28% APY – Greater than Sensible’s 2.24% and Revolut’s 2.59% (Extremely plan).

Naturally, these elevated returns reshape Aave as a profitable magnet for yield-hungry customers searching for higher capital effectivity.

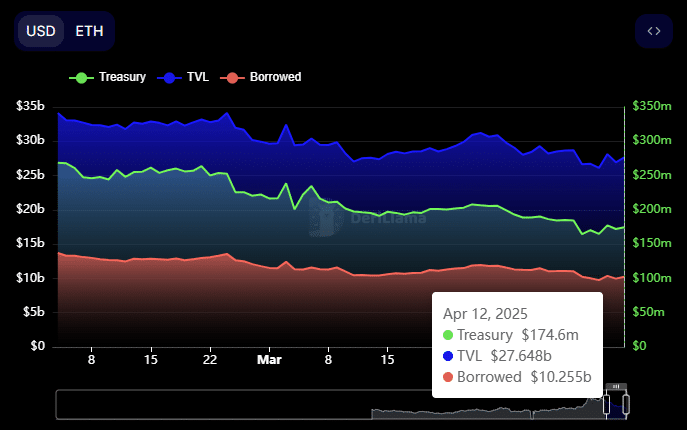

On prime of that, DeFiLlama information revealed a surge in exercise throughout the protocol, with liquidity inflows marking a visual uptick. Borrowing on Aave climbed to $10.255 billion – Indicative of rising person engagement throughout the board.

In the meantime, the protocol’s TVL rose to $27.648 billion, hinting at extra deposits and stronger belief in Aave’s ecosystem.

Supply: DeFiLlama

This steered that there’s a pattern of rising curiosity amongst contributors available in the market. By extension, it may have an effect on AAVE’s worth on the charts – The platform’s native token.

How did the market react to AAVE?

Patrons available in the market have continued to build up AAVE following information of its improvement and engaging yields.

In actual fact, information from IntoTheBlock highlighted a notable hike within the quantity of AAVE bought on exchanges for long-term holding. On the time of writing, roughly $1 million value of AAVE had been purchased from the market.

