- The elevated exercise on-chain and in speculative buying and selling pointed towards short-term bullish sentiment.

- The upper timeframe outlook remained bearish, and $130-$145 may very well be the degrees that crush bullish hopes of restoration.

Solana’s [SOL] value bounced from Monday’s low at $95.26 to $130 at press time, a 36% turnaround inside per week.

In an evaluation, AMBCrypto famous that the $114 area was an essential horizontal degree. Now that SOL was buying and selling above this degree as soon as extra, a restoration appeared doable.

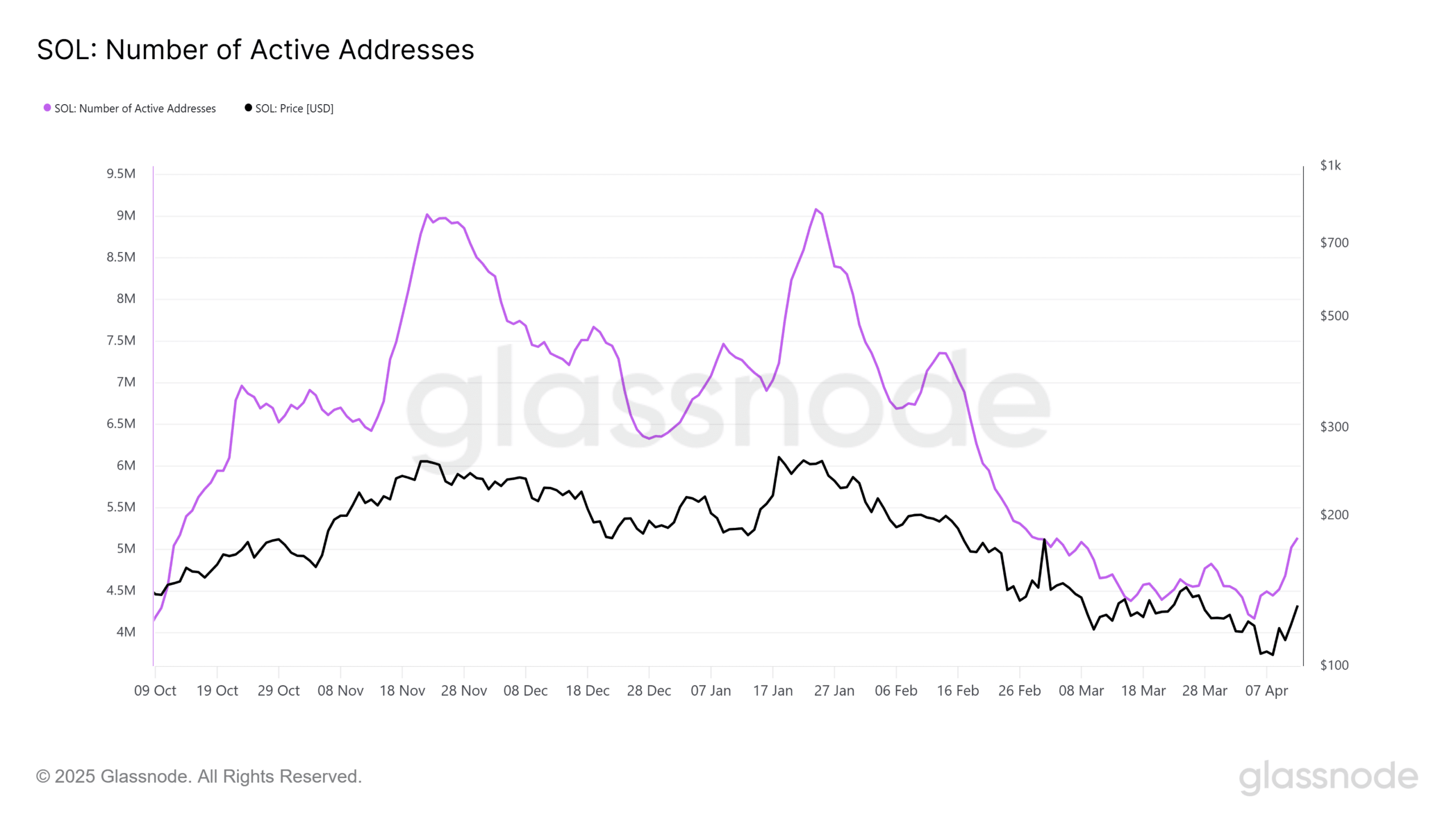

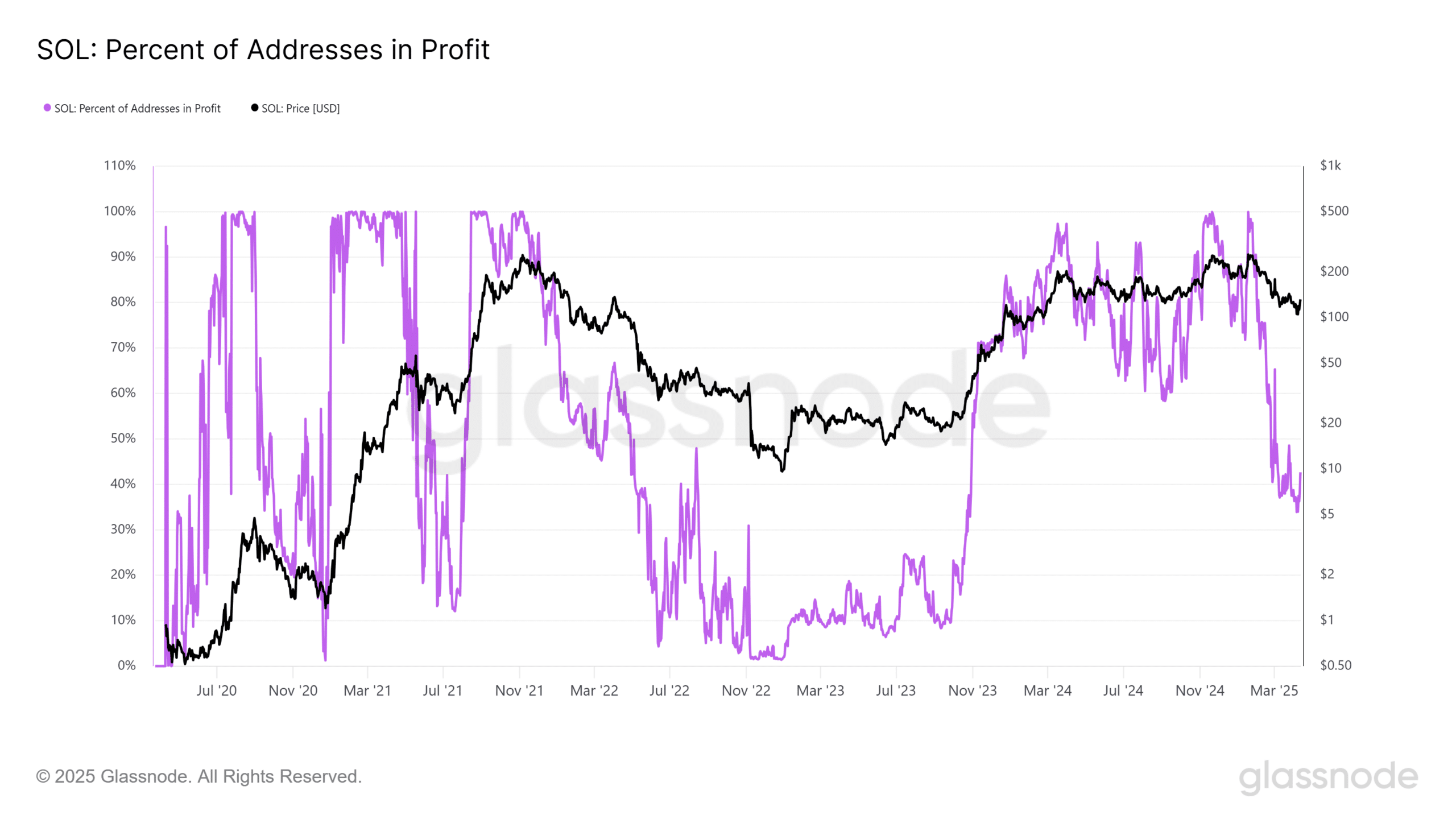

Supply: Glassnode

The rising variety of lively addresses over the previous week got here alongside the value bounce. The 7-day Transferring Common (MA) was used to clean out the chart, and it confirmed that the downtrend of the current months could be reversing.

