- Merchants mustn’t FOMO into shopping for XRP after the break of the six-week trendline resistance.

- The opportunity of a brief squeeze meant that merchants may search for alternatives to quick XRP after a minor bounce.

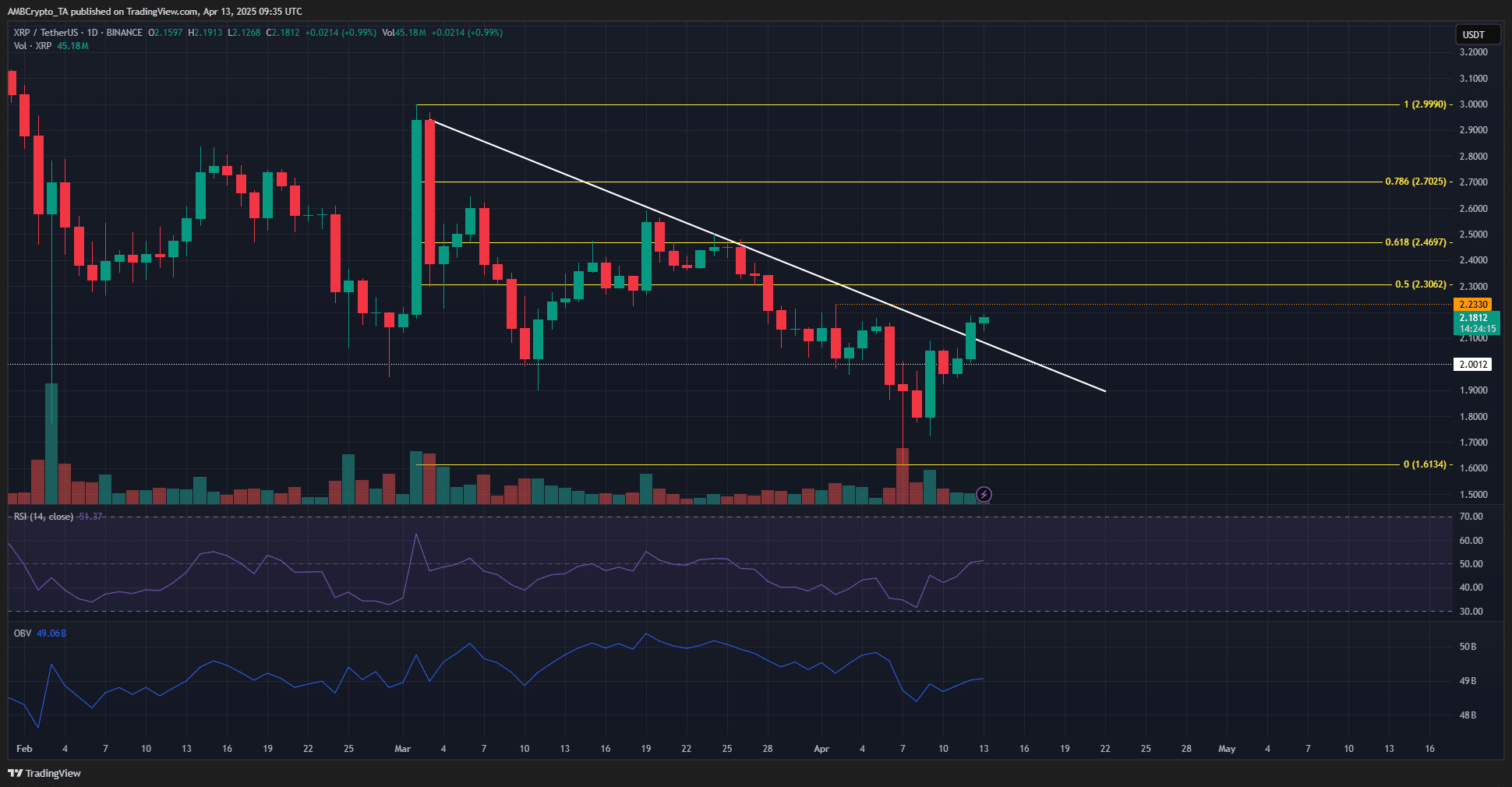

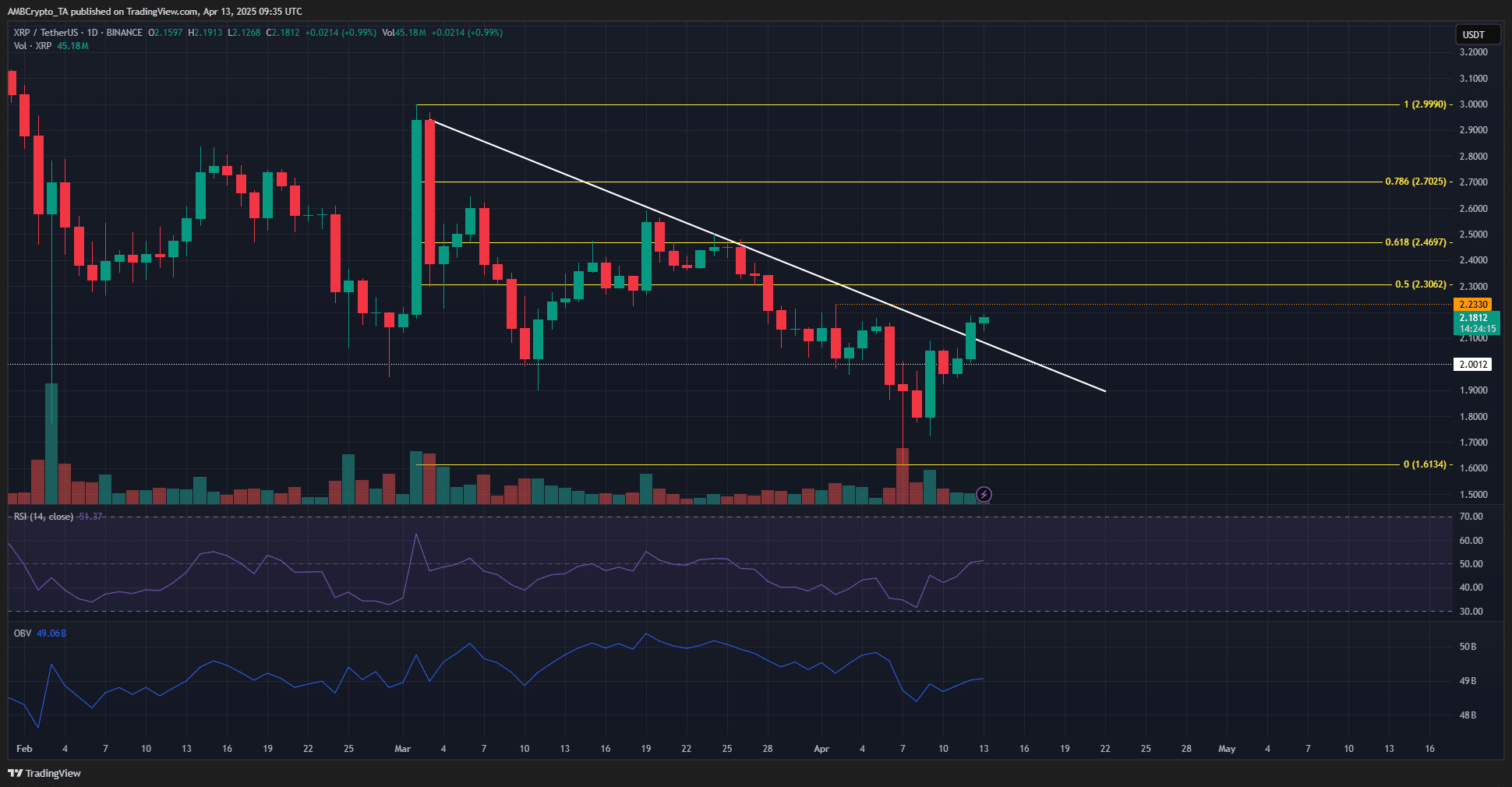

Ripple [XRP] noticed a breakout past the descending trendline resistance that has been in play since early March.

