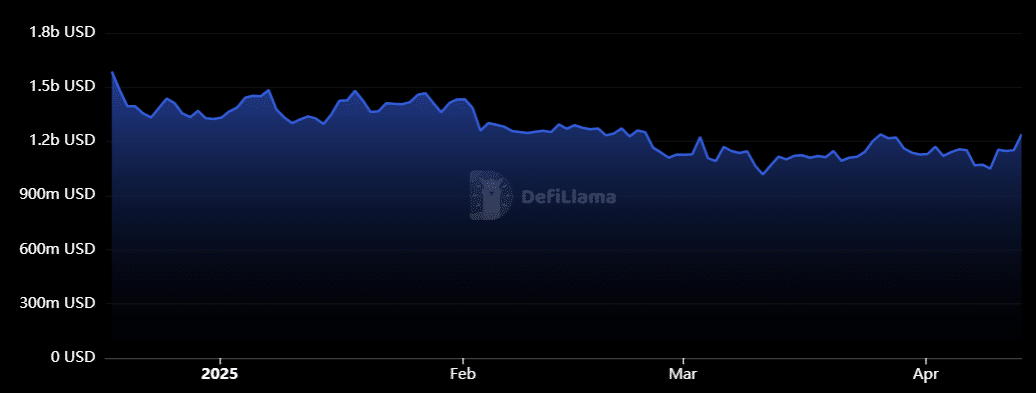

TVL rebounds after three-month decline

Avalanche’s TVL confirmed a notable rebound in April, climbing again above $1.2 billion after a persistent downtrend since early January.

The chart displays a transparent dip from over $1.5 billion initially of 2025 to sub-$1.1 billion by late March, mirroring broader risk-off sentiment in crypto markets.

Supply: DeFiLlama

Nonetheless, the current uptick suggests a shift in momentum — seemingly pushed by rising AVAX costs, consumer incentives, and protocol reactivations.

Whereas nonetheless under This autumn 2024 ranges, this bounce marks the primary signal of sustained restoration and will sign a turning level.

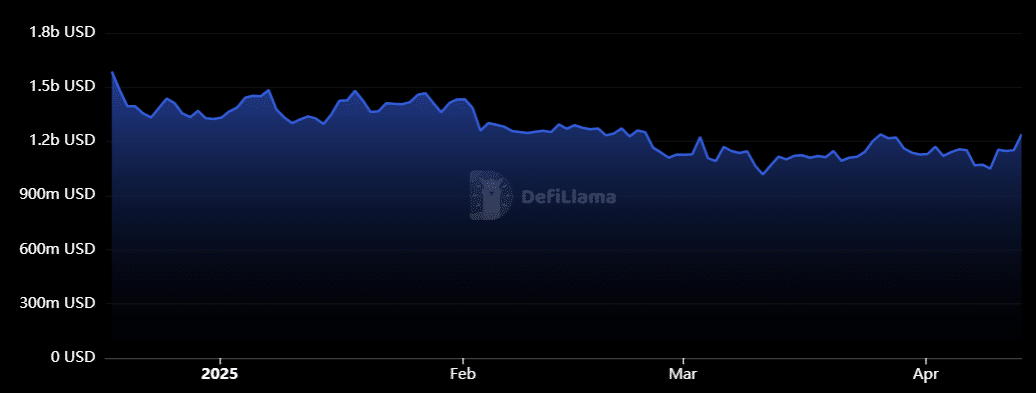

AVAX eyes $30, however resistance looms

At press time, AVAX was buying and selling round $20, recovering from March lows close to $16.

Technically, the $30 degree stays a key psychological and structural resistance – final examined in early February 2025 and once more throughout a number of rejections in mid-2024.

Supply: TradingView

The chart signifies that AVAX is breaking out of its short-term downtrend. Nonetheless, for a decisive transfer towards the $30 mark, bulls should clear the resistance zone between $24 and $26.

If momentum holds and AVAX firmly reclaims the $26 degree, a push towards $30 turns into achievable. That stated, a interval of short-term consolidation is probably going earlier than any potential breakout happens.