The lively addresses’ 7-day MA was already above the highs from early March when SOL was buying and selling at $144.

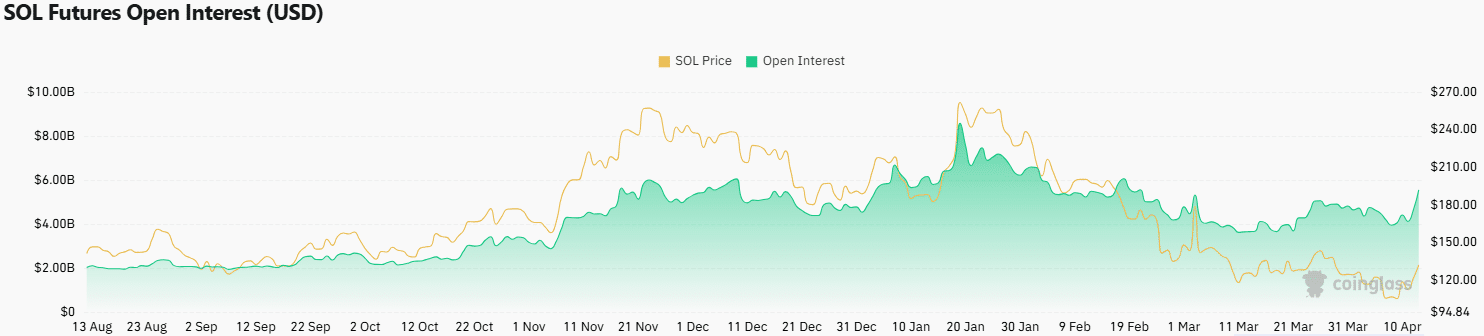

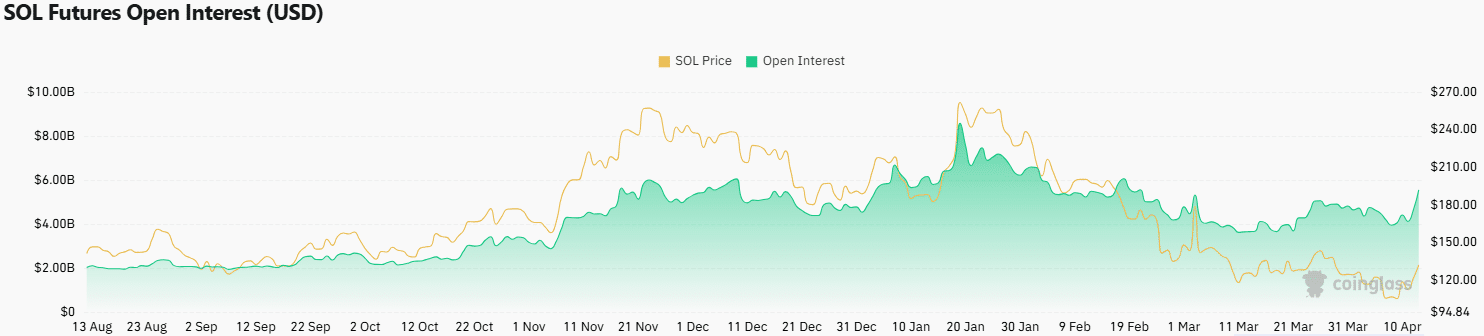

Supply: Coinglass

The close to 40% value bounce of the previous week additionally introduced in a flurry of speculative buying and selling exercise. The Open Curiosity (OI) has risen by almost $1.5 billion for the reason that eighth of April.

The OI was increased at press time than at any level in March, one other signal of a bullish turnaround.

Can Solana bulls sustain this strain, or was this bounce a promoting alternative?