Whereas this breakout, mixed with flipping the psychological $2 stage to help, was encouraging, it was not the tip of the downtrend.

An earlier evaluation underlined a build-up of liquidity round $1.95. A deeper worth drop towards $1.2 was anticipated, however the liquidity overhead pulled costs increased. This pattern is more likely to proceed within the quick time period.

Traders and merchants can put together to promote XRP at these ranges

Supply: XRP/USDT on TradingView

The value chart on the each day timeframe confirmed a bearish construction in play. The decrease excessive at $2.23 was not but breached, though the trendline resistance was damaged. Therefore, the bearish outlook should be retained by merchants.

The RSI was at 54, displaying a bullish momentum shift. This was an early signal of a reversal, but it surely was overshadowed by the OBV’s discovering. The amount indicator was in a downtrend alongside the worth.

Till it will possibly set a brand new increased excessive to sign regular demand, traders, and merchants should be cautious of taking bullish positions. The Fibonacci retracement ranges confirmed that $2.46 and $2.7 have been formidable resistance ranges past the native resistance at $2.23.

Supply: Coinalyze

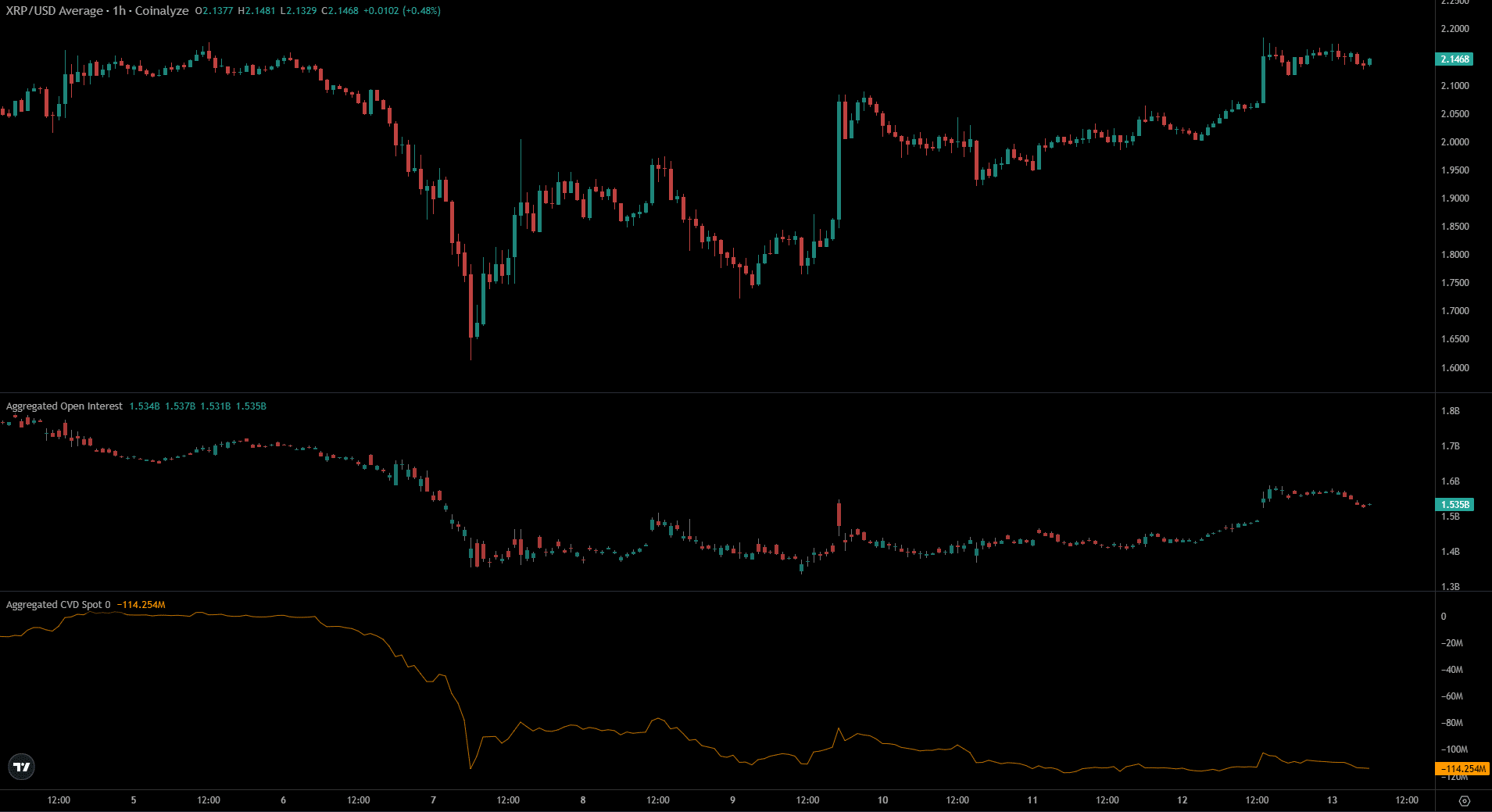

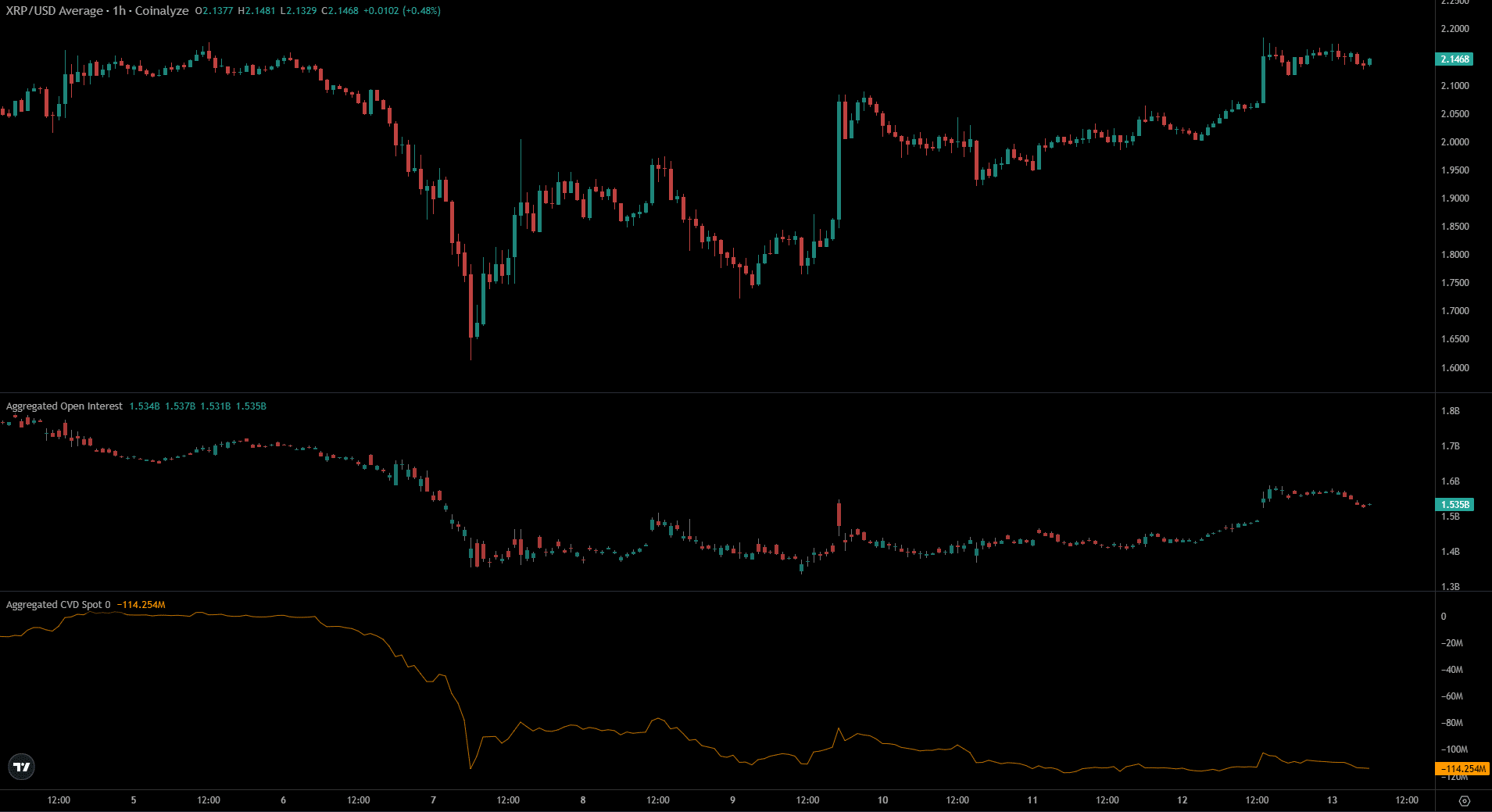

The Open Curiosity (OI) behind XRP has elevated over the previous 24 hours as the worth rallied 6%, at press time. This enhance in OI was not accompanied by an increase in spot CVD.