Supply: IntoTheBlock

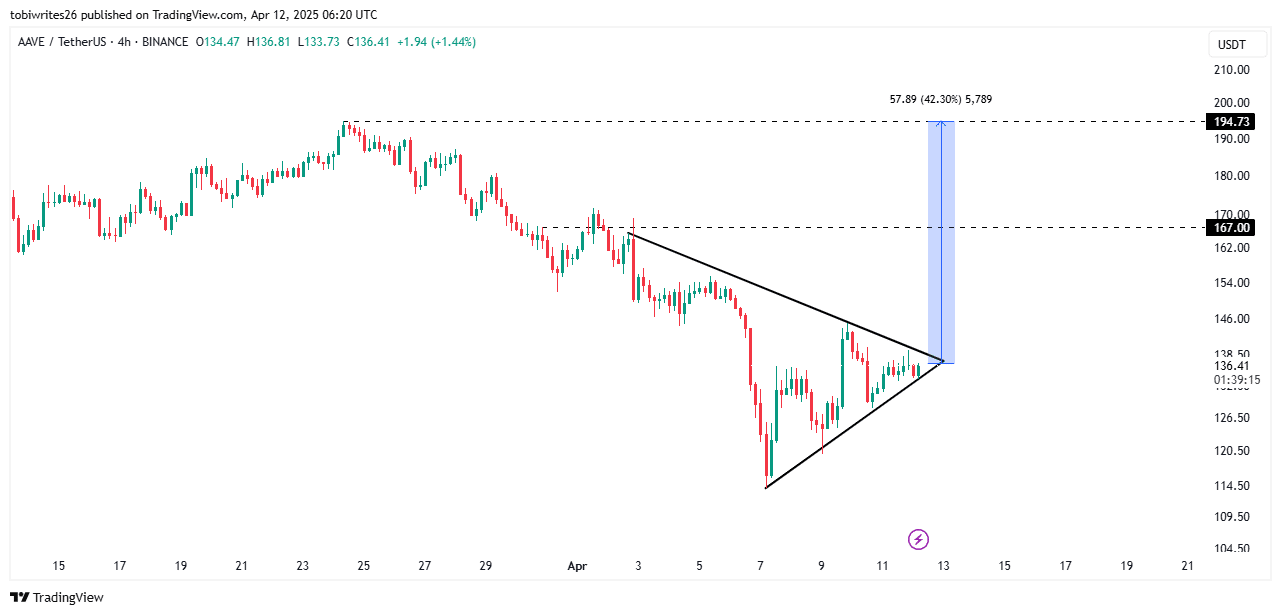

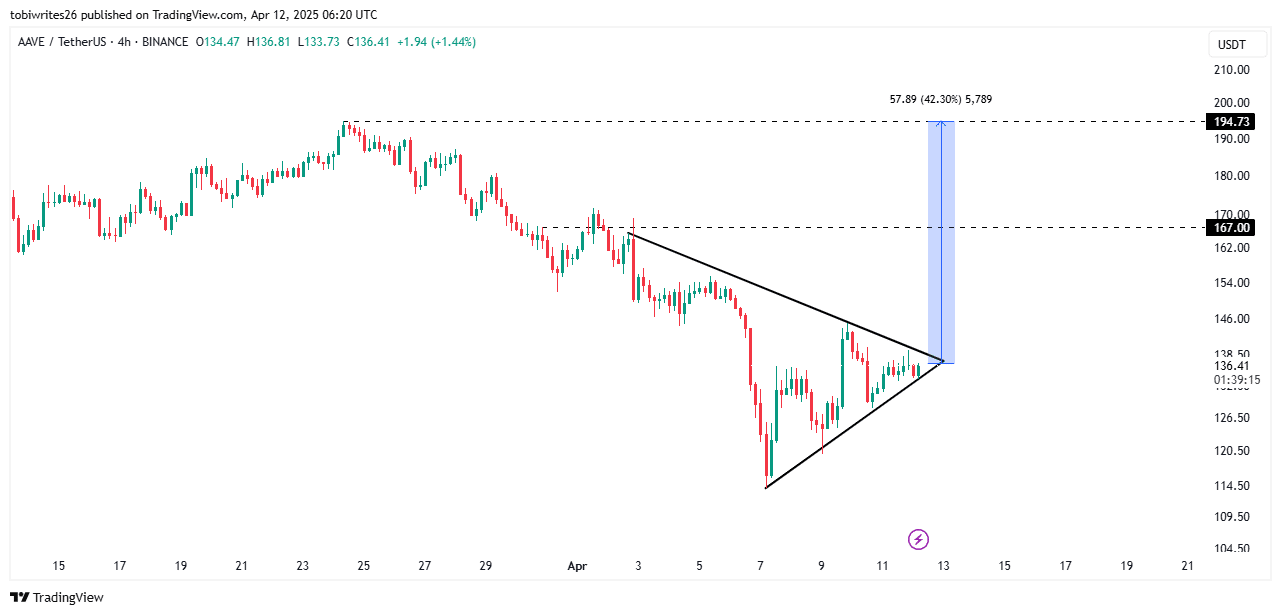

This rising curiosity, if it continues, could lead on to an enormous rally of 42%, with the altcoin climbing to $194. This may very well be the case because the asset has been buying and selling inside a symmetrical triangle sample referred to as a bullish sample.

This sample is made up of converging help and resistance strains. A breach of the resistance line would alerts the beginning of a rally for AAVE, with a short-term goal of $167 and a long-term goal of $194.

Supply: TradingView

Such a rally may even rely upon the energy of market momentum. If it stays excessive, then the breach is extra probably.

Quite the opposite, AAVE could proceed to consolidate inside this sample, the place accumulation retains occurring.

Adoption stays excessive

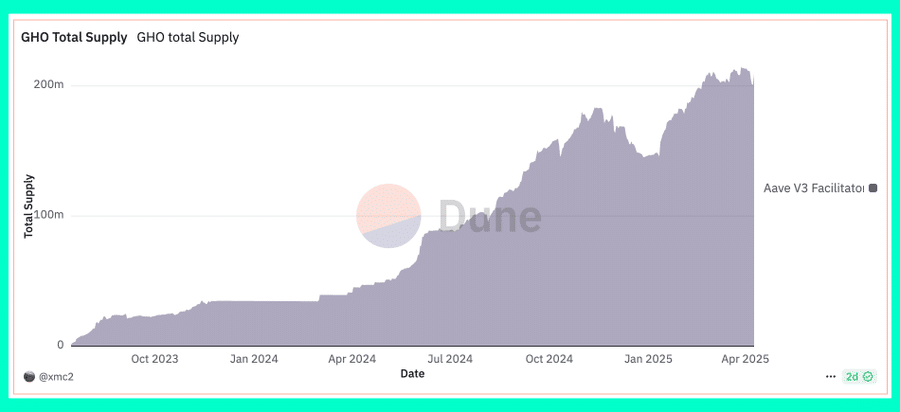

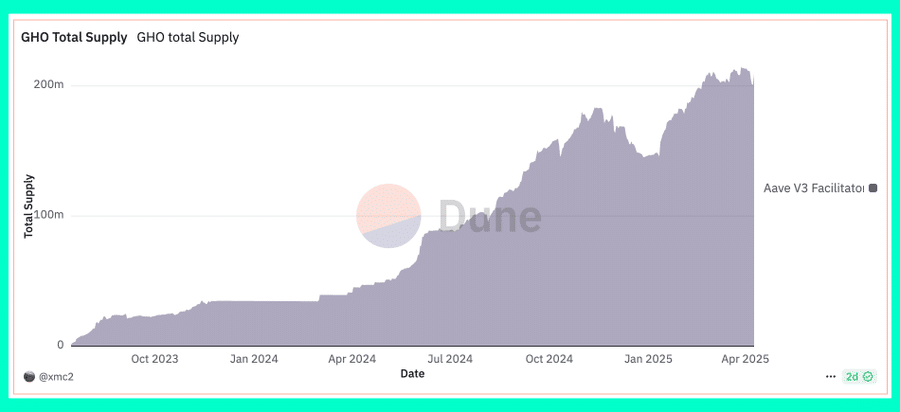

There’s been rising adoption of Aave’s native stablecoin, GHO, with the identical seeing huge development of 442% over the previous yr alone.

Such an uptick in stablecoin provide implies sustained utility of the stablecoin and, by extension, the Aave protocol. If the full provide surges, it might imply rising demand. This may almost certainly be mirrored in AAVE’s worth climbing larger on the charts.

Supply: Dune Analytics

Lastly, market sentiment has remained bullish currently. AAVE has the next likelihood of reaching its near-term goal of $167 if this pattern is maintained.