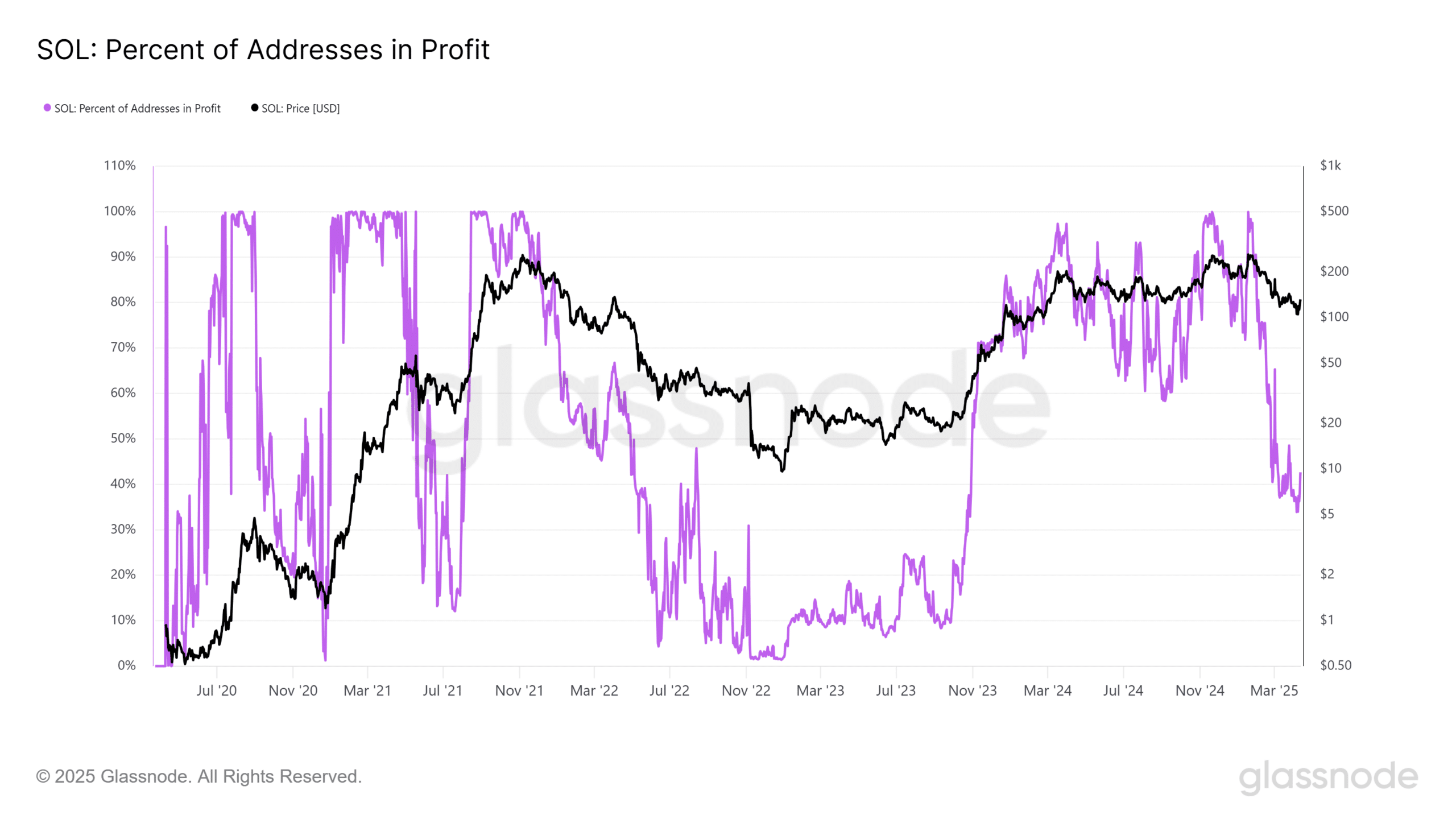

Supply: Glassnode

The share of distinctive addresses whose purchase value was under the present market value was represented within the metric above. The downtrend of Solana from $240 in January noticed the metric fall to lows not seen since November 2023.

Again then, the value of Solana was $40, and the bear market was ending. The circumstances have been totally different this time. All through 2024, the $120-$130 area had served as a robust help.

The drop within the % of addresses in revenue indicated that holders would use a value bounce to attempt to exit at break-even. Due to this fact, the current value bounce won’t materialize into the reversal bulls have been hoping for.

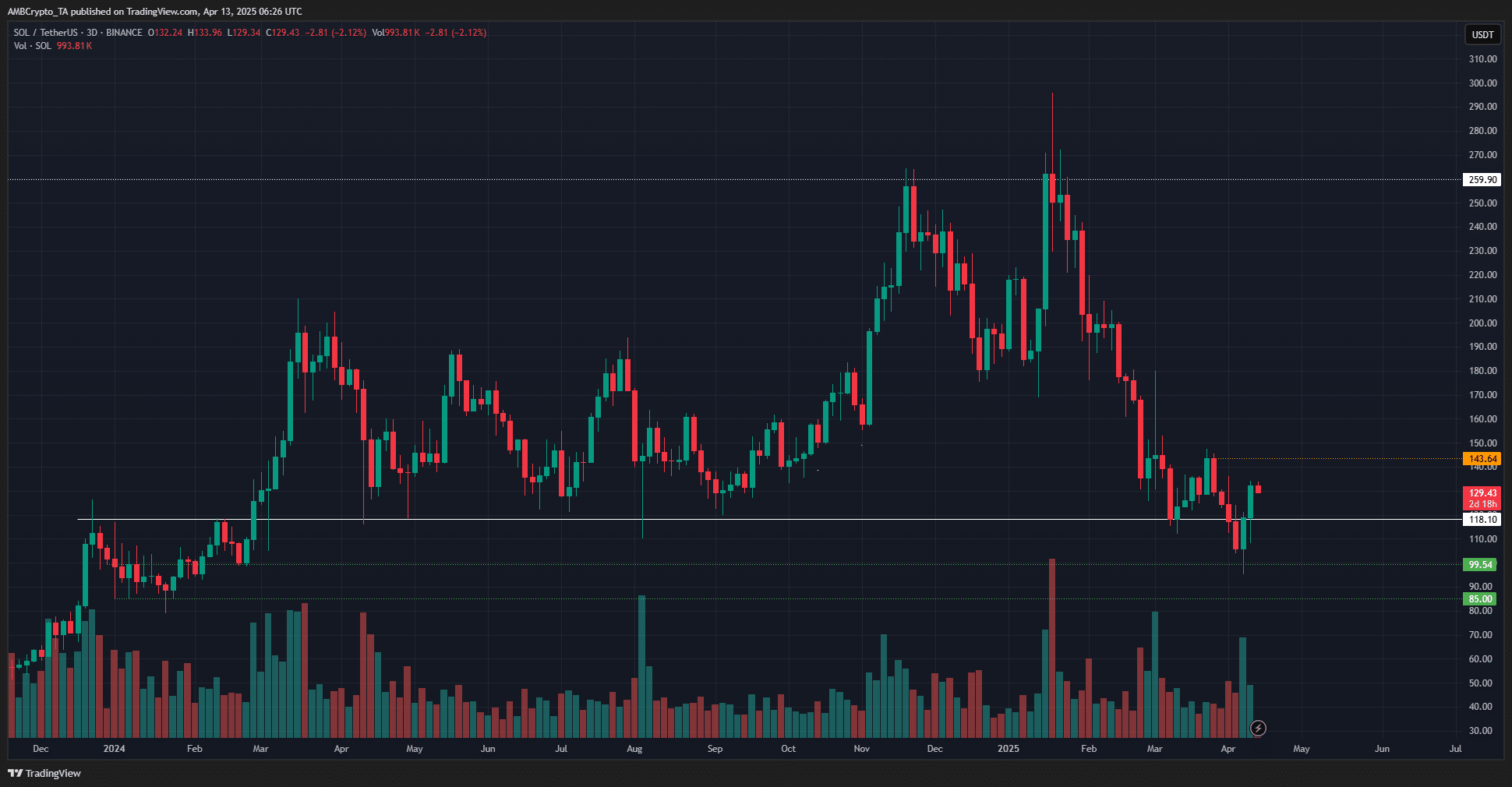

Supply: SOL/USDT on TradingView

The three-day chart highlighted this bearish pattern, with decrease highs and decrease lows since January. The $143 degree was the current decrease excessive, and SOL was not near breaching this degree. Merchants and traders can use a breakout past this degree to flip their bias bullishly.

In the meantime, the $99 and $85 help ranges have been the subsequent value targets, as long as the construction remained bearish.