This indicated a scarcity of shopping for stress within the spot markets. Subsequently, it was extra possible that the latest rally was pushed by derivatives and will falter quickly.

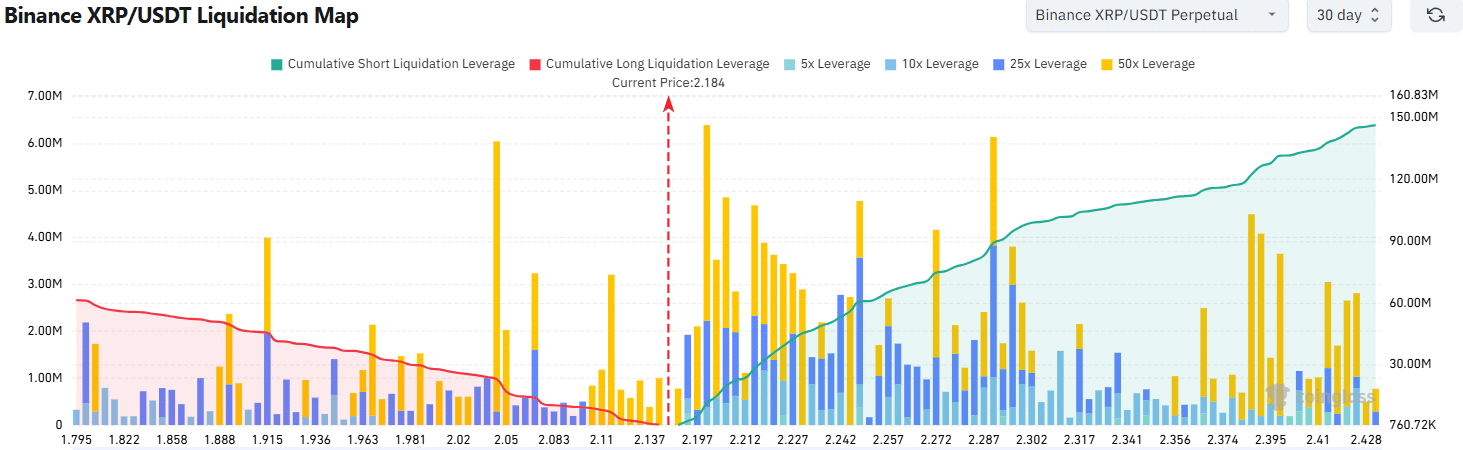

Supply: Coinglass

The liquidation heatmap strengthened this view. It confirmed a cluster of high-leverage liquidations simply above the XRP market worth, stretching to $2.25.

The elevated cumulative leverage overhead meant that quick sellers may get hunted within the quick time period earlier than a bear reversal.

This quick squeeze may yield a short-term bounce and in addition give merchants an opportunity to go quick